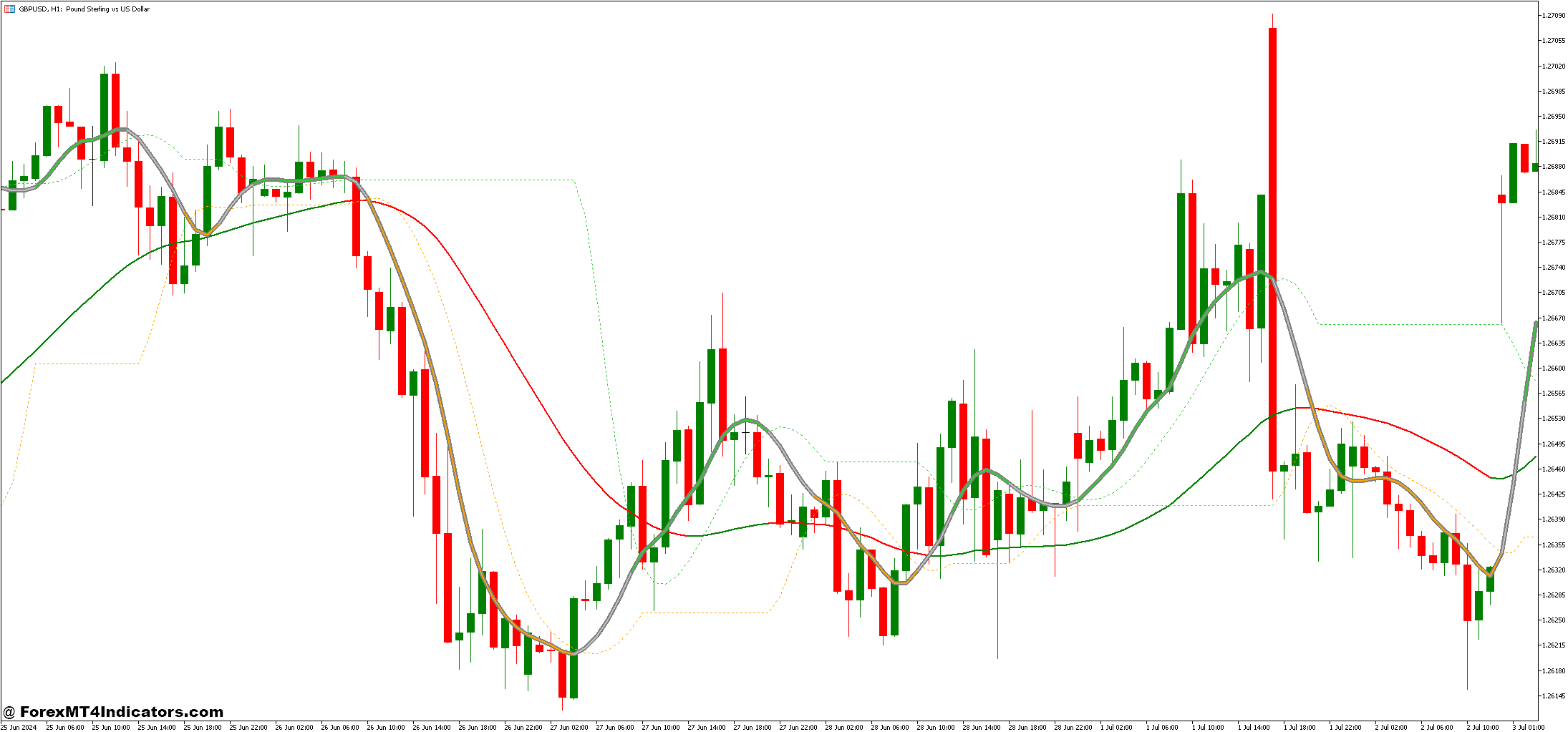

The Slope Direction Line and Super Smoother Levels Forex Trading Strategy represents a complicated approach to navigating the complexities of Forex. By harnessing the ability of the Slope Direction Line (SDL), traders can accurately gauge market trends, while the Super Smoother Levels indicator enhances this evaluation by filtering out market noise. This mix allows traders to make more informed decisions, capitalizing on each trend direction and price stability.

At its core, the Slope Direction Line provides a visible representation of the present market trend, indicating whether a currency pair is in an upward or downward trajectory. By measuring the slope of price movements over a delegated period, the SDL equips traders with a transparent understanding of trend strength. When paired with the Super Smoother Levels, which minimizes short-term fluctuations to disclose longer-term price movements, this strategy empowers traders to discover potential entry and exit points with greater precision.

In a market characterised by rapid changes and unpredictable shifts, the Slope Direction Line and Super Smoother Levels strategy stands out as a precious tool for Forex traders. By specializing in the interplay between these two indicators, traders can enhance their ability to identify trend reversals and continuations, thereby improving their overall trading performance. As we explore the intricacies of this strategy, we’ll delve into its essential components, practical applications, and suggestions for maximizing its effectiveness in various trading scenarios.

Slope Direction Line Indicator

The Slope Direction Line (SDL) indicator is a strong tool designed to offer traders with a transparent visualization of market trends. It operates by calculating the slope of price movements over a specified period, allowing traders to discover the direction and strength of a trend effectively. The SDL is often plotted as a line on the worth chart, changing color based on the trend’s direction: for example, it might appear green during an uptrend and red during a downtrend. This color-coding makes it easy for traders to quickly assess market conditions at a look.

One among the important thing benefits of the Slope Direction Line is its ability to filter out market noise, which is usually a big challenge in Foreign currency trading. By specializing in the slope somewhat than the worth itself, the SDL helps traders avoid false signals that may arise from minor price fluctuations. Moreover, the indicator will be adjusted to suit different trading styles and timeframes, making it versatile for each short-term and long-term traders. When used along side other technical indicators, the SDL can enhance a trader’s ability to make well-informed decisions based on clear trend signals.

Furthermore, the Slope Direction Line can function a precious component in a broader trading strategy. Traders often use it to discover potential entry and exit points, confirming trade signals generated by other indicators. As an example, when the SDL aligns with support and resistance levels or other trend indicators, it will possibly provide a stronger confirmation of the trader’s hypothesis, thereby improving the likelihood of successful trades.

Super Smoother Levels Indicator

The Super Smoother Levels indicator is designed to offer traders with a clearer view of price trends by minimizing the results of volatility and market noise. Unlike traditional moving averages, the Super Smoother Levels utilize a complicated smoothing algorithm that reduces lag and reacts more swiftly to cost changes. This makes it particularly effective in identifying significant price movements while filtering out minor fluctuations that will result in false signals. The Super Smoother Levels will be used to set key support and resistance levels, helping traders to make more informed decisions regarding entry and exit points.

One among the standout features of the Super Smoother Levels is its adaptability to varied market conditions and trading styles. Traders can customize the settings to suit different timeframes, enabling them to use the indicator effectively across short-term scalping, medium-term day trading, or long-term investing strategies. This flexibility allows traders to keep up a consistent approach, no matter their specific market focus.

Moreover, the Super Smoother Levels indicator will be combined with other technical indicators to reinforce overall trading strategies. When used alongside the Slope Direction Line, for instance, it provides a more comprehensive evaluation of market conditions. The Super Smoother Levels can confirm trends indicated by the SDL, helping traders to discover optimal trade setups and reinforcing the strength of their trading signals. This synergy between indicators creates a strong framework that may result in more successful trading outcomes within the dynamic Forex market.

Tips on how to Trade with Slope Direction Line and Super Smoother Levels Forex Trading Strategy

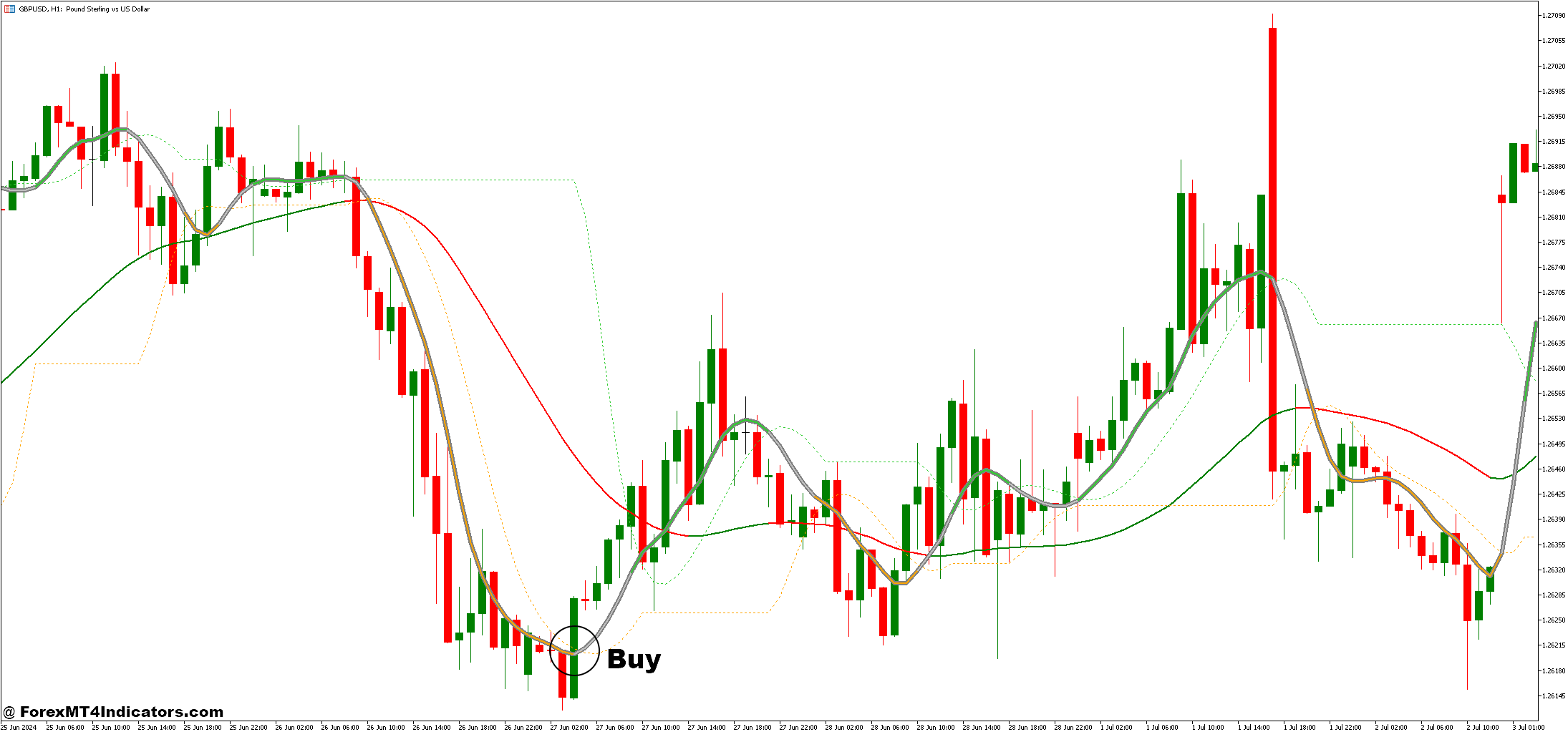

Buy Entry

- Discover Uptrend: Make sure the Slope Direction Line (SDL) is green and moving upwards.

- Price Crossover: Wait for the worth to cross above the Super Smoother Levels.

- Confirmation: Look for added confirmation, akin to support levels or positive market sentiment.

- Set Stop-Loss: Place a stop-loss order just under the Super Smoother Level to administer risk.

- Take-Profit Goal: Set a take-profit level at key resistance zones or a risk-reward ratio that aligns together with your trading strategy.

Sell Entry

- Discover Downtrend: Make sure the Slope Direction Line (SDL) is red and moving downwards.

- Price Crossover: Wait for the worth to cross below the Super Smoother Levels.

- Confirmation: Look for added confirmation, akin to resistance levels or negative market sentiment.

- Set Stop-Loss: Place a stop-loss order just above the Super Smoother Level to administer risk.

- Take-Profit Goal: Set a take-profit level at key support zones or a risk-reward ratio that aligns together with your trading strategy.

Conclusion

The Slope Direction Line and Super Smoother Levels Forex Trading Strategy offers traders a strong framework for navigating the complexities of Forex. By effectively combining the trend-identifying capabilities of the Slope Direction Line with the noise-reducing features of the Super Smoother Levels, traders can enhance their market evaluation and make more informed decisions. This strategy not only aids in identifying potential entry and exit points but additionally helps in managing risk more effectively through strategic stop-loss placements.

Really useful MT4 Broker

XM Broker

- Free $50 To Start Trading Immediately! (Withdraw-able Profit)

- Deposit Bonus as much as $5,000

- Unlimited Loyalty Program

- Award Winning Forex Broker

- Additional Exclusive Bonuses Throughout The 12 months

- Exclusive 50% Money Rebates for all Trades!

>> Sign Up for XM Broker Account here with Exclusive 50% Money Rebates For All Future Trades [Use This Special Invitation Link] <<

Already an XM client but missing out on cashback? Open Latest Real Account and Enter this Partner Code: 𝟕𝐖𝟑𝐉𝐐

Click here below to download:

Get Download Access