The BB MACD Prolonged and Heiken Ashi Oscillator Forex Trading Strategy is a robust combination of indicators that may significantly enhance a trader’s ability to identify potential price movements within the forex market. By mixing the Bollinger Bands (BB) with the MACD Prolonged and Heiken Ashi Oscillator, this strategy provides traders with a transparent and reliable method for identifying trends, reversals, and entry points. As foreign currency trading requires a deep understanding of market dynamics, this strategy offers a scientific approach that simplifies the decision-making process, giving traders an edge in an otherwise complex and volatile environment.

The Bollinger Bands (BB) are widely utilized in technical evaluation to measure market volatility and potential overbought or oversold conditions. When combined with the MACD Prolonged, a more refined version of the standard MACD indicator, this strategy becomes even more practical in spotting changes in momentum and trend direction. The MACD Prolonged provides smoother signals, reducing false alarms and helping traders stay in sync with the general market direction. Meanwhile, the Heiken Ashi Oscillator acts as a trend confirmation tool, helping traders filter out noise and concentrate on real price movements. Together, these indicators offer a comprehensive view of the market, enabling more precise and assured trading decisions.

For many who are recent to foreign currency trading, the BB MACD Prolonged and Heiken Ashi Oscillator strategy is a wonderful strategy to start developing a solid trading plan. This strategy’s strength lies in its simplicity and effectiveness. By utilizing these indicators in conjunction, traders can discover trends, potential breakouts, and price reversals with high accuracy. The mix of those tools empowers traders to administer risk more effectively, providing a structured method for entering and exiting trades with the next degree of certainty. Whether you’re a novice or an experienced trader, this strategy offers invaluable insights into the forex market, helping to spice up profitability while minimizing unnecessary risks.

The BB MACD Prolonged Indicator

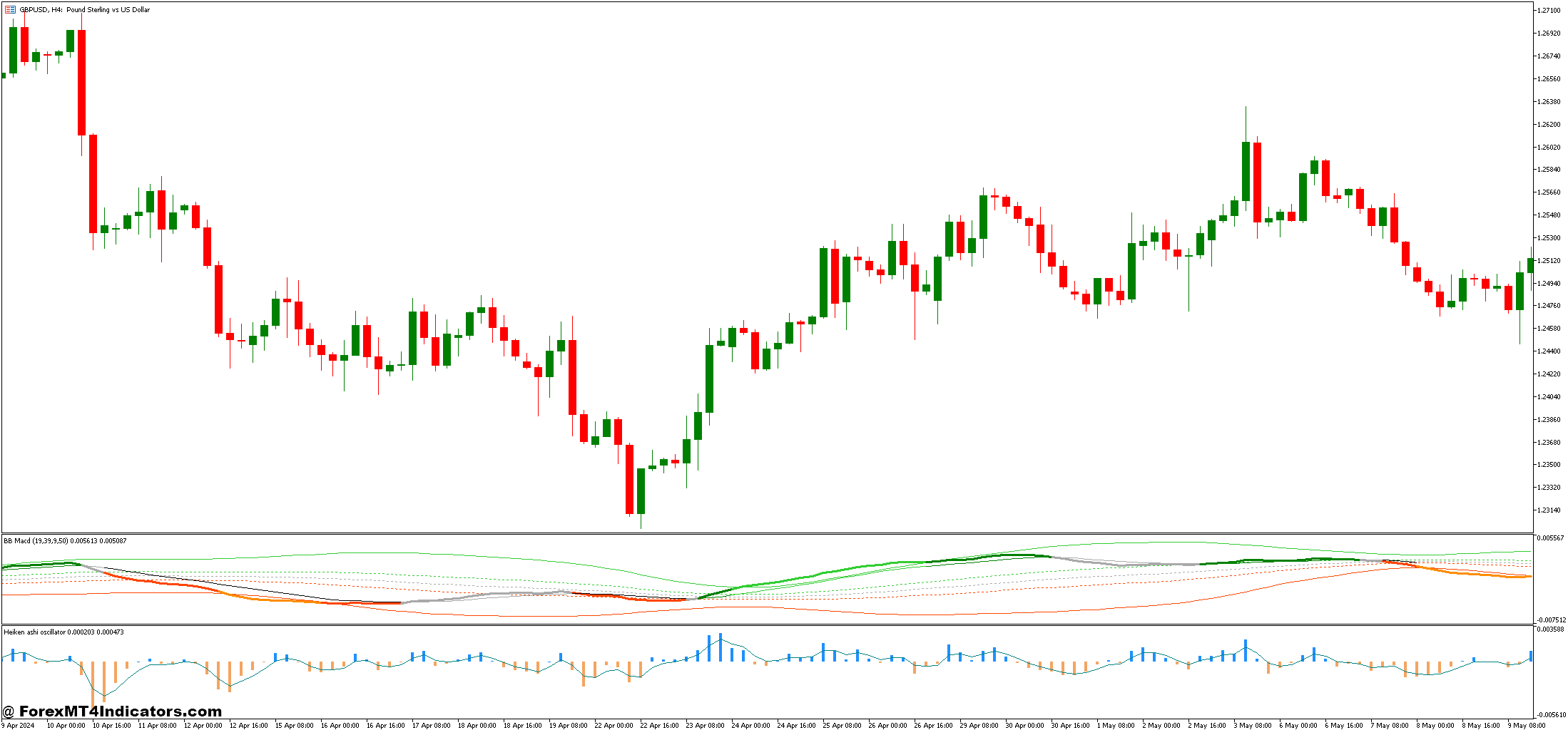

The BB MACD Prolonged Indicator is a refined version of two highly popular tools: the Bollinger Bands (BB) and the Moving Average Convergence Divergence (MACD). By combining these two indicators, the BB MACD Prolonged enhances the flexibility to discover price trends, market volatility, and momentum shifts. Bollinger Bands are known for his or her capability to measure the volatility of an asset by displaying a spread around a moving average. These bands expand when volatility increases and contract during quieter market conditions, providing traders with a transparent visual representation of potential price movement.

The MACD, however, is a momentum oscillator that helps discover changes within the strength, direction, momentum, and duration of a trend. The “prolonged” version of the MACD enhances the standard MACD by smoothing the signal line, making it more aware of price movements and fewer susceptible to the noise that may result in false signals. When combined with the Bollinger Bands, this indicator allows traders to discover potential breakouts or reversals. When the value touches or moves outside the bands, it suggests heightened volatility, and the MACD’s extension can confirm whether the momentum is powerful enough to follow through or if a reversal is probably going. Together, the BB MACD Prolonged Indicator provides a robust framework for detecting profitable entry and exit points available in the market.

The Heiken Ashi Oscillator Indicator

The Heiken Ashi Oscillator Indicator is a trend-following tool designed to smooth price motion and help traders higher understand the underlying market trend. Unlike traditional candlestick charts, the Heiken Ashi technique uses modified open, close, high, and low values to create smoother candles, which helps eliminate the noise often present in standard charts. This permits traders to simply spot trends without being misled by small price fluctuations or market irregularities.

The Heiken Ashi Oscillator, an extension of this method, takes the concept a step further by turning the smoothed price data into an oscillator format. The resulting oscillator plots the difference between the present and former Heiken Ashi close values, showing positive or negative values depending on whether the market is bullish or bearish. This makes it easier for traders to visualise momentum changes and trend shifts. Positive readings typically suggest a continuation of an uptrend, while negative readings indicate a downtrend. By incorporating the Heiken Ashi Oscillator right into a trading strategy, traders can filter out market noise and concentrate on identifying real trend signals, providing a further layer of confirmation for potential trades. This indicator is especially useful when combined with other trend-following tools, because it enhances the accuracy of signals and supports more confident decision-making.

Easy methods to Trade with BB MACD Prolonged and Heiken Ashi Oscillator Forex Trading Strategy

Buy Entry

- Price Breaks Above the Upper Bollinger Band: Price moves outside the upper Bollinger Band, indicating increased volatility and potential for an uptrend.

- MACD Prolonged Bullish Momentum: The MACD line crosses above the signal line, confirming strong upward momentum.

- Heiken Ashi Oscillator Positive: The Heiken Ashi Oscillator shows positive values, indicating that the market is in an uptrend.

- Additional Confirmation: Be certain that the market is consistently moving upwards with the oscillator showing sustained positive values before entering.

Sell Entry

- Price Breaks Below the Lower Bollinger Band: Price moves outside the lower Bollinger Band, indicating increased volatility and potential for a downtrend.

- MACD Prolonged Bearish Momentum: The MACD line crosses below the signal line, confirming strong downward momentum.

- Heiken Ashi Oscillator Negative: The Heiken Ashi Oscillator shows negative values, indicating that the market is in a downtrend.

- Additional Confirmation: Be certain that the market is consistently moving downward with the oscillator showing sustained negative values before entering.

Conclusion

The BB MACD Prolonged and Heiken Ashi Oscillator Forex Trading Strategy offers traders a sturdy framework for identifying high-probability trade opportunities. By combining the volatility measurement of the Bollinger Bands, the momentum evaluation of the MACD Prolonged, and the trend confirmation provided by the Heiken Ashi Oscillator, this strategy empowers traders to make more informed and precise decisions.

Really useful MT4 Broker

XM Broker

- Free $50 To Start Trading Immediately! (Withdraw-able Profit)

- Deposit Bonus as much as $5,000

- Unlimited Loyalty Program

- Award Winning Forex Broker

- Additional Exclusive Bonuses Throughout The Yr

- Exclusive 50% Money Rebates for all Trades!

>> Sign Up for XM Broker Account here with Exclusive 50% Money Rebates For All Future Trades [Use This Special Invitation Link] <<

Already an XM client but missing out on cashback? Open Latest Real Account and Enter this Partner Code: 𝟕𝐖𝟑𝐉𝐐

Click here below to download:

Get Download Access