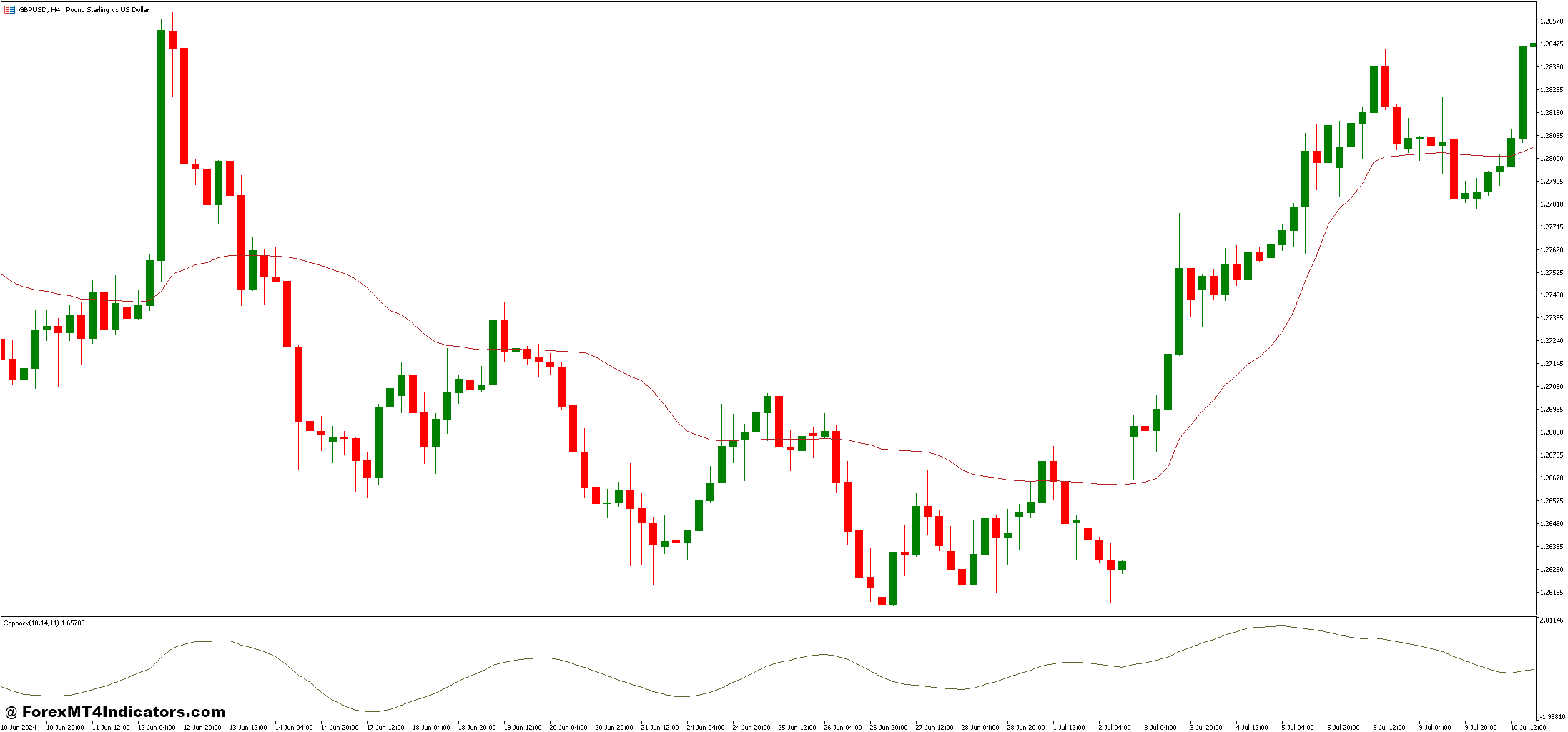

The Coppock and KAMA Forex Trading Strategy is a strong combination of two distinct indicators designed to supply traders with a transparent and adaptive approach to navigating the forex market. The Coppock Curve, a momentum indicator, is widely known for its ability to detect long-term trend reversals, making it ideal for traders seeking to discover key turning points available in the market. Paired with the Kaufman Adaptive Moving Average (KAMA), which adjusts dynamically to market volatility, this strategy offers a mix of precision and suppleness. Together, these tools equip traders to filter out market noise while staying attuned to significant price movements, ensuring well-informed trading decisions.

What makes this strategy stand out is the complementary nature of its components. While the Coppock Curve excels at highlighting the broader direction of the market, KAMA focuses on tracking price movements with an emphasis on adaptability. This synergy creates a strong framework that balances long-term trend evaluation with real-time responsiveness to market changes. Traders can use this mix to confidently discover entry and exit points, particularly in trending markets, reducing the chance of false signals and enhancing profitability.

Within the fast-paced forex market, having a technique that blends reliability with adaptability is crucial for fulfillment. The Coppock and KAMA Forex Trading Strategy caters to each novice and experienced traders by offering a structured yet flexible system. Whether you might be looking for to refine your trading methods or explore a recent approach, this strategy provides worthwhile insights and practical tools to assist you stay ahead within the ever-evolving forex landscape.

Coppock Indicator

The Coppock Indicator, also referred to as the Coppock Curve, is a momentum-based tool designed to discover long-term trend reversals in financial markets. Developed by Edwin Coppock within the Sixties, the indicator was originally intended for stock market evaluation but has since found utility in foreign currency trading. It operates on the premise that emotional market cycles, resembling optimism and pessimism, drive price movements. By calculating a weighted moving average of the sum of two different rate-of-change (ROC) values, the Coppock Indicator smooths out short-term fluctuations and focuses on broader trends.

One in every of the standout features of the Coppock Indicator is its simplicity and effectiveness in recognizing potential buying opportunities. Traditionally, values below zero are considered a signal for an upward reversal, especially when the curve begins to rise from negative territory. This makes it particularly useful for traders seeking to enter long positions throughout the early stages of a bullish trend. Nonetheless, while it excels in detecting upward momentum, it’s less effective for pinpointing sell signals, because it was not specifically designed for bearish markets.

Despite its straightforward application, the Coppock Indicator works best when used alongside complementary tools. Within the Coppock and KAMA Forex Trading Strategy, it provides the directional framework, helping traders discover the general trend and assess market sentiment. Its role as a number one indicator makes it a worthwhile component of the strategy, offering insights into potential reversals before they occur.

KAMA Indicator

The Kaufman Adaptive Moving Average (KAMA) is a trend-following indicator that stands out for its ability to adapt to various market conditions. Developed by Perry Kaufman in 1998, the KAMA differs from traditional moving averages by incorporating a smoothing factor that adjusts dynamically to market volatility. When the market is trending strongly, KAMA reduces its sensitivity to noise, offering a smoother line that focuses on the dominant trend. Conversely, in periods of consolidation or sideways movement, it becomes more attentive to price changes, ensuring that traders don’t miss significant shifts.

The important thing advantage of the KAMA Indicator lies in its adaptability. Traditional moving averages often struggle to balance responsiveness with noise reduction, resulting in delayed signals or whipsaws. KAMA solves this issue through the use of an Efficiency Ratio (ER) to gauge the market’s price motion. This ratio determines how much weight is given to recent price movements, allowing the indicator to regulate its behavior based on current conditions. Consequently, KAMA offers a transparent view of the prevailing trend while minimizing the impact of insignificant price fluctuations.

Within the Coppock and KAMA Forex Trading Strategy, KAMA plays an important role in filtering out false signals and providing precise entry and exit points. By aligning the adaptive nature of KAMA with the trend-reversal insights of the Coppock Indicator, traders can achieve a balanced and effective approach to the forex market. This synergy ensures that the strategy stays robust across different market environments, enhancing each accuracy and profitability.

Trade with Coppock and KAMA Forex Trading Strategy

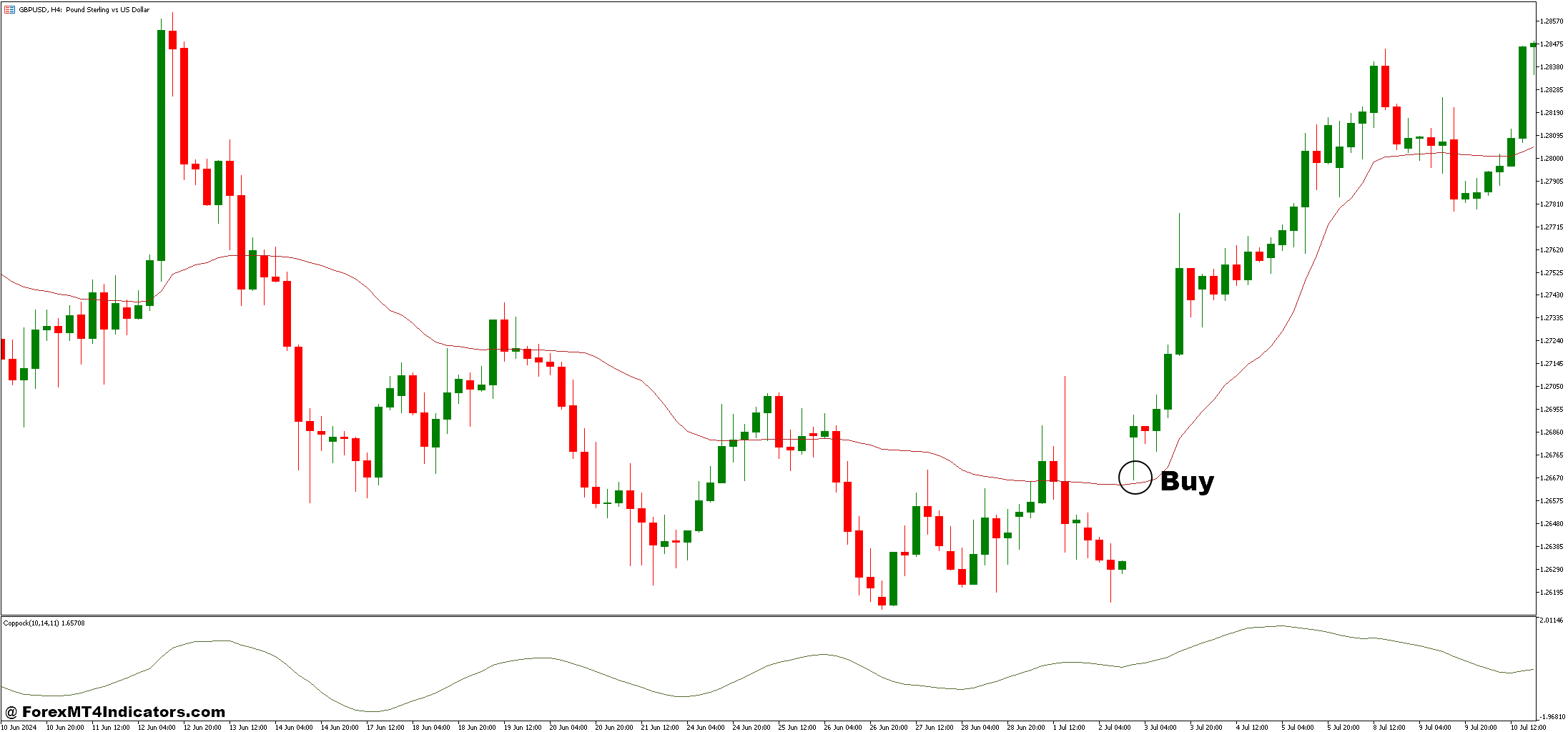

Buy Entry

- The Coppock Curve have to be rising, preferably moving upward from negative territory, signaling bullish momentum.

- The worth ought to be trading above the KAMA line.

- The KAMA line ought to be sloping upward, confirming an uptrend.

- Wait for a slight pullback of the value toward the KAMA line.

- Enter the buy trade when the value bounces upward after touching or nearing the KAMA line.

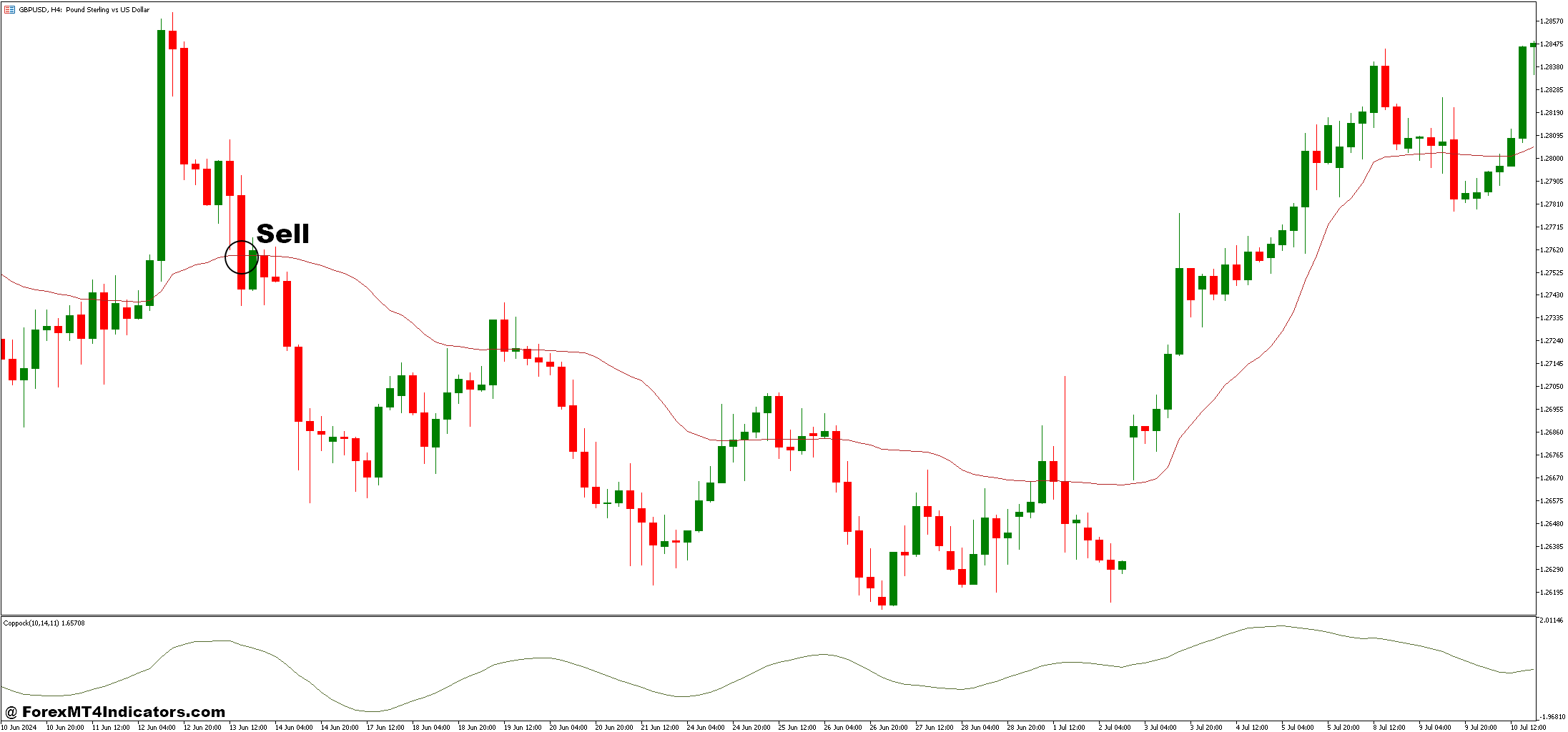

Sell Entry

- The Coppock Curve have to be reversing downward, particularly from a peak, signaling bearish momentum.

- The worth ought to be trading below the KAMA line.

- The KAMA line ought to be sloping downward, confirming a downtrend.

- Wait for a slight retracement of the value toward the KAMA line.

- Enter the sell trade when the value moves downward after touching or nearing the KAMA line.

Conclusion

The Coppock and KAMA Forex Trading Strategy is a thoughtful mix of long-term trend evaluation and adaptive price tracking, making it a flexible alternative for traders of all experience levels. The Coppock Indicator’s ability to discover market reversals provides a solid foundation for understanding the broader market direction, while the Kaufman Adaptive Moving Average (KAMA) refines this angle by adapting dynamically to market conditions. Together, these tools create a technique that is just not only reliable but additionally attentive to the complexities of the forex market.

Advisable MT4 Broker

XM Broker

- Free $50 To Start Trading Immediately! (Withdraw-able Profit)

- Deposit Bonus as much as $5,000

- Unlimited Loyalty Program

- Award Winning Forex Broker

- Additional Exclusive Bonuses Throughout The Yr

- Exclusive 50% Money Rebates for all Trades!

>> Sign Up for XM Broker Account here with Exclusive 50% Money Rebates For All Future Trades [Use This Special Invitation Link] <<

Already an XM client but missing out on cashback? Open Latest Real Account and Enter this Partner Code: 𝟕𝐖𝟑𝐉𝐐

Click here below to download:

Get Download Access