Latest report from Galaxy Digital’s Crypto and Blockchain Enterprise Capital has revealed some interesting trend recorded within the crypto market last 12 months especially in regards to the VC sector.

In keeping with the report, within the fourth quarter of 2024, nearly half of all enterprise capital funding within the cryptocurrency and blockchain sector was directed toward startups based in the USA.

Moreover, 46% of the whole invested capital flowed to US-based startups. This figure far exceeded the share received by other jurisdictions, with Hong Kong coming in second at 16% and Singapore and the UK following behind.

Early and Late-Stage Funding Trends

Assessing the report further, it reveals that the US also led in deal volume, accounting for 36% of all enterprise capital deals throughout the quarter. Despite the continued regulatory uncertainty and pressures inside the US, the country’s dominance in attracting each capital and deal activity was evident.

Galaxy head of research Alex Thorn in a post on X identified that the favorable outlook for the sector, combined with the potential for a pro-crypto administration taking office, may further strengthen the US’s position in the worldwide digital currency enterprise capital landscape.

Meanwhile, Enterprise capital activity in Q4 2024 revealed a continued appetite for each early and late-stage digital currency startups. Roughly 60% of the capital raised went to early-stage firms, highlighting sustained interest in recent and revolutionary blockchain projects.

The remaining 40% was directed toward later-stage firms, driven partly by significant deals corresponding to Cantor’s $600 million investment in Tether.

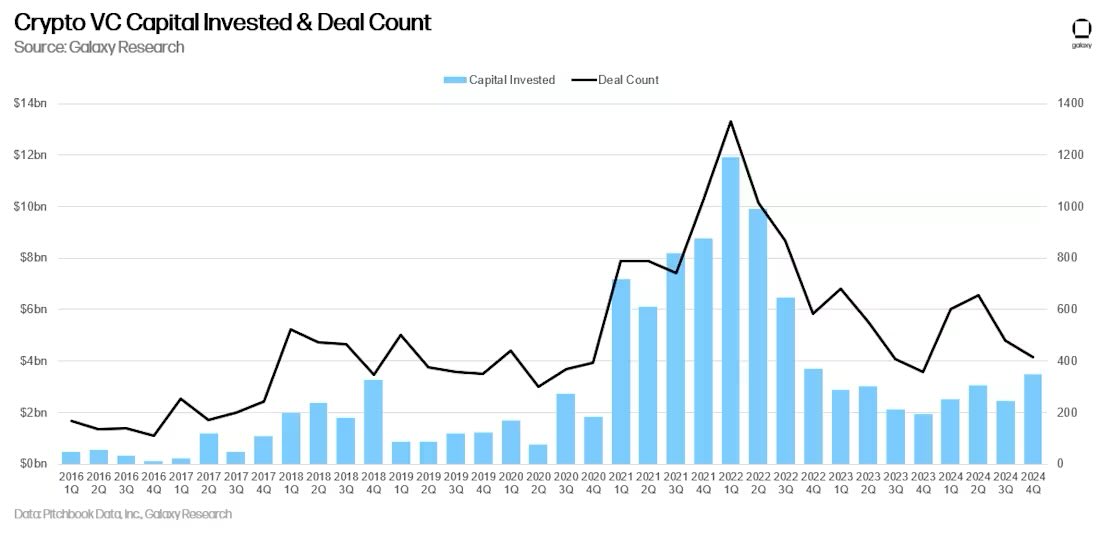

The information also showed that median deal sizes increased over the 12 months, reflecting a trend seen across the broader enterprise capital market. While the variety of deals declined barely, the general dollar amount invested reached $3.5 billion for the quarter, a 46% increase quarter-over-quarter.

Nonetheless, despite the rise in funding levels, crypto enterprise funds themselves faced challenges, with just $1 billion allocated across 20 recent funds—near quarterly lows seen way back to early 2021.

The Road Ahead for US Crypto Startups

Because the US solidifies its status as the highest destination for digital currency enterprise funding, industry observers want to 2025 for further growth.

The election of a more crypto-friendly administration could help address regulatory uncertainties, paving the best way for even greater investment within the sector. As well as, the strong activity in early-stage deals signals that entrepreneurs with fresh ideas are still in a position to secure funding, ensuring a gradual pipeline of innovation.

Looking beyond the US, the report highlighted key themes in the worldwide crypto enterprise market, including the rise of Web3 projects, decentralized finance (DeFi), and blockchain infrastructure.

These sectors led when it comes to capital allocation, indicating where investors see essentially the most promise for growth. Because the market matures, these areas are expected to drive further capital flows and shape the long run of the crypto ecosystem.

Featured image created with DALL-E, Chart from TradingView