Momentum Breakouts are market scenarios wherein price motion would break strongly outside a market range. These momentum breakouts typically develop at the highest of market congestion since this condition often represents the start of a market expansion phase. Momentum Breakouts are also typically followed by strong market runs which might turn into a trend.

Seasoned Momentum Breakout Traders often trade these market scenarios with the assumption that the worth would proceed throughout the direction of the momentum.

Allow us to debate how we are going to systematically trade momentum breakouts using two technical indicators.

Breakout Bars Trend Indicator

The Breakout Bars Trend Indicator is a momentum technical indicator developed to help traders spot and discover potential momentum breakouts and discover the direction of the immediate market trend. This indicator was developed as an alternative to moving average indicators for identifying the trend direction.

The Breakout Bars Trend Indicator relies on the iMovment Indicator and was developed as a hybrid Linear Reversal Indicator. These two indicators detect momentum and trend direction using a elaborate algorithm that uses data from the open, high, low, and shut of each price candle. Nonetheless, the difference between the two is that unlike the movement Indicator, the Breakout Bars Trend Indicator uses the actual high and low of a price, which is its extremum, since the delta or parameter for identifying reversals, momentum, and trend.

The Breakout Bars Trend Indicator overlays price bars on each price candle, modifying the color of each candle. Each candle color represents a special indication, which could possibly be a Breakout Open, Breakout High or Low, or a Neutral Candle that has not reversed against a previous trend.

A blue candle indicates a bullish Breakout Open Candle, while a royal blue candle indicates a bullish Breakout High Candle. A deep sky blue candle on the other hand indicates a bearish candle inside a bullish momentum market.

Inversely, a red candle indicates a bearish Breakout Open Candle, while a tomato candle indicates a bearish Breakout Low Candle. Lastly, an orange candle indicates a bullish candle inside a bearish momentum market.

Amongst all these colors, the blue and red candles are most indicative of a robust momentum breakout. The blue candle typically forms as a bullish momentum candle, while the red candle typically forms as a bearish momentum candle.

Bollinger Bands

The Bollinger Bands Indicator is a volatility indicator that was developed by John Bollinger throughout the Eighties. This indicator is often utilized by financial traders to objectively assess the market’s trend, momentum, and volatility, along with overbought and oversold market levels.

The Bollinger Bands is an envelope type of indicator that plots three lines forming a band-like structure that typically wraps around price motion. These three lines are its middle line and its two outer lines drawn above and below the middle line.

The middle line of the Bollinger Bands is a Easy Moving Average (SMA) line which is continuously preset to calculate for 20 bars. The outer lines, on the other hand, are standard deviations of price drawn above and below the middle line, which is continuously calculated as 2 standard deviations. Nonetheless, these variables will also be modified throughout the indicator settings.

Provided that the middle line of the Bollinger Bands is a 20 SMA line, this indicator is perhaps used as a trend indicator. Traders may easily discover uptrend markets at any time when price motion is generally above the middle line. Downtrends on the other hand will also be identified at any time when price motion is generally below the middle line.

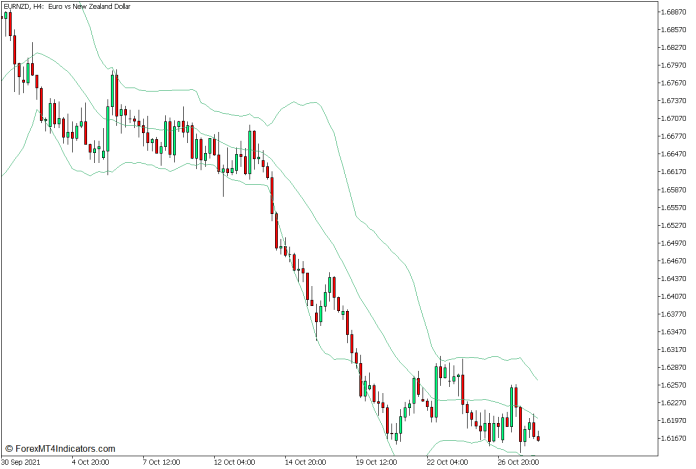

This indicator will be normally used as a volatility indicator. The Bollinger Bands typically expand at any time when the market is in a market expansion phase and contracts at any time when the market is in a market contraction phase. Expansions typically indicate high volatility, while contractions typically indicate low volatility.

Traders also use this indicator as an overbought and oversold indicator. Price levels above the upper Bollinger Band line are considered overbought, while price levels below the lower line are considered oversold. Each market scenarios are price conditions for a possible mean reversal as price motion normally rebalances after an overextended price level.

Lastly, traders also can use this indicator as a momentum breakout indicator. Momentum candles closing outside the Bollinger Bands after market contraction typically indicate a momentum breakout.

Trading Strategy Concept

This trading strategy is a Momentum Breakout Strategy which trades on momentum breakout scenarios that develop right after market contraction or congestion. This strategy uses two technical indicators which allows us to objectively assess market contraction phases and discover momentum breakout scenarios.

On this strategy, the Bollinger Bands Indicator is used primarily to help us discover market contraction phases. This is perhaps observed on the worth chart as price motion which is normally inside contracting Bollinger Band. From there, we could start observing for momentum breakouts.

The Breakout Bars Trend Indicator is used to help us objectively qualify momentum breakout candles based on the color of the bars. What we’re in quest of are blue or red candles which indicate a Breakout Open Candle. These candles is perhaps our momentum breakout entry signals.

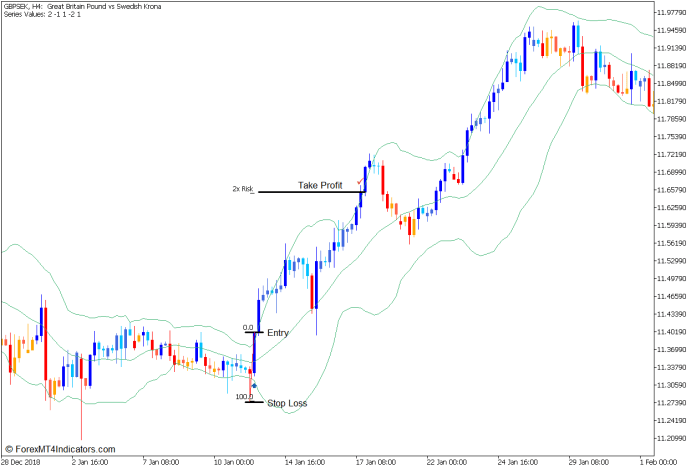

Buy Trade Setup

Entry

- Observe price motion and the Bollinger Bands for market contraction.

- Open a buy order as soon since the Breakout Bars Trend Indicator plots a blue bullish momentum candle closing above the upper Bollinger Bands line.

Stop Loss

- Set the stop loss on the fractal below the entry candle.

Exit

- Set the take profit goal at 2x the variability of pips risked on the stop loss.

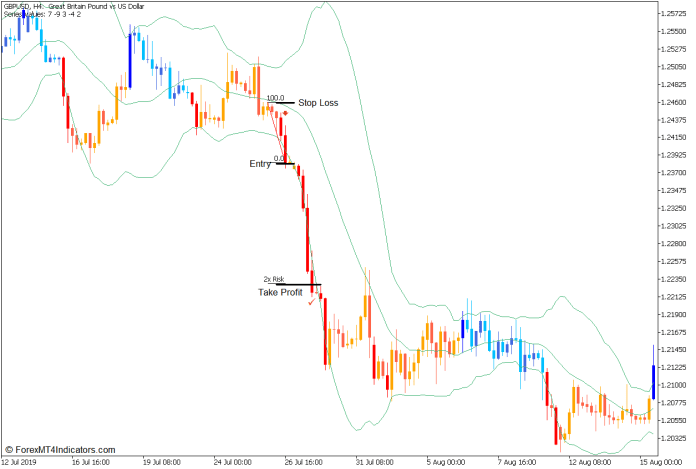

Sell Trade Setup

Entry

- Observe price motion and the Bollinger Bands for market contraction.

- Open a sell order as soon since the Breakout Bars Trend Indicator plots a red bearish momentum candle closing below the lower Bollinger Bands line.

Stop Loss

- Set the stop loss on the fractal above the entry candle.

Exit

- Set the take profit goal at 2x the variability of pips risked on the stop loss.

Conclusion

Such a trading strategy is normally utilized by momentum breakout traders. It’s an efficient trading strategy once used on the fitting time and within the fitting market condition. Most successful momentum traders also trade momentum breakout strategies at key time windows using time and price theories, during times when trading volume is anticipated to spike. Traders should practice this trading strategy first before implementing it to get a feel of the best way it should be used.

Forex Trading Strategies Installation Instructions

This MT5 Strategy is a mixture of Metatrader 5 (MT5) indicator(s) and template.

The essence of this forex strategy is to rework the gathered history data and trading signals.

This MT5 strategy provides a possibility to detect various peculiarities and patterns in price dynamics which might be invisible to the naked eye.

Based on this information, traders can assume further price movement and adjust this strategy accordingly.

Advisable Forex MetaTrader 5 Trading Platforms

XM Market

- Free $50 To Start Trading Immediately! (Withdrawable Profit)

- Deposit Bonus as much as $5,000

- Unlimited Loyalty Program

- Award Winning Forex Broker

- Additional Exclusive Bonuses Throughout The Yr

>> Claim Your $50 Bonus Here <<

The best option to install This MT5 Strategy?

- Download the Zip file below

- *Copy mq5 and ex5 files to your Metatrader Directory / experts / indicators /

- Copy tpl file (Template) to your Metatrader Directory / templates /

- Start or restart your Metatrader Client

- Select Chart and Timeframe where you should test your forex strategy

- Right click in your trading chart and hover on “Template”

- Move right to pick the MT5 strategy

- You’ll note strategy setup is obtainable in your Chart

*Note: Not all forex strategies include mq5/ex5 files. Some templates are already integrated with the MT5 Indicators from the MetaTrader Platform.

Click here below to download:

Get Download Access