What’s it about some traders that permit them spot one of the best trades within the stock market?

Is it some sort of insider knowledge we’re not allowed to have?

In reality, the reality is loads simpler!

They’re using tools which help make price motion much easier to grasp.

And some of the useful?

The Volume Weighted Moving Average (VWMA).

OK, you’re considering you already know all the pieces about moving averages, right?

But VWMA isn’t just any old standard moving average.

Volume Weighted Moving Average is far more responsive, reacting to trading volume and supplying you with deeper insight into where price motion is basically happening.

It might make it easier to understand market dynamics more clearly, highlighting key turning points and trends.

When you grasp how it really works, Volume Weighted Moving Average can completely transform the way you analyze markets.

In this text, I’ll cover all the pieces it’s essential find out about how it might take your trading strategies to the subsequent level.

By the tip, you’ll have learned:

- What makes VWMA stand out from other moving averages

- apply VWMA across various market conditions and volatilities

- use VWMA to discover key price levels and trends, with real chart examples to guide you

- Common mistakes traders make when using VWMA, like misreading deviations during low-volume scenarios

Able to begin?

Let’s dive in!

Understanding VWMA

How is Volume Weighted Moving Average Calculated?

VWMA is calculated by weighting each price point with its trading volume across a time period.

You get it by:

…adding the product of price and volume for every interval…

… after which dividing by the entire volume over that period.

That’s it!

This offers you a moving average that reflects the common price of the asset over time but additionally shows you price points where trading activity was most concentrated.

It also implies that higher-volume periods have a greater influence on the Volume Weighted Moving Average than lower-volume periods.

Alright, I do know the plain query is, why not only use an easy moving average?

While each tools are useful, VWMA gives you a novel advantage since it includes volume within the calculation.

It’s this extra information which might give you deeper insight into where everyone’s getting involved!

Let’s explore a bit more about why Volume Weighted Moving Average is value it.

How Does VWMA Differ from Normal Moving Averages?

While each the Volume Weighted Moving Average and traditional moving averages are used to research price trends, the best way they work and the insights they provide you with differ loads.

As mentioned, the most important difference comes from VWMA including volume.

It gives more weight to cost points with higher trading activity.

Traditional moving averages, reminiscent of the Easy Moving Average (SMA), calculate the common price over a set period without touching volume.

Are you able to see how more volume moves could give extra insight in comparison with an easy moving average?

Take a have a look at what VWMA is trying to point out you…

What Does VWMA Represent?

Unlike a Easy Moving Average (SMA), which treats all price points equally, the VWMA ensures that price movements with heavier volumes show up more clearly in your radar.

In other words, Volume Weighted Moving Average allows you to in on the worth moves that really matter.

A helpful strategy to consider it’s as a measure of fair value for the time period you’re .

The VWMA reveals where many of the trading took place, highlighting key price zones and providing a more precise understanding of market behavior.

Crucially, this implies the VWMA can often reveal market sentiment, too.

Prices above the Volume Weighted Moving Average may reflect bullish momentum, suggesting a security is trading at a premium, while prices below the VWMA may indicate bearish sentiment and a possible discount.

This volume-adjusted viewpoint is useful in trend evaluation, too, helping you’re employed out pivotal levels for decision-making.

I’ll show you the way these work practically a bit later in this text.

For now, let’s have a look at how timeframes shape the Volume Weighted Moving Average.

Ability to Be Relevant on Different Timeframes

While Volume Weighted Moving Average is traditionally used for flexible trend evaluation, it might be adapted for various timeframes.

For shorter timeframes, the VWMA captures the connection between price and volume over minutes or hours, helping traders find more immediate trends and key levels of interest.

For longer timeframes, reminiscent of every day, weekly, or monthly periods, the VWMA can reveal broader trends by balancing the volume-weighted activity over prolonged periods.

What do I mean by that?

Well, the further you zoom out with VWMA, the more external aspects could cause it to reflect significant but isolated movements.

And since they’re isolated, they won’t at all times provide probably the most useful insight.

Let me provide you with an example.

Say an organization proclaims a groundbreaking recent product at first of the 12 months.

This announcement may lead to a pointy increase in each trading volume and stock price over the next week, right?

So, when you calculate the VWMA over a monthly or yearly timeframe that features this event, it’s going to be heavily influenced by the high volume and elevated prices during that news period…

And I mean, while this reflects substantial activity, it won’t exactly be fair value for the complete timeframe (e.g. a 12 months)

It’s something to take into account when using Volume Weighted Moving Average for longer-term evaluation…

Example of announcements on Volume Weighted Moving Average:

On this scenario, Volume Weighted Moving Average represents the common price during a period of volatility, but not necessarily during normal trading activity.

And now the most important query…

With all of the above considered, can you employ VWMA in forex?

Relevance to Stock Trading vs. Forex

In stock trading, the Volume Weighted Moving Average is very effective since it leverages precise volume data provided by centralized exchanges.

This reliability enables accurate VWMA calculations, offering you a transparent picture of fair value and significant trading activity inside the stock market.

I mean, the VWMA reflects real market dynamics – reality, right?

Nevertheless, foreign currency trading?

Well, it presents a distinct challenge!

Since the forex market is decentralized, it means there is no such thing as a single exchange providing comprehensive volume data.

As a substitute, brokers often supply tick volume, which measures the variety of price changes slightly than the actual traded volume.

Because of this, Volume Weighted Moving Average calculations in forex are loads less reliable and will not accurately reflect what’s actually happening.

So, it’s fair to say under those conditions, the VWMA can lose its effectiveness and risks becoming more of a source of noise than a great tool!

For that reason, forex traders may have to depend on other indicators or interpret VWMA data with an additional pinch of salt.

At any rate, let’s explore some real examples of how it might be utilized in practice!

VWMA Strategies

OK – the fun part!

Let’s have a look at how you can actually use Volume Weighted Moving Average in your trading.

Begin by trend-following systems…

Trend Following

VWMA can function a helpful guide for trend-following strategies, helping you confirm the strength and direction of a trend.

In an uptrend, prices consistently trading above the VWMA suggest bullish sentiment, indicating that buyers are dominating the market.

Is smart, right?

Prices below the VWMA in a downtrend signal bearish conditions, reflecting strong selling pressure.

Put them together, and VWMA becomes a dynamic tool for identifying pullback opportunities.

In an uptrend, for example, a short lived retracement to the VWMA can act as a possible entry point for an extended trade, meaning you may align your positions with the broader trend.

Nevertheless, it’s necessary to do not forget that VWMA is only when used together with other indicators.

Tools like momentum oscillators, trendlines, horizontal levels, or candlestick patterns may give extra confirmation of the trend and make it easier to refine your entry points.

Let’s break this down with an example…

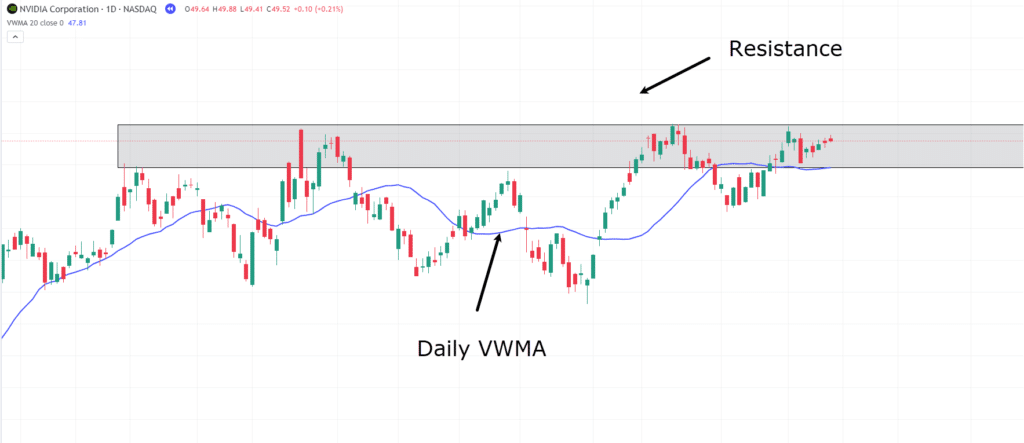

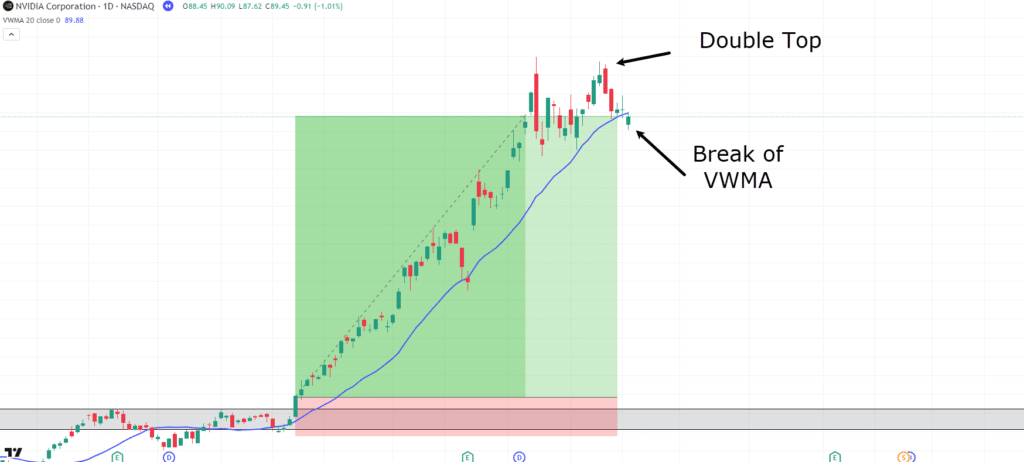

NVIDIA Every day Chart:

On this every day chart of NVIDIA, the worth approaches a resistance zone where you anticipate the subsequent breakout trend.

While the worth often moves above the VWMA, entering too early without confirmation can get you caught up in market fluctuations as the worth oscillates across the VWMA.

To avoid this, ensure Volume Weighted Moving Average is paired with other types of technical evaluation, reminiscent of a transparent breakout pattern or a momentum indicator that confirms the breakout’s strength.

Through the use of VWMA together like this, you may enhance your decision-making and reduce the chance of false signals.

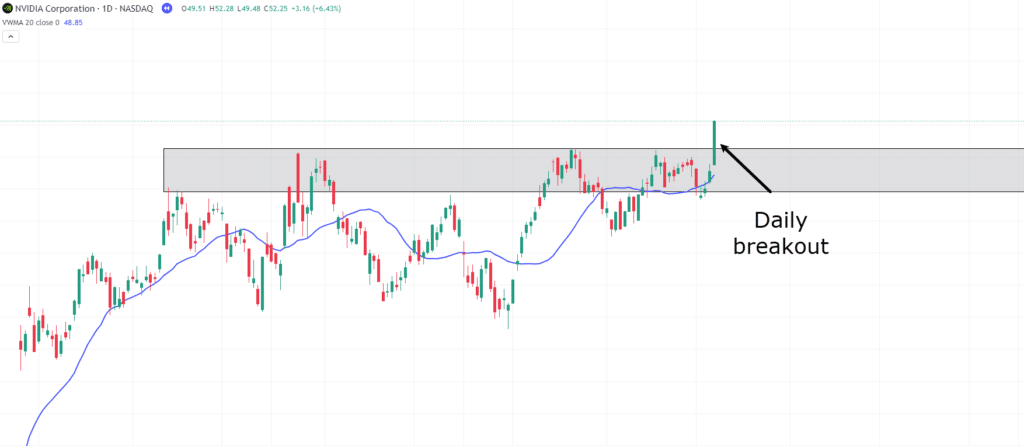

NVIDIA Every day Breakout:

Let’s have a look at this chart and take into consideration whether or to not take motion.

Price has come as much as a resistance zone for the fifth time…

…but each time it’s rejected the zone, it’s fallen barely lower – but hasn’t gone right into a reversal and began down trending.

This tells you that Price desires to stay here for some reason!

Now, on this fifth try to break the resistance, the worth has broken through and closed above the resistance level with a powerful bullish engulfing candle…

Price is acting above the every day VWMA!

So, evidently loads aligns with bullish sentiment.

Let’s take an extended position…

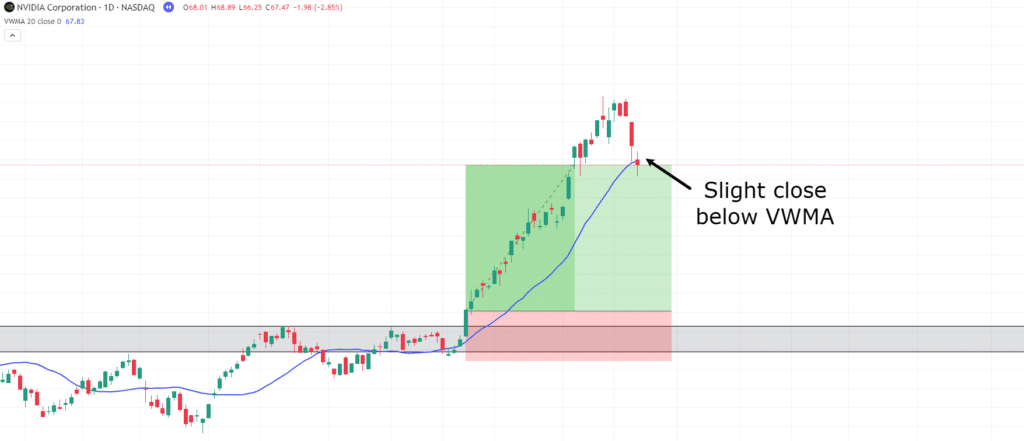

NVIDIA Trend Following:

OK, now that the worth has taken off from the breakout, something else has occurred:

Price has just barely closed below the Volume Weighted Moving Average on the every day.

This presents a trading decision.

You possibly can either:

– close early here expecting that the worth might proceed down or

– you may wait for the subsequent candle to verify the VWMA trend has truly finished.

My opinion?

Well, as a result of the hammer nature of this candle, and the indecision behind it, I’d prefer to carry this trade for an additional day and see what happens.

Let’s have a look…

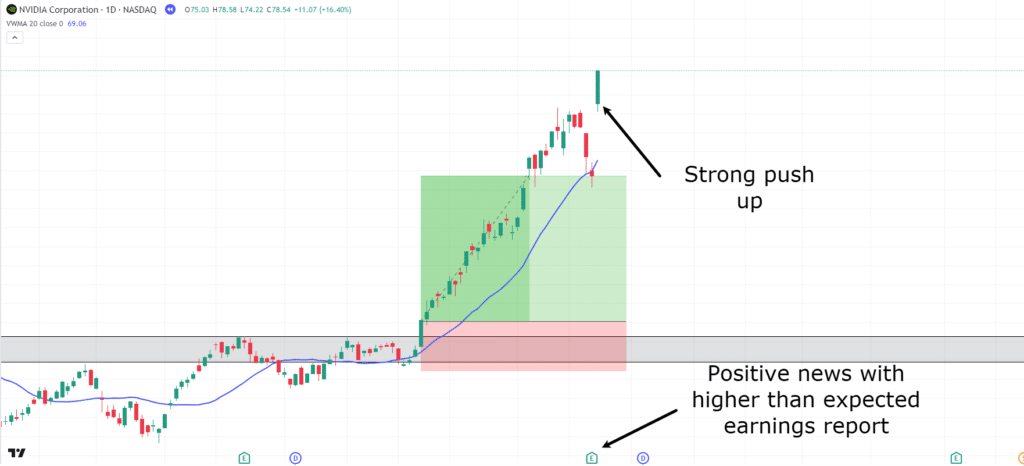

NVIDIA Earnings Report:

I mean, it’s no coincidence that the market got a bit anxious near the earnings report, bringing the worth down toward the VWMA in anticipation of probably poor earnings.

Nevertheless, by waiting to see the actual earnings, you’d have been rewarded!

Let’s see when this trend setup gives one other exit trigger…

NVIDIA Double Top:

There are two things that stand out from this chart.

A double top has formed where its clear price is now beginning to form a recent resistance level and there’s a recent break of the every day Volume Weighted Moving Average.

Although the break isn’t significant, there are beginning to be signs that the bulls are running out of steam…

This implies this might either be an exit opportunity…

Or, it could be a time to attend for a clearer direction…

For argument’s sake, let’s wait to see some more confirmation…

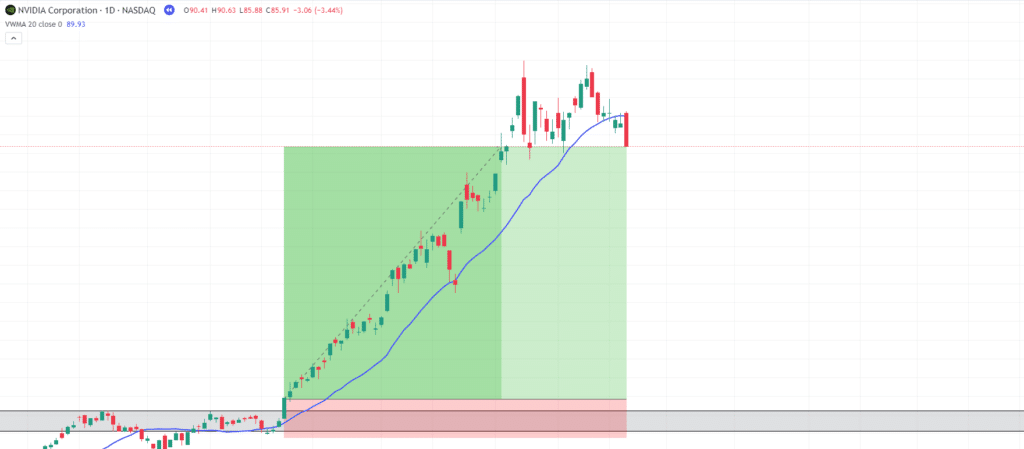

NVIDIA Trade Exit:

Our intuition was correct!

It’s time to exit this trade with the bearish engulfing candle.

OK so, are you able to see how at no point the trading decisions were black and white?

You used different evaluation tools and your experience to inform you the proper and improper time to exit the trade.

Remember, simply because there’s a minor break of the VWMA – it doesn’t mean you HAVE to exit the trade.

Be certain to make use of the general context of the market to make one of the best decision you may on the time.

There is completely nothing improper with waiting for what tomorrow might bring!

Next, let’s have a look at a reversion to the mean strategy for you.

Reversion to the Mean

The Volume Weighted Moving Average could be a wonderful tool for mean-reversion strategies, allowing you to seek out and earn on price deviations from the “fair value” line.

Importantly, when the worth moves significantly above or below the VWMA, it often signals overbought or oversold conditions.

This implies potential trading probabilities!

Price tends to gravitate back toward the Volume Weighted Moving Average, since it reflects the asset’s weighted average price based on volume.

For example, imagine a scenario where a stock’s price surges well above its VWMA during a low-volume rally.

This divergence could signal that the rally lacks strength and participation, bringing a likelihood to short the stock, expecting the worth to revert back to the VWMA.

But at all times remember – context is critical!

In trending markets, where momentum drives prices further away from the common, reversion to the mean strategies often fails.

Attempting to counter a powerful uptrend or downtrend by betting on mean reversion could end in significant losses.

For this reason reversion to the mean strategies works best in range-bound or consolidating markets, where price motion is more contained.

Let’s dive right into a real-life example to see it…

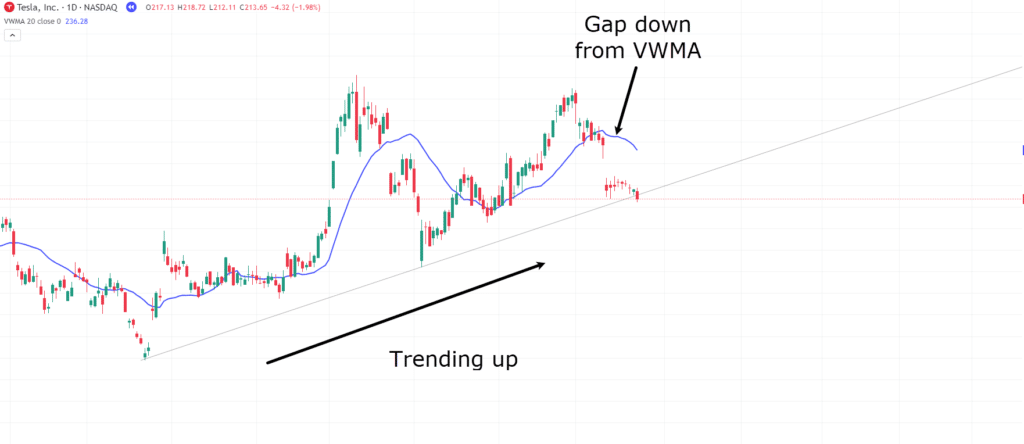

Tesla Every day Chart:

Here, you may see a novel scenario on the Tesla every day chart.

Price has gapped down from the Volume Weighted Moving Average towards the trendline.

On this case, Tesla is in a shorter-term uptrend while in a longer-term range, which implies…

…a possibility to capture a move using reversion to the mean!

For whatever reason, price has gapped down, but, as seen previously, price tends to hover across the VWMA…

Let’s take a have a look at how you possibly can potentially arrange this trade…

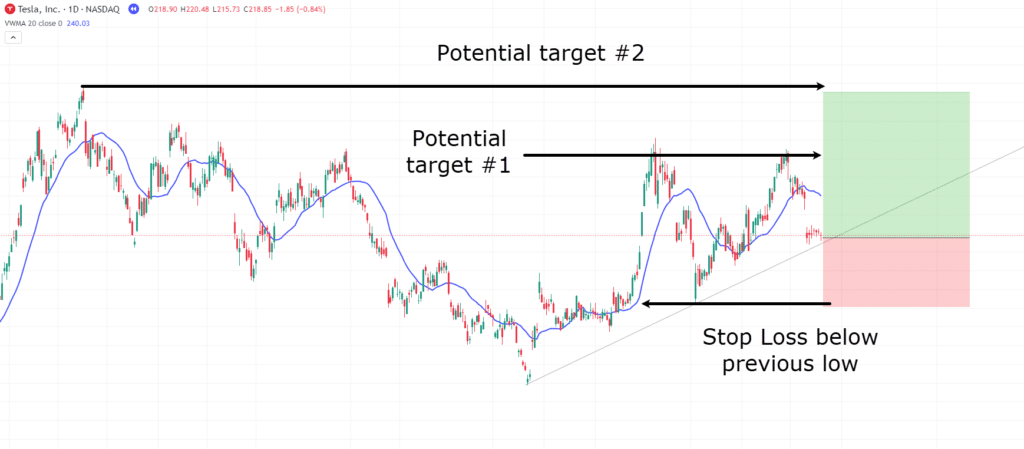

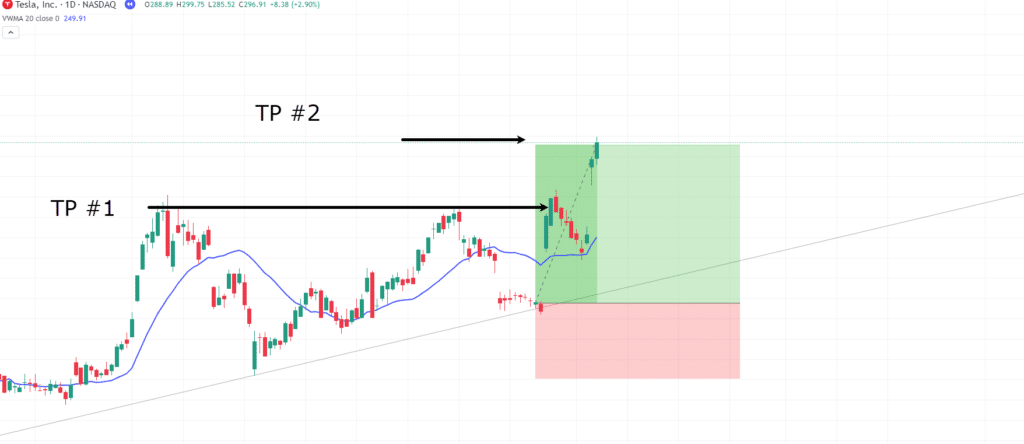

Tesla Trade Setup:

Your entry could possibly be positioned on the trendline with a stop loss below the previous low.

It makes an awesome invalidation point because the trade doesn’t work if the worth forms a recent low (the worth isn’t any longer trending up)

As for taking profits, there are a couple of options, with the primary reasonable goal being the best high.

Essentially the most recent highs also provide a useful profit level, depending on how the worth responds to the trendline and resistance levels…

Take Profit Options:

As you may see price was well and truly responded to the trendline and bumped as much as the take profit 1.

Price then retraced back to the VWMA.

In the event you selected to take profits at TP1, the trade can be over, and also you’d have taken profits before the retracement.

Nevertheless, when you were targeting the TP2…

…the Volume Weighted Moving Average holding price as support was crucial!

Alright, I would like to offer you one final use for the VWMA that applies to this exact trade.

It involves VWMA as a support and resistance, meaning you get dynamic take profits!

VWMA as Dynamic Support and Resistance

Volume Weighted Moving Average can act as a dynamic level of support or resistance, supplying you with price levels to work with.

In an uptrend, VWMA often serves as a support level, where buyers step in to defend the trend.

In a downtrend, VWMA can act as resistance, where sellers are likely to take care of control.

Understanding this provides you a likelihood to set stop-losses or take-profit levels.

For example, if a stock is trading above VWMA and approaches it during a pullback, a bounce of VWMA could signal a continuation of the trend…

…this implies you’d get a likelihood to either add to your position or hold it!

Nevertheless, if the worth breaks below VWMA with strong volume, it might indicate a reversal, prompting you to exit or switch your bias.

Let’s take a have a look at the instance…

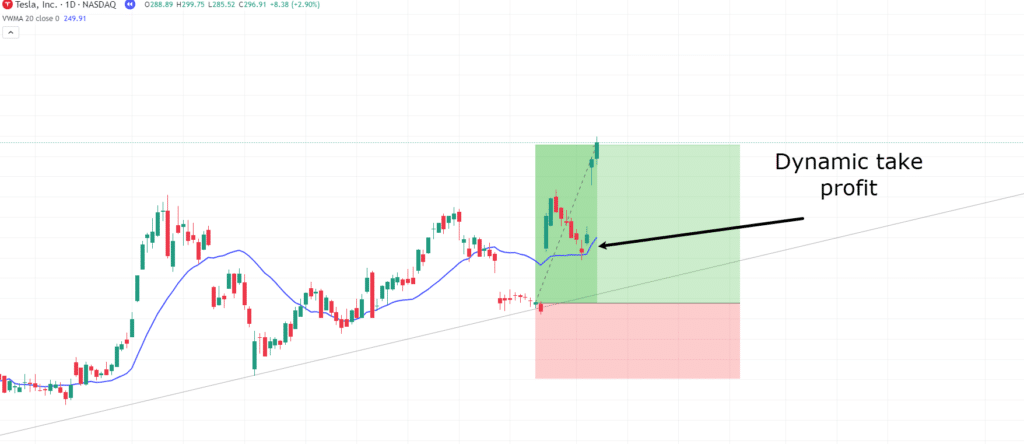

Dynamic Take Profit:

Using the identical example because the last trade, as a substitute of using a static take-profit, what when you viewed the VWMA more as a dynamic support level?

The rule can be, if the worth fell below the VWMA – you’re taking your profit. Got it?

Now, despite its volatile movement, it’s essential work out if it’s begun a recent uptrend.

It’s at times like these you should use the VWMA as a trailing stop loss / take profit.

Let’s see what would occur when you used the Volume Weighted Moving Average as a trailing take profit….

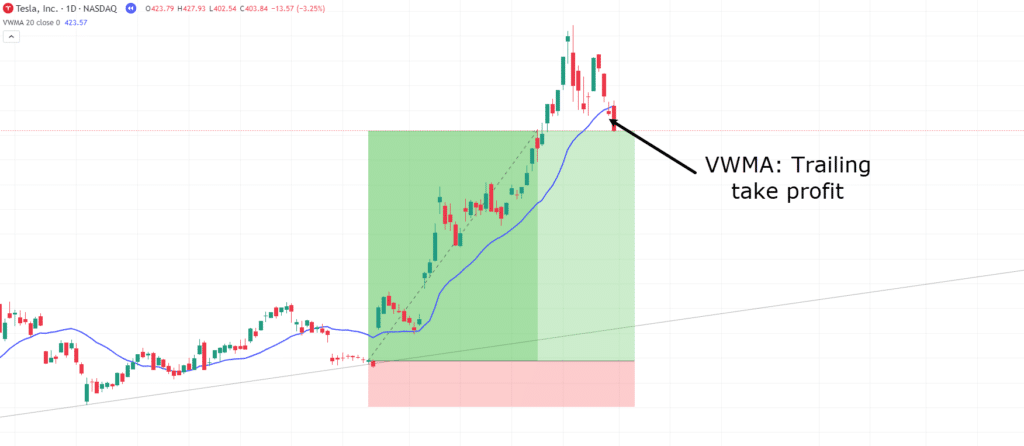

Trailing Take Profit:

Wow – Quite the Move!

Are you able to see how useful the Volume Weighted Moving Average could be as a dynamic level?

Structure your trades off it? Check.

Aid you work out the proper time to exit or hold your position? Check again!

Keep in mind, though, that sometimes, waiting for VWMA to be broken – pending volatility – you may find yourself delaying an exit that truly finally ends up less profitable, compared with a static take profit over an extended time period.

So, again – at all times have a look at as much of the image as possible.

Speaking of which, let’s show an example of when VWMA might actually hinder your profit-taking…

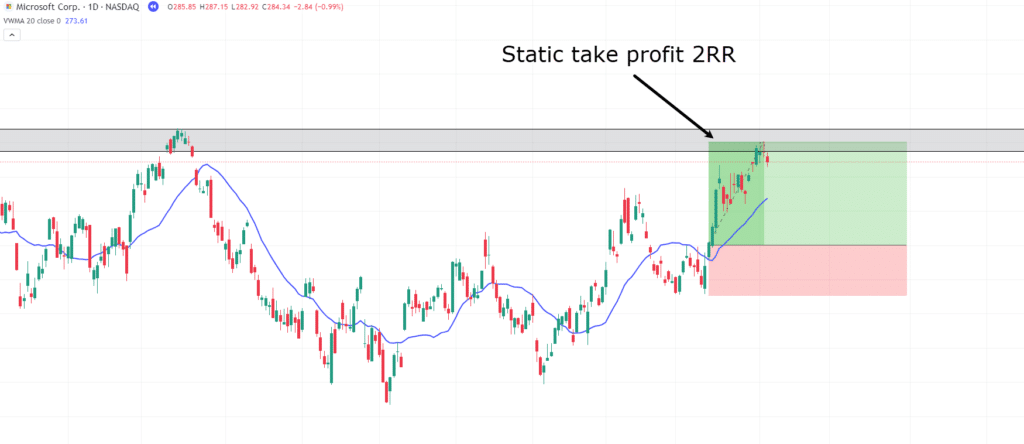

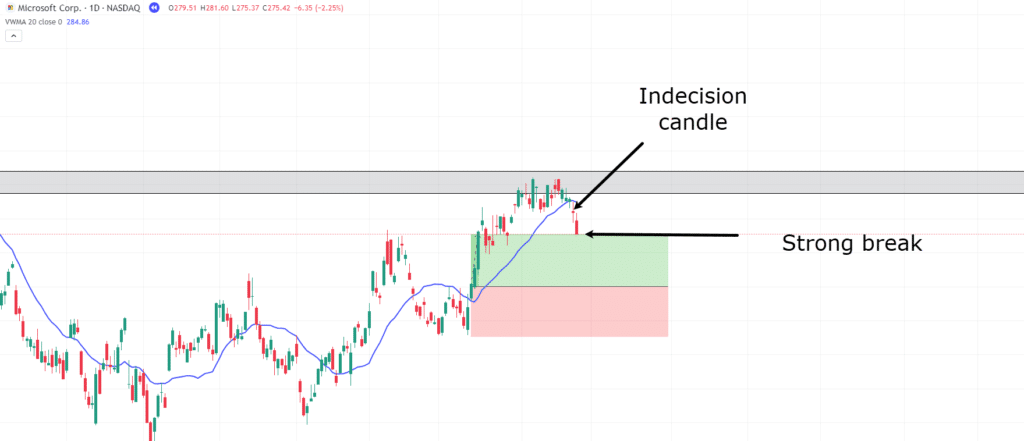

Microsoft Every day Chart:

Say you might be on this trade, and the worth has come back to an inexpensive resistance level.

You will have the choice to take profits and claim a 2RR trade in a brief time period.

Nevertheless, when you were to make use of the Volume Weighted Moving Average dynamic trialing stop loss to take profit on this scenario, here’s what might occur…

Microsoft Dynamic Take Profit:

As the worth closes below the Volume Weighted Moving Average with an indecision candle, you’ve got the choice to carry – within the hope that it’s a temporary break and that price stays in an uptrend.

But then the subsequent candle closes strongly below the VWMA, making it seem like this resistance is solely too strong for the trend to proceed.

In the long run, you’ve waited an additional two to 4 days and halved your profit with a 1RR trade.

Frustrating!

But, this may occur and it’s why VWMA should be considered within the context of the general market and your trading goals.

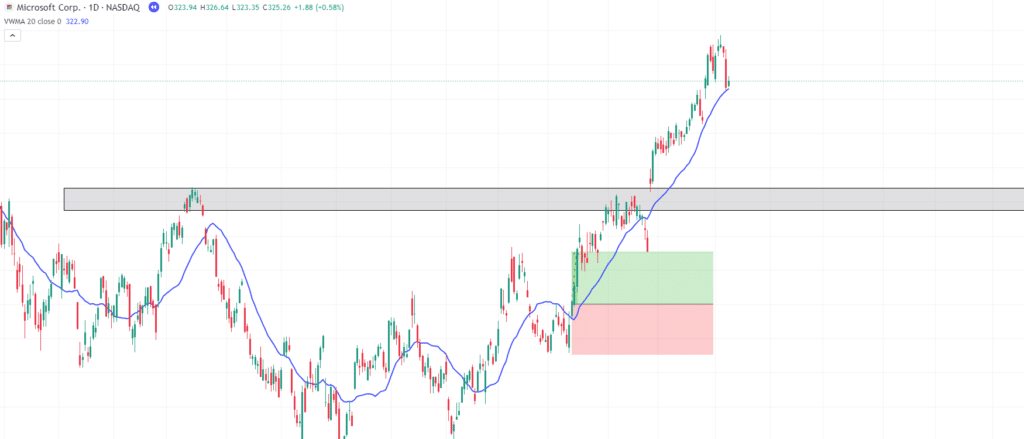

Take a have a look at what happens next, though…

Microsoft Trend Continuation:

Price actually does proceed its the direction of the trend, and the break below the VWMA was only temporary.

What’s my point?

Well – hopefully, you may see Volume Weighted Moving Average is just not the right solution to all of your trading problems!

Sometimes, the market will respond in a different way to different market news, reports, and technical levels.

Taking profits early may appear to be a failure but when there are profits to be taken, it’s often best to take them once they can be found or when you don’t have a transparent read on what the market is attempting to do.

I mean, this trade could easily have ended up right back on the entry-level!

Remember – don’t get greedy.

Limitations and Mistakes to Avoid

Limitations and Mistakes to Avoid

As shown within the last example, while the Volume Weighted Moving Average (VWMA) is a flexible and insightful tool, it does have its limitations.

Failing to grasp these challenges and avoiding common pitfalls can prevent you from getting useful results out of the VWMA.

Misinterpreting VWMA in Low-Volume Markets

Volume Weighted Moving Average’s reliability can falter in low-volume markets.

When trading activity is minimal, a couple of large trades or abrupt price movements can really mess up the VWMA’s significance.

In turn, this distortion often leads to misleading signals, because the indicator becomes too heavily influenced by volume spikes.

You’ll often find it happening in thinly traded stocks or illiquid assets, for instance.

In such cases, the VWMA might appear to signal critical price levels or trend shifts when, in point of fact, there isn’t that much market interest or activity to back it up.

To avoid falling into this trap, it’s essential enter low-volume situations with skepticism.

I prefer to ask myself whether the amount behind the move justifies the motion, or whether it’s an outlier that’s throwing off the information.

As mentioned, let VWMA add to what you’re doing slightly than attempt to live off it.

All the time start with a transparent plan of what you’re on the lookout for out there…

…then use Volume Weighted Moving Average to assist confirm your hypothesis.

This shift in mindset can make it easier to avoid chasing false signals and improve your overall trading consistency.

Now, let’s expand on this concept further!

Over-Reliance on VWMA

Although Volume Weighted Moving Average is a highly insightful and dynamic tool, over-relying on it might result in poor trading decisions.

While it’s more responsive than traditional moving averages, it should never be used alone.

As a substitute, use it as a part of an entire trading strategy, including trendlines, support and resistance levels, candlestick patterns, and other volume-based indicators.

A standard mistake is considering that each price interaction with VWMA will end in a reversal or bounce.

But this completely ignores how complex the market truly is!

Pondering back to the previous VWMA example – price cut below, then straight back above the VWMA, right?

Well, as a result of stock news, prices may keep cutting through VWMA like that – without respecting it as a support or resistance level…

It’s all about market context.

In the event you rely solely on Volume Weighted Moving Average signals without considering other aspects, you risk entering trades based on false signals or getting whipsawed out by noise.

To mitigate this, use VWMA as one piece of the puzzle.

Lagging Nature of VWMA

Like all moving averages, Volume Weighted Moving Average is a lagging indicator, because it relies on historical data to calculate its values.

This lag could make it less effective in fast-moving markets or during sharp price reversals, where real-time sentiment and momentum can shift rapidly.

In volatile conditions, relying solely on VWMA to predict future price movements can result in missteps, so use it as a benchmark slightly than a predictive tool in these cases.

For instance, in trending markets, VWMA can confirm the direction of the trend or highlight key pullback zones.

Nevertheless, in highly volatile or choppy conditions, its lagging nature may render it less reliable for timing precise entries or exits.

Consider an organization announcing really bad sales for its quarterly report.

VWMA can’t factor that news in until the worth has already reacted to it.

Differentiating Short-Term and Long-Term Uses

One of the common mistakes traders make is failing to tell apart between Volume Weighted Moving Average’s short-term and long-term applications.

Although VWMA could be calculated over any timeframe, the best way it’s interpreted depends significantly on the period being analyzed.

For instance, using intraday VWMA is especially useful for identifying trading activity and volume shifts inside a single session.

Alternatively, calculating VWMA over multiple days or perhaps weeks may give insight into broader market trends and key levels of trading activity over an extended horizon.

But keep them separate.

These longer-term VWMA calculations won’t mean as much when applied to short-term trading strategies and vice versa.

Confusing these applications can result in inaccurate conclusions about market direction or critical price zones.

So, in case your trading style involves quick scalps or intraday trades, using a multi-day VWMA won’t align along with your goals!

Similarly, when you’re swing trading or investing, counting on a single-session Volume Weighted Moving Average could miss the larger picture.

As such, it’s crucial to obviously understand what your goals are before applying VWMA.

By choosing VWMA settings that match your approach, you make sure that the indicator gives you one of the best insights in your decisions.

Similar to a compass, VWMA is implausible for identifying directions, but it might’t show the complete map.

Successful navigation of the markets requires combining it with other indicators, market context, and a well-rounded trading plan.

Conclusion

The Volume Weighted Moving Average (VWMA) is a robust tool that may seriously enhance your market evaluation and trading decisions!

By getting trading volume into the equation, VWMA gives you a more responsive and accurate picture of price movements.

It might make it easier to discover key trends and price levels with greater accuracy, too.

When used together with other technical indicators, VWMA can provide an edge, allowing you to make more informed, higher-probability trades while avoiding common pitfalls.

Nevertheless, like all other tool, it’s best used with a solid trading strategy and disciplined execution!

In this text, you’ve learned:

- What makes VWMA unique, and the way it differs from other moving averages

- apply VWMA in various market conditions and with different volatilities

- use VWMA to capture trends and execute reversion to the mean trades through real-life examples

- Common mistakes traders make when interpreting VWMA and the way you may avoid them

Always remember that VWMA is only one piece of the puzzle, but mastering it might be a game-changer in your trading approach.

Now, when you’re able to dive deeper into VWMA, I encourage you to experiment with it in your individual trading!

Try it in numerous market conditions and on different timeframes.

And, when you’ve already used Volume Weighted Moving Average, tell me about your experience with it!

Share your thoughts and questions within the comments below!