This post was originally publihed onn TKer.co

Stocks rallied again, with the S&P 500 climbing 2.7% last week. The index is now up 11.8% from its October 12 closing low of three,577.03 and down 16.6% from its January 3, 2022 closing high of 4,796.56.

The past two weeks have include loads of latest data, and a number of analysts getting back from break published tons of fresh research.

Listed below are a couple of charts in regards to the market that stood out:

Financial obligations have been manageable

“To this point, higher rates of interest haven’t negatively impacted margins,” Jonathan Golub, chief U.S. equity strategist at Credit Suisse, wrote in a January 4 note to clients.

For instance this, Golub share this chart of S&P 500 interest expenses as percentage of revenue.

For more on the implications of upper rates of interest, read “There’s more to the story than ‘high rates of interest are bad for stocks’ 🤨,“ “Business funds look great 💰,“ and “Why repaying $500 could be harder than repaying $1,000 🤔“

Corporations are investing of their business

“Despite macro uncertainty, capex spending has remained strong, accelerating to +24% YoY in 3Q, driven by Energy and Communication Services,“ Savita Subramanian, head of U.S. equity strategy at BofA, observed on Friday.

BofA expects the U.S. economy to enter recession this 12 months.

“Although capex is usually pro-cyclical, we see several reasons that capex will probably be more resilient during this recession than up to now, including persistent supply challenges, the necessity to spend on automation amid wage inflation/tight labor market, reshoring, underinvestment by corporates for a long time, and the energy transition.“

For more on capex spending, read “9 reasons to be optimistic in regards to the economy and markets 💪“ and “Three massive economic tailwinds I am unable to stop fascinated about 📈📈📈.“

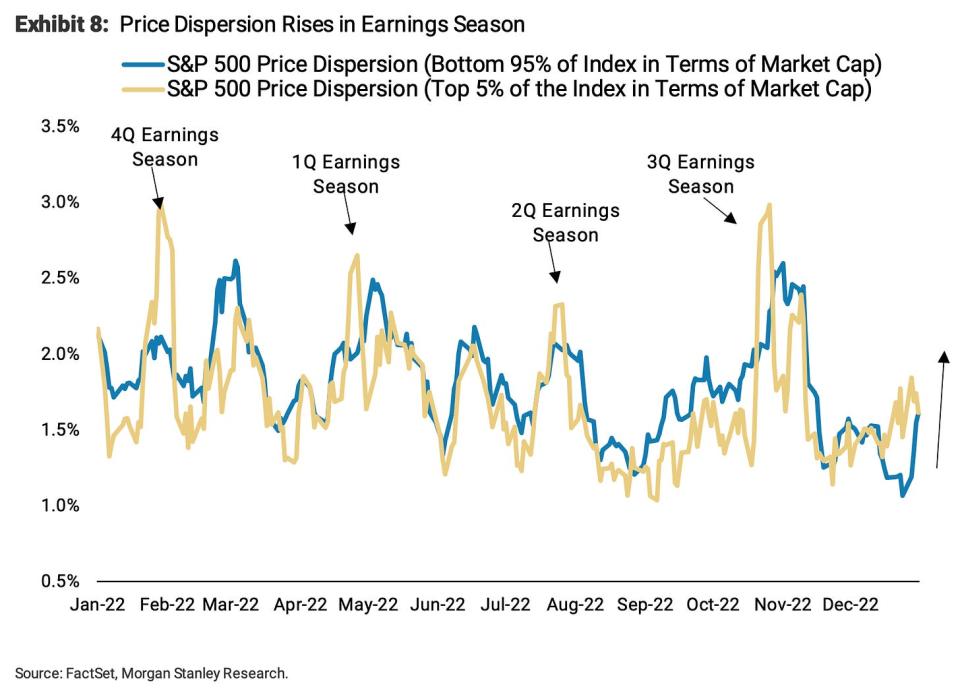

Look ahead to stocks to decouple during earnings season

“We search for price dispersion to rise over the following ~6 weeks because it has done throughout prior earnings seasons,” Mike Wilson, chief U.S. equity strategist at Morgan Stanley, wrote on Monday.

Dispersion reflects the degree to which individual stocks move together.

While Subramanian believes capex spending will delay, Wilson argues that corporations cutting back will probably be see their stock prices outperform.

“In our view, a key driver of this pick up in dispersion will probably be the widening relative performance gap between those corporations which are operationally efficient on this difficult macro environment and people who should not,” he said. “On this sense, we expect corporations that minimize capex, inventory and labor investment and maximize money flow will probably be rewarded on a relative basis.”

Subscribed

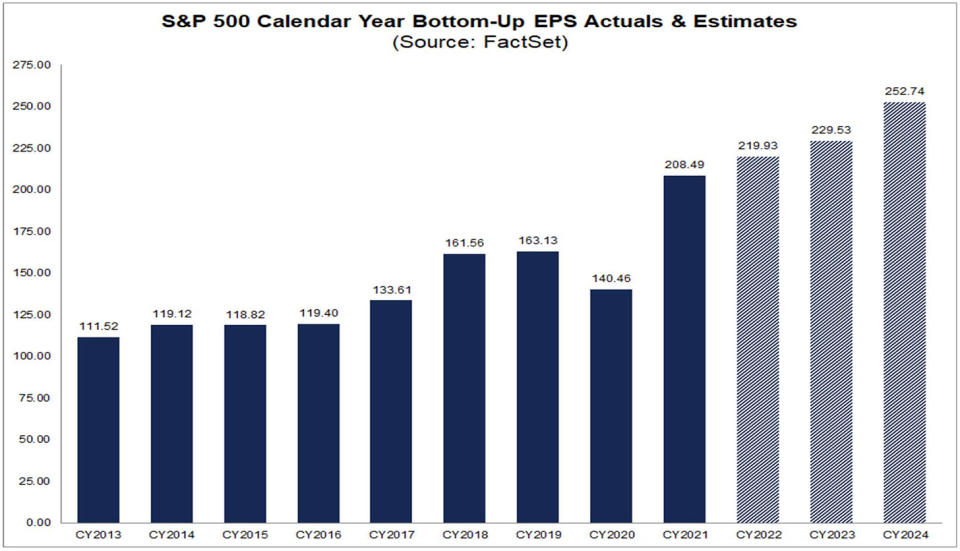

Analysts expect earnings growth in 2023 and 2024

Based on FactSet, analysts predict S&P 500 earnings per share (EPS) to rise to $229.53 in 2023 and $252.74 in 2024.

For more bullish metrics, read “9 reasons to be optimistic in regards to the economy and markets 💪.“

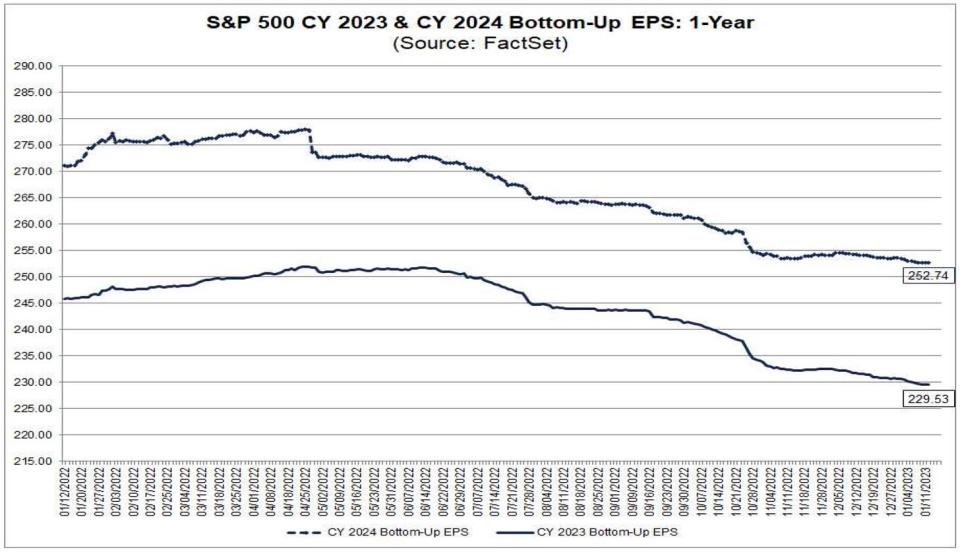

Nonetheless, those expectations have been coming down

From FactSet:

There’s no shortage of strategists expecting these numbers to be revised lower. For more, read “Some of the ceaselessly cited risks to stocks in 2023 is ‘overstated’ 😑.“

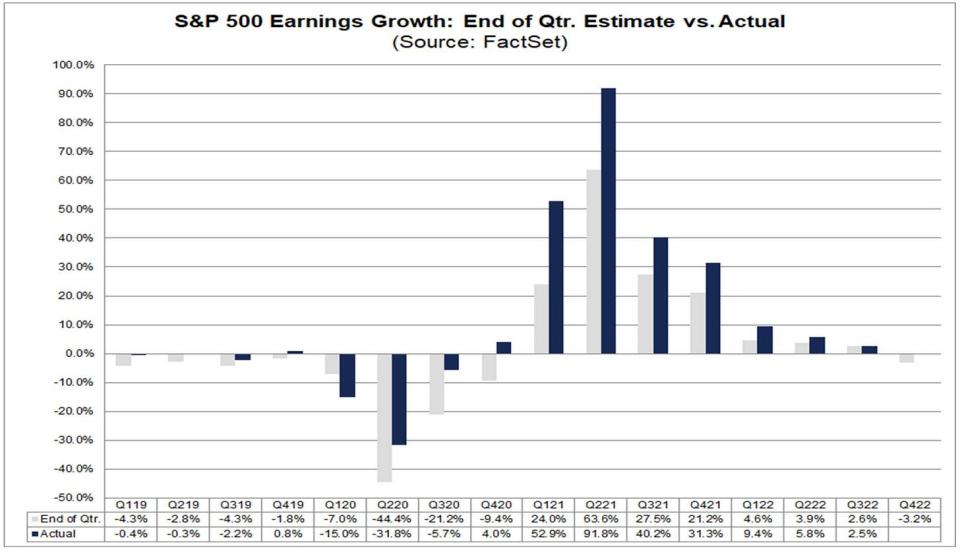

Earnings growth normally beats estimates

From FactSet: “…the actual earnings growth rate has exceeded the estimated earnings growth rate at the tip of the quarter in 38 of the past 40 quarters for the S&P 500. The one exceptions were Q1 2020 and last quarter (Q3 2022).”

For more on this, read “‘Higher-than-expected’ has lost its meaning 🤷🏻♂️“ and “The reality about analysts’ deteriorating expectations 📉.“

Valuations bottom before expected earnings

“In prior bear markets, equities have troughed ~1m before the ISM bottoms, but 1-2 months after financial conditions peak,” Keith Parker, head of U.S. equity strategy at UBS, wrote in a January 4 note. “The market bottom coincides with the P/E bottom in just about all instances, with an increase within the P/E typically following a fall in corporate bond yields.“

The chart below shows the P/E bottom also precedes the underside in forward earnings estimates.

For more on P/E ratios, read “Use valuation metrics just like the P/E ratio with caution ⚠️.“ For more on stocks bottoming, read “Stocks normally bottom before every thing else.“

In the long term, earnings go up

Deutsche Bank’s Binky Chadha expects Q4 earnings of $53.80 per share for the S&P 500. This is able to bring EPS closer to its long-run trend, which is up and to the suitable.

For more on long-term earnings, read “Expectations for S&P 500 earnings are slipping 📉“ and “Legendary stock picker Peter Lynch made a remarkably prescient market statement in 1994 🎯.“

Great years follow horrible years

“Up to now 90 years, the S&P 500 has only posted a more severe loss than its 19.4% annual decline in 2022 on 4 occasions – 1937, 1974, 2002, and 2008,” Brian Belski, chief investment strategist at BMO Capital Markets, observed on Thursday. “In the next calendar years, the index logged >20% gains every time with a median price return of 26.5% as highlighted in Exhibit 8.“

For more on short-term patterns within the stock market, read “2022 was an unusual 12 months for the stock market 📉“ and “Don’t expect average returns within the stock market this 12 months 📊“

Subscribed

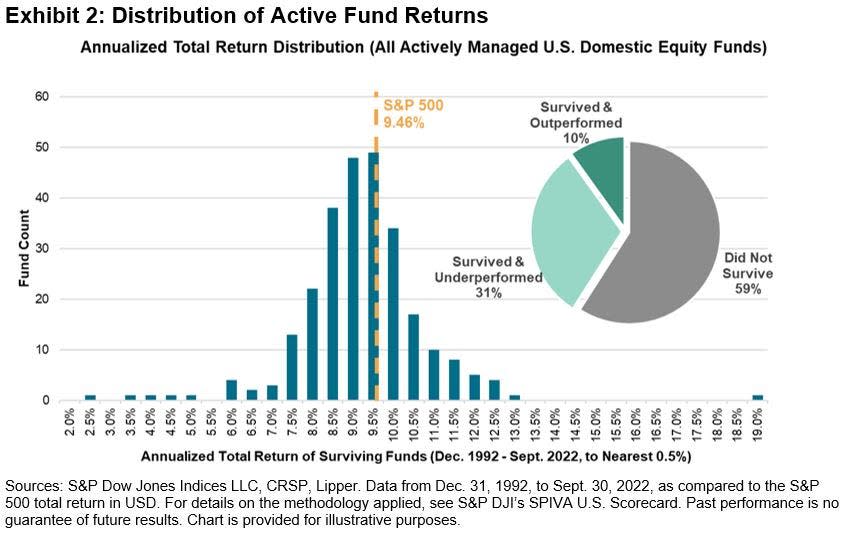

Not many ETFs beat the S&P 500

From S&P Dow Jones Indices: “On Jan. 29, 2023, the world’s longest-surviving exchange-traded fund — initially often known as the Standard & Poor’s Depository Receipt or by the acronym SPDR (the “Spider”) — will have a good time 30 years because it began trading… Investing in an index tracker was seen (by some) as an admission of defeat back in early 1993. At best, an index fund was “settling for average.” But, because it seems, a portfolio roughly replicating the S&P 500’s return would have been emphatically above average since then.”

For more on this, read “Most experts cannot beat the market 🥊“

Most consumers expect stocks to fall

From the NY Fed’s Survey of Consumer Expectations: “The mean perceived probability that U.S. stock prices will probably be higher 12 months from now decreased by 0.8 percentage point to 34.9%.“

For more on this, read “Most of us are terrible stock market forecasters 🤦♂️.“

BONUS: Execs are talking sh*t on earnings calls

From the FT’s Robin Wigglesworth: “Using AlphaSense/Sentieo’s transcription search function, we will see that the ‘polycrisis’ of runaway inflation, pandemics, rate of interest increases, supply chain snafus and wars helped lift swearing on earnings calls and investor days to a brand new record high in 2022. Sadly, once we first looked into this last 12 months it turned out that almost all of the redacted swear words were pretty plain vanilla, like ‘shit’ and ‘bullshit.’“

It’s quite a bit to process. Indeed, investing within the stock market could be complicated.

Overall, there appear to be a number of reasons to be optimistic. And the explanations to be pessimistic aren’t particularly out of the bizarre.

For a lot of more charts on the stock market, read “2022 was an unusual 12 months for the stock market 📉.“

–

Related from TKer:

Reviewing the macro crosscurrents 🔀

There have been a couple of notable data points from last week to think about:

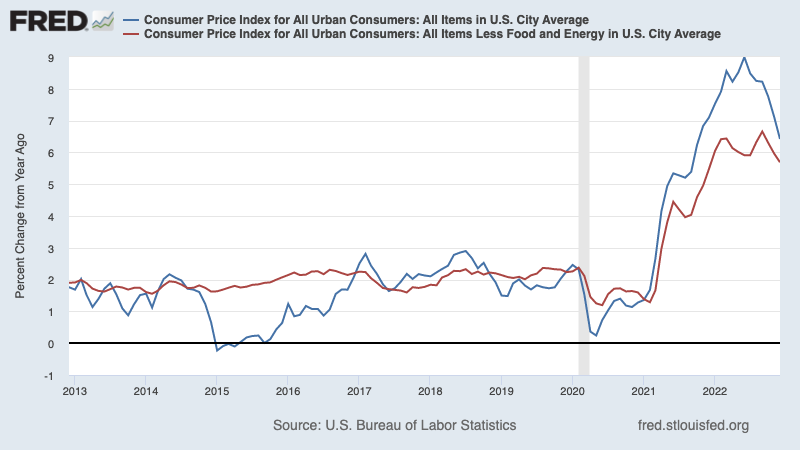

🎈 Inflation continues to chill. The consumer price index (CPI) in December was up 6.5% from a 12 months ago, down from 7.1% in November. Adjusted for food and energy prices, core CPI was up 5.7%, down from 6.0%.

On a month-over-month basis, CPI was down 0.1% and core CPI was up 0.3%.

For those who annualized the three-month trend within the monthly figures, CPI is rising at a cool 1.8% rate and core CPI is climbing at a just-above-target 3.1% rate.

For more on the implications of cooling inflation, read “The bullish ‘goldilocks’ soft landing scenario that everybody wants 😀.“

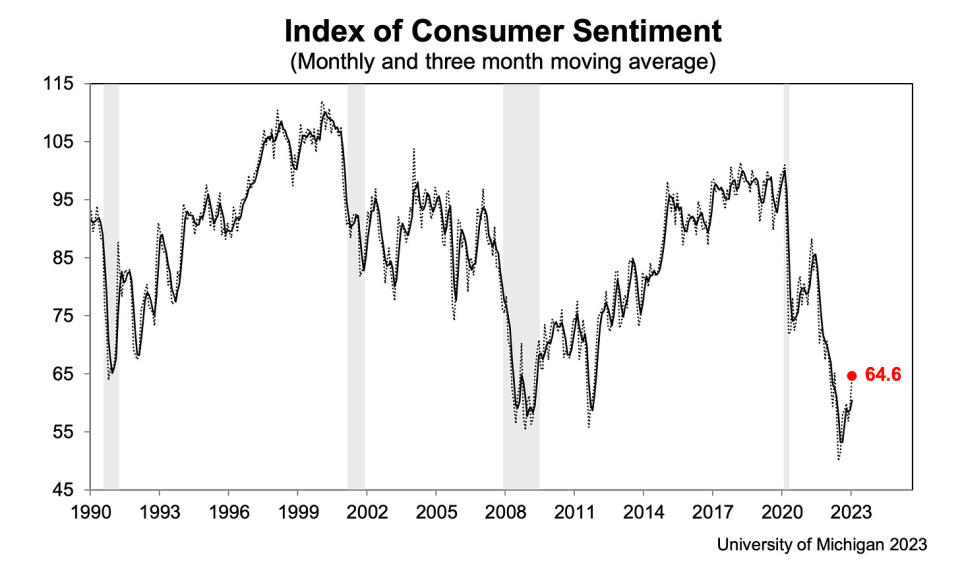

👍 Consumer sentiment improves. From the University of Michigan’s December Survey of Consumers: “Consumer sentiment remained low from a historical perspective but continued lifting for the second consecutive month, rising 8% above December and reaching about 4% below a 12 months ago. Current assessments of private funds surged 16% to its highest reading in eight months on the premise of upper incomes and easing inflation… Yr-ahead inflation expectations receded for the fourth straight month, falling to 4.0% in January from 4.4% in December. The present reading is the bottom since April 2021 but stays well above the two.3-3.0% range seen within the two years prior to the pandemic.“

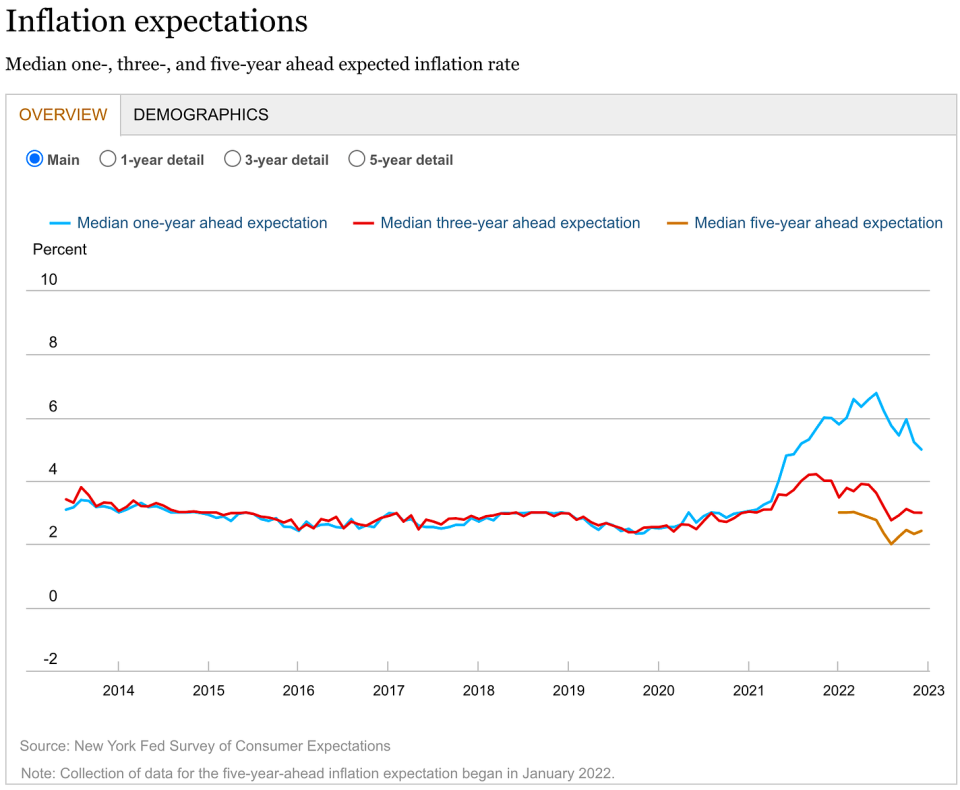

👍 Expectations for inflation improve. From the NY Fed’s December Survey of Consumer Expectations: “Median one-year-ahead inflation expectations declined to five.0%, its lowest reading since July 2021, in keeping with the December Survey of Consumer Expectations. Medium-term expectations remained at 3.0%, while the five-year-ahead measure increased to 2.4%.“

💳 Consumers are taking up more debt. Based on Federal Reserve data released Monday, total revolving consumer credit outstanding increased to $1.19 trillion in November. Revolving credit consists mostly of bank card loans.

💳 Bank card rates of interest are up. From Axios: “The Federal Reserve’s most up-to-date report on costs of consumer credit showed average rates of interest on bank-issued bank cards touching 19.1% within the fourth quarter. That beats the previous record high — 18.9% — set in the primary quarter of 1985.“

💳 Bank card delinquencies are low, but normalizing. From JPMorgan Chase’s Q4 earnings announcement: “We expect continued normalization in credit in 2023.“ The bank’s outlook assumes a “mild recession within the central case.“ For more on this, read “Consumer funds are in remarkably fine condition 💰“

💰 Overall consumer funds are stable. From Apollo Global Management’s Torsten Slok: “…households across the income distribution proceed to have a better level of money available than before the pandemic, and the speed with which households are running down their money balances in recent quarters has been very slow. Combined with continued solid job growth and robust wage inflation, the underside line is that there stays a strong tailwind in place for US consumer spending.“

“The U.S. economy currently stays strong with consumers still spending excess money and businesses healthy,” Jamie Dimon, CEO of JPMorgan Chase, said on Friday. For more on this, read “Consumer funds are in remarkably fine condition 💰“

🛍️ Consumer spending is stable. From BofA: “Although upper-income (<125k) spending modestly outperformed lower-income (<50k) spending in the course of the holidays, we see no clear signs of cracks within the latter. Lower-income HHs are still allocating a bigger share of total card spending to discretionary categories than they were before the pandemic (Exhibit 7). This means they should not yet moving to a more precautionary stance. Lower-income HHs also don’t yet seem like facing liquidity issues, since they’re allocating a smaller share of total card spending to bank cards than they did in 2019 (Exhibit 8).“ For more economic indicators which are holding up, read “9 reasons to be optimistic in regards to the economy and markets 💪.“

💼 Unemployment claims remain low. Initial claims for unemployment advantages fell to 205,000 in the course of the week ending Jan. 7, down from 206,000 the week prior. While the number is up from its six-decade low of 166,000 in March, it stays near levels seen during times of economic expansion.

🤒 Many are out sick. From KPMG’s Diane Swonk: “Nearly 70% more staff out sick every month than pre-pandemic average. The scars of the pandemic are adding to staffing shortages. The variety of those out sick and unable to work hit 1.6 million in November; that left nearly 700,000 more people on the sidelines than in any month of the 2010s. Fatalities to this point are higher than other developed economies. Many older staff had COVID and are unable to work because of long COVID. Younger retirees are actually needed to take care of grandchildren and elderly parents, because of acute shortage of kid and long-term care staff. Those out from work because of childcare problems reached an all-time high in October as more children were sick with RSV, Flu, and COVID-19.“

💼 Job openings are ticking lower. From labor market data firm LinkUp: “…labor demand continued to say no through the tip of 2022 as total energetic job listings dropped 4.5% within the U.S. from November to December, in comparison with the 6.9% decrease in listing volume from October to November, and declined across nearly all states and industries as well. Employers also created fewer listings in December, because the count of latest job listings dropped 3.2% month-over-month. Nonetheless, while we observed declines in each latest and total listings, removed listings grew by 3.5% from November to December.“ For more on this, read “How job openings explain every thing right away 📋“

📈 Inventory levels are up. Based on Census Bureau data released Tuesday, wholesale inventories climbed 1.0% to $933.1 billion in November, bringing the inventories/sales ratio to 1.35. For more, read “We will stop calling it a supply chain crisis ⛓.”

Putting all of it together 🤔

We’re getting a number of evidence that we may get the bullish “Goldilocks” soft landing scenario where inflation cools to manageable levels without the economy having to sink into recession.

But for now, inflation still has to return down more before the Federal Reserve is comfortable with price levels. So we should always expect the central bank to proceed to tighten monetary policy, which implies tighter financial conditions (e.g. higher rates of interest, tighter lending standards, and lower stock valuations). All of this implies the market beatings are prone to proceed and the danger the economy sinks right into a recession will intensify.

Nonetheless, we may soon hear the Fed change its tone in a more dovish way if we proceed to get evidence that inflation is easing.

It’s necessary to keep in mind that while recession risks are elevated, consumers are coming from a really strong financial position. Unemployed individuals are getting jobs. Those with jobs are getting raises. And lots of still have excess savings to tap into. Indeed, strong spending data confirms this financial resilience. So it’s too early to sound the alarm from a consumption perspective.

At this point, any downturn is unlikely to show into economic calamity provided that the financial health of consumers and businesses stays very strong.

As at all times, long-term investors should keep in mind that recessions and bear markets are only a part of the deal whenever you enter the stock market with the aim of generating long-term returns. While markets have had a terrible 12 months, the long-run outlook for stocks stays positive.

For more on how the macro story is evolving, take a look at the previous TKer macro crosscurrents »

For more on why that is an unusually unfavorable environment for the stock market, read “The market beatings will proceed until inflation improves 🥊“ »

For a better have a look at where we’re and the way we came, read “The complicated mess of the markets and economy, explained 🧩”

This post was originally publihed onn TKer.co

Sam Ro is the founding father of TKer.co. Follow him on Twitter at @SamRo

CLIST Nedir? | I just wanted to take a moment to express how much I appreciate the effort that goes into creating such informative and engaging content.

Fermuarlı Bomber Oversize Jogger Eşofman Takımı | Blogunuzdaki içerikler gerçekten kaliteli ve özgün. Sizi takip etmek benim için büyük bir keyif.

Üsküdar’ın Tarihi Güzellikleri | I find MAFA Technology’s content to be indispensable.

History of Velocette | Your vulnerability is a strength. Thank you for sharing your journey with us.

Çilimli / Düzce | Yazınızda bahsettiğiniz web tasarım trendleri gerçekten ilginçti. Web sitemin daha modern ve güncel bir tasarıma sahip olması için bu trendleri dikkate alacağım. Bilgilendirici içerikleriniz için teşekkür ederim.

Sultançiftliği / Sultangazi Beton Kesme | Rüzgar Karot’s professionalism and effective communication ensured smooth progress in our work.

Asymmetrical Haircuts for Women | Your blog is a garden of wisdom, blooming with insights waiting to be harvested by those who dare to seek them.

Wat is Cryptografie? | MAFA’s expertise in web design and software development is unparalleled. I’m always impressed by their ability to meet their clients’ needs.

ücretsiz site ekle | Bu yazıda anlatılanlar gerçekten benim için çok faydalı oldu. Dizin.org.tr’nin sunduğu içerikler gerçekten kaliteli ve işe yarar.

Barneveld | Es ist offensichtlich, dass MAFA wirklich weiß, was sie tun, wenn es um Webdesign und Softwareentwicklung geht. Ich kann es kaum erwarten, mit ihnen zusammenzuarbeiten.

Wat is Windows Update? | Deze blog heeft me geholpen meer te leren over MAFA en waarom ze de toonaangevende autoriteit zijn op het gebied van webdesign en softwareontwikkeling. Hun werk is gewoon geweldig.

E-Ticarette Başarı Hikayeleri | MAFA’s expertise in web design and development shines through in every article. Thank you for your commitment to excellence.

Malazgirt / Muş Toptan Giyim | RENE Toptan Tekstil ve Giyim Çözümleri’nin ürünleri her zaman beklentilerimin üzerinde çıkıyor. Kaliteli ve şık tasarımları ile göz dolduruyorlar.

Orhan Gazi, Sultanbeyli Koltuk Yıkama | PENTA’nın sunduğu çözümler, işletmeler için gerçekten bir zorunluluk gibi görünüyor. Bu yazı, bu konuda çok değerli bilgiler içeriyor.

What is Self Insurance | Your posts always leave me feeling empowered. Thank you for the boost of confidence.

İstanbul Çöp Poşeti | Eminoğlu Ambalaj’ın çeşitli ambalaj seçenekleri, işimizi yaparken büyük kolaylık sağlıyor. Her zaman ihtiyacımızı karşılayacak bir çözüm bulabiliyoruz.

Top Men’s Fade Haircuts That are Trendy Now | I’m always blown away by the depth of your insights. Keep up the amazing work!

Gölmarmara / Manisa | MAFA’s articles are a testament to the power of storytelling in the world of web design education.

Bahçeköy Merkez / Sarıyer Beton Kırma | Rüzgar Karot’un işlerini zamanında ve özenle teslim etmesi beni gerçekten etkiledi, teşekkürler!

Riva Beton Delme | Rüzgar Karot’s professionalism and effective communication ensured smooth progress in our work.

Linkbuilding Drenthe | MAFA blijft indruk maken met hun innovatieve aanpak van webdesign en softwareontwikkeling. Ik kijk altijd uit naar hun werk.

Kartal Zip Perde Sistemleri | Venster Systems’ retractable insect screens are truly impressive, catching attention with both their functionality and sleek designs.

Üsküdar Plastik Bardak | Eminoğlu Ambalaj’ın ürünleri her zaman kaliteli ve dayanıklı. İşimizi rahatça yapabilmemiz için bize güven veriyorlar.

95 M2 Prefabrik Ev Fiyatları ve Modelleri | We were highly satisfied with the service provided. They meet expectations both in terms of product quality and customer service.

Gediz / Kütahya Toptan Tekstil | RENE Wholesale Textile and Clothing Solutions’ products consistently exceed my expectations. Their quality and stylish designs always stand out.

JavaScript onresize Nedir? | MAFA’s insights into web design are akin to finding a rare gem in a sea of information overload.

Best Curtain Bangs for All Hair Types & Lengths | Your vulnerability is a strength. Thank you for sharing your journey with us.