The ATR Volatility and Wilders DMI Averages Forex Trading Strategy offers traders a dynamic approach to navigating the volatile forex market. At its core, this strategy leverages two powerful technical indicators: the Average True Range (ATR) and Wilder’s Detrended Oscillator (DMI). Together, these tools help traders understand market volatility and trend strength, making it easier to discover potential entry and exit points. By utilizing ATR to measure price volatility and DMI to investigate market direction, this strategy allows for more informed decision-making within the fast-moving forex environment.

One in all the important thing benefits of this strategy is its ability to adapt to changing market conditions. The ATR helps traders gauge the extent of price fluctuations, giving insight into whether a currency pair is in a period of high or low volatility. This volatility measurement helps to set stop-loss levels and take-profit targets more effectively, ensuring that trades are adjusted in response to market conditions. Meanwhile, Wilder’s DMI, which consists of the Plus Directional Indicator (+DI) and Minus Directional Indicator (-DI), assesses the strength of a trend, providing clarity on whether the market is trending upward or downward.

Incorporating each ATR and DMI right into a unified trading strategy enhances the flexibility to trade with the trend while accounting for potential market reversals. By recognizing when volatility is high and the trend is powerful, traders can maximize profit potential and reduce the likelihood of getting caught in false breakouts or reversals. The ATR Volatility and Wilders DMI Averages Forex Trading Strategy is especially effective for traders preferring a scientific approach, because it allows them to make data-driven decisions fairly than counting on intuition alone.

ATR Volatility Indicator

The Average True Range (ATR) is a widely used volatility indicator within the forex market, developed by J. Welles Wilder. Its primary function is to measure the volatility of a market, providing traders with an understanding of the range of price movements over a selected period. Unlike traditional indicators that deal with price direction, the ATR focuses purely on the extent of price fluctuations, whether the market is experiencing high or low volatility. The ATR is calculated by averaging the true ranges over a specified variety of periods, typically 14, to offer a smoother representation of volatility.

The important thing strength of the ATR lies in its ability to adapt to changing market conditions. In periods of heightened volatility, similar to major economic announcements or news events, the ATR reading tends to rise, signaling that price movements are more extreme. Conversely, in calm market conditions, the ATR decreases, indicating smaller price ranges. Traders use the ATR to find out optimal stop-loss levels, because it helps in assessing how much a currency pair is more likely to move in a given time-frame. For instance, in a highly volatile market, traders might place wider stop-loss orders to avoid being prematurely stopped out, while in a low-volatility market, tighter stop-losses might be used to capture smaller moves.

The ATR is a non-directional indicator, meaning it doesn’t predict price movement direction but simply measures the strength of price changes. This makes it a flexible tool that works well in each trending and range-bound markets. It is particularly precious when combined with other indicators, similar to the Wilders DMI, which offer information on trend direction. Together, these indicators offer a comprehensive view of each volatility and trend strength, allowing traders to make more informed trading decisions.

Wilders DMI Averages Indicator

The Wilders DMI Averages indicator, also often known as the Directional Movement Index (DMI), is a trend-following tool developed by J. Welles Wilder to assist traders assess the strength of a prevailing market trend. The DMI consists of three components: the Plus Directional Indicator (+DI), the Minus Directional Indicator (-DI), and the ADX (Average Directional Index), which together provide insight into whether the market is in an uptrend, downtrend, or trending in any respect. The DMI’s primary focus is to find out whether a trend exists, its strength, and the direction of that trend.

The +DI measures the strength of upward price movements, while the -DI gauges the strength of downward price movements. When the +DI is above the -DI, it indicates a bullish trend, and when the -DI is above the +DI, it signals a bearish trend. The ADX, a separate line that ranges from 0 to 100, measures the strength of the trend, no matter its direction. A high ADX value (above 25) indicates a powerful trend, while a low ADX (below 20) suggests a weak or non-existent trend. Traders use the DMI to discover whether a market is trending or ranging, and to pinpoint optimal entry and exit points based on the strength of the trend.

Within the context of the ATR Volatility and Wilders DMI Averages Forex Trading Strategy, the DMI serves as a trend strength indicator, complementing the ATR’s volatility measurement. By combining each, traders gain a more complete picture of market conditions. As an example, when the DMI shows a powerful trend and the ATR indicates high volatility, it could signal a possible opportunity to capitalize on large price movements. Conversely, if the DMI shows a weak trend and ATR is low, it could indicate a scarcity of market direction, suggesting that traders should avoid entering trades in periods of consolidation. Together, the ATR and DMI provide a robust framework for making data-driven, informed trading decisions.

Tips on how to Trade with ATR Volatility and Wilders DMI Averages Forex Trading Strategy

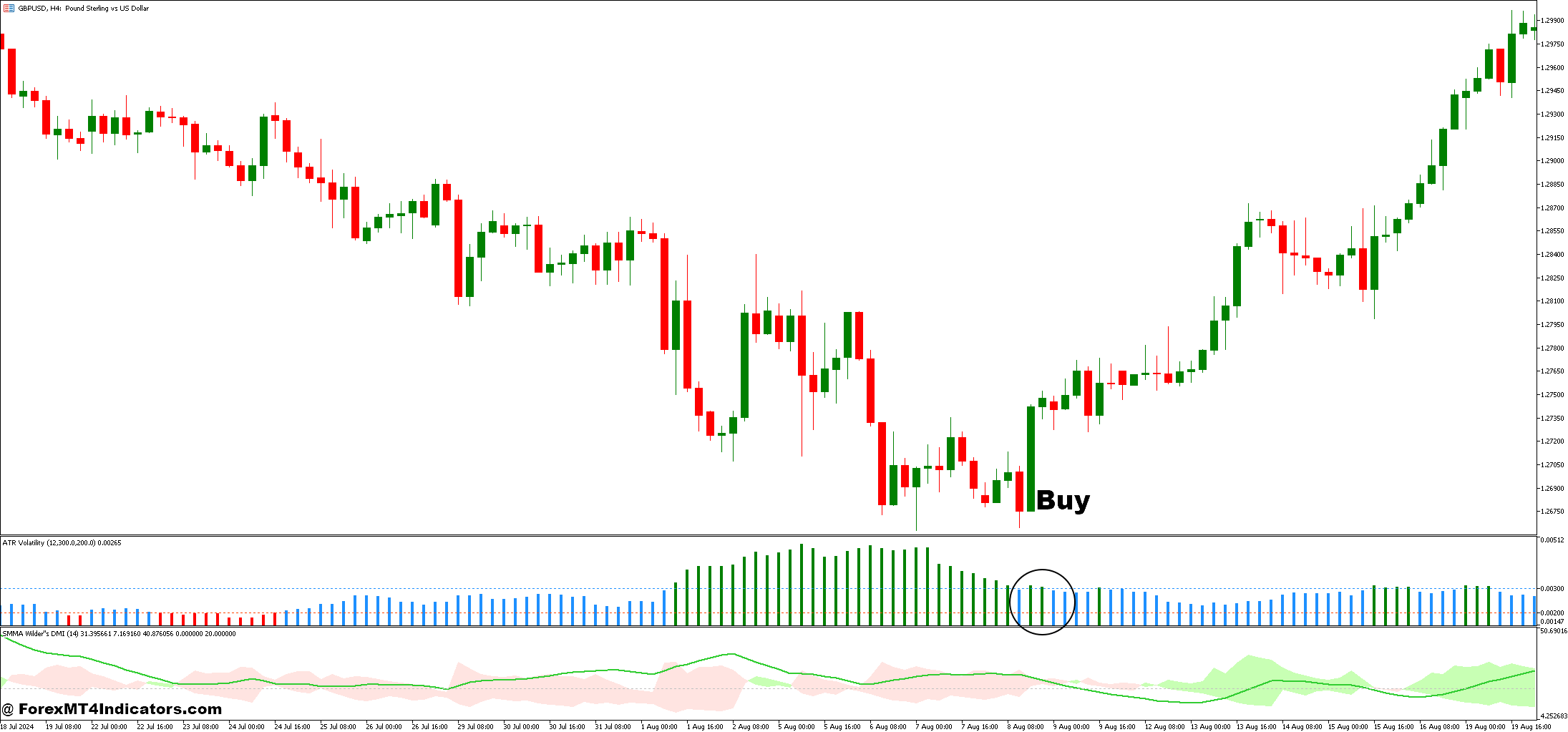

Buy Entry

- +DI above -DI: Indicates a bullish trend, suggesting a possible buy opportunity.

- ADX above 25: Confirms the strength of the trend, showing a powerful upward momentum.

- ATR indicating rising volatility: Shows that the market is moving with sufficient volatility, allowing for larger price moves.

- Price above key moving averages: Optional, but confirms the trend direction.

- Confirmation: Wait for a pullback or consolidation followed by a breakout to enter at a positive price.

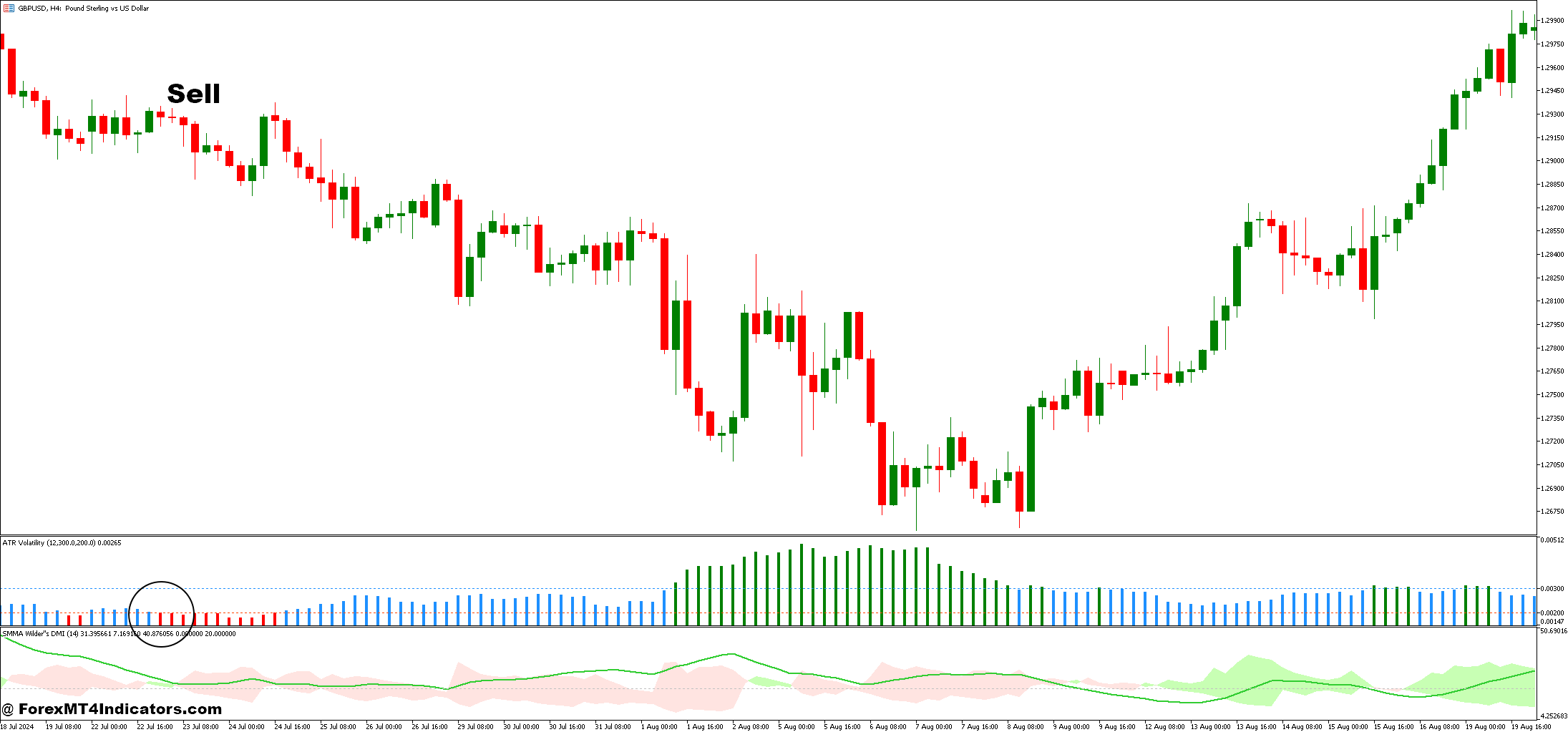

Sell Entry

- -DI above +DI: Indicates a bearish trend, suggesting a possible sell opportunity.

- ADX above 25: Confirms the strength of the trend, showing a powerful downward momentum.

- ATR indicating rising volatility: Shows that the market is moving with sufficient volatility, allowing for larger price moves.

- Price below key moving averages: Optional, but confirms the trend direction.

- Confirmation: Wait for a rally or retracement followed by a breakdown to enter at a positive price.

Conclusion

The ATR Volatility and Wilders DMI Averages Forex Trading Strategy provides traders with a sturdy framework to navigate the complexities of the forex market by combining two powerful indicators: the ATR and DMI. By measuring each market volatility and trend strength, this strategy helps traders make more informed decisions, whether the market is trending or in a period of consolidation. The ATR enables traders to regulate their risk management techniques by setting stop-loss levels based on current volatility, while the DMI helps determine the strength and direction of trends, ensuring that trades are aligned with the market’s momentum.

Advisable MT4 Broker

XM Broker

- Free $50 To Start Trading Immediately! (Withdraw-able Profit)

- Deposit Bonus as much as $5,000

- Unlimited Loyalty Program

- Award Winning Forex Broker

- Additional Exclusive Bonuses Throughout The Yr

- Exclusive 50% Money Rebates for all Trades!

>> Sign Up for XM Broker Account here with Exclusive 50% Money Rebates For All Future Trades [Use This Special Invitation Link] <<

Already an XM client but missing out on cashback? Open Latest Real Account and Enter this Partner Code: 𝟕𝐖𝟑𝐉𝐐

Click here below to download:

Get Download Access