Cardano (ADA), the smart contracts platform known for its meticulous development process, finds itself at a critical juncture. Analysts are split on the cryptocurrency’s immediate future, with some predicting a bullish breakout and others bracing for a bearish correction.

Related Reading

Analyst Buckles Up For A Reversal

One analyst, known by the moniker Trend Rider, has taken an optimistic stance. They’ve identified a technical pattern suggesting a possible trend reversal for ADA. This pattern involves an initial price surge followed by a pullback, a scenario mirrored by several other cryptocurrencies recently.

$ADA had a temporary pump after which corrected, similar to all other coins.

Based on the facts, I see it lacks momentum. On the chart, I’ve marked the important thing levels:

🟢Zone for longs: $0.36–$0.40

📈Key price to start out reversing the trend: $0.50

Note: Each day Timeframe pic.twitter.com/3fH7xI08Ke

— Trend Rider (@TrendRidersTR) June 10, 2024

Trend Rider believes a key breakout point lies at $0.50. Surpassing this level could signal a major shift in momentum, potentially ushering in a latest uptrend for ADA. Moreover, they’ve identified a buying zone between $0.36 and $0.40, suggesting this may very well be a good entry point for investors looking for long positions.

Analyst Averages Offer Tentative Midpoint

Adding one other layer to the complexity is the common price prediction from various crypto analysts. These predictions collectively suggest a mean price of $0.422 for ADA in June 2024, with a variety between $0.405 and $0.439. This midpoint prediction positions ADA precariously near its current price, offering little guidance for investors looking for decisive direction.

Total crypto market cap currently at $2.39 trillion. Chart: TradingView

ADA Price Forecast

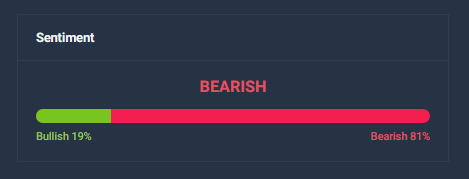

The present evaluation of Cardano (ADA) indicates a possible price increase of 5.00%, potentially reaching $0.446851 by July 12, 2024. Despite this optimistic price projection, the technical indicators suggest a bearish market sentiment.

That is further corroborated by the Fear & Greed Index, which currently reads 72, signifying a state of greed out there. Over the past 30 days, Cardano has experienced a moderate level of volatility at 3.52%, and only 40% of those days have been positive, indicating limited bullish momentum.

Related Reading

Source: CoinCodex

Source: CoinCodex

Given the prevailing market conditions and sentiment indicators, it seems that now isn’t an opportune time to speculate in Cardano. The bearish sentiment and high greed level suggest a possible market correction or increased risk of downside volatility. Investors might consider waiting for a more favorable market environment or clearer bullish signals before entering a position in Cardano.

Ultimately, the fate of ADA’s price hinges on a confluence of things beyond the realm of pure technical evaluation. Regulatory developments, institutional adoption, and broader market sentiment will all play a job in shaping ADA’s trajectory.

Featured image from Goodwood, chart from TradingView