Ethereum (ETH) recently dropped below the critical and psychological support level at $3,000, raising concerns for ETH bulls. This development comes amid the continued decline in revenue generated on the Ethereum network.

Related Reading

Ethereum Crashes Below $3,000

Ethereum is down below $3,000, with this downtrend believed to be on account of several aspects. One is the outflows, which the Spot Ethereum ETFs have been experiencing since they began trading on July 23. Data from Farside Investors shows that these funds again experienced a net outflow of $54.3 million on August 2.

These funds haven’t had the specified impact on ETH’s price that they were expected to have, with Ethereum down over 10% since they began trading. Data from Soso Value shows that these funds have suffered cumulative net outflows of $510.7 million since they launched. Grayscale’s Ethereum Trust (ETHE) has been individually accountable for these outflows, with $2.12 billion flowing out of the fund since its launch.

This has put significant selling pressure on ETH, resulting in its recent downtrend. ETH’s price has also dropped below $3,000 due to the downtrend within the broader crypto market led by Bitcoin. Ethereum was sure to suffer a major decline following Bitcoin’s drop as data from the market intelligence platform IntoTheBlock shows that each assets currently have a powerful price correlation.

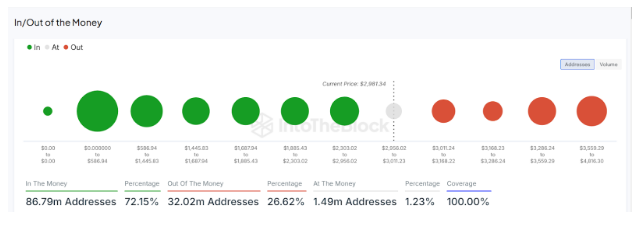

Ethereum’s drop below $3,000 is undoubtedly worrisome for investors, considering how much lower it could drop. Nevertheless, ETH has quickly reclaimed the $3,000 level these past three months every time it drops below this significant support zone. As such, this time might not be any different, especially with data from IntoTheBlock indicating a powerful demand for Ethereum at this price level.

Ethereum is now trading at $2,991. Chart: TradingView

If Ethereum fails to carry this range, the second-largest crypto token risks dropping to as little as $2,700, a more crucial support zone for ETH considering that 11.11 million addresses bought the token at a mean price of $2,647.

Ethereum’s Revenue Drops To Recent Lows

Data from Token Terminal shows that Ethereum’s revenue has dropped to recent lows, down by 40.4% within the last 30 days and 44.8% annually. Fees earned on the network haven’t been impressive either. During the last 30 days, Ethereum users have paid $92.97 million in fees, a 32.8% decline and 38.3% at an annual rate.

This drop in Ethereum’s revenue and costs might be attributed to the decline within the network’s energetic day by day users. Further data from Token Terminal shows a 9.8% drop in Ethereum’s monthly energetic users. The identical goes for the weekly and day by day energetic users, with 20.1% and 15.3% drops, respectively.

Related Reading

On the time of writing, Ethereum is trading at around $2,979, down over 5% within the last 24 hours, in keeping with data from CoinMarketCap.

Featured image from Pexels, chart from TradingVIew