The Profit Calculator and Volatility Ratio Forex Trading Strategy mix two powerful tools that may significantly enhance a trader’s ability to navigate the unpredictable forex markets. The Profit Calculator provides a transparent picture of potential gains or losses by calculating the end result of trades based on entry and exit points, lot size, and stop-loss or take-profit levels. This permits traders to make informed decisions before executing a trade, managing risk effectively, and maintaining control over their positions. Meanwhile, the Volatility Ratio offers insights into market fluctuations, enabling traders to gauge how much price movement is probably going inside a given timeframe. Together, these tools create a technique that helps traders maximize profits while minimizing risk exposure.

Incorporating a Profit Calculator right into a foreign currency trading strategy brings a level of precision and confidence that is significant in a market known for its volatility. By estimating potential profits and losses ahead of time, traders can assess the risk-to-reward ratio of a trade and adjust their position sizes accordingly. This permits for smarter decision-making and greater control, ensuring that traders don’t overexpose themselves to dangerous situations. By incorporating this tool, traders can tailor their approach to suit their individual risk tolerance and trading goals, making it an indispensable a part of a sound trading plan.

Alternatively, the Volatility Ratio is an equally essential component of this strategy. It measures the degree of price fluctuations inside a specific currency pair, giving traders a greater understanding of market dynamics. A high volatility ratio signals that there could also be significant price movements ahead, creating opportunities for larger profits, but additionally posing higher risks. Conversely, a low volatility ratio suggests calmer market conditions, where profits could also be more gradual but potentially more consistent. By integrating the Volatility Ratio into their strategy, traders can fine-tune their approach, choosing the correct market conditions to match their trading style and risk profile, making their strategy each more adaptive and effective in changing market environments.

Profit Calculator Indicator

The Profit Calculator Indicator is a helpful tool that helps forex traders estimate the potential end result of a trade before making any decisions. It calculates profits and losses based on key parameters reminiscent of entry price, stop-loss, take-profit levels, and lot size. The important advantage of this indicator is its ability to supply a precise risk-to-reward ratio, allowing traders to evaluate whether a trade is value taking based on the potential for gain versus the chance of loss. This level of clarity helps traders make more informed decisions and avoid emotional trading, as they’ll see upfront whether the trade suits inside their risk management strategy.

The Profit Calculator typically works by simply inputting the important thing trade details reminiscent of currency pair, entry point, stop-loss level, take-profit goal, and the dimensions of the position (lot size). Once these parameters are set, the indicator mechanically computes the expected profit or loss at various levels. This is particularly helpful when traders are managing multiple positions without delay, because it offers a simple solution to track potential outcomes across different trades. Moreover, it could actually be adjusted for various account types, ensuring that the calculations are aligned with the trader’s specific financial goals and trading style. Through the use of this indicator, traders could make decisions with more confidence, knowing exactly how much they stand to achieve or lose.

The Profit Calculator can be an important risk management tool, because it helps traders resolve whether the potential profit is definitely worth the risk involved. With this indicator, traders can modify their entry or exit points to attain a greater risk-to-reward ratio or adjust the position size to suit their risk tolerance. Through the use of the Profit Calculator consistently, traders can avoid the common mistake of entering trades without fully understanding the potential end result, which might result in unexpected losses and inconsistent results. It fosters a more disciplined approach to trading, allowing traders to optimize their strategies for consistent profitability.

Volatility Ratio Indicator

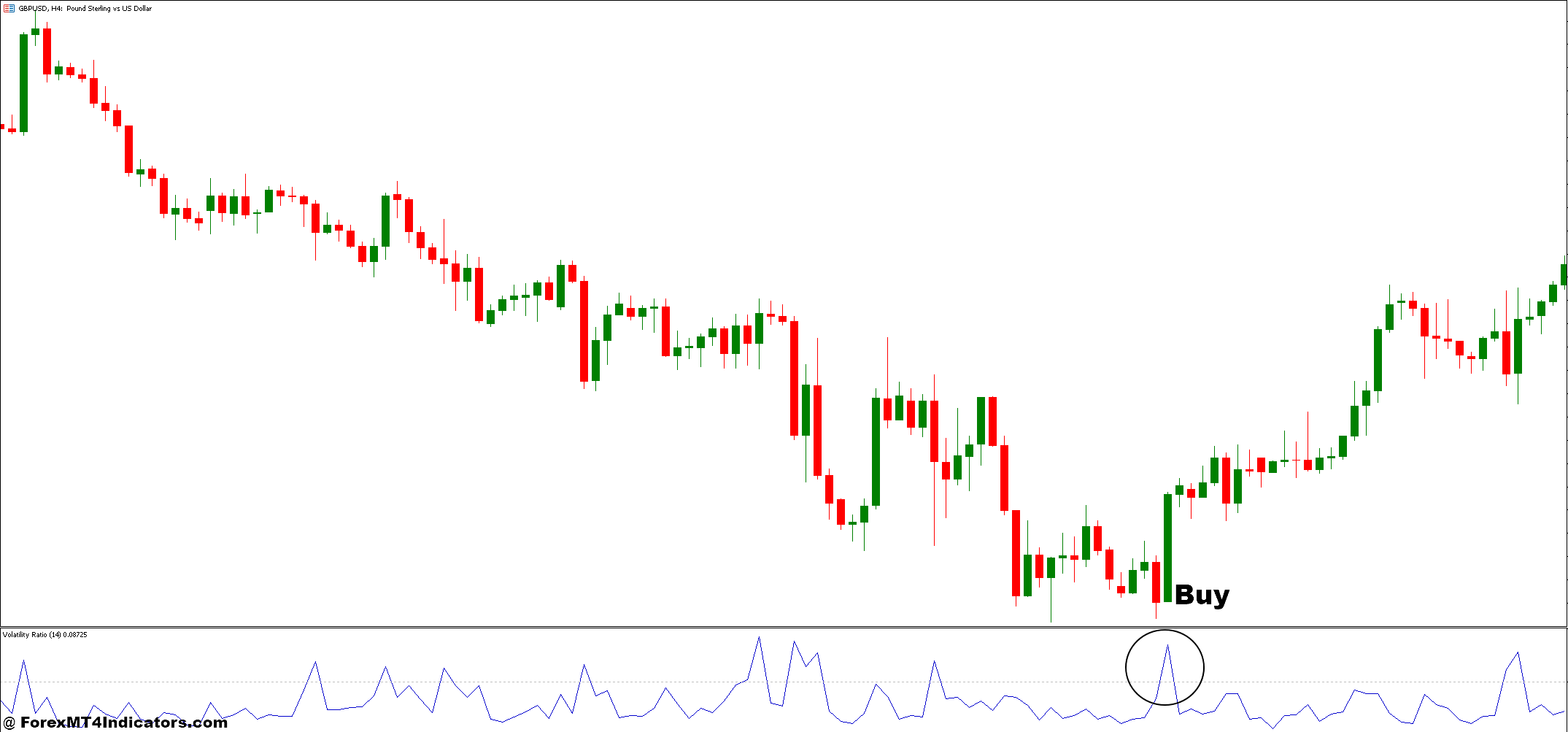

The Volatility Ratio Indicator is a tool that helps traders assess the extent of price fluctuation in a currency pair over a selected time frame. By measuring volatility, it provides insights into how much a currency pair is predicted to maneuver, each by way of magnitude and direction. Volatility is a vital consider foreign currency trading since it directly impacts risk and reward. A high volatility ratio typically signals that there shall be larger price movements, creating opportunities for significant profits but additionally increasing the chance of losses. Alternatively, a low volatility ratio suggests a calmer market, where price movements are smaller and more gradual, often resulting in steadier, less dangerous profits.

The Volatility Ratio is often calculated by comparing the value range (the difference between the best and lowest prices) of a currency pair over a selected period with its historical price range. The next ratio indicates increased volatility, while a lower ratio points to stability. Traders can use this indicator to find out one of the best times to enter or exit the market. For example, during times of high volatility, traders may decide to cut back on position sizes to administer risk higher, while in low-volatility environments, they may feel more comfortable taking larger positions. By combining the Volatility Ratio with other tools, traders can develop strategies that align with current market conditions, improving the accuracy and effectiveness of their trades.

One in every of the important thing benefits of the Volatility Ratio Indicator is its ability to present traders a way of market timing. Understanding when the market is prone to experience sharp price movements generally is a game-changer for identifying breakout opportunities or avoiding periods of market congestion. Furthermore, it could actually help traders adapt their strategies to changing market conditions. For instance, during times of high volatility, traders might use wider stop-loss orders to account for larger price swings, while in additional stable markets, tighter stop-loss levels could be used to guard profits. By incorporating the Volatility Ratio into their trading toolbox, traders could make more calculated decisions and higher manage the risks related to volatile market conditions.

How one can Trade with Profit Calculator and Volatility Ratio Forex Trading Strategy

Buy Entry

- Set Entry Price: Discover a positive entry point based in your evaluation (e.g., at a key support level, or after a pullback).

- Calculate potential profit and loss based on entry, stop-loss, take-profit levels, and lot size.

- Ensure a positive risk-to-reward ratio (ideally 2:1 or higher).

- High Volatility: If volatility is high, expect larger price swings and adjust your stop-loss accordingly to avoid getting stopped out prematurely.

- Low Volatility: If volatility is low, think about using tighter stop-loss levels and more conservative take-profit targets for smaller, steadier profits.

- Enter the trade when the value shows signs of a bullish breakout or continuation available in the market.

- Make sure the market conditions align along with your risk management parameters (position size, stop-loss, and take-profit).

- Adjust position size based on the Volatility Ratio. For top volatility, reduce position size to attenuate risk; for low volatility, you possibly can trade larger positions.

- Monitor and Adjust: Keep monitoring market conditions and adjust stop-loss and take-profit levels if volatility or market conditions change.

Sell Entry

- Set Entry Price: Discover an entry point based in your evaluation (e.g., after a resistance level is reached or a bearish reversal pattern forms).

- Calculate potential profit and loss based on entry, stop-loss, take-profit levels, and lot size.

- Make sure the risk-to-reward ratio meets your trading criteria (preferably 2:1 or higher).

- High Volatility: If the volatility ratio indicates high volatility, expect wider price fluctuations and adjust your stop-loss levels to accommodate larger swings.

- Low Volatility: If the volatility ratio indicates low volatility, tighten your stop-loss and take-profit targets for smaller, more predictable moves.

- Enter the sell trade when price breaks below a key support level or shows a confirmed bearish trend.

- Make sure that market conditions support the trade (i.e., low volatility means smaller, more consistent price movements, while high volatility may signal potential for quick price motion).

- For top volatility, decrease your position size to scale back risk. For low volatility, you possibly can afford to trade larger positions with a tighter stop-loss.

- Monitor and Adjust: Proceed to watch price motion and adjust your stop-loss and take-profit levels if volatility changes or the market moves against you.

Conclusion

Incorporating each the Profit Calculator and Volatility Ratio into your foreign currency trading strategy significantly enhances your ability to administer risk, optimize trades, and increase overall profitability. The Profit Calculator provides a transparent, calculated view of potential rewards and risks, ensuring you enter trades with a well-defined risk-to-reward ratio. Meanwhile, the Volatility Ratio helps you assess the market’s conditions, allowing you to regulate your strategy in response to the expected price fluctuations. Whether you’re trading in highly volatile markets or more stable conditions, these tools make sure that your decisions are data-driven and aligned along with your risk management goals.

Really helpful MT4 Broker

XM Broker

- Free $50 To Start Trading Immediately! (Withdraw-able Profit)

- Deposit Bonus as much as $5,000

- Unlimited Loyalty Program

- Award Winning Forex Broker

- Additional Exclusive Bonuses Throughout The Yr

- Exclusive 50% Money Rebates for all Trades!

>> Sign Up for XM Broker Account here with Exclusive 50% Money Rebates For All Future Trades [Use This Special Invitation Link] <<

Already an XM client but missing out on cashback? Open Recent Real Account and Enter this Partner Code: 𝟕𝐖𝟑𝐉𝐐

Click here below to download:

Get Download Access