The TRIX and Breakout Trading Forex Strategy is an efficient and dynamic approach that mixes the facility of the TRIX indicator with breakout strategies to discover high-probability trade opportunities within the forex market. The TRIX (Triple Exponential Average) is a momentum indicator that helps traders filter out market noise and concentrate on the underlying trend by smoothing price data. It provides useful insights into market trends, momentum, and potential reversals, making it a well-liked tool for traders trying to capture substantial price movements.

When paired with a breakout strategy, the TRIX indicator becomes much more powerful. Breakout trading revolves around identifying key support or resistance levels and entering the market when the value breaks out of those levels. Through the use of the TRIX to substantiate the momentum behind the breakout, traders can avoid false signals and increase the accuracy of their trades. This mix not only enhances the trader’s ability to identify trending markets but in addition allows them to enter trades at optimal points where the value is more likely to proceed moving within the breakout direction.

This strategy is especially effective in volatile and trending market conditions, where breakouts usually tend to result in sustained price movements. By understanding the way to use the TRIX at the side of breakout points, traders can develop a structured approach that minimizes risk while maximizing potential rewards. In this text, we are going to explore the way to use the TRIX and Breakout Trading Forex Strategy intimately, examining the entry and exit signals, risk management techniques, and the way to apply it across different timeframes and market conditions.

TRIX Indicator

The TRIX indicator, short for Triple Exponential Moving Average, is a momentum-based technical evaluation tool that’s designed to filter out market noise and highlight the underlying trend. It is basically a smoothed version of the standard Exponential Moving Average (EMA) and helps traders discover the direction and strength of a trend. Unlike other indicators which may be more susceptible to whipsaws, the TRIX smooths price data thrice, which leads to a more reliable and accurate representation of the market’s momentum.

The TRIX is calculated by applying an EMA to the value data, then smoothing the result with one other EMA, and repeating the method another time. The ultimate output is a line that oscillates around a zero level, with upward movements indicating positive momentum and downward movements showing negative momentum. One in every of the important thing features of the TRIX is its ability to remove short-term fluctuations, making it particularly useful in trending markets where traders seek to capture long-term price movements. The TRIX also generates signals when the indicator line crosses above or below the zero line, with an upward cross signaling potential buying opportunities and a downward cross suggesting potential sell signals.

A standard technique when using the TRIX is to watch its divergence with price motion. If the value is making recent highs, however the TRIX is failing to follow suit, it could signal a weakening trend or potential reversal. However, if the value is making recent lows, however the TRIX just isn’t confirming the brand new low, it’d indicate that the downtrend is losing strength. This makes the TRIX a flexible tool for each trend-following strategies and identifying possible trend reversals.

Breakout Trading Indicator

Breakout trading is a technique focused on entering trades when the value breaks above a key resistance level or below a support level. The premise is that when the value breaks through these levels, it should proceed to maneuver within the breakout direction, offering traders a chance to capture significant price movements. Breakout trading is very effective in markets that exhibit volatility and have clear support or resistance levels, as these levels act as barriers that, when breached, often signal a recent phase of price motion.

To discover potential breakouts, traders typically use technical indicators like support and resistance levels, trendlines, or chart patterns comparable to triangles, rectangles, or flags. These patterns signify periods of consolidation or range-bound price motion, where the market is coiling up before making a decisive move. Once the value breaks out of those patterns, it’s seen as a signal that the trend is more likely to proceed within the breakout direction, whether upward or downward. Volume is one other key element in breakout trading, as a rise in trading volume often confirms the validity of the breakout, suggesting that the value movement is supported by significant market participation.

A breakout strategy could be applied across different timeframes, making it adaptable to each short-term traders (comparable to day traders and scalpers) and longer-term traders (comparable to swing traders and position traders). It is crucial to make use of proper risk management when trading breakouts, as false breakouts, referred to as “breakout failures,” can result in significant losses. These occur when the value initially breaks a level but then quickly reverses, often trapping traders who entered on the idea that the breakout would proceed. To mitigate this risk, traders often wait for confirmation signals, comparable to an in depth above or below the breakout level, or use indicators just like the TRIX to substantiate momentum before entering a trade.

The way to Trade with TRIX and Breakout Trading Forex Trading Strategy

Buy Entry

- Step 1: Discover a key resistance level or breakout pattern (comparable to a triangle or flag).

- Step 2: Wait for the value to interrupt above the resistance level.

- Step 3: Confirm with TRIX:

- The TRIX should cross above the zero line and show positive momentum (rising).

- Search for a bullish crossover within the TRIX (if the TRIX crosses from below zero to above zero).

- Step 4: Enter the trade:

- Place a buy order as the value breaks above the resistance and the TRIX confirms positive momentum.

- Step 5: Set a stop-loss below the breakout level or essentially the most recent swing low.

- Step 6: Set a take-profit goal at a key resistance level or use a 1:2 risk-reward ratio.

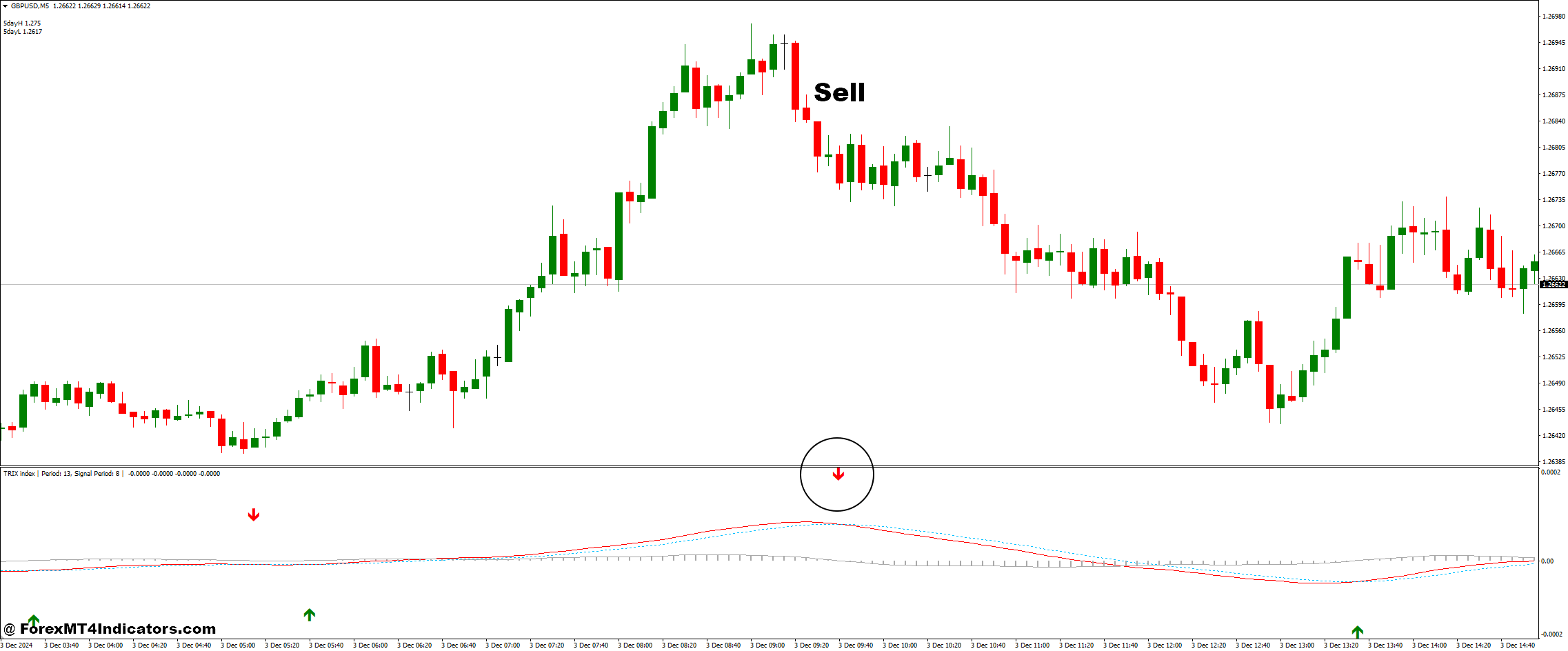

Sell Entry

- Step 1: Discover a key support level or breakout pattern (comparable to a triangle or flag).

- Step 2: Wait for the value to interrupt below the support level.

- Step 3: Confirm with TRIX:

- The TRIX should cross below the zero line and show negative momentum (falling).

- Search for a bearish crossover within the TRIX (if the TRIX crosses from above zero to below zero).

- Step 4: Enter the trade:

- Place a sell order as the value breaks below support and the TRIX confirms negative momentum.

- Step 5: Set a stop-loss above the breakout level or essentially the most recent swing high.

- Step 6: Set a take-profit goal at a key support level or use a 1:2 risk-reward ratio.

Conclusion

The TRIX and Breakout Trading Forex Strategy is a robust and effective approach for capturing profitable price movements within the forex market. By combining the momentum confirmation of the TRIX indicator with the precision of breakout trading, traders can enter high-probability trades with increased confidence. The TRIX helps filter out market noise and confirms the strength of the trend, while the breakout strategy identifies key levels where significant price motion is more likely to occur.

Advisable MT4 Broker

XM Broker

- Free $50 To Start Trading Immediately! (Withdraw-able Profit)

- Deposit Bonus as much as $5,000

- Unlimited Loyalty Program

- Award Winning Forex Broker

- Additional Exclusive Bonuses Throughout The Yr

- Exclusive 50% Money Rebates for all Trades!

>> Sign Up for XM Broker Account here with Exclusive 50% Money Rebates For All Future Trades [Use This Special Invitation Link] <<

Already an XM client but missing out on cashback? Open Latest Real Account and Enter this Partner Code: 𝟕𝐖𝟑𝐉𝐐

Click here below to download:

Get Download Access