guvendemir/iStock via Getty Images

We’ve previously covered Star Bulk Carriers Corp. (NASDAQ:SBLK) here as a post-FQ3’22-earnings article in November 2022. We posited that the corporate’s FQ4’22 results could also be negatively impacted because of the lower-than-expected TCE rates. The increased expenses for dry docking in Q3, resulting in a quarterly dividend cut then, weren’t well received by investors as well. Combined with the normalization of the Baltic Dry Index [BDI], SBLK may face more temporary headwinds indeed.

For this text, we will probably be specializing in SBLK’s intermediate-term prospects, as China reopens with a GDP goal of as much as 5.5% in 2023. Notably, Hebei is more aggressive with a goal of as much as 6%, potentially ramping up its steel manufacturing output after three years of the Zero Covid Policy. The federal government’s immense stimulus and extension of bank credits may support the recovery of the country’s property market as well, boosting consumer confidence ahead.

The Dry Bulk Investment Thesis Is Still Robust

5Y BDI Rates

Trading Economics

Dry bulk shipping spot rates have been hammered indeed, attributed to the overly drastic normalization from hyper-pandemic levels and easing port congestions. The BDI has shown drastic declines, reaching $801 by January 19, 2023, plunging by -85.5% from the height levels of $5.54K in October 2021 and by -39.3% from the common of $1.32K in 2019.

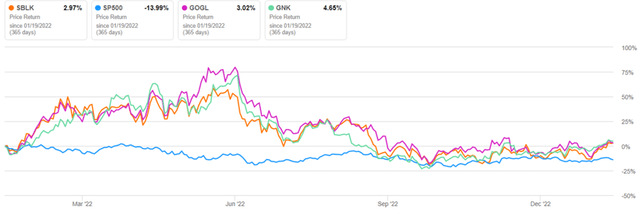

SBLK 1Y Stock Price

Looking for Alpha

Subsequently, it is not any wonder that many dry bulker stocks, including SBLK, Golden Ocean Group Limited (NASDAQ:GOGL), and Genco Shipping & Trading Limited (NYSE:GNK), have been notably trading sideways for the past few months.

Nonetheless, we’re naturally more bullish, attributed to the 30Y low dry bulk order book and the IMO 2023. The Panamax is anticipated to only expand by a minimal 1.6% in 2023, with Capesize similarly growing by 0.3% and Handysize by 2.1% at the identical time. That is significantly aided by the record low order book at 960 vessels through 2024, accounting for a minimal 7.3% of the worldwide vessel count of 13.1K.

Market analysts also expect a pick-up within the demolition of older tonnage in 2023 because of the introduction of IMO 2023, which requires fleets to attain improved energy efficiency and reduced carbon output. With over 75% of the worldwide dry bulk fleet not complying with the brand new regulation, we might also see slower steaming ahead, triggering a possible reduction in fleet supply by one other -3%.

Why does this matter? SBLK has notably recorded elevated off-hire days of 1.26K over the past nine months (484 days in Q3, 491 days in Q2, and 291 days in Q1), leading to dry-docking expenses of $29M, growing by 20.9% YoY. That is primarily attributed to its ballast water installation program and upgrading efforts to comply with the brand new IMO 2023 regulations.

With 98% of its fleets already fitted with water treatment systems, we naturally expect the corporate to learn from the upgraded fleet and optimized sailing speed ahead. Subsequently, we’re especially encouraged by the management’s guidance of a minimal 520 off-hire days and $19M in dry-docking expenses for 2023, suggesting its improved fleet coverage ahead.

SBLK also guided that the dry bulk demand may increase by 1.4% ton-miles, attributed to the shift of coal, grain, and minor bulk trade patterns through longer haul routes. This can further construct upon the expansion in coal shipments by 3.7% YoY and minor bulk by 3.2% YoY in Q3’22.

Notably, the EU and India increased their coal imports in 2022, because of the Ukraine war and better electricity demand, respectively. These headwinds are unlikely to lift within the short term as well, because of the upper oil/gas prices by 33% in comparison with pre-pandemic levels. These may trigger tailwinds for SBLK’s execution within the intermediate term.

China’s Property Market May Boost Iron-Ore Demand From H2’23 Onwards

Chinese Recent 12 months festivities and surging COVID-19 infections may temporarily delay the prompt recovery of the Chinese property market. Nonetheless, we expect these headwinds to rapidly lift by H2’23, with policymakers in China aiming for GDP growth of as much as 5.5% in 2023 to maintain unemployment at bay. These numbers are impressive indeed, for the reason that country recorded 2022 numbers of two.8% and 2019’s 6%.

Notably, the Hebei province aimed to attain an excellent more ambitious GDP of 6% in 2023, with Liaoning expecting 5%. These two provinces matter, since Tangshan, the country’s largest steel-producing city, is positioned within the Hebei. Town accounted for 58% of China’s total steel output in 2022. The raised GDP goal suggests a possible ramp-up in its manufacturing output indeed, after three years of Covid disruptions.

Liaoning has also been dubbed because the ‘cradle of China’s steel industry,’ because it is home to the country’s five largest iron ore mines, producing as much as 58M metric tonnes of iron ore annually.

As well as, the Chinese government has poured immense stimulus packages, price 300B Yuan ($43B) for infrastructure investments and 1T Yuan ($140B) for the semiconductor industry. These may further contribute to the recovery cadence for iron ore prices and major dry-bulk rates ahead. Edward Al Hussainy, analyst at Columbia Threadneedle, said:

The reopening story is looking quite good and … there may be plenty of credit and financial stimulus that China is putting into the system. That stimulus is finding its way into global asset prices. (Reuters)

These numbers matter to SBLK indeed, since 89 of its 128 fleets namely, Newcastlemax, Capesize, Post Panamax, and Kamsarmax, are configured to hold major bulks akin to iron ore and coal. It’s noteworthy that 83.1% of its 14.1M deadweight tonnage can also be attributed to major bulks (fleets between 80K dwt and 210K dwt), with as much as 77% of the worldwide Capesize fleets commonly used for iron ore transports. While the corporate doesn’t publish how much of its business is attributed to China or counterparties, it has disclosed this information in its quarterly financial statements:

Economic slowdown within the Asia Pacific region, particularly in China, could have a materially opposed effect on us, as we anticipate a major variety of the port calls made by our vessels will proceed to involve the loading or discharging of dry bulk commodities in ports within the Asia Pacific region. We conduct a considerable portion of our business in China or with Chinese counterparties. (Looking for Alpha)

The iron ore prospects seem brilliant within the intermediate term as well, with multiple Chinese banks extending over $378B of credit lines to real-estate developers over the past few months, propping up the ailing industry with increased insolvency risk.

Market analysts speculated that the federal government is keen on ending the decades-old practice of selling properties first and constructing later, especially after the catastrophic mortgage loans boycott price $43B in Q3’22. The move from pre-sale purchases to after-construction sales may boost the flagging consumer confidence within the currently distressed real estate industry indeed. Andrew Polk, co-founder of consulting firm Trivium, said:

We expect this can lay the groundwork to exit the presales model of housing. Sales aren’t going to guide construction. Construction will lead sales. (Bloomberg)

As China accounts for over a 3rd of the annual dry bulk imports and 43.07% of worldwide iron-ore demand at 1.12B tonnes, it is not any wonder that market analysts are optimistic a couple of reversal of TCE rates by H2’23, attributed to the beginning of recent constructions then. The country’s iron ore inventory can also be notably much lower YoY by -14.8% to 133.6M metric tonnes on the time of writing, suggesting a powerful market demand.

In the primary sign of optimism, Wanda Properties Global Company recently issued a two-year US dollar bond with a yield of 12.375%, receiving as much as $1.4B in orders from global investors, akin to Blackrock, Fidelity, Pictet AM, Invesco, and PAG. It marked an amazing reversal from the country’s property default crisis in 2021, which had led to the panic selling of Chinese dollar bonds then.

Terence Chia, head of debt capital markets syndicate for Asia-Pacific at Credit Suisse, said:

It was almost not possible to do any China property high-yield deal last yr [after China’s property crisis]. But we began to see the market turn because of this of the Chinese government’s leisure and supportive measures for the true estate sector, in addition to the lifting of its Zero-Covid policy. (South China Morning Post)

Lastly, Chinese households grew their savings tremendously in 2022, because of the Zero Covid Policy impacting their discretionary spending. The sum grew to an eye-popping sum of $1.9T in bank deposits just throughout the first nine months of 2022, a number which is notably greater than Canada’s 2022 GDP of $1.64T.

There are already some early signs of a turnaround in China’s property market, with new-home sales rising at a median of 20% YoY over the primary three days of the 2023 calendar yr. This is very true in big cities akin to Beijing at 80%, Shanghai at 74%, and Guangzhou at 131.5%. Analysts are attributing this phenomenon to the pent-up demand after three years of lockdowns, significantly aided by developer discounts and government policies.

Subsequently, TCE rates may indeed recuperate moderately by mid-2023, if the optimistic sentiment persists.

So, Is SBLK Stock A Buy, Sell, or Hold?

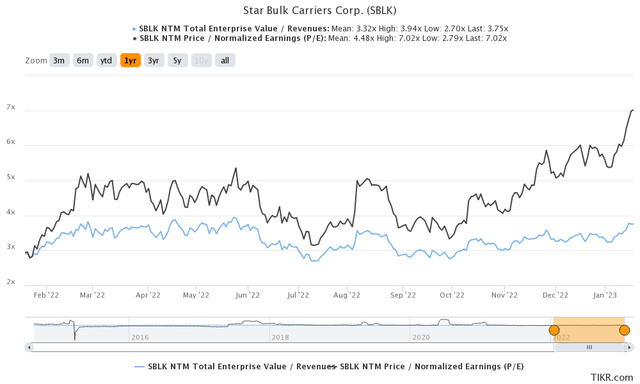

SBLK 1Y EV/Revenue and P/E Valuations

S&P Capital IQ

SBLK is currently trading at a NTM P/E of seven.02x, lower than its 3Y mean of 9.29x, though higher than its 1Y mean of 4.48x. Based on its projected FY2024 EPS of $4.77 and current P/E valuations, we’re taking a look at a moderate price goal of $33.48. These mirror the consensus estimates goal of $28.33 as well, suggesting a superb 29.7% upside potential from current levels.

Despite the highly promising China reopening and 30Y low order book, it is obvious that Mr. Market is uncertain about dry-bulker’s short-term prospects. This is probably going because of the 70% likelihood of a recession in 2023, with the Feds’ recent meeting minutes suggesting a raised terminal rate to over 5% by mid-2023 and a pivot only from 2024 onwards.

As well as, market analysts are growingly concerned about China’s unexpected reopening as it could throw a wrench within the Fed’s battle with the rising inflation ahead. Because the world’s leading importer of crude oil and iron ores, the latter two commodities have seen spot prices rallying by 14.9% and 52.7% over the past two months, respectively. These naturally trigger more uncertainties within the short term, delaying the recovery of worldwide macroeconomics. It also stays to be seen if the pent-up demand from China is in a position to counterbalance the deceleration in global demand over the subsequent few quarters.

Subsequently, there may be likelihood that SBLK may proceed trading sideways within the short-term, before speculatively recovering by H2’23. Investors must also understand the inherently cyclical shipping and commodity industry, pointing to the stock’s speculative nature. Nevertheless, opportunistic investors could also be tempted by the projected FY2024 dividends of $4.43, suggesting a stellar forward yield of 20.2% against its 4Y average of 6.84% and sector median of 1.69%.

Consequently, we rate the SBLK stock as a Buy, because of the improved margin of safety. Naturally, portfolios must even be sized appropriately within the event of volatility, for the reason that excellent dividends will not be sufficient to cover the possibly drastic gap down from this possible volatility.