Do you ever feel like market turbulence during news events catches you off guard?

How is it that some traders can navigate these stormy periods with ease…

…when you’re left scrambling!

Trust me, I’ve been there.

Fortunately, it’s not luck or intuition, though.

It’s all all the way down to strategy.

Successful traders don’t just trade the news – they actively plan for it!

At first glance, trading through news might feel like navigating a minefield of unexpected spreads, sudden gaps, and extreme volatility that may shake even essentially the most seasoned trader.

But with the correct approach, you’ll be able to definitely handle these challenges with confidence.

In this text, I’ll guide you thru the essentials of reports events:

- The different sorts of economic news

- How market expectations set the scene

- How the actual economic data points affect the charts

- The role the USD has on the forex market

- Some risk management tools to guard you during news events

Able to take control of your trades, even in the course of the most turbulent market moments?

Let’s dive in!

Sorts of Economic News: High, Medium, and Low Impact

Let’s face it: not all economic news hits the market with the identical force.

Some events cause massive waves of volatility, while others barely make a ripple.

If you ought to trade smart, you want to know which news moves the needle and the way it influences the markets.

Let’s break it down:

High-Impact News: The Market Movers

These events are the heavy hitters.

When high-impact news drops, markets can react within the blink of a watch, with volatility spiking dramatically.

These are the moments that traders live for or dread because they’ll quickly turn a superb day into a foul one or vice versa.

High Impact News Events Example:

Here’s what you need to keep watch over:

Central Bank Decisions

When central banks just like the Federal Reserve or the European Central Bank announce rate of interest changes or tweak their monetary policy, the markets hang on every word.

Even a subtle change in tone or terminology can result in major shifts within the markets.

GDP Reports

Consider Gross Domestic Product (GDP) because the economy’s report card.

A surprise within the GDP growth rate can jolt the markets, signaling either strength or weakness within the broader economy.

Traders often adjust their positions accordingly, especially when the numbers are different from expectations.

Inflation Data (CPI)

Inflation is one other big news topic

When Consumer Price Index (CPI) data surprises to the upside or downside, it might fuel speculation about future rate of interest moves, sending currencies and commodities on a rollercoaster.

Employment Data (NFP)

The U.S. Non-Farm Payrolls (NFP) economic news report is a monthly event that each trader marks on their calendar.

It provides a snapshot of the job market and sets the tone for market sentiment.

A powerful or weak NFP release can dramatically shift expectations for economic growth and rates of interest.

Geopolitical Events

Political surprises, similar to unexpected election outcomes, wars, or sudden leadership changes, can send shockwaves through global markets.

Traders often flock to safe-haven assets like gold or the U.S. dollar in periods of uncertainty.

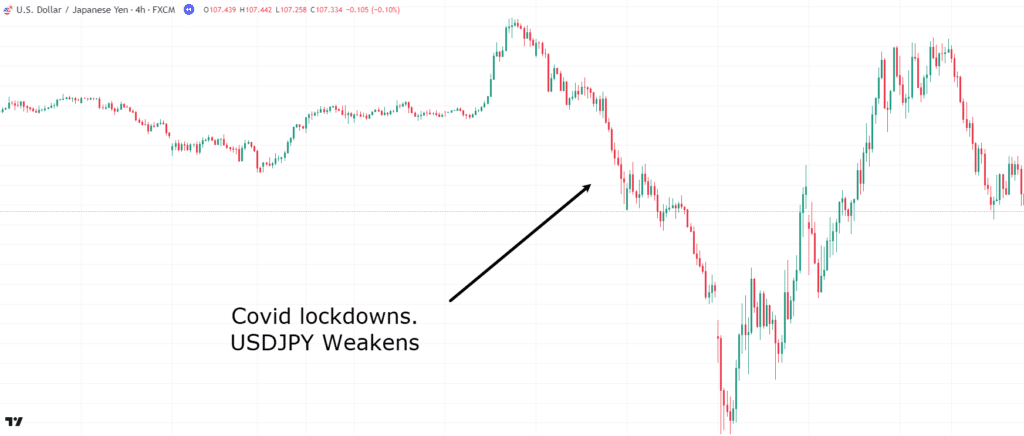

Examples include the market reactions to the onset of COVID-19 lockdowns, Russia’s invasion of Ukraine, and even the recent election leads to America.

AUD/USD Every day Chart Covid Lockdowns:

See how an unexpected event like COVID-19 caused panic out there?

These situations are rare but all the time extremely vital to pay close attention to.

Let’s move on to medium-impact news.

Medium-Impact Economic News: The Regular Drummers

While these events may not cause immediate market fireworks, they still play a vital role in shaping longer-term trends and overall sentiment.

Medium-impact news provides helpful context and trading opportunities for those being attentive.

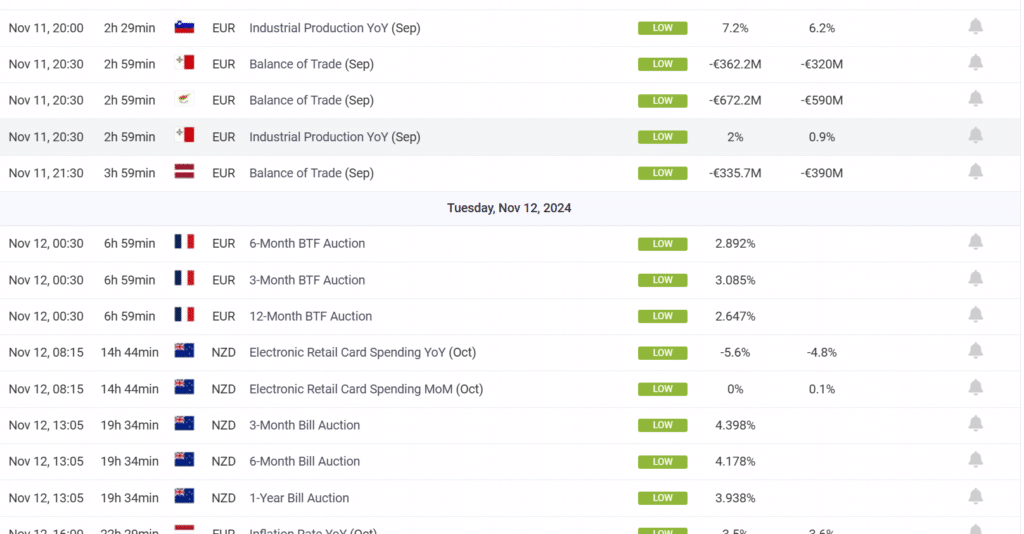

Medium Impact News Events Example

Let’s have a look at some key examples:

Retail Sales Data

Retail sales give a snapshot of consumer spending, which is a serious driver of economic growth.

Surprises on this data can shift market sentiment, especially in the event that they signal changes in consumer confidence or spending habits.

PMI Reports (Business Confidence)

Purchasing Managers’ Index (PMI) reports offer an early glimpse into the health of the manufacturing and services sectors.

Strong PMI readings can boost market optimism, while weaker numbers may point to potential slowdowns.

Central Bank Speeches

Even outside formal policy decisions, speeches by central bank officials can move markets.

Some traders scrutinize their tone and word selections for hints about future monetary policy, making these events vital for predicting shifts in market sentiment.

Trade Balance Reports

These economic news reports reveal the gap between a rustic’s exports and imports.

A narrowing trade deficit can signal improving economic conditions, while a widening deficit might raise red flags.

Although these reports often cause limited immediate market response, surprises can still shift long-term sentiment.

Why Medium-Impact News Matters

While you may not see dramatic moves on the charts unless something unexpected happens, medium-impact news could also be something to listen to.

It helps reinforce the narrative set by high-impact events and might offer clues about their potential outcomes.

Observant traders use these reports to anticipate how markets might react to imminent high-impact news, giving them an edge in making informed decisions.

So, have a look at medium-impact news more as a touch at what might come.

Low-Impact News: The Background Noise

Low-impact news may not send shockwaves through the markets, but it surely still serves a purpose.

While these events rarely trigger significant price movements, they add depth to your overall market evaluation…

Low Impact News Events Example:

Here’s what matches into this category:

Consumer Sentiment Surveys:

These offer you a feel for the way optimistic or pessimistic persons are in regards to the economy.

While they’re unlikely to cause big moves, they’re helpful in predicting shifts in consumer behavior.

Construction and Housing Data:

Economic news reports like housing starts and constructing permits mainly affect area of interest sectors, like real estate or construction stocks, fairly than the broader market.

Lesser-Known Indicators:

Data similar to wholesale inventories or regional surveys may not make headlines but can still offer area of interest insights.

Although most traders don’t give low-impact news much attention, staying informed can still be advantageous.

These reports might indirectly influence major market moves, but they supply subtle hints about overall market health and may also help shape your trading bias.

In brief, there’s no harm in keeping track of low-impact news it might function a useful complement to your broader trading strategy.

Just remember to not overreact and overanalyze its results and never let it take up an excessive amount of time and energy.

Why Does This Economic News Matter?

Okay Rayner, so there are news events which have different impacts in the marketplace.

But how does that fit into my trading?

Well, understanding the impact levels of economic news lets you prioritize and manage your focus.

High-impact news? That’s your time to shine. These are the events more than likely to trigger significant market moves.

Medium-impact news provides helpful context, helping you gauge trends and prepare for future volatility and potentially giving insights into what high-impact news consequence is prone to be.

Meanwhile, low-impact news adds depth, offering area of interest insights without overwhelming your evaluation.

It’s vital you acknowledge the differences between these categories so you’ll be able to stay ahead of the curve, avoid unnecessary noise, and consider the events that actually matter.

But how do you interpret this data in real time?

And more importantly, how do you identify whether the market will react strongly, mildly, or by no means?

Let’s take a deeper dive into how expectations and actual data impact the market.

Market Expectation

Why does high-impact news sometimes send markets right into a frenzy while, at other times, it barely causes a ripple?

The reply lies in market expectations.

Before any significant economic data drops, analysts and economists put out their forecasts.

These predictions are essentially the market’s baseline:

- If inflation is predicted to rise by 0.3%, traders price that in.

- If job growth is projected at 200,000 latest jobs, markets adjust ahead.

In essence, the market braces itself for the “expected” scenario, which is why you’ll often hear the phrase “priced in.”

But here’s the catch: analysts don’t all the time get it right.

Market Reality

Once the actual data is released, traders compare it against those expectations, which is when the true motion begins.

Let’s break down the three possible outcomes:

In Line with Expectations:

There is no such thing as a shock here.

When the economic news data matches forecasts, the market often stays calm, with minimal price movements. Traders were already prepared for this, so there’s no use to regulate positions.

Higher Than Expected:

That is what traders love.

Positive surprises, like stronger job growth or faster GDP expansion, often spark buying sprees.

You’ll see prices shoot up as market optimism surges.

Worse Than Expected:

Negative surprises, similar to disappointing job numbers or higher-than-expected inflation, can trigger sell-offs.

Traders quickly adjust to the gloomier outlook, and costs often tumble.

Take this instance, as an illustration:

Say the market expects 200,000 latest jobs, however the report shows only 100,000.

That’s a giant miss, and you may see stocks fall or currencies weaken as traders reassess their positions.

Volatility when actual economic news results are higher or worse than expected will be extreme, which is why traders either embrace or avoid these moments, depending on their risk tolerance.

It’s value mentioning the difference between scheduled and unpredictable news.

As shown above, some market turbulence will be predicted by noting the economic calendar and preparing for the important thing dates with risk management techniques.

Nonetheless, some news can catch traders off guard, similar to geopolitical tensions and natural disasters.

Next, it’s vital to debate how news affecting the USD impacts the remainder of the market.

The Power of the USD: How It Moves Global Markets

The U.S. Dollar (USD) isn’t just any currency; it’s the heavyweight champion of world finance.

Because the world’s most traded currency and the go-to reserve for central banks, its movements greatly affect global markets.

From currencies to commodities like oil and gold, it’s fair to say nothing comes near the USD.

So when the U.S. releases major economic news data similar to GDP growth, inflation figures, or employment stats, the whole financial world takes note.

A strong jobs report or a hawkish decision from the Federal Reserve can propel the dollar higher, setting off chain reactions in other markets.

Because many commodities are priced in USD, shifts of their value directly impact commodity-dependent currencies just like the Canadian dollar (CAD) and the Australian dollar (AUD).

So, does every currency react to U.S. news? In a word: yes.

However the extent and nature of those reactions vary.

Let’s take a better look.

How Other Currencies React

Currencies often take their cues from the USD.

Major Pairs

EUR/USD

As essentially the most traded currency pair, EUR/USD is especially sensitive to U.S. economic news releases.

Strong U.S. data typically results in a stronger dollar, pushing this pair lower. Conversely, weak U.S. data or dovish Federal Reserve policies may cause the euro to rise against the dollar.

GBP/USD

While the pound reacts to U.K. news, it often responds much more sharply to U.S. data.

Events like Federal Reserve rate hikes or unexpected inflation figures can overshadow domestic aspects, driving significant moves on this pair.

USD/JPY

This pair tells a novel story, because the yen is commonly seen as a safe-haven currency.

When U.S. data signals economic strength, USD/JPY tends to rise, reflecting risk-on sentiment.

But in times of world uncertainty, the yen gains strength, causing the pair to drop as traders seek safety.

Let me show you an example of this…

USD/JPY 4hr Chart Weakening USD/JPY as money shifts to the Yen:

Commodity-linked currencies just like the Australian Dollar (AUD), Recent Zealand Dollar (NZD), and Canadian Dollar (CAD) also react to U.S. news, especially when it impacts commodity prices.

A powerful dollar can weigh on these currencies by making exports like oil or metals costlier.

Why This Matters for Economic News and Economic Calendars

Understanding the USD’s influence helps make clear why U.S. news is crucial, even for traders focused on non-dollar pairs.

High-impact U.S. events don’t just affect the dollar. They will shift sentiment across the whole financial ecosystem.

Whether you trade EUR/GBP, AUD/NZD, and even commodities, understanding how these events might trigger ripple effects is vital.

That’s where economic calendars are available in.

By highlighting major releases like Federal Reserve meetings or U.S. employment data, these tools make it easier to anticipate when volatility could spike.

Spotting these events allows you to stay ahead of market moves and position yourself accordingly.

With that in mind, let’s take a have a look at learn how to actively use news and calendars in your trading.

Risk Management: Navigating Market Storms During Economic News Events

Trading around economic news releases can feel like steering a ship through a sudden storm – thrilling but full of danger!

Market volatility during these events can result in rapid price swings, widened spreads, and unexpected gaps.

And not using a clear risk management strategy, even experienced traders can face heavy losses.

On this section, let’s explore critical ways to safeguard your trading account during this high-stakes motion.

The best way to Protect Yourself During News Events

Use Stop-Loss Orders:

Stop-loss orders are your first line of defence.

They robotically close your trade when the market moves against you by a predefined amount.

This will prevent small losses from snowballing into larger ones.

Nonetheless, in fast-moving markets, slippage is an actual concern, as your order may not execute at the precise level you set, especially during highly volatile news events.

To mitigate this:

Consider placing tighter stops in the event you’re trading smaller, more volatile assets.

You possibly can also adjust stops and move them into profit areas in the event you’re already in a positive trade, allowing you to secure gains while staying protected.

Reduce Position Sizes:

Cutting down your trade size is one in all the only ways to limit risk.

In case you know a serious announcement is coming, reduce your exposure.

You possibly can also consider taking some profits off the table to cover costs or lock in gains before the storm hits

Diversify Your Trades:

Avoid concentrating your risk by diversifying across different asset classes or currency pairs.

If one market moves against you, other uncorrelated positions might remain unaffected or offset losses.

Be mindful, nonetheless, that in extreme global events, correlations between assets can increase, so select your diversification properly.

Strategies to Avoid High-Risk News Periods

Sometimes, the most effective move is not any move, especially during high-risk news events.

By knowing when to step back, you’ll be able to protect your capital and avoid unnecessary stress.

Listed below are some strategies I exploit to assist me stay secure when the market is primed for volatility

Check Economic Calendars:

Tools like Forex Factory, myfxbook, or TradingView provide detailed schedules of upcoming news events.

High-impact events are frequently highlighted, giving a transparent heads-up on when to tread rigorously.

Close Positions Before Major Economic News:

In case you’re not confident about handling the volatility, consider closing open positions beforehand.

This eliminates the danger of sudden price movements and lets you reevaluate after the dust has settled.

Avoid Trading In the course of the First Minutes of News Releases:

The moments immediately after a serious release are sometimes essentially the most volatile.

Waiting for the initial dust to settle may also help avoid impulsive trades and erratic price motion.

Deal with Low and Medium-Impact News Periods:

In case you prefer a more stable trading environment, keep on with times when the market isn’t on edge over major announcements.

Adjust Your Trading Timeframe

Often, when trading on a better timeframe, news events still can affect your trade, but generally with much less risk.

On higher timeframe setups, it’s common for stops to be wider, targets to be long term, and news events to be a blip on the radar within the grand scheme.

Let me show you an example…

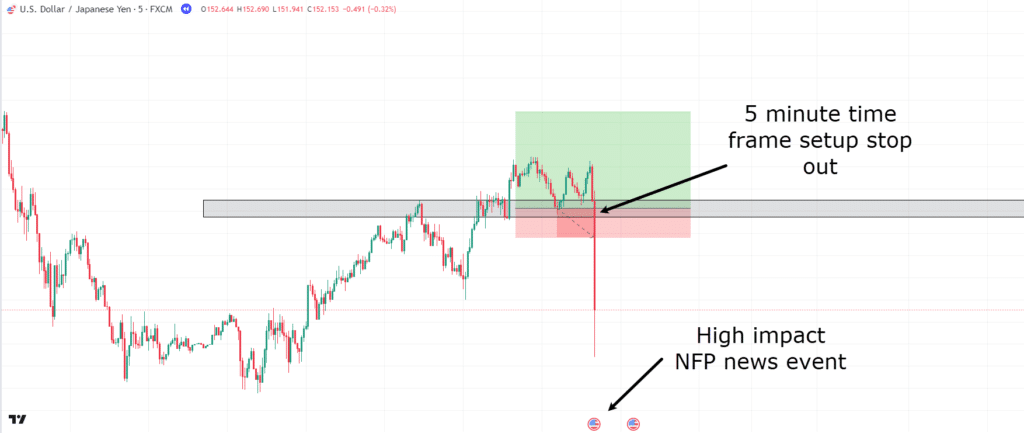

USD/JPY 5 Minute Chart Failed trade:

As you’ll be able to see, a setup revealed itself for a straightforward support and resistance flip.

If this trade had been entered a number of minutes before probably the most volatile high-impact news events, Non-Farm Payroll, this trade would’ve resulted in a major loss!

Nonetheless, in the event you have a look at the upper timeframe, you’ll see something completely different…

USD/JPY 1 Hour Chart Zone Respected:

The lower 1-hour timeframe zone makes way more sense, and as you’ll be able to see, as volatile because the NFP news event was, it still respected the zone.

Clearly, news events are way more volatile when viewed through the lower timeframe lens.

On higher timeframes, volatility tends to be less disruptive to trades planned around key levels.

With wider stop losses and profit targets, the impact of sudden market moves can often be minimized.

As such, if a serious event is on the horizon and also you’re in a higher timeframe trade, there’s normally less cause for concern, as your broader trade structure shouldn’t be as prone to be affected.

Conclusion

Navigating market turbulence during high-impact economic news events can feel daunting, but with the right strategy and risk management techniques, it doesn’t must be!

Successful traders don’t just react to market shifts; they plan and use proven tools to administer volatility and protect their capital.

In this text, you’ve:

- Explored the differing types of economic news and their various impacts in the marketplace

- Learned how market expectations shape the initial response to economic data

- Gained a deeper understanding of how actual economic releases affect currency pairs and asset prices

- Discovered the crucial role the U.S. Dollar (USD) plays in global markets

- Identified key risk management tools like stop-loss orders, position sizing, and avoiding high-risk periods to safeguard your trades

By incorporating these insights and techniques into your trading plan, you’ll give you the option to handle the unpredictable nature of reports events with confidence, turning potential pitfalls into profitable opportunities.

In case you’re able to take control of your trades and approach market news with a solid plan, now could be the time to implement what you’ve learned.

And now – I’d love to listen to from you!

How do you manage risk during high-impact news events?

What tools or strategies have helped you navigate market volatility?

Share your thoughts and experiences within the comments below!