CoreLogic, the chance modelling and catastrophe data company, has provided an initial estimate for insured losses from the Los Angeles, California wildfires, saying the overall is anticipated to fall in a variety from $35 billion to as high as $45 billion.

CoreLogic noted that each of the essential wildfires which can be burning remained only lower than 50% contained as of Thursday afternoon, meaning the ultimate insurance and reinsurance market loss estimates may differ.

In a recent update this afternoon, the California fire authorities said the Palisades fire stays only 22% contained, while the Eaton fire is now 55% contained.

The chance modelling and catastrophe data specialist company said a final insured loss estimate can be provided once the wildfires have been fully contained.

CoreLogic is the primary catastrophe risk modeller to issue a public estimate for the potential insurance and reinsurance market financial exposure to the still burning wildfires in California.

The estimate for insurance market losses of between $35 billion and $45 billion is predicated on CoreLogic’s evaluation across residential and business exposures for the Eaton and Palisades Fires in Los Angeles, California.

The corporate explained, “This evaluation of insured damage for each residential and business properties accounts for each fire and smoke damage in addition to demand surge, debris removal, clean up and Additional Living Expenses (ALE). Nearly all of losses are to residential properties.

“A lot of the doubtless impacted properties are high value homes, so even moderate damage from the fires or smoke could lead to costly claims.”

Tom Larsen, Senior Director of CoreLogic Insurance Solutions, also said, “The destruction brought on by these fires is anticipated to be the costliest within the state’s history with effects on the insurance industry that may persist into the long run.

“This event highlights the paramount challenge for homeowners and the insurers that support them – the increasing density of homes and properties near the wildlife-urban-interface. Los Angeles is a resilient community, and as they appear to rebuild it is going to be essential to design or redesign with mitigation practices in mind, so an event of this magnitude never happens again.”

The estimate aligns with where analyst estimates have risen to, given that they had been in a variety of $15 billion to $25 billion, then most rose towards the upper-half of that range, while some others have reached the $30 billion level and better.

An industry lack of between $35 billion and $45 billion makes these wildfires by far the costliest loss event for that peril ever for the insurance market.

If the loss settles on this range it is going to definitely trigger reinsurance and even perhaps some retrocessional recoveries, although nearly all of the loss would still be expected to fall to personal insurers and California’s FAIR Plan, it’s assumed. At this level of industry impact, the Fair Plan could exhaust its reinsurance and other financing resources, it has been speculated.

Catastrophe bond exposure is harder to judge presently. But at this level of industry loss, the erosion of exposed multi-peril aggregate cat bond attachments will naturally be more significant in every case.

It’s also price noting that a catastrophe industry loss event of this magnitude could have ramifications for sector capital, risk appetites and because of this some effect on the long run direction of property catastrophe reinsurance prices.

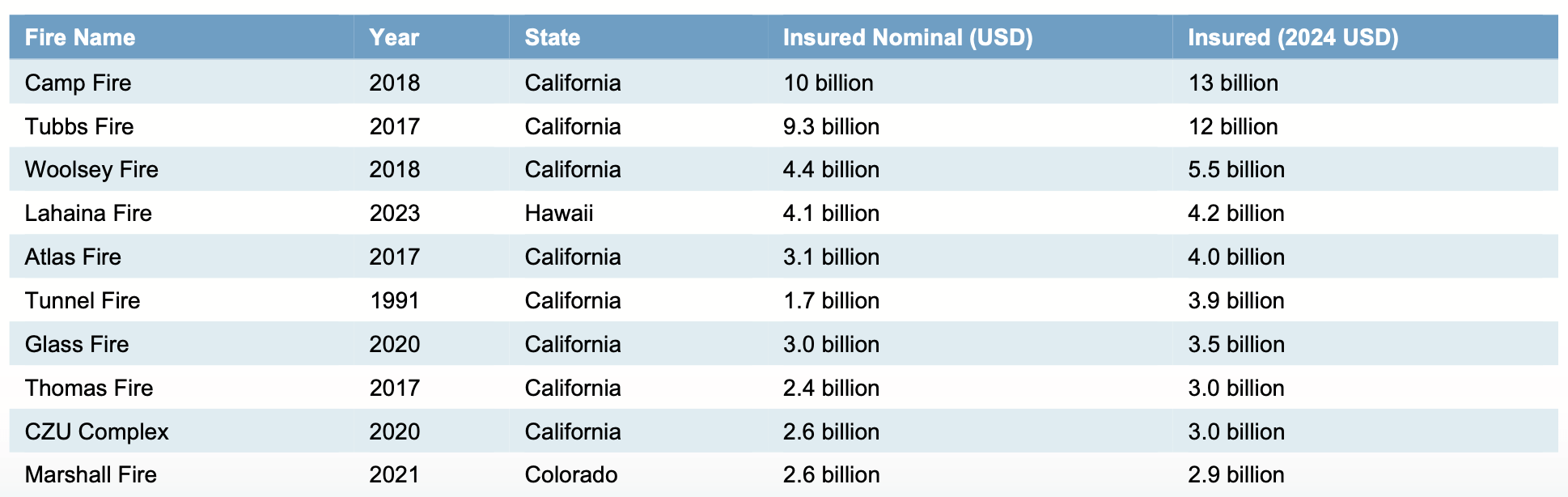

You’ll be able to see a listing of the most costly US wildfire insured loss events within the table below, taken from a report from reinsurance broker Gallagher Re:

Also read:

– Alternative capital can provide wildfire capability, but pricing a sticking point: Morningstar DBRS.

– Stone Ridge marks mutual cat bond / ILS funds essentially the most on LA wildfires.

– Euler ILS Partners puts wildfire industry loss at $15bn-$17bn, highlights BI / ALE uncertainty.

– Wildfire losses may cause re/insurance pricing to firm as payback sought: Berenberg.

– BMS says LA wildfire insured losses prone to exceed $25bn. KBW analyses as much as $40bn.

– Autonomous raises its LA wildfire loss estimate to $25bn, $18bn from Palisades fire.

– California wildfires: Subrogation topic raised, as utilities come into focus.

– ICEYE satellite evaluation: Over 10,900 buildings likely destroyed in Palisades and Eaton fires.

– Catastrophe bond price movements as a result of LA wildfire exposure.

– Evercore ISI: LA wildfire insured loss $20bn-$25bn. May very well be one event under reinsurance.

– LA wildfire losses to “notably exceed” $10bn, could approach $20bn: Gallagher Re.

– Mercury says LA wildfire losses to exceed reinsurance retention.

– LA fires: “Considerable attachment erosion” likely for some aggregate cat bonds – Steiger, Icosa.

– LA wildfires: Over 10k structures destroyed. Insured losses as much as ~$20bn, economic $150bn.

– LA wildfire losses unlikely to significantly affect cat bond market: Twelve Capital.

– LA wildfires unlikely to cause meaningful catastrophe bond impact: Plenum Investments.

– JP Morgan analysts double LA wildfire insurance loss estimate to ~$20bn.

– LA wildfires: Analysts put insured losses in $6bn – $13bn range. Economic loss said $52bn+.

– LA wildfires bring aggregate cat bond attachment erosion into focus: Icosa Investments.