Ordinals are a comparatively novel innovation throughout the crypto space, but ORDI, the cryptocurrency with the Ordinals namesake, is throughout the grasp of the bears.

In accordance with the newest market data provided by CoinCodex, the token is down nearly 5% throughout the last 24 hours despite Bitcoin making an 11% gain throughout the past week.

Related Reading

Up And Down The Rabbit Hole

Although the market seems bullish for Bitcoin and the market as a complete, Ordinals appear to go against the grain. Analysts are hopeful that ORDI is on the trail to a possible bullish breakthrough, nonetheless, this seems unlikely.

Although BRC-20 standard tokens are following the final market trend, ORDI in itself is bland, offering no other utility, unlike others throughout the same category. But its utility in bringing NFTs to the Bitcoin blockchain might provide some value to the combo.

A recent “State of the Union-esque” done at Christie’s Art and Tech Summit showed that the NFT market’s relationship with the standard art world is in a transitional stage.

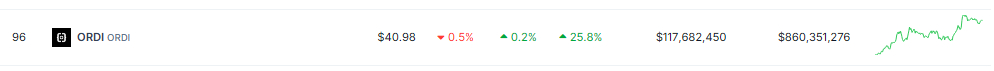

ORDI is now trading at $41. Chart: TradingView

“We all know that there’s a provenance verification opportunity here. All of us realize it and everyone knows that the art world is resisting it since it suggests transparency, which we are saying we would like but we don’t really need,” Pace Gallery CEO Marc Glimcher said on the event.

If Bitcoin Ordinals keeps attracting developers to its area of interest, further expanding the codebase on Github, there is likely to be a likelihood that a rise in development for the open-source platform will result in overall higher adoption of the BRC-20 standard that can increase investor confidence towards the asset.

$50 ORDI Closer Than Expected?

Despite volatility being a double-edged sword for essentially the most part, ORDI bulls are in an amazing position to push the token to its limits; On the time of writing, ORDI sustained a solid 26% rally within the weekly frame. And at $41.33, the value offers little resistance to the general positive mood of the market, which could result in a bullish takeover inside the following couple of days.

ORDI price up within the weekly frame. Source: Coingecko

Related Reading

Once this happens, ORDI has a better likelihood of meeting the $50 mark inside the following few weeks. However the high volatility also implies that this move of accumulation can be of venture for investors and traders as increasingly more analysts eye an even bigger breakthrough in the long term.

This scenario is very depending on the final market upswings that may or may not occur these next few weeks. Investors and traders should monitor the market and search for other opportunities before considering a runback to ORDI.

Featured image from Pexels, chart from TradingView