Here’s something I would like to share.

You’re probably here without delay since you’ve realized that trading is greater than just technical evaluation…

…and it’s greater than just earning money and methods, right?

Well, if what I’m saying resonates with you, there’s something else I want to let you know:

You’re greater than halfway to profitability!

It’s true!

By now, you’re waking as much as the actual fact profitability comes from mastering oneself.

Nevertheless, a million-dollar query stays:

How can I develop consistency in trading?

Well, rest assured, my friend.

In today’s guide, I’ll share with you a whole blueprint to realize just that – consistency in trading.

Specifically, you’ll learn:

- What consistency in trading means, and what it looks like practically

- The largest factor all traders need, to realize consistency in trading (it’s not what you’re thinking that)

- My personal trading routine (which platforms I exploit and the way I exploit them every day)

I’ll be certain that that after you finish reading this guide…

…You’ll have significantly better clarity and a step-by-step plan to realize consistency in trading.

Are you ready?

Then let’s start…

What does consistency in trading appear like? (and why do some traders remain inconsistent)

A straightforward truth is that trading results at all times depend upon how consistently you execute your strategy.

Because the underside line is…

…if you happen to want consistent results, then you definately need a consistent set of actions!

Do you retain changing your strategy or tweak your indicators every 2-3 losing trades?

Then, don’t be surprised in case your results change into inconsistent.

But what does consistency in trading appear like?

Well, all of it boils right down to these three things…

- Knowing and selecting your trading style

- Knowing and selecting your trading methodology

- Scaling your capital appropriately

I do know. The third one looks misplaced.

But let me explain…

Knowing and selecting your trading style

It’d be best to take notes here…

..because ‘trading style’ is a useful concept I’ll throw around on this guide quite rather a lot.

It may well help answer common questions like:

“What’s the most effective timeframe to make use of in trading?”

“What’s the most effective strategy?”

…and more!

To interrupt it down, step one is selecting your trading style from the next:

- Day trading (below 1-hour timeframe)

- Swing trading (4-hour timeframe to every day timeframe)

- Position trading (every day timeframe to weekly timeframe)

In point of fact, you’re simply selecting which timeframe to lock onto – because jumping between timeframes isn’t going to work!

Now, it could possibly be that your first selection is to be a day trader.

You would like that quick profits within the markets, right?

But bear in mind you’ll also experience quick losses.

After all, I won’t stop you from being a day trader.

To be honest, I suggest you are attempting it out at the very least once!

Two things you must at all times take into account when selecting a trading style, though, are the next:

- If it matches your trading lifestyle

- If it’s compatible together with your mental capability

It doesn’t make sense to need to be a day trader if you happen to’re juggling responsibilities in life, right?

The truth is, to assist you learn more in regards to the trading styles I’m sharing with you and tips on how to work them, be at liberty to examine out any of those guides below:

Intraday Trading: 4 Things You Must Know If You Want To Succeed

The NO BS Guide to Swing Trading

The NO BS Guide to Position Trading

So, once you have got picked the fitting timeframe, next is selecting your trading methodology…

Knowing and selecting your trading methodology

Understanding your trading style focuses on knowing which timeframe you’ll have a look at consistently.

But trading methodology?

Well, it’s all about knowing how you must enter and exit your trades!

So, what are different trading methodologies on the market?

Let me share them with you…

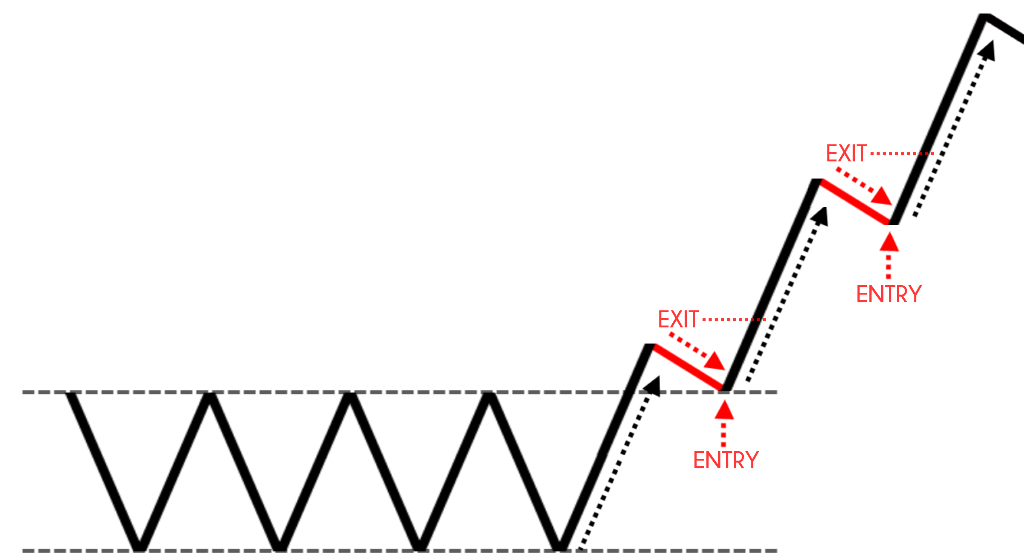

The predominant objective here is to capture the entire trend until it bends.

If the trend doesn’t work out?

Simply exit the position quickly and move on to the subsequent trade!

But when it goes your way?

Then, you’ll be able to expect monster risk to reward setups because the trend develops!…

But in fact, it also means you have got to endure pullbacks – which will not be easy, mentally.

Adopting a trend-following approach typically signifies that your win rate will probably be around 40% to 50% (which is normal, in fact!)

In contrast to trend-following…

Momentum trading means that you just’re only trying to capture the short-term strength of the markets.

Which means that your trades wouldn’t last long in comparison with trend-following, and also you don’t must endure market pullbacks.

…as once the market loses its momentum?

You exit immediately!

After all, one downside is the frequency of trades.

One other is your trading portfolio would require more “maintenance”, as you’d be entering trades – possibly every day!

Nevertheless, attributable to the short-term nature of momentum trading, your win rate shall be higher, perhaps around 50% to 70% win rate.

Mean Reversion

This is solely just one other term for “pullback trading”, where you are attempting to reap the benefits of the weakness of the market!

It is a trading methodology that will not be for everybody – as you might be entering a trade against the present market momentum (the alternative of momentum trading!).

But when done right, you would like the market to “come to you” at a less expensive price to reap the benefits of!…

Like momentum trading, your trades could be short-lived and potentially have an identical win rate of fifty% to 70%.

So, as you’ll be able to see…

No trading methodology is ideal.

All of them have their Pros and Cons.

But what matters is you discover a trading methodology where the Pros outweigh the Cons – for you!

After all…

There are probably more trading methodologies, so don’t let your education stop here.

Nevertheless, these are the trading methodologies I’ve been using for years.

Nonetheless, knowing the difference between trading style and methodology is the important thing aspect to constructing your identity as a trader.

Scaling your capital appropriately

I feel these rules are value memorizing:

Don’t invest nearly all of your savings when beginning to trade.

Don’t put all of your retirement funds in when beginning to trade.

Don’t borrow an enormous amount of cash when beginning to trade.

Should you don’t follow these rules, it won’t matter if you have got the “best strategy” on the earth…

…the moment you begin live trading, you’re trading with a confidence you don’t have!

And once you begin doing that, it’s a transparent recipe for disaster!

Now, I’m not telling you to avoid trading altogether.

Reasonably, I’m advising the alternative – the most effective solution to gain experience in trading is thru live trading.

To start, when you’ve successfully worked out your trading style and methodology…

Start small.

If you have got $10,000 then I suggest you begin with a fraction of that budget, resembling $1,000

If you have got $1,000 then start smaller, around $500!

Starting as soon as you’ll be able to and as small as you’ll be able to is certainly one of the keys to long-term consistency in trading.

Why?

Because when you have got less attachment to your trading account, you’ll be able to focus more on the method than the result.

After you begin developing consistency in trading and convalescing results…

…that’s the time you must consider adding more funds!

In brief, start small to accumulate your confidence and add more funds as you progress in trading.

I feel that is sensible, right?

Now, I need to admit that successfully mastering those three features can take months and even years.

You have got to undergo lots of trial and error and a technique of unlearning before finally reaching the fitting trading plan for you.

It’s only by learning what didn’t give you the results you want up to now you can trust within the trading method you’ll eventually select.

At all times attempt to keep in mind that!

But you’re likely asking…

“Isn’t there a solution to speed up this process?”

Luckily – you bet there may be!

And I’ll do my best to share them in the subsequent section…

A 3-step process on tips on how to achieve consistency in trading

At this point…

I’ve shared with you a practical process for achieving consistency in trading.

Nevertheless, one thing I actually have neglected is the “you” part.

What must you do while you’ve just lost half of your account?

What must you do while you’re holding into losing trades, and desperate for a greater strategy?

What must you do when managing other people’s money and things are going south?

You will have so many challenges without delay.

Even when you have got a blueprint or a method that works, it’ll almost be inconceivable to follow them through.

The explanations?

Attachment and expectations.

That’s the reason, in those situations, the primary process towards achieving consistency in trading is to…

Step 1: Stop Trading

I get it.

You desire to be a full-time day trader.

You would like trading to be your primary source of income.

You’ve seen others get a +1,000% gain in a matter of just a few months (because everyone only boasts about their wins), and you desire to achieve the identical thing.

But the reality is that if that’s your predominant focus in trading then you definately will begin to waver and make psychological mistakes in trading the moment you experience losses.

And if you happen to’re already in that spiral of losses, the worst thing you’ll be able to do is so as to add more funds!

Why?

Because now you’re “expecting” to get those losses back!

So, as an alternative…

If you desire to achieve consistency in trading, you have to put yourself in a state of learning.

It’s a sort of state where you’re not expecting anything from the markets, and also you’ve submitted yourself to learning out of your mistakes and trying something latest in trading (to find what works and what doesn’t).

And at this stage, the one solution to begin doing that’s so that you can stop trading.

By hitting that big pause button, you’ll be able to clear your mind and let go of your expectations, removing the attachment that you have got from the markets.

After all, it is less complicated said than done, and I understand that stopping trading can take a while.

But a vital step, nonetheless.

Step 2: Check out different trading methodologies

When you’ve put yourself in a state of learning as a trader, you’ve passed through a serious hurdle in developing consistency in trading.

Because now could be the time to explore other trading methodologies on the market!

Whether it’s fundamental trading, technical trading, algo trading, there are every kind to pick from…

So try every one out and learn as much as you’ll be able to!

Because when you’re in that stage of learning or being open to latest information…

You will note latest pieces of information as opportunities to grow.

Surrender searching for the ‘holy grail’ strategy that never loses.

Step 3: Develop a correct trading routine then start small

That is the cream on top of developing consistency in trading.

There isn’t a way around it – you have to establish a trading routine.

This implies knowing what specific day of the week or time of day you must:

- Develop your watchlist

- Check your charts and find trading setups

- Execute trading setups

That’s right – you have to know when you must and shouldn’t check your charts.

This step is all about attempting to make your trading business as efficient as possible!

Again…

All of those steps will take a while, and depending in your situation, there could also be extra lessons to learn on the best way.

But provided you maintain direction, you’re closer than you’re thinking that to becoming consistent as a trader!

Now, practical advice is probably the most useful and so I’m going to disclose my exact trading routine, including the sort of strategy and platforms that I exploit…

…because I would like to point out you the results of going through the entire steps and blueprints on this guide!

Sounds good?

Then read on!

An example of how I maintain consistency in trading

Before I start, listed here are a few things that I would love to share with you:

First, growth never stops in trading.

Which means that there’ll at all times be times when I actually have to adapt and alter my trading processes, so I highly suggest you achieve this as well!

Second, in constructing more confidence in trading…

I could even have began one or two latest trading portfolios by the point you read this guide.

And lastly…

The whole lot I’ll share with you is the results of years of trial and error to realize consistency in trading.

I actually have tried loads of methods up to now that didn’t work, consider me!

Make sense?

Great, then let’s start!

Overview of portfolios and trading methodology

Currently, I trade using two portfolios.

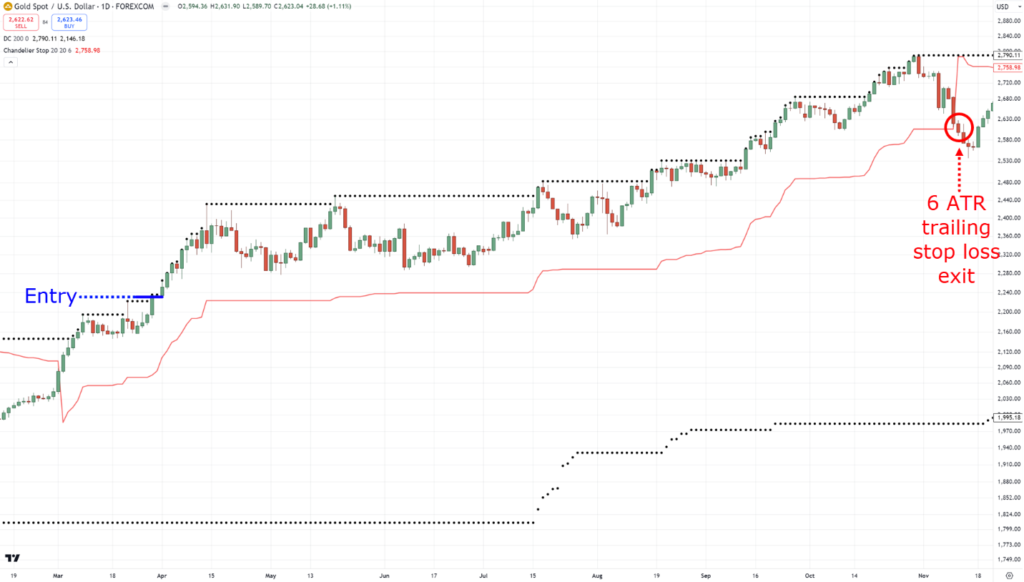

First is a scientific trading portfolio.

What’s systematic trading, you could ask?

Well, it’s where every little thing is black and white with no discretion.

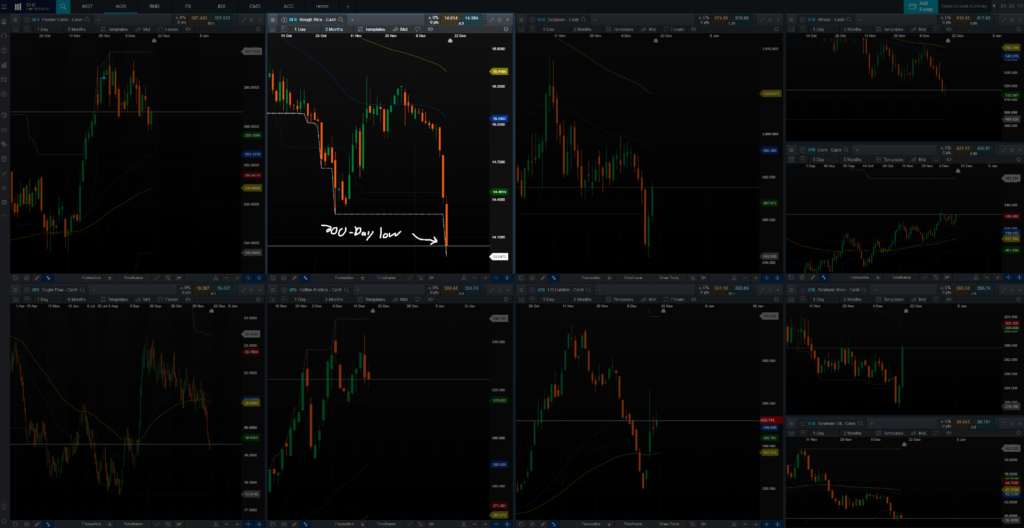

If the worth closes makes a latest 200-day high…

Then enter long with a 6 ATR initial stop loss and trailing stop loss…

Vice versa for shorts, and that’s just about it.

There isn’t a fundamentals, no drawing of any support and resistance, just pure systematic trading.

And yes, that is a method I’ve been using for years, which is inspired by Andreas Cleanow’s following the trend…

One major upside, in fact, is the simplicity of the system!

It’s very easy to be consistent with it!

But at the identical time there’s no flexibility on which timeframe you trade, and having a scientific trading strategy signifies that it’s designed to capture a particular market condition., which is…

…the trend!

That’s why I actually have my second portfolio, which is a discretionary trading price motion portfolio…

This enables me to trade all market conditions, from breakouts to pullback setups on the forex market!

With a discretionary portfolio, you furthermore may have the flexibleness to make your mind up whether or not you must use a trailing stop loss or a hard and fast goal profit!

Nevertheless…

This takes time to master and quite lots of practice to acknowledge your setups on the chart.

Let alone draw the tools you propose to make use of, resembling a trend line or support and resistance.

But hey, that’s why I actually have two trading portfolios!

Each are different, but they aim to enrich one another.

Overview of trading platforms

For my systematic trading portfolio, I exploit the broker CMC Markets.

That is certainly one of the few brokers that gives hundreds of markets to trade!

And yes, in terms of a trend-following system, diversification is essential.

So, there’ll often be times once I would have 10-20 open trades at a time, which helps with the system’s returns and is something CMC Markets can do!

As for my discretionary account, I exploit the great old MetaTrader 4.

There’s no denying it.

MetaTrader 4 is a time-tested platform whose strength is to trade Forex.

Since my discretionary trading portfolio trades the Forex markets alone, constructing consistency in trading with MetaTrader 4 is a no brainer!

Overview of trading routine

At any time when you’re in search of a trading platform, this feature is a must…

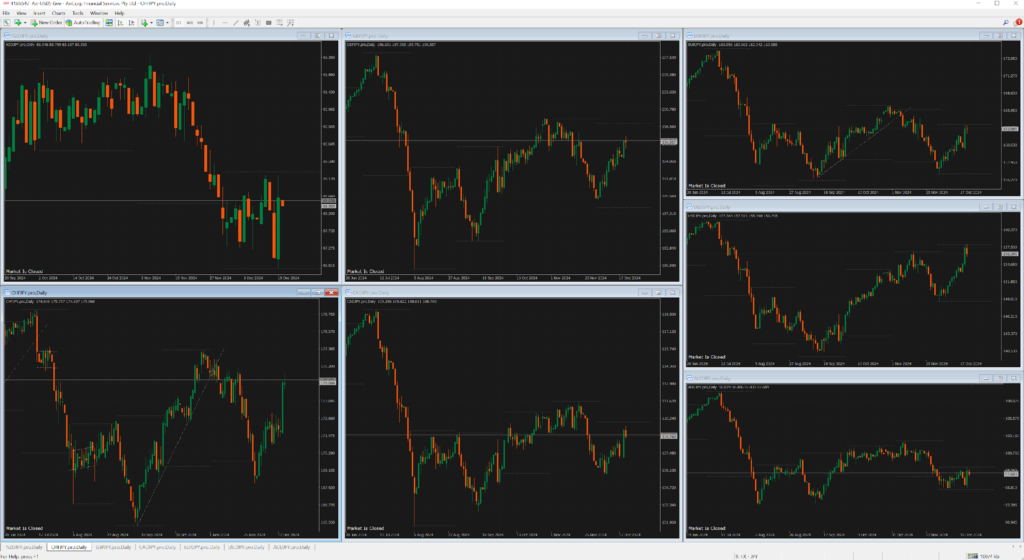

Multi-charts…

This one feature of each CMC Markets and MetaTrader 4 is my primary key to being consistent in trading, because it gives you a glimpse of many potential setups in several markets in only just a few seconds!

So, how do I am going about using it every day?

First, I start with MetaTrader 4 every 9 am.

I have a look at my watchlists, all summed up within the multi-chart

And I simply search for a “setup.”

That’s right, I don’t plot my support and resistance or do any evaluation right out of the bat.

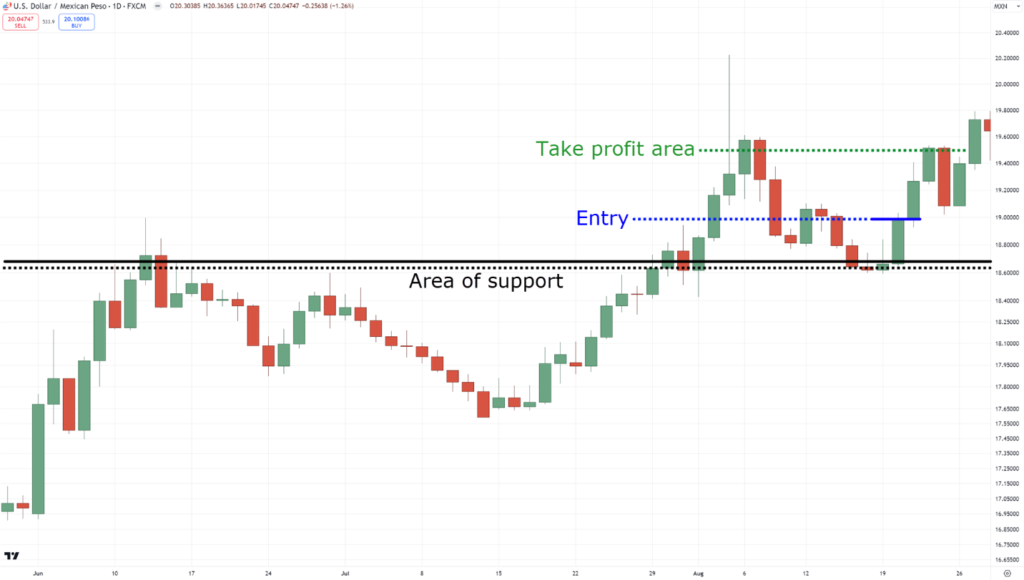

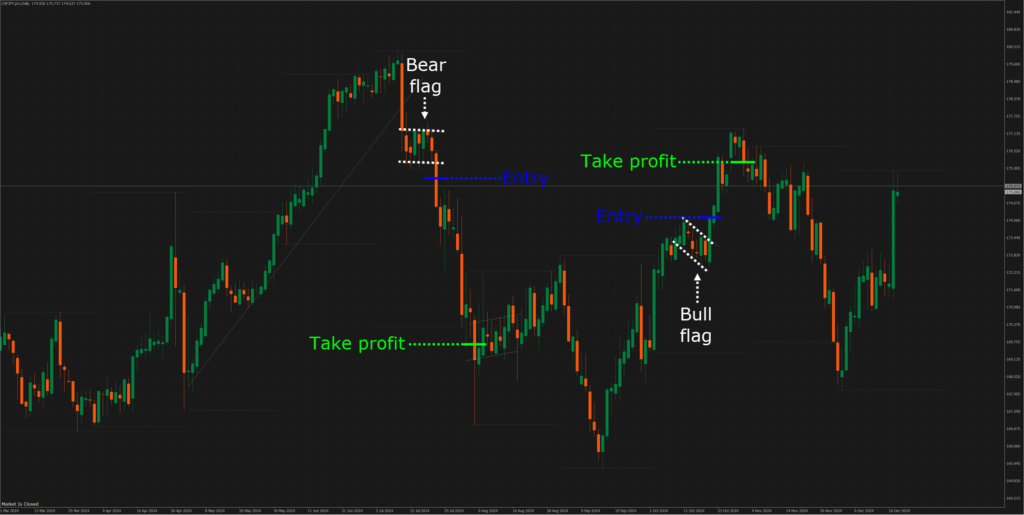

I search for setups that generally is a breakout setup of a bear flag pattern…

Or a pullback setup from an area of support reversal…

Once I spot a setup on my watchlist, resembling here, for instance…

Then, that’s the one time where I analyze the chart in full and choose whether or not I should enter the trade.

This process normally takes lower than 5 minutes!

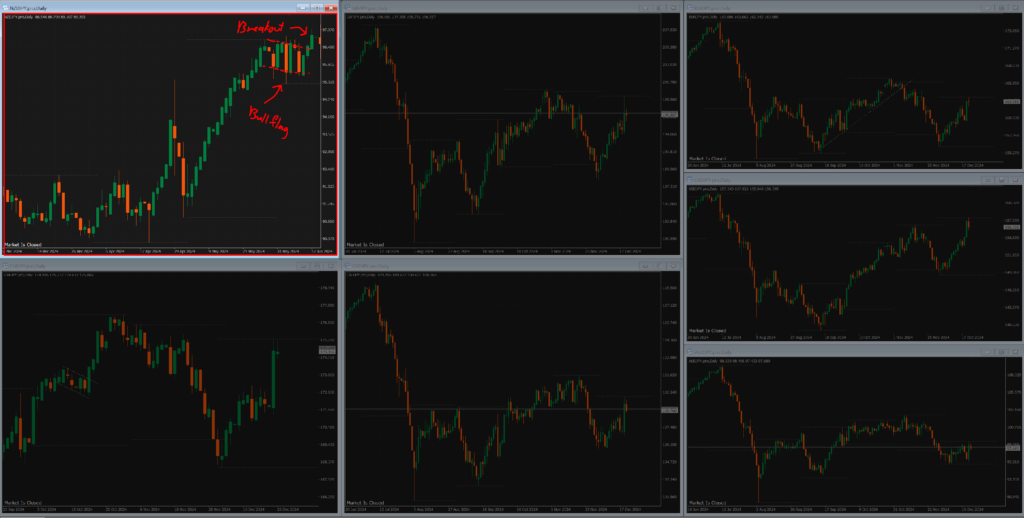

Afterward, I proceed to CMC markets and have a look at my multi-chart watchlists…

And what am I in search of?

That’s right, in search of a 200-day high or low breakout using the Donchian Channel.

And on this case, there’s a brief setup for Rough Rice, and that’s just about it!…

Since it is a long-term trading strategy, I normally don’t get latest setups.

Nonetheless, this process takes lower than 3 minutes.

And now you is perhaps wondering:

“What do you do now for the remainder of the day?”

“When must you check your charts again?”

The reply is that this:

I don’t have a look at my charts for the remainder of the day.

I do the identical process that I shared with you the subsequent day at 9 am!

You see…

The longer you stare at your portfolio, the upper the possibilities of you messing up your consistency in trading.

For this reason you wish a particular schedule on when you must and shouldn’t check your charts.

And… there you go!

An example of how I operate my trading business every day!

Now, I’ve done my best to share and display practical tips about achieving consistency in trading.

But the fact is that you just and I are two different traders.

So, the journey that got me towards consistency in trading will differ from yours.

Got it?

You might be the just one who can discover what works for you the most effective.

With that said, let’s do a fast recap of what you’ve learned today…

Conclusion

Should you’ve reached the top of this guide, then I would love to congratulate you!

You must now have an summary picture of what it takes to be consistent in trading.

And at this point…

You must also know that achieving consistency in trading is all about developing the correct routine and habits that nurture good trading.

Here’s what you’ve learned today:

- Consistency in trading means selecting a method, maintaining a routine, and starting small when trading live

- Should you’re facing significant losses, take a break to reset, manage expectations, and give attention to learning

- Finding the fitting strategy involves trial and error — discovering what works by ruling out what doesn’t

- For instance, I manage two portfolios with different brokers and check them every day at a set time

That’s just about it!

An entire guide and context on tips on how to achieve consistency in trading.

So now, over to you…

What part are you in without delay in your trading journey?

Are you close up to developing consistency in trading?

Share your trading journey with me within the comments below.

I’ll be waiting!