On a relative basis, catastrophe bonds have rarely presented a more compelling investment opportunity than today, as despite spreads having tightened somewhat the cat bond asset class diversification offering may be at its strongest when other assets like equities are overvalued, fund manager Icosa Investments has said.

Previously, the investment manager has explained that with catastrophe bond spreads remaining at historically elevated levels, it sees a sexy entry point to the asset class for investors.

In its latest insight, specialist cat bond fund manager Icosa Investments has explained further the explanation why it sees catastrophe bonds as a very compelling alternative asset class at this time limit, highlighting their diversification profit and the way which may be sought out at times of perceived overvaluation in other asset classes.

Broader financial markets have been in flux, while there remain concerns over the potential for rate cuts and where inflation may head, but at the identical time equity markets have ripped on the back of the US election. Many see this as a volatile time for the common investor and institution.

Which suggests diversifying sources of return remain in high-demand and alternatives like cat bonds are increasingly sought out, while investors navigate the broader markets.

Icosa Investments said, “While it’s true that cat bond spreads have tightened, investors should keep a key seasonal think about mind: with the hurricane season ending soon, the chance within the cat bond market will reach its annual low. That is just because the likelihood of hurricanes throughout the winter months is minimal.

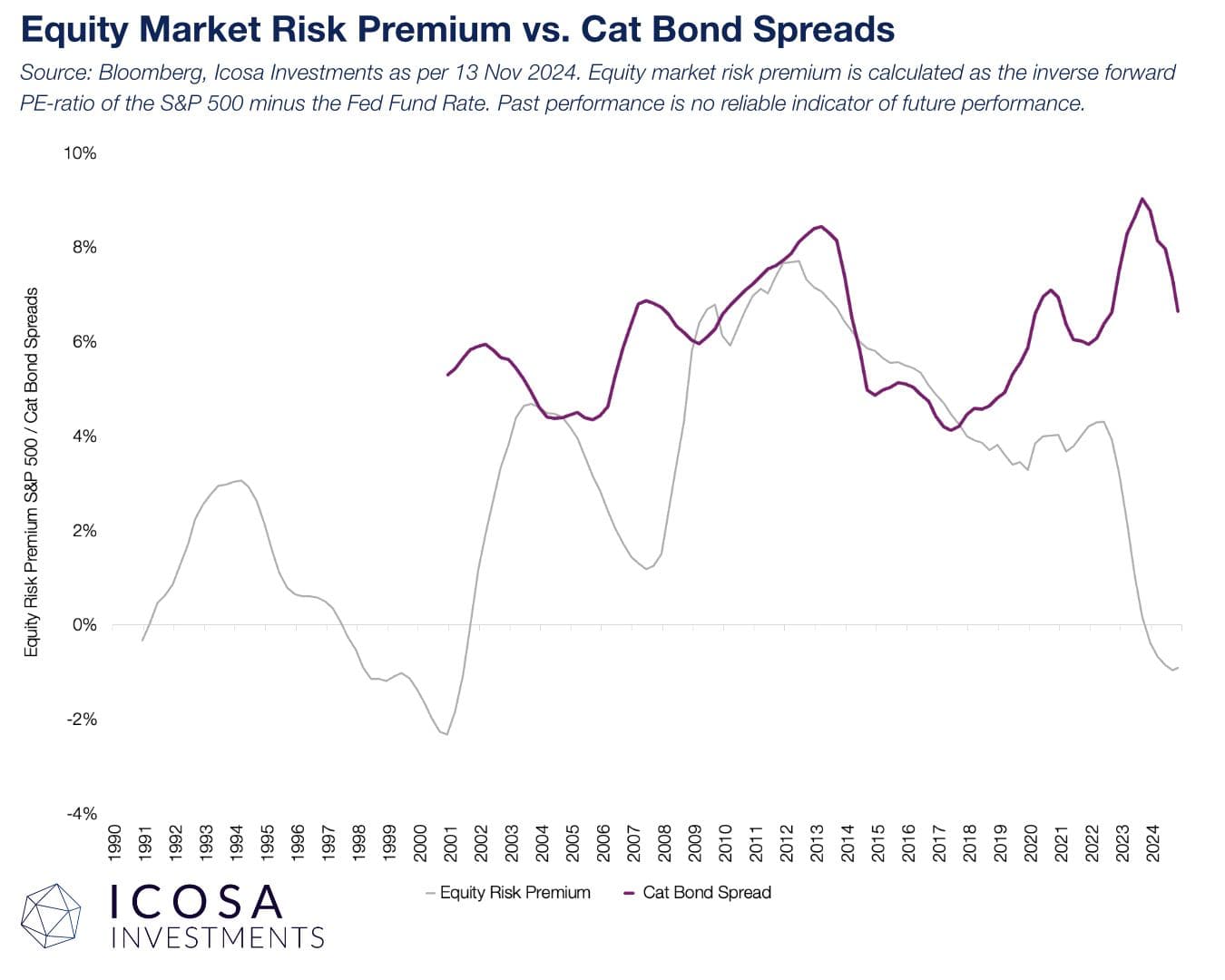

“But timing an entry into cat bonds isn’t nearly seasonal risk. The optimal moment so as to add cat bonds to a multi-asset portfolio isn’t necessarily once they’re most tasty in isolation, but when other markets – like equities – are overvalued, and the necessity for diversification is best.”

The investment manager shared the chart below, that plots the equity risk premium (inverse of the S&P 500 PE ratio minus the Fed Funds Rate) against cat bond spreads.

“The result? Cat bonds have rarely been more compelling on a relative basis,” Icosa Investments concludes. Adding “For investors in search of uncorrelated returns and diversification in today’s environment, cat bonds offer an ideal opportunity to cut back drawdown risk.”

Florian Steiger, CEO of Icosa Investments, further explained, “Higher spreads are all the time appealing – who wouldn’t wish to earn more? But for stylish investors, the true value of cat bonds lies of their ability to assist protect portfolios from losses elsewhere.

“In today’s environment, with equity markets experiencing an incredible rally, it’s a really perfect moment to think about diversifying into assets which are uncorrelated to traditional markets.

“Cat bonds serve precisely this purpose. They provide diversification advantages and resilience, no matter where spreads stand. And speaking of spreads: They continue to be highly attractive!”

One other factor that makes catastrophe bond investments compelling at the moment is the incontrovertible fact that, with the US hurricane season drawing to an in depth for the yr the seasonality-adjusted expected lack of the outstanding market is now at a very low level.

Icosa Investments analysed this and located that, at this time limit, the adjusted expected lack of the market sits as little as it has done since late 2016 to early 2017.

At the identical time, the chance spread of the outstanding cat bond market stays historically attractive as well, making for a robust access point to the market.

Icosa Investments said, “One among the important thing facets to grasp when investing in cat bonds is the seasonal fluctuation in risk levels. This fluctuation is driven by meteorological patterns, which determine when specific perils are most probably to occur. A significant slice of the cat bond market is exposed to US hurricanes, meaning that risk levels for these bonds are considerably lower within the winter in comparison with the height hurricane season, which runs from July to mid-October.

“With the hurricane season behind us, the annualized risk levels across the cat bond market usually are not just at their lowest for the yr – they’re at their lowest in recent times. For investors in search of to benefit from this unique asset class, there’s no higher moment to explore the market than today.”