Struggling to know Forex charts? A chart shows how currency prices change over time using easy visuals. This guide will teach you the fundamentals, explain key components, and enable you spot trading opportunities.

Keep reading a forex chart like smarter!

Key Takeaways

- Forex charts show how currency prices change over time using price and time axes. Tick Charts, line, bar, and mountain charts are common types used for various evaluation styles.

- Timeframes matter in foreign currency trading. Short frames like quarter-hour show quick trends, while longer ones like day by day or weekly reveal broader market activity.

- Support levels stop price drops; resistance levels block price rises. Traders use them to plan buy-and-sell points and spot trend reversals early.

- RSI shows overbought or oversold conditions, while MACD highlights momentum changes. Combining these tools improves trade accuracy on forex charts.

- Charts for Beginners should start with easy line charts, practice on demo accounts, and stick with one trading strategy for higher focus and confidence-building over time.

Read Forex Charts for Higher Evaluation

Forex charts show how currency prices change over time. Learn easy methods to trade to make use of them by specializing in price movement and key patterns.

What’s a Forex Trading Chart?

A chart shows how a currency pair’s price changes over time. The vertical axis (y-axis) represents the worth, while the horizontal axis (x-axis) tracks time.

It helps traders analyze trends and price movement. For instance, a USD/EUR chart may show if the dollar is gaining value against the euro during every week or month. Use forex charts are essential for making trading decisions like when to purchase or sell.

Key components of Forex charts: price and time axes

The value axis runs vertically on a trading chart. It shows how much a financial instrument costs at any point. The time axis is horizontal, tracking when trades occur. Together, they form the bottom of all forex price charts.

On a candlestick chart, each candle tells 4 prices: open, close, high, and low. Traders use these details to research market trends and patterns over time frames like hours or days.

Next, study why timeframes matter in forex evaluation!

The importance of timeframes within the Forex Trading Chart

Timeframes show price movements over specific periods. A 15-minute timeframe, for instance, tracks changes inside that block of time. Shorter timeframes help traders spot quick trends and patterns for day trading.

Longer ones, like day by day or weekly charts, suit swing trading by tracking broader market activity.

Each style of chart works higher with certain timeframes. Candlestick charts can display short-term data clearly while line or bar charts suit longer trends. Using precise timeframes helps discover support and resistance levels effectively during evaluation.

Kinds of Forex Charts

Forex charts are available in various forms, each serving a particular purpose. Understanding these types may also help traders pick the very best chart pattern for his or her trading style.

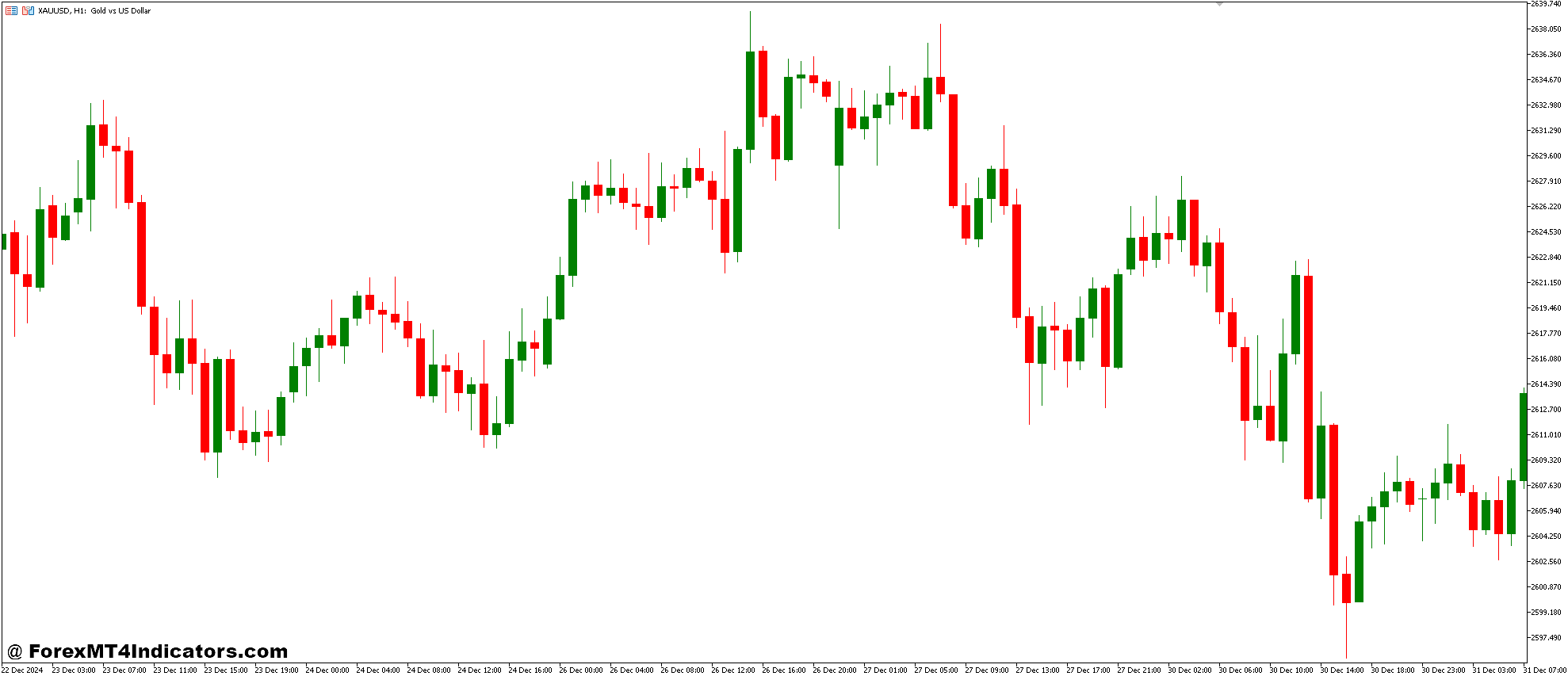

Candlestick Charts

Each candlestick shows price movement over a set time, like quarter-hour. A green candle means the closing price was higher than the opening price—buyers dominated. A red candle signals a lower closing price—sellers led.

Long green candles highlight strong buying pressure, while long red ones show heavy selling.

A doji forms when open and shut prices are almost equal, suggesting indecision. Candlesticks also reveal trends and patterns traders use to plan trades. This chart type helps spot key details quickly, making it essential for evaluation moving forward into other varieties of candlestick charts.

Line Charts

Line charts show the closing price during a selected trading period. Points representing these prices connect with form an easy line. They’re cleaner than candlesticks or bar charts, making them easy for beginners to read and understand.

Traders use line charts to identify trends quickly. These charts give an overall view of price movement without extra details cluttering the screen. For instance, they assist discover if an asset is trending upward or downward over time.

Move on to explore more visual options in candlestick Charts.

Bar Charts

Bar charts show price movements in foreign currency trading. Each bar represents a set time, like 1 hour or 1 day. The vertical line shows the range between the high and low prices during that period.

A small notch on the left marks the open price, while one on the proper shows the close price.

These charts help traders see trends. For instance, if bars are getting taller, it might signal higher volatility. Forex traders use these to seek out patterns and make decisions about buying or selling currency pairs quickly.

Using Technical Evaluation with Forex Charts

Technical evaluation helps you make sense of forex charts. It shows trends, price movements, and points to trade smartly.

Support and resistance levels

Support and resistance levels are key for foreign currency trading. They assist traders predict price movements and make higher selections.

- Support level stops price drops. It acts like a floor where falling prices pause before rising again. For instance, if the U.S. dollar falls to $1.10, it might bounce back up from this level.

- Resistance level blocks upward moves. It is sort of a ceiling where prices struggle to go higher before possibly dropping. As an example, the identical dollar may stall at $1.20.

- Traders use these levels to plan entry and exit points. Buying near support or selling near resistance helps reduce risks within the forex market.

- These levels mark possible reversals. A break below support or a climb above resistance shows recent trends forming within the foreign exchange market.

- Key tools include technical indicators for accuracy. Use RSI or MACD to substantiate strong support or resistance zones before making trades.

- Multiple timeframes give clearer pictures. Mix short-term charts with longer ones to identify stronger support and resistance lines during trading sessions.

Identifying trends and patterns

Trends and patterns help traders make higher decisions. They show price movement and predict future changes.

- Long green candlesticks show strong buying pressure. This implies the worth goes up fast.

- Long red candlesticks signal strong selling pressure, showing a price drop.

- Short candlesticks with long wicks reveal a fight between buyers and sellers but no clear winner.

- A doji happens when the opening and shutting prices are almost the identical. It shows indecision out there.

- Higher highs and better lows indicate an uptrend. Prices keep climbing over time.

- Lower highs and lower lows suggest a downtrend, meaning prices are falling steadily.

- Horizontal movement of costs points to consolidation or a sideways trend.

- Patterns like head-and-shoulders signal trend reversals or continuations. These are easy to identify on charts.

- Chart indicators like RSI confirm overbought or oversold conditions during trends.

- MACD shows momentum changes, helping detect recent trends early.

Using indicators like RSI and MACD

RSI and MACD are great tools for Forex chart evaluation. These indicators help traders spot trends and signals quickly.

- RSI shows overbought or oversold conditions. Values above 70 mean the asset is overbought, while below 30 means it’s oversold.

- MACD highlights momentum and trend strength. It uses two moving averages and a histogram to signal buy or sell points.

- Mix RSI with MACD for higher accuracy. Use each to substantiate trends before trading actions.

- Each work well on various kinds of charts, like candlesticks or line charts, giving flexibility in evaluation styles.

- Practice using these indicators on demo accounts to know them fully before real trades—this reduces risks significantly.

Suggestions for Beginners to Master Forex Chart Reading

Start small and stay focused. Use easy tools to review price movements and trends with confidence.

Start with easy chart types

Line charts are the best for beginners. They show price trends clearly over time by connecting closing prices with a line. One of these chart helps recent traders see basic price movements without extra details, reducing confusion.

Unlike candlesticks or bar charts, line charts focus only on overall trends. Beginners can use them to research long-term direction and make higher trading account decisions. Start reading these before moving to more detailed types like candlesticks.

Practice with demo accounts

Demo accounts help recent traders learn without risks. They permit practice with virtual money, so no real funds are lost. Many forex traders use these accounts to check trading strategies and study price charts.

XM encourages using demo accounts for higher skill-building.

Experiment with different chart types like candlesticks or bar charts on a demo account. Track buy-and-sell activity and analyze trends without pressure. This builds confidence and sharpens evaluation skills before live trading starts—focus next on one trading strategy for regular growth.

Give attention to one trading strategy

Start practicing with demo accounts, but stick with one trading strategy for consistency. Selecting a transparent plan helps avoid confusion and builds discipline. For instance, use support and resistance levels to seek out buy and sell points.

This keeps your evaluation focused without overcomplicating decisions.

Beginners often try many styles, but this results in errors and lost money in trading activity. Using one method improves understanding of charts like candlestick or line charts. It also sharpens skills in predicting market trends through patterns or indicators like RSI.

Conclusion

Reading forex charts takes practice but is value it. Master the fundamentals like candlestick patterns and timeframes. Use tools like RSI or MACD to identify trends. Stay consistent with one strategy.

Over time, you’ll trade smarter and make higher decisions.