At the height of the 2020 to 2021 bull run, ADA, the native token of Cardano, rose to $3 in August. Interestingly, developers activated smart contracts across the top of this cycle after completing the Alonzo hard fork, ushering within the Goguen phase.

Did Alonzo And Smart Contracts Kill ADA?

Nonetheless, as Atomic Wallet analysts note, ADA has been on a downtrend since then, crumbling by over 90% over time on the time of writing. ADA is changing hands at $0.32 when writing, finding immediate support at around $0.30, a psychological number.

Related Reading

Though traders are optimistic about what lies ahead, the turn of events during the last three years could suggest that the activation of smart contracts on Cardano did “kill” the coin’s valuation. The plummeting prices, made worse by the 2022 crypto winter, mean those that bought in August 2021 are holding mud.

ADA has been dumping since September 2021 | Source: @AtomicWallet via X

Whether ADA will recuperate in the approaching weeks and rewind losses of 2022 stays to be seen. What’s clear is that the activation of the Alonzo hard fork and the beginning of the Goguen era was a key milestone for Cardano. The transition was crucial considering that before September 2021, developers couldn’t deploy dApps and tackle Ethereum and competing properties supporting smart contracts.

For years, for the reason that genesis block, Cardano developers have been accused of delaying the method while using billions for development. After Alonzo, users can, even now, create complex smart contracts using Plutus scripts and run dApps. Like other blockchains, all fees are payable in ADA, the native token.

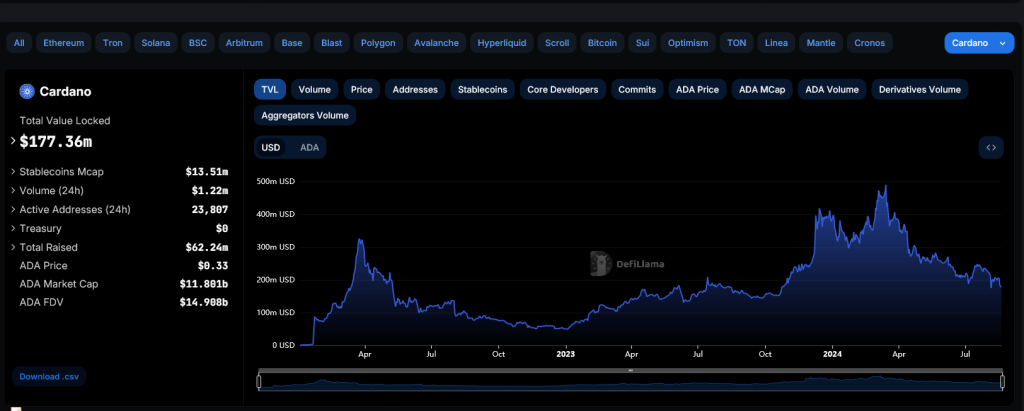

Over time, Cardano has grown its ecosystem, the overall value locked (TVL). In keeping with DeFiLlama, DeFi protocols on Cardano, energetic after Alonzo, now manage over $177 million in assets.

Cardano TVL | Source: DeFiLlama

Cardano TVL | Source: DeFiLlama

Though relatively low in comparison with those in Ethereum and the BNB Chain, developers took advantage of smart contracts and built solutions on the network.

Cardano Transitioning To Voltaire: Will Things Change?

The present disconnect between ADA valuation and the expectation of coin holders post-Goguen is a priority. It’s so especially as Cardano completes the Basho stage, moving to Voltaire, the ultimate phase of the platform’s development.

Related Reading

Voltaire focuses on making Cardano governance decentralized. Here, ADA may have more utility, allowing holders to vote on proposals and directly helping improve the network. Moreover, there might be a treasury for funding projects deploying on Cardano. Up to now, the Chang hard fork is in progress, with roughly 33% of all stake pool operators (SPOs) ready.

Cardano price trending downward on the each day chart | Source: ADAUSDT on Binance, TradingView

Meanwhile, ADA stays under immense selling pressure and will plunge to 2023 lows of around $0.22 if buyers don’t step in. If prices rise above $0.50, bulls will likely push ADA toward March 2024 highs.

Feature image from Shutterstock, chart from TradingView