Are you having trouble predicting market moves in foreign currency trading? Pivot points evaluation will help. It’s a key tool for spotting support and resistance levels. This is significant for making smart trading decisions.

But, many traders don’t use it to its full extent. They miss out on vital insights. Learning to make use of pivot points can boost your trading strategy. It would even allow you to make more cash within the fast-paced forex market.

Key Takeaways

- Pivot points help discover support and resistance levels in foreign currency trading

- They’re calculated using previous session’s high, low, and shut prices

- Movement above the pivot point signals bullish momentum

- Movement below the pivot point indicates bearish sentiment

- Pivot points will be applied across various timeframes

- Integration with other indicators can enhance trading signal reliability

Understanding the Fundamentals of Pivot Points

Pivot points are key trading indicators. They assist traders find market turning points. These tools are at the guts of many winning strategies, giving insights into market trends.

What Are Pivot Points and Their Role in Trading

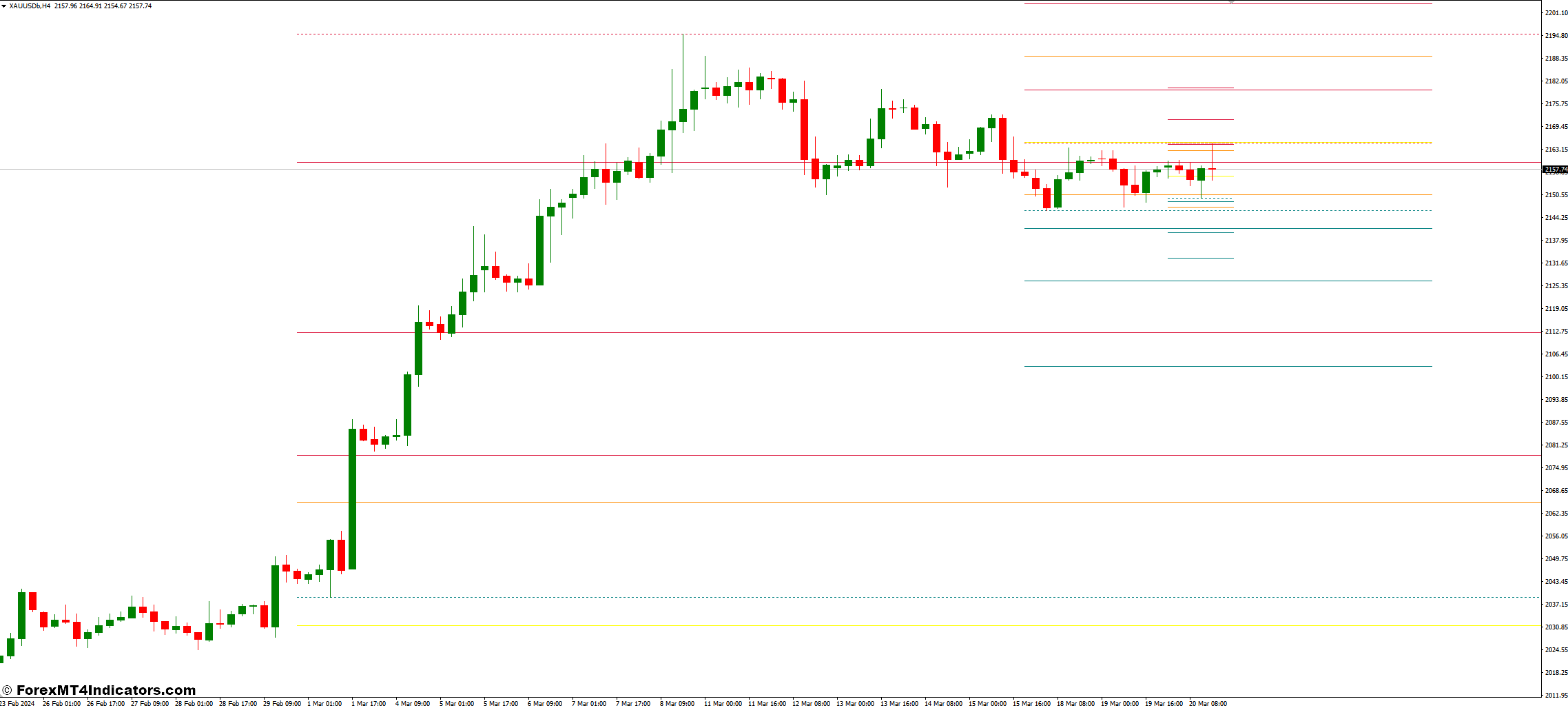

Pivot points use the high, low, and shut prices from the last trading day. The primary pivot point (PP) is the central point. Support and resistance levels come from it. These levels help traders spot price changes and large moves.

Historical Development of Pivot Points

Pivot points began with floor traders in commodity markets. They were for quick mental math. Now, they’re advanced tools in lots of financial markets, including forex.

Key Components of Pivot Point Evaluation

The pivot point system has several vital parts:

- Central Pivot Point (PP)

- Support levels (S1, S2, S3)

- Resistance levels (R1, R2, R3)

These parts give a full view of market moves. Traders use them to search out when to purchase or sell, set stop-loss orders, and understand market mood.

| Component | Formula | Usage |

|---|---|---|

| Pivot Point (PP) | (High + Low + Close) / 3 | Central reference point |

| Support 1 (S1) | (PP x 2) – High | First support level |

| Resistance 1 (R1) | (PP x 2) – Low | First resistance level |

Knowing pivot point basics helps traders make smart decisions. By learning this, you’ll be able to boost your trading plan and recover at market evaluation.

Calculating Pivot Points in Forex Markets

Pivot point calculation is vital in forex market evaluation. It helps traders find support and resistance levels. The formula for the central pivot point is easy: (High + Low + Close) / 3. It uses the previous period’s high, low, and shut prices.

After finding the pivot point, we are able to get support and resistance levels. These levels are vital for trading decisions. Listed below are some interesting facts:

- The actual low is generally 1 pip below Support 1 (S1)

- The actual high is about 1 pip below Resistance 1 (R1)

- S2 and R2 are about 53 pips from the actual high and low

- S3 and R3 are about 158-159 pips from the actual high and low

These facts show how accurate pivot points are in predicting market moves. For instance, the actual low is below S1 44% of the time. The actual high is above R1 42% of the time. This info can improve your trading strategy.

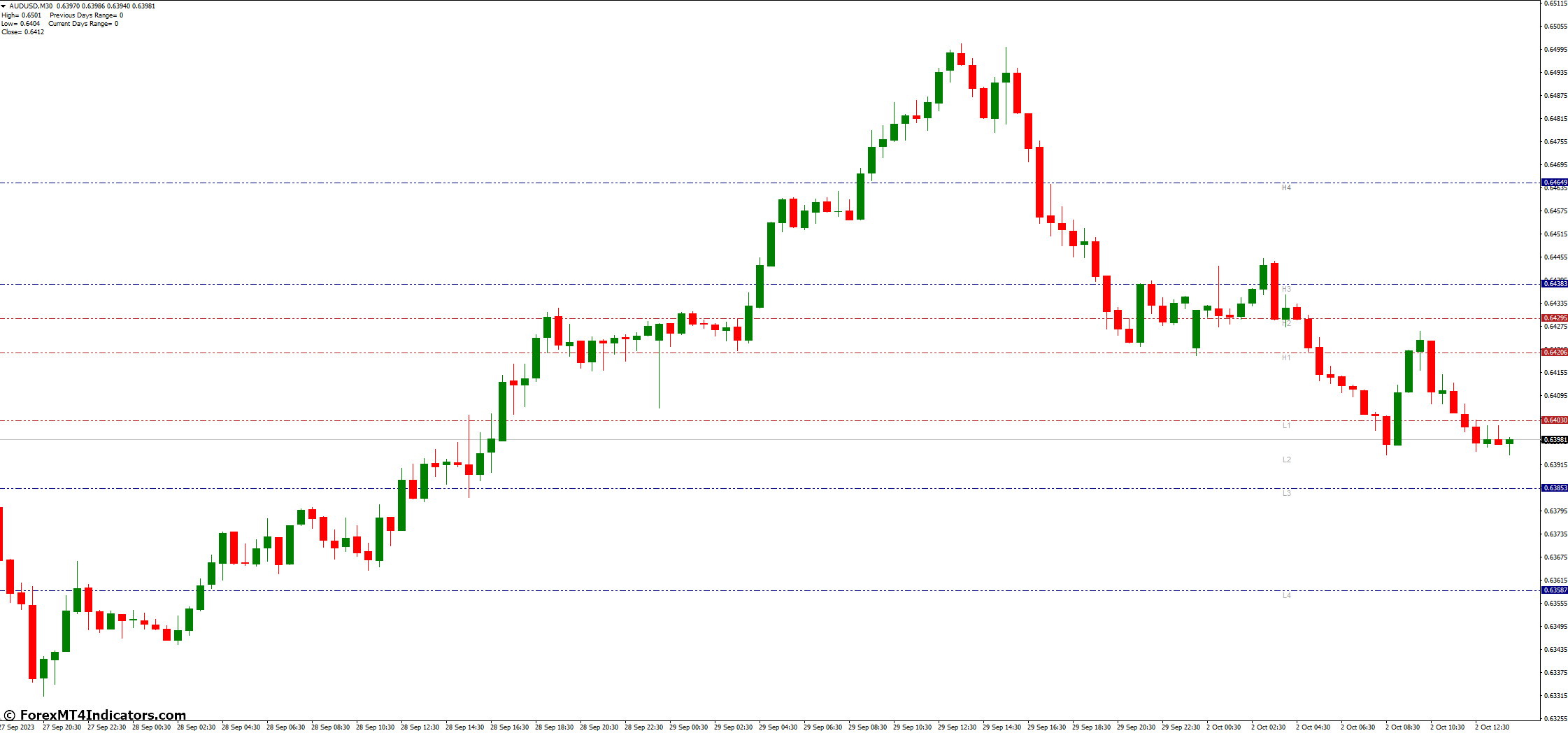

Pivot points aren’t only for day trading. You should use them for every day, weekly, monthly, or yearly time frames. This makes it easy to investigate the forex market in several periods.

Pivot Points Evaluation in Forex

Pivot points are a key forex evaluation technique. They assist find market reversals and predict support and resistance levels. These tools aid traders in creating effective strategies and spotting trends.

Standard Pivot Point Formula

The central pivot point is found using the day gone by’s high, low, and shutting prices. That is the bottom for locating support and resistance levels. Traders use these levels to choose when to enter or exit trades.

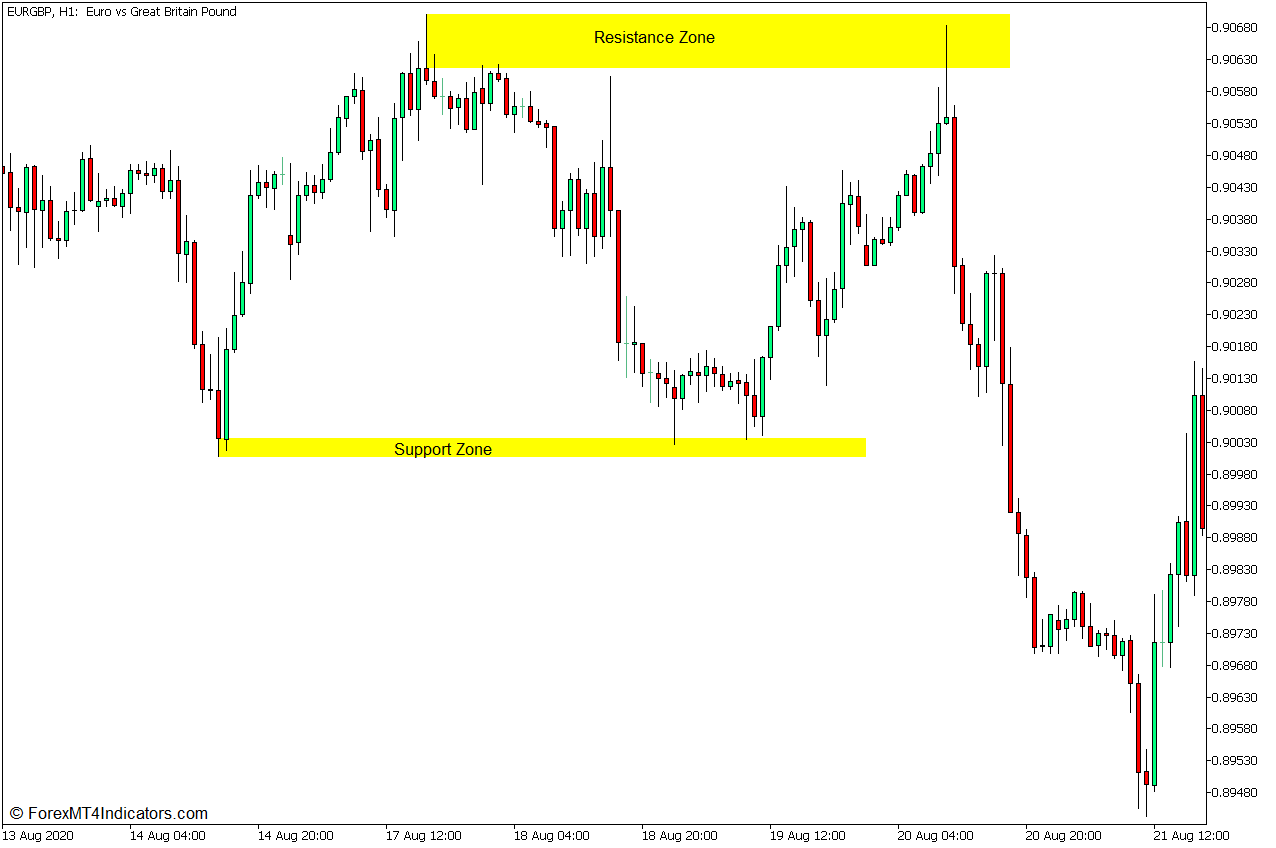

Support and Resistance Levels

Support and resistance levels are key in pivot point evaluation. They show where to enter and exit the forex market. The primary support (S1) and resistance (R1) levels are found using the central pivot point and the day gone by’s prices.

| Level | Formula |

|---|---|

| Central Pivot Point (P) | (High + Low + Close) / 3 |

| Support 1 (S1) | (2 * P) – High |

| Resistance 1 (R1) | (2 * P) – Low |

Advanced Calculation Methods

Advanced pivot point systems give traders more insights. These include Fibonacci, Camarilla, and Demark pivot points. Each system has its formula for locating support and resistance levels. This offers traders many options for analyzing the market.

- Fibonacci Pivot Points: Use Fibonacci retracement levels

- Camarilla Pivot Points: Calculate 4 levels of support and resistance

- Demark Pivot Points: Based on the connection between closing and opening prices

By learning about these pivot point methods, traders can improve their evaluation and methods. This helps them navigate market trends higher.

Kinds of Pivot Point Systems

Pivot point variations are key in today’s trading systems. They assist traders see market trends and make smart decisions. Let’s take a look at 4 primary pivot point systems utilized in foreign currency trading.

Standard Floor Pivot Points

Standard Floor Pivot Points are the bottom of pivot point evaluation. They use yesterday’s high, low, and shut to search out support and resistance. Traders use these levels to identify market reversals and entry points.

Woodie’s Pivot Points

Woodie’s Pivot Points focus more on the closing price. This makes them quick to react to market changes. Day traders like them because they should act fast.

The formula for Woodie’s pivot point is:

Pivot Point = (H + L + 2C) / 4

Where H is the previous high, L is the previous low, and C is the previous close.

Camarilla Pivot Points

Camarilla Pivot Points give several support and resistance levels. That is great for day traders who intend to make probably the most of short-term prices. Camarilla points are tight, perfect for fast-changing markets.

Fibonacci Pivot Points

Fibonacci Pivot Points use the Fibonacci sequence in evaluation. They mix traditional pivot points with Fibonacci retracement levels. This offers a full view of market turning points. Traders use them to search out key support and resistance in trending markets.

Each pivot point system has its advantages and uses. Traders try different ones to match their trading style. Knowing these systems will help traders improve their evaluation and results.

Implementing Pivot Points in Trading Strategies

Pivot points are key for market evaluation and trading. They assist find good times to purchase or sell. This makes them great for managing risk.

Traders watch how prices react at pivot levels. If a currency pair hits a pivot point after which turns back, it’s a robust sign. This implies it’s a great time to purchase or sell.

Let’s take a look at a practical example:

- In a 15-minute GBP/USD chart, the worth tests the S1 support level

- Traders might buy here, setting a stop loss below S2

- Take profit targets might be the pivot point (PP) or first resistance (R1)

Most trading happens between S1 and R1. S2, R2, S3, and R3 are tested less. Use pivot points with other indicators for a robust trading plan.

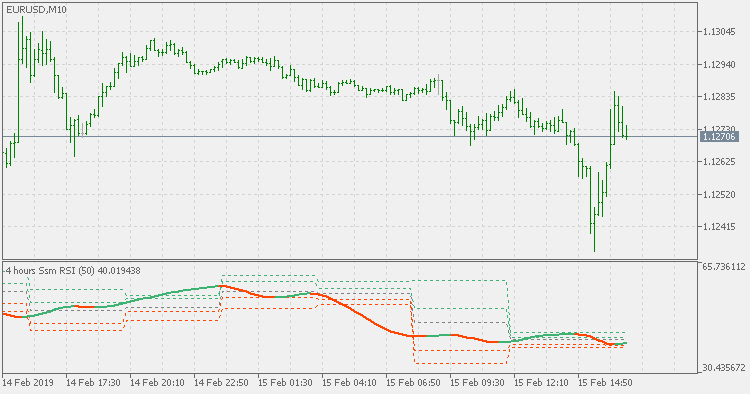

Combining Pivot Points with Technical Indicators

Pivot points are even higher when used with other tools. They assist traders find trends and make higher decisions. Let’s see how pivot points work with moving averages, RSI, and MACD to create strong signals.

Integration with Moving Averages

Moving averages and pivot points are an incredible team. When prices are above each, it shows a robust trend. This helps traders find good times to enter and stay in trends longer.

Using RSI with Pivot Points

The Relative Strength Index (RSI) makes pivot points even stronger. When RSI is high near a pivot resistance, it warns of possible reversals. Traders search for these signs to plan exits or short positions.

MACD and Pivot Point Synergy

MACD and pivot points are a robust team for confirming trends. A MACD crossover above its signal line, with a price break above a pivot resistance, signals a robust buy. This MACD pivot point strategy helps catch big market moves.

| Indicator | Role with Pivot Points | Trading Signal |

|---|---|---|

| Moving Averages | Trend Confirmation | Price above PP and MA: Bullish |

| RSI | Overbought/Oversold | RSI overbought at R1: Possible reversal |

| MACD | Momentum Gauge | MACD cross above signal at PP: Strong buy |

Using pivot points with these indicators gives traders a clearer view of the market. This manner, they’ll spot likely trades and manage risks higher.

Risk Management Using Pivot Points

Pivot points are key for managing risks in forex. They assist traders set stop-loss orders to guard their money. This manner, they avoid big losses if the market changes suddenly.

Setting Stop-Loss Levels

Good stop-loss strategies involve setting orders near support or resistance levels. That is for each long and short positions. It keeps traders in profit and limits losses when the market changes.

Position Sizing with Pivot Points

Pivot points help traders work out how big their trades needs to be. They appear at the space from entry points to pivot levels. This helps keep risks even and makes portfolios stable.

Managing Trading Psychology

Pivot points help with trading psychology too. They make traders follow a system, not emotions. This manner, traders stay focused and follow their risk management plans.

- Set stop-loss orders near pivot-based support or resistance levels

- Use pivot point distances to find out position sizes

- Depend on pivot evaluation to take care of trading discipline

Adding pivot points to your trading plan will help with risk management. By setting clear stop-loss levels, sizing positions right, and staying disciplined, traders can handle the forex market higher.

Common Mistakes and Avoid Them

Traders often fall into traps when using pivot points. We’ll take a look at some common errors and share tricks to avoid them.

Over-Reliance on Single Time Frames

Many traders focus an excessive amount of on one-time frames. This may cause them to miss probabilities and get false signals. To repair this, use several time frames for a greater view of the market.

Studies show that using different time frames can boost success by as much as 70%.

Ignoring Market Context

One other mistake is ignoring the large picture. Economic news and market mood can greatly affect pivot points. About 60% of traders who ignore these lose money.

Poor Risk-Reward Ratios

Not setting good risk-reward ratios is a giant mistake. Use pivot points to set clear profit goals and stop-loss levels. It’s sensible to risk not more than 1% of your account per trade.

For instance, aim to make $4.00 from entry to the primary resistance level (R1).

Remember, pivot points work best with other technical tools. Traders who use this combo see a 50% rise in wins in comparison with those only using pivot points.

Conclusion

Pivot point evaluation is vital in foreign currency trading. It helps traders understand the currency markets higher. By learning about pivot points, traders can recover at analyzing the market.

The formula for the Central Pivot Point is easy: P = (High + Low + Close) / 3. This formula helps find vital support and resistance levels.

Using pivot points in trading gives traders a giant advantage. They study market feelings. For instance, prices often stay between the pivot level and support or resistance during quiet times.

This data helps traders resolve when to purchase or sell. It’s a giant help make smart trading decisions.

But, knowing about pivot points is just a part of the job. Good traders use many tools and methods. They practice on demo accounts and keep improving their skills.

This manner, they create a robust trading plan. They use pivot points correctly and manage risks well within the fast forex world.