Understanding the best way to react in numerous market situations is important when starting trading.

So, what’s the key formula?

Well, veteran traders actually use quite a lot of trading strategies – not only one!

Attending to grips with these strategies early can put you on a solid path to greater future success.

I admit that, while at first glance, trading strategies can seem complicated…

…don’t let that stop you!

I’ve written this guide on Understanding Trading Strategies for Beginners only for you – precisely to provide help to start!

With slightly little bit of digging into the main points, I promise these strategies will quickly develop into clear…

…providing you with that vital edge during your next trading session.

In this text, you’ll explore three essential strategies:

- The Break and Retest Strategy (Understanding flipping supports and resistances and the best way to follow large trending moves)

- The Breakout Strategy (Learning to capture strong volatile moves with fast profits)

- The Range Strategy (Capturing multiple successful trades of the identical levels with precision)

Are you ready?

Then let’s go!

Break and Retest Strategy

What’s it about?

The Break and Retest Strategy is generally known as a Trend Continuation Strategy.

It’s all about entering a trade after the value breaks through a big level of support or resistance, after which retests that level from the alternative side.

This strategy focuses on the “flipping” of support into resistance – or – resistance into support, depending on the direction of the trend.

You should utilize it in trending markets, with the aim of capturing a continued trend move.

This strategy helps you discover significant levels out there while also trading within the direction of the trend.

It also signifies that by bringing together multiple technical levels into one strategy, you increase the possibility of success!

Why use this strategy

Multiple indicators in your favour.

The Break and Retest Strategy offers you a much higher win rate in comparison with entering trades randomly in an uptrend.

A few the reason why this strategy is so effective:

- Identifying Areas of Value: You possibly can actually pinpoint areas where the value has previously struggled after which successfully broken through.

These areas, generally known as “areas of value,” are critical for making higher trading decisions.

- Core Technical Evaluation Components: This strategy uses two key parts of technical evaluation:

- Breaking through horizontal levels.

- Trading within the direction of the trend.

By combining these elements, you create a very potent trading approach that increases the likelihood of successful trades when used accurately.

Easy to discover and an incredible foundation for future systems

When starting out in trading, simplicity is vital!

Using this strategy means you possibly can easily discover resistance and support levels, in addition to work out the present market direction.

Higher yet, these concepts are the idea for more advanced trading systems.

Learning about them now allows you to improve your strategies over time, laying much more groundwork for future trading success!

Can result in significant gains

Lastly, the Break and Retest Strategy can result in substantial profits.

By lining up your trades with the trend, you possibly can profit from longer price movements over days, weeks, and even months following your entry.

It’s an approach that lets you ride the momentum all of the strategy to the tip trend, maximizing profit!

How it really works

So what does this appear like exactly?

Resistance Break And Retest:

Within the diagram, you possibly can see price moves up after which briefly retraces, right?

This forms what’s called the initial resistance level.

When price comes back to this resistance level, it could be met with some rejection, but eventually price breaks through – with a robust break of the previous high or resistance level.

Price then pulls back to retest the broken resistance level, which now acts as a support level.

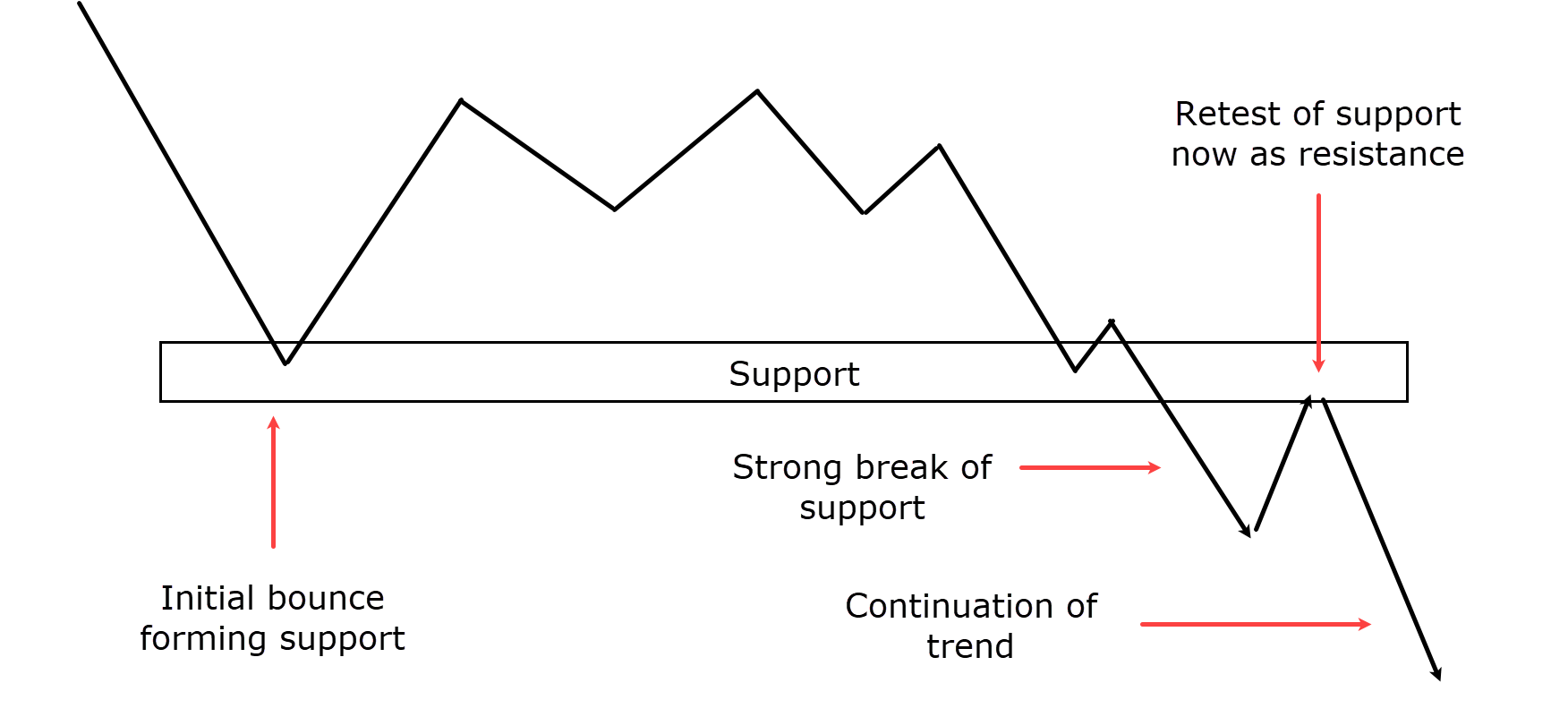

This concept works the exact same for the downtrend example, too…

You possibly can see the value is in a downtrend, forming a low where price bounces…

…the break of support eventually occurs, followed by the retest of the support as a recent resistance.

On the retest , it is necessary to search for rejection candles that inform you price is now rejecting this key level as resistance.

This rejection might appear as shooting star candlesticks or bearish engulfing candles within the critical area.

Finally, the value continues within the trend direction.

That’s the idea of it, anyway!

Now let’s have a look at some real-world examples and discuss profit-taking and stop-loss placement!

Trading Examples

Take a have a look at the next chart…

USD/ZAR 1-Hour Chart Retest:

As you possibly can see, price breaks the previous resistance but takes a while before price comes back to really retest the zone properly.

But when the value does come back, a retest trade opportunity presents itself!

Within the USD/ZAR 1-hour chart shown, the candles have begun to stall on the zone and show signs of rejection – that is the chance to take a protracted trade.

You possibly can place your stop loss safely below the zone after which goal either the previous resistance or a set reward, on this case, I’m using a 2.5RR…

USD/ZAR 1-Hour Take Profit:

…and have a look at that!

Price stalled on the zone and made its strategy to the take profit!

That is an incredible example of how price is drawn to previous areas of value.

By rigorously specializing in what price does in these areas, you possibly can higher estimate what might occur in the long run.

But what if I told you the trade opportunities didn’t end here?

Let’s proceed following the value for a bit longer…

USD/ZAR 1-Hour Break of Original Zone:

As you possibly can see on the chart above, price actually returns to the zone again.

There can have been one other opportunity to take a protracted trade here, which is logical.

Nevertheless, for this instance, let’s say you expected this zone to fail due to the speed price returned to it.

Eventually, price breaks below the unique zone but, that presents the following trading opportunity!

Actually, the more times a zone is breached, the less significance I give it.

It’s best to all the time update your zones usually to match where price has previously reacted!…

USD/ZAR 1-Hour Break and Retest:

Here, the retest and rejection occur when price steadily returns to the zone and is met with a robust bearish engulfing candle.

This candle shows you ways sellers are influencing this area, providing resistance.

So for a trade just like the last one, you would place your stop loss just above the resistance zone, which now acts as the realm of value…

…and your take profit might be set across the previous lows…

USD/ZAR 1-Hour Take Profit #2:

Hey, did you see that!?

Price continued its downtrend momentum and eventually reached the previous low goal where profits might be taken!

Are you able to see how this area of value prompted multiple reactions from price?

It’s an incredible example of why it’s crucial to remain open-minded.

Even when the initial trade doesn’t go your way, rigorously watching how price reacts at the brand new levels can show you recent trading opportunities.

I check with this approach as being “in flow” with the market.

It’s all the time higher to let the market show you its intentions relatively than project your expectations onto it!

Let’s examine one last example…

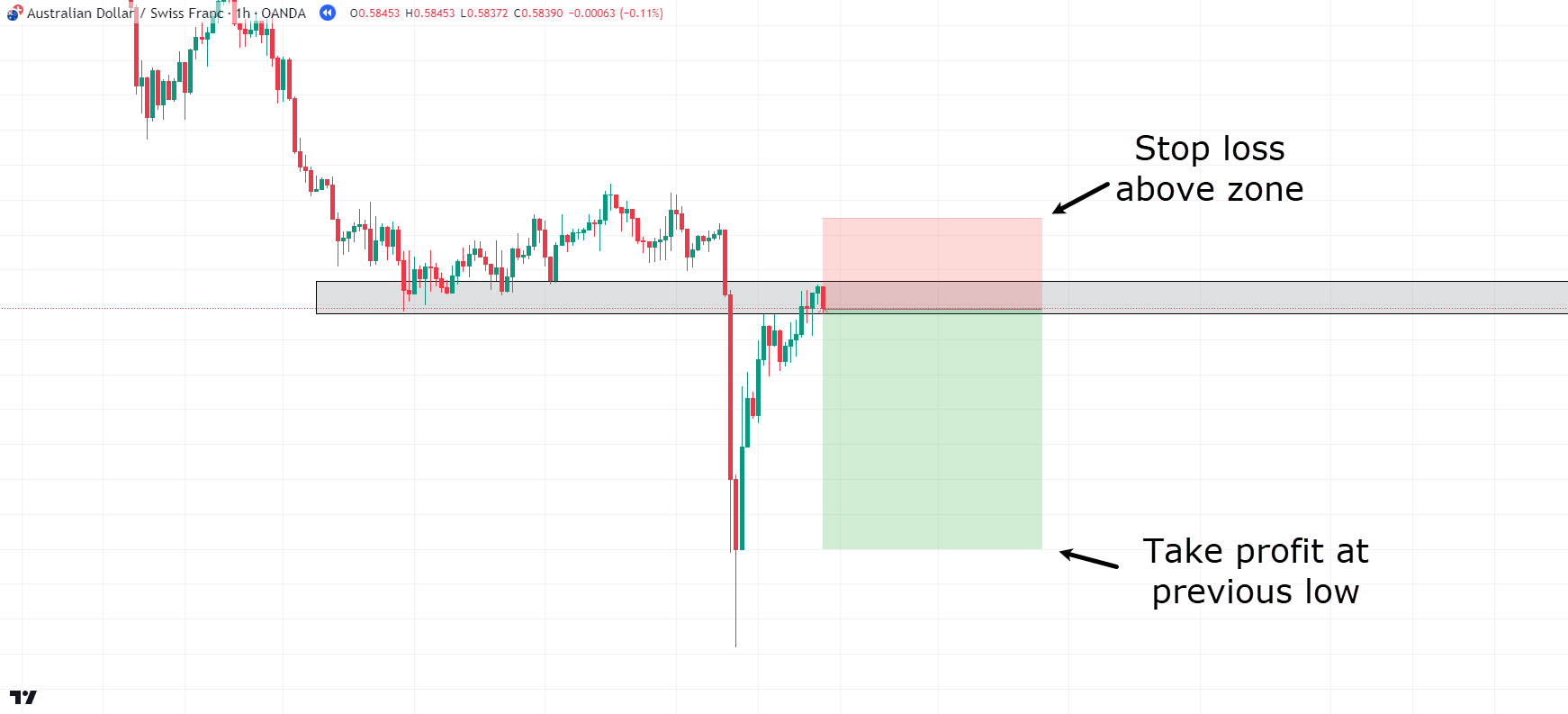

AUD/CHF 1-Hour Chart:

Here is one other clear example of price breaking below a transparent support level.

Although price has moved a great distance away from the support level, let’s have a look at what happens…

AUD/CHF 1-Hour Chart Break and Retest:

Price grinds its way back as much as the zone… where it appears to stall.

Now, just like the previous examples, let’s place the stop safely above the zone and goal the previous low…

AUD/CHF 1-Hour Chart Zone Break:

Hey, hold on!

Price is definitely beginning to break above the zone?

But what does that mean?

Well, at this point, you’ve to ask yourself two necessary questions:

Is my trade unfolding as expected?

Is that this zone being respected as resistance?

I hope you answered “no” to each of those questions!

But let’s assume you desired to let the trade play out naturally…

AUD/CHF 1-Hour Chart Stop Loss Hit:

As expected, the trade didn’t play out as expected.

Price eventually moved all of the strategy to the stop loss.

So, what’s the lesson here?

Crucially, if the value begins to disrespect the zone you’ve identified, then you have to reevaluate – relatively than hoping the value will turn in your favor!

Over your trading profession, you’ll learn that cutting losses early is vital to staying in the sport and becoming profitable.

On this case, there was a possibility to exit your trade early – when the value broke above the zone.

I mean, it might end in a smaller loss than in case your full stop loss was hit, right?

At all times monitor this when planning and executing trades, as not every break and retest trade will probably be successful.

Now, let’s have a look at some pros and cons of this strategy!

Pros and cons

Pros:

Clear Levels

This strategy is superb for beginners since it’s straightforward.

Just give attention to support and resistance levels where price has clearly reacted prior to now.

It greatly simplifies decision-making.

Trading with the trend

Typically aligned with breakout strategies, trading with the trend means you follow the market’s momentum.

Most setups occur within the direction of the prevailing trend…

…increasing the likelihood of successful trades!

Multiple trade management strategies available

There’s loads of flexibility in managing trades here.

You possibly can harness recent momentum using trailing stop losses or targeting certain take profit levels.

The initial stop-loss placement is evident, too, being based on the identified level.

Cons:

Price might go and not using a retest

One drawback is that sometimes price may not retest the broken level!

This could lead on to missed opportunities at identified key levels.

Rejection on the zone might be subjective

Determining rejection at a zone can vary amongst traders, resulting in inconsistent entries until a trader defines their criteria for rejection.

It’s necessary to decide on your bounds – and persist with them.

Price can fakeout

False breakouts at key levels can occur, where price briefly moves beyond a level but fails to sustain the momentum.

Naturally, this may end up in losses if trades are based on these false signals.

Pro Suggestions

Moving Average Confirmation

It may well be a superb idea to make use of the 50-day moving average as extra confirmation of a trend and support/resistance levels.

Although I sometimes use the 50-day moving average, try fooling around with different moving averages that make sense to you.

It’s all in regards to the timeframe you might be trading!

Volume Confirmation:

One other good idea is to search for increased volume on the breakout and retest to verify the validity of the move.

Increased volume can suggest that a breakout shouldn’t be a fakeout – but that there are literally strong forces behind the break of the important thing level!

All clear? Great!

Now let’s move on to the following strategy: the breakout strategy!

Breakout Strategy

What’s it about?

Support and Resistance being Broken and Trading in that Direction

Breakout trading means entering a position when the value breaks through an outlined support or resistance level with significant volume.

Once these critical levels are breached, the value is more likely to proceed moving in that direction, often resulting in big price movements.

You possibly can seek for these impending breakouts, capturing the momentum and gaining from market shifts!

Momentum and Volatility Can Speed up the Market

The momentum from breakouts may cause quick price changes, allowing you to take advantage of short-term market actions.

The increased activity also creates higher volatility, making breakouts popular if you should profit from fast market moves.

By capturing these big price changes, you possibly can ride the wave of volatility – and maximize your gains!

This strategy works well in markets with strong movements, where the possibility for large price swings is higher.

Why use this strategy

Capture Big Fast Moves

When the value of something breaks through a vital level, like support or resistance, it often sets off a flurry of activity out there.

Consequently, prices can shoot up or down, providing you with a likelihood to make loads of money in a short while.

The longer the value has been stuck in a spread, the stronger the breakout tends to be when it finally happens.

Consider it like pressure increase before getting rapidly released, causing the large price moves!

Easy to Discover

Another excuse traders love breakout strategies is that’s is amazingly easy to discover a breakout.

When a price breaks through a vital level, like support or resistance with momentum it is commonly very clear.

This provides the trader a black and white picture of whether price has broken out or not!

Trade setups develop into easy with clear price points of where the trade can be invalidated and stop losses placed.

The way it Works

Price Involves a Resistance or Support

Breakout trading starts by figuring out key support and resistance levels on a price chart.

When the value approaches these critical zones, it signals potential areas where buyers (at support) or sellers (at resistance) may develop into energetic.

This sets the stage for a possible breakout!

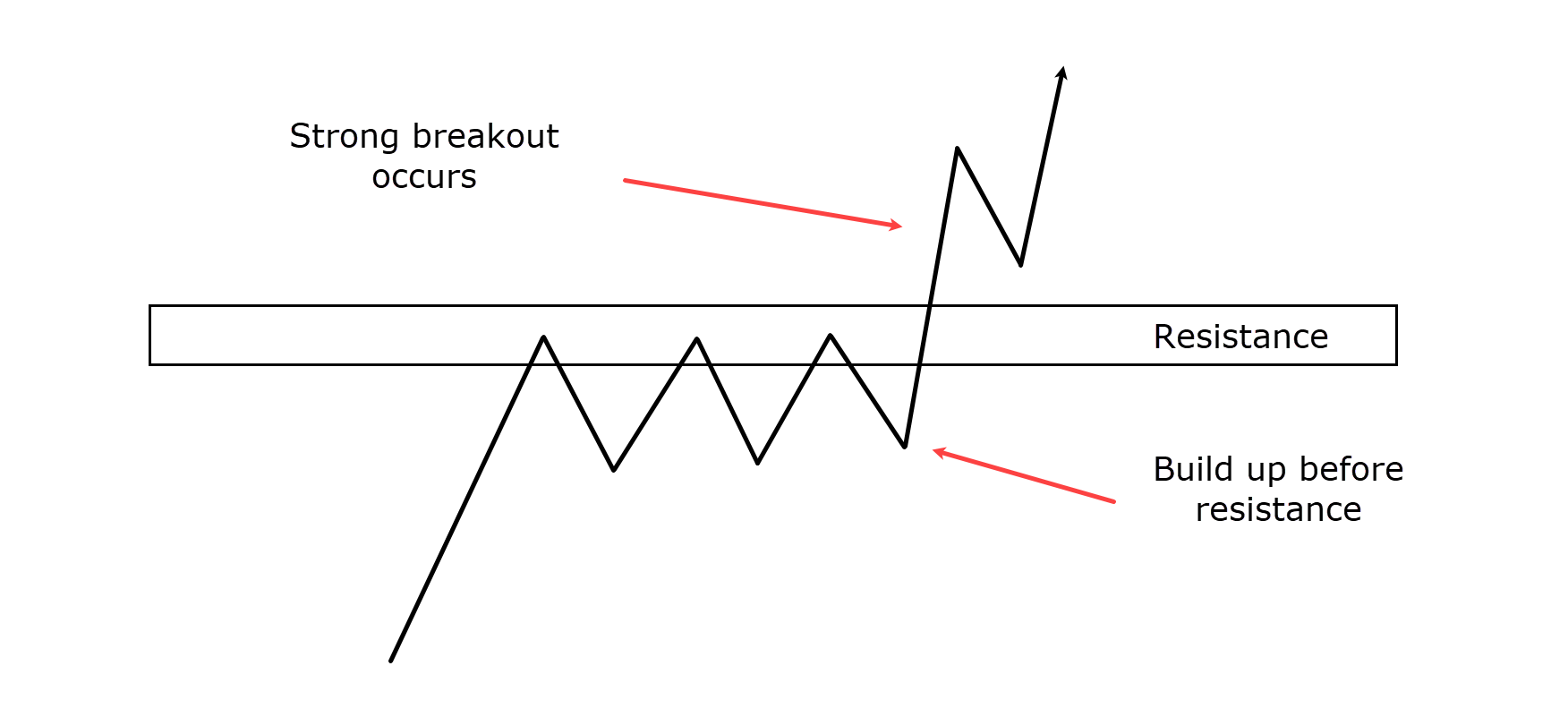

Construct-Up Below or Above the Level

Before a breakout, the value often consolidates near the support or resistance level, making a build-up.

This phase often displays reduced volatility and tighter price ranges.

On the one hand, in an uptrend approaching resistance, increasingly higher lows signal increasing buying pressure.

However, in a downtrend nearing support, progressively lower highs signal growing selling pressure.

This squeezing suggests the market is preparing for an enormous move, as traders position for an expected breakout!…

Breakout Example:

Strong Candle Break Through

A robust candlestick pattern often signals a real breakout, breaking through the established support or resistance level.

This breakout candlestick ought to be robust and decisive, clearly breaching the important thing level.

For instance, a bullish breakout may be marked by a big green candle closing above the resistance level with minimal wicks…

…indicating strong buyer momentum.

Entry Occurs on the Break of Key Level

Once a robust candlestick confirms the breakout, you possibly can look to enter positions.

Entry is beneficial as the value moves beyond the important thing support or resistance level.

I’d strongly think about using a buy-stop or sell-stop order to automate your entry, too…

…once the value reaches your chosen level, you possibly can simply catch the breakout because it happens.

Price Continues Its Strong Momentum within the Direction of the Break

After the breakout, the value often continues within the direction of the initial move.

It’s principally driven by momentum and the influx of traders joining the trend.

That is what can result in big price movements, with great profit potential.

Use trailing stop-loss orders to lock in profits while allowing the trade to run so long as the trend continues.

Monitoring volume throughout the breakout may confirm what’s happening, as higher volume typically comes with more reliable breakouts.

Let’s get into some real-life examples!

Trading Examples

In this instance, I actually have the GBP/CHF 4-hour chart…

GBP/CHF 4-hour Chart Support:

Price has formed a very clear support level – where price continues to bounce.

As you possibly can see, price steadily starts forming lower highs into support.

This implies price could soon potentially breach the zone…

GBP/CHF 4-hour Chart Support Weakening:

Again, as price returns to the zone, it becomes clear that this support level is struggling to maintain the sellers at bay…

GBP/CHF 4-hour Chart Support Breaks:

Eventually, support breaks and the next candles show some try and get back above the zone or no less than hold the zone.

At this stage, what must you do?

OK, I believe I do know what you might be considering!

“Rayner, let’s sell – RIGHT NOW!!”

Although that wouldn’t be a terrible idea, with breakout strategy, I prefer to get some extra confirmation in the shape of… momentum candles!

Without confirmation, this might just be a transient fakeout before the reclaim of the support level, so let’s have a look…

GBP/CHF 4-hour Chart Entry:

Right!

Now you’ve crystal-clear confirmation that price has broken support and the sellers are on top of things.

So let’s take a trade and goal a 2RR!…

GBP/CHF 4-hour Chart Take Profit:

Congratulations!

The worth continued its momentum and went straight to the goal on the following candle!

Are you able to see how once a flood of selling pressure was confirmed, price then carried on with that momentum?

It created what some would call an aggressive downward move…

…and it’s precisely a lot of these moves a breakout strategy goals to capture.

Let’s take a have a look at one other example…

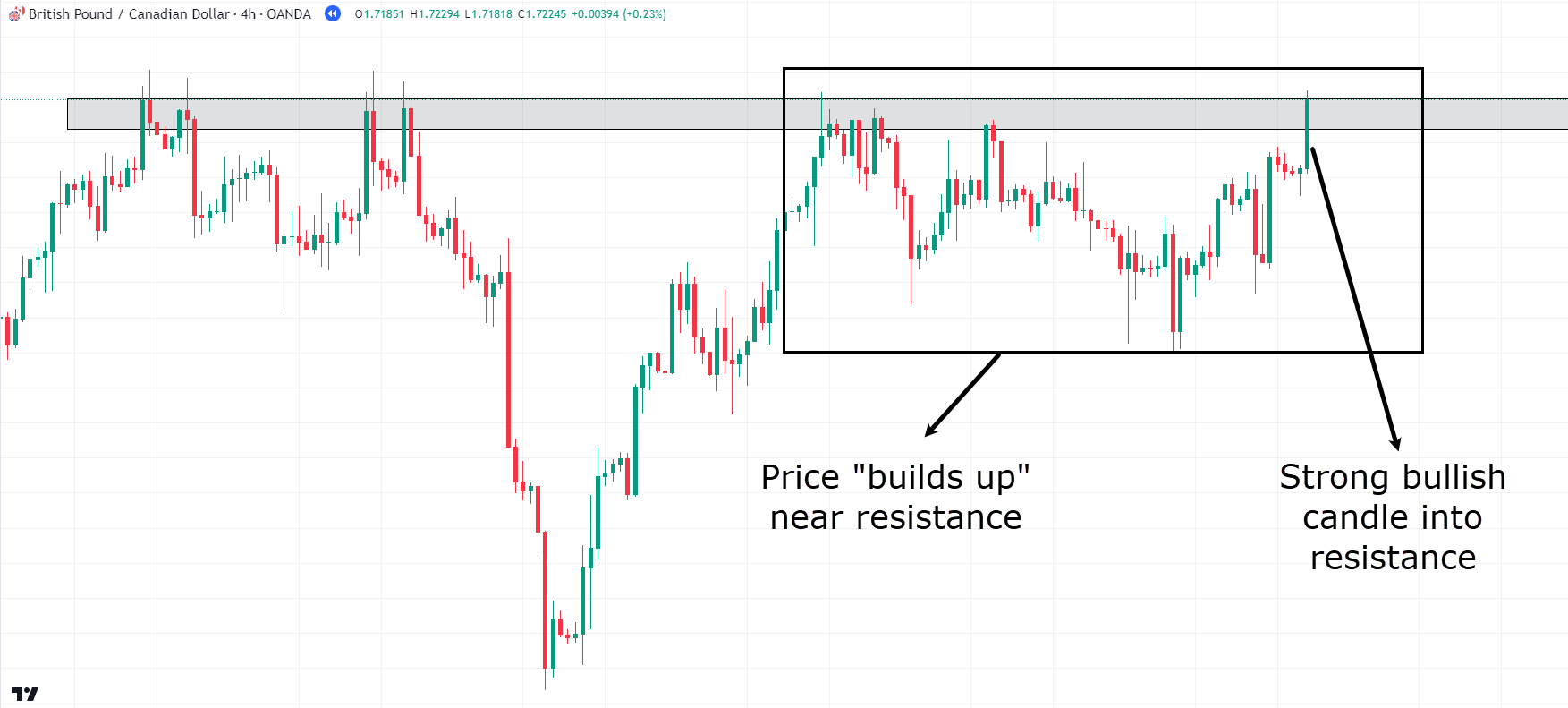

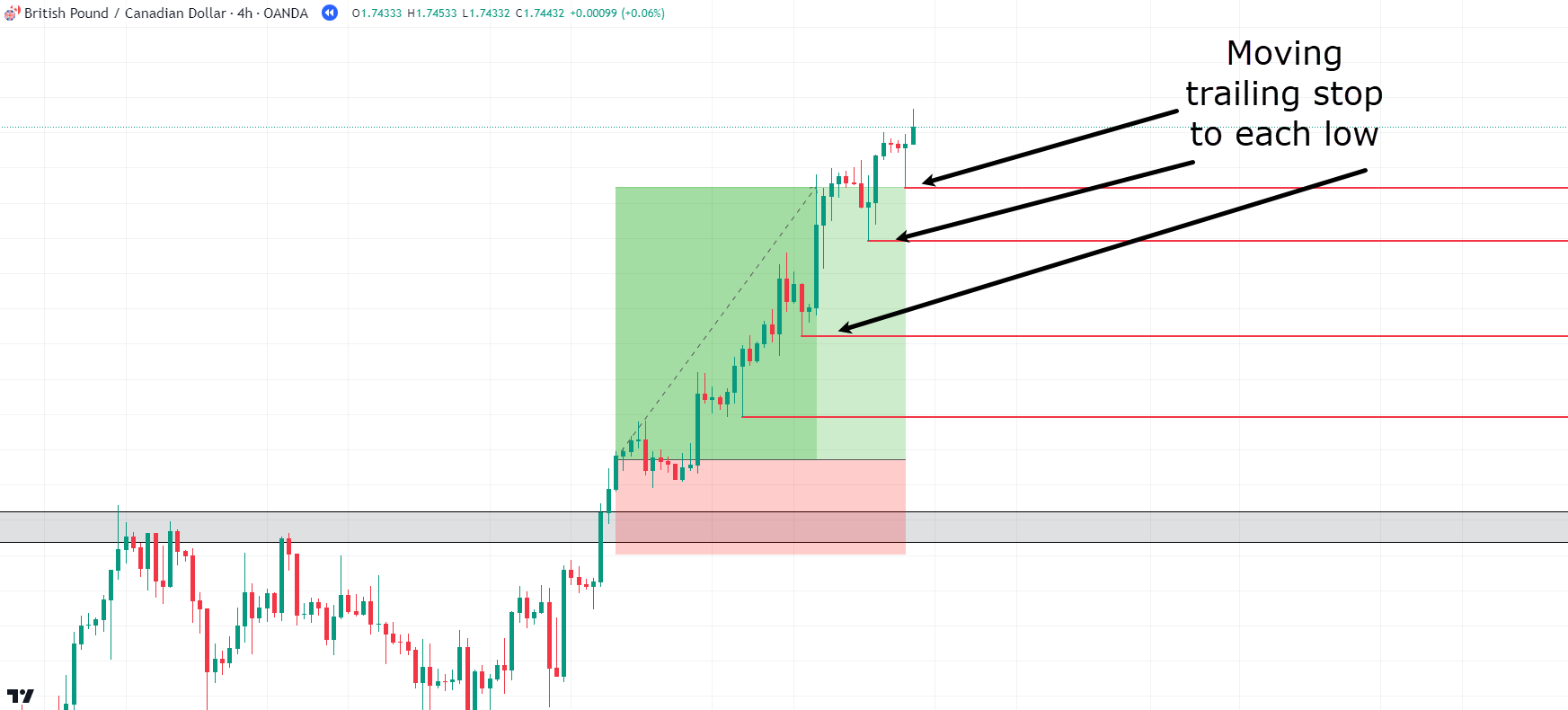

GBP/CAD 4-Hour Chart:

Identical to within the previous example, you possibly can see a transparent resistance level has formed…

…and price has rejected this zone multiple times.

Have a look at what happens next…

GBP/CAD 4-Hour Chart Construct-Up:

As price approaches the zone again, are you able to see how price has formed a “build-up” near the resistance level?

It’s followed by a robust bullish candle into the zone, which could mean a breach is nearby…

GBP/CAD 4-Hour Chart Entry:

There! You see the clear break of resistance with relatively bullish candles!

In this instance, the value closed above the zone for 2 additional candles.

Normally, you’d place the stop loss below the zone…

…but this time, let’s take a distinct approach to the take profit…

GBP/CAD 4-Hour Chart Trailing Stop:

As the value moves up out of your entry point, take into consideration trailing the stop closely behind the small 4-hour swing lows – you will discover them by in search of hammers or momentum candles.

This approach keeps profits secure while staying out of the best way of the trade…

GBP/CAD 4-Hour Chart Moving Trailing Stop:

Each line represents where you would move your trailing stop as price pushes off from the previous swing or low.

By the best way – the way you discover swings is entirely as much as you!

Some traders might take a less aggressive approach, while others might base it on risk-to-reward levels.

I encourage you to try all of them out with this manner of profit-taking to see what suits your setup best!

As for the present example, have a look at what happens next…

GBP/CAD 4-Hour Chart Take Profit:

As you possibly can see, the value eventually shifted back towards the previous low, stopping you out, but not before capturing a formidable move!

Let’s have a look at one last trade!…

GBP/AUD 4-Hour Chart Setup:

Identical to within the previous examples, you possibly can see the value has reached a resistance level and commenced forming a build-up.

Actually, this trade looks prefer it’s able to break out, doesn’t it?

Strong bullish candles into the zone…

…followed by the breach of the zone…

…with one other strong bullish candle?

Let’s take the trade!…

GBP/AUD 4-Hour Chart Entry:

As before, you possibly can set your stop loss just under the zone, and again, let’s attempt to capture profits with a trailing stop!…

Oh no!

The worth initially moved in your favor, but before you would move your stop to your expected take profit, heavy bearish momentum got here in and stopped you out!

Disappointing, right?

So, what’s the lesson here?

It’s the identical as with every strategy:

Breakout trading won’t work 100% of the time!

Fakeouts do occur, and it must be something you consider – and even expect – when taking these types of trades.

The logic behind this trade made sense, and also you followed the strategy exactly as you were presupposed to…

…things just didn’t work out as expected this time – and it happens!

Don’t get caught up on individual trades, reset for the following one as an alternative.

Limitations

Fakeouts Can Occur

As you simply saw within the previous example, breakout trading carries the danger of false breakouts, also generally known as “fakeouts.”

These occur when the value moves beyond a support or resistance level but fails to proceed in that direction.

This will lead you to enter positions too early, just for the value to reverse shortly after.

Fakeouts often result from low trading volume or temporary market fluctuations that don’t indicate an actual change in market sentiment.

Hard to Enter a Trade if Price Moves Too Removed from the Area of Value:

One other challenge with breakout trading is entering a trade after the breakout has happened.

If the value moves too removed from the breakout point, it could possibly create a big stop-loss distance, making the trade riskier and fewer appealing.

You would possibly find yourself chasing the value, which may result in poor entry points and better risk…

…or miss the trade entirely if you happen to wait too long for a pullback that never happens.

Watch your entry timing.

Hard to Determine Take Profit Levels:

Setting take-profit levels in breakout trading might be tricky!

I mean, it’s difficult to know the way far the value will move after a breakout, which may make it tough to decide on the correct exit points.

When you set the profit goal too low, you may miss out on larger gains…

When you set it too high, the value might never reach it…

It requires a careful balance between risk and reward, using critical risk management techniques like trailing stops.

Pro Suggestions

Construct-up Before the Explosive Move

Recognizing the build-up phase before an enormous price move is very important for successful breakout trading.

This build-up happens when the value stays inside a narrow range, resulting in smaller and more frequent candlestick patterns.

It’s a phase that reveals the balancing act between buyers and sellers, creating pressure that may result in a big breakout.

Crucially, during longer build-ups, stop orders accumulate above resistance and below support levels.

When the value finally breaks out, these stop orders trigger, increasing trading volume and amplifying the value movement within the breakout direction.

It’s generally known as the “spring-loaded” effect: the longer the value stays in its build-up phase, the more powerful the breakout might be.

Strong Candlesticks on the Top of Resistances

Strong candlesticks at resistance levels are key signals when analyzing breakouts.

Long-bodied bullish candles or patterns just like the engulfing pattern show strong buying momentum.

When these candlesticks appear at resistance levels, it suggests buyers are overcoming selling pressure, making a breakout more likely.

These strong candlesticks also often include increased trading volume, confirming the breakout’s strength.

Search for these signals in your strategy, as they indicate the next likelihood of the value continuing beyond the resistance level.

Placing stop-loss orders just under these candlesticks may help manage risk while still capturing the large upward movements!

Wait for Close Confirmation on the Break

One other useful tip is to attend for a detailed confirmation on the break.

While setting a buy or sell stop can make sure you enter on the break of the important thing level, this method can sometimes trap you in fakeouts, where the value wicks above the zone briefly but then ultimately closes below the zone.

To avoid this, consider taking a more hands-on approach and waiting for the candle to shut below or above your key area of value.

This approach gives you a clearer understanding of where the market is headed and the way strong the break actually is.

It’s all about making more informed trading decisions and reducing the danger of falling for fakeouts!

So with breakouts covered, let’s move on to the last of the three strategies…

I introduce you to… the range trading strategy!

Range Trading Strategy

What’s it about?

The range trading strategy is one among my favorite strategies, because it is each easy and intensely effective if executed accurately.

Range trading is beneficial when the market shouldn’t be trending in any particular direction.

As an alternative, it’s coasting along… in either accumulation or distribution.

The overall idea of range trading is to search out the highs and lows of the range and execute trades off those key areas of value.

In the long run, the range will break, but not before multiple trade opportunities show themselves!

Why Use This Strategy

Easy To Discover

Range trading is one among the best strategies to know and perform, making it great for beginner traders.

Most novice traders can discover clear support and resistance levels where the value has repeatedly modified directions, setting the boundaries of the range.

This approach lets you give attention to crucial price levels and make decisions without unnecessary complexity.

Clear Targets and Stop Losses

One other advantage of range trading is how easy it’s to set precise profit targets and stop losses.

Since this strategy operates inside clearly defined limits, you possibly can…

…set your profit targets at the alternative end of the range out of your entry point and…

…place stop losses just outside the range boundaries.

This clear definition of risk and reward helps you retain a good risk-to-reward ratio.

Having these exit points also helps remove emotional trading decisions, encouraging you to maintain to the strategy even during volatile market conditions.

Reliable in Range-Certain Markets

Markets often spend a protracted period of time in range-bound conditions, especially during times of low volatility or when there’s nothing happening to drive a trend.

It’s a typical situation, right?!

This makes range trading an incredible strategy that might be used repeatedly over long periods.

It’s even possible to capture multiple trades off the identical trading range over the course of weeks and even months!

This consistency is healthier if you happen to prefer regular, predictable trading environments relatively than the uncertainty that comes with trending markets.

How it really works

Identifying a Range

To discover a spread, search for areas on the chart where the value consistently bounces between two horizontal levels.

These levels act as psychological barriers where buying and selling pressures are roughly equal…

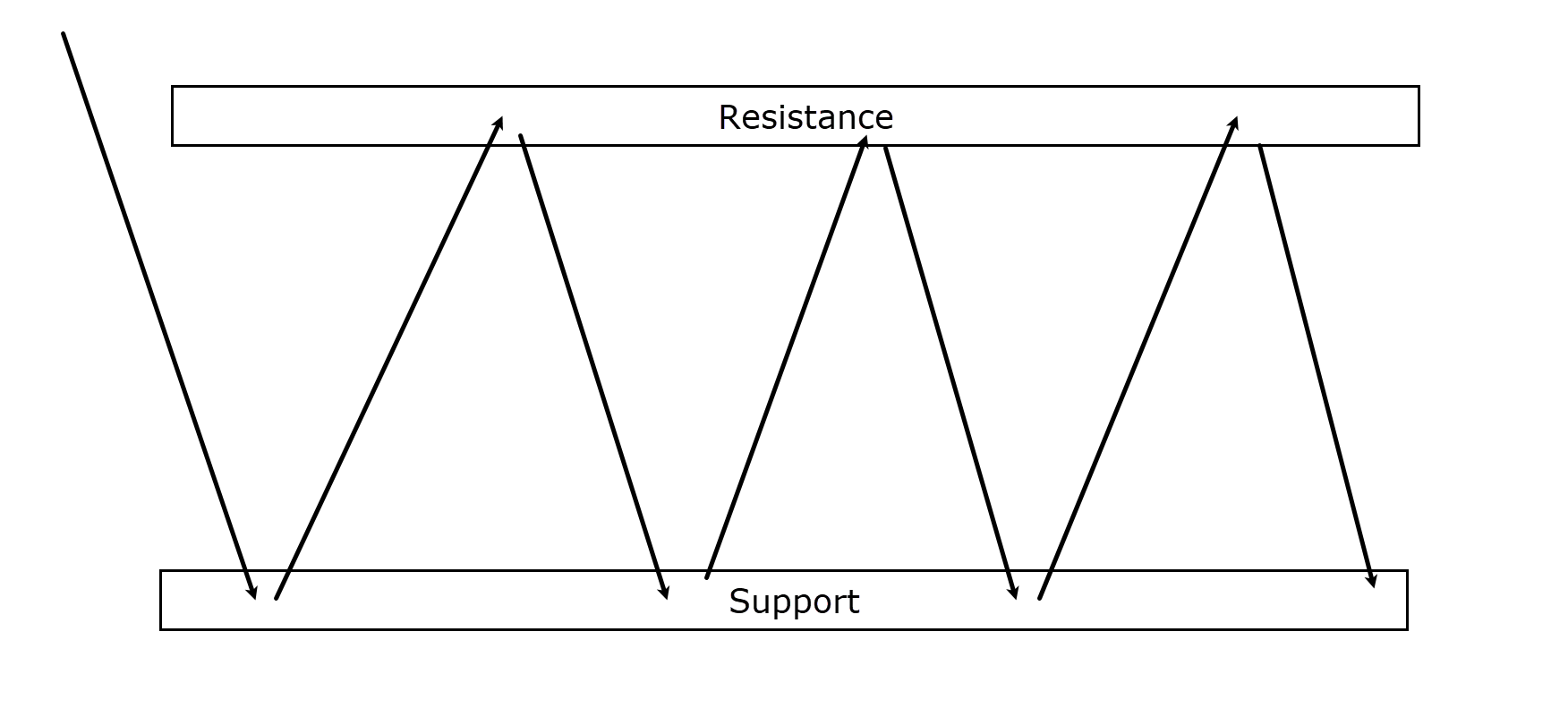

Range Example:

By recognizing these patterns, you possibly can work out the boundaries of the range and prepare to trade inside them!

Targeting Highs and Lows

When you’ve found your range, you have to buy on the lower boundary (support) and sell on the upper boundary (resistance).

The secret is to enter trades as near the extremes of the range as possible – maximizing potential profit while minimizing the danger.

It’s all about cashing in on price movements cycling between values throughout the identified range.

Entry and Exit Points

So that you found your levels – what next?

Well, when the value reaches the support or resistance levels, the very first thing is to verify the reversal through candlestick patterns or other technical signals.

Tight stop losses might be placed just outside the range boundaries to guard against false breakouts.

Meanwhile, profit targets are set at the alternative end of the range to capture the complete price movement from support to resistance, or vice versa!

It’s the clear definition of entry and exit points that helps maintain discipline and consistency.

Trading Examples

Let’s take a have a look at some real examples to actually capture this idea!…

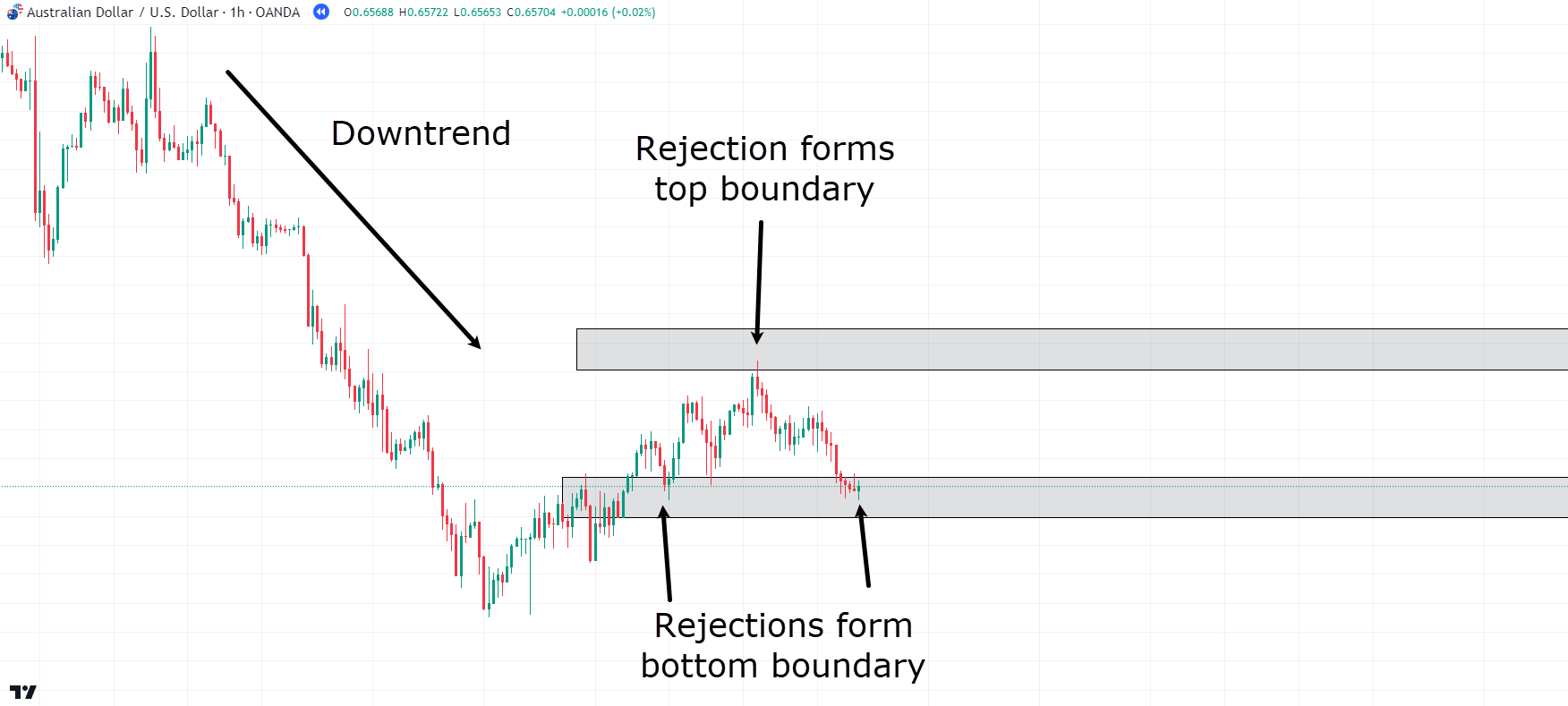

AUD/USD 1 Hour chart:

Here you possibly can see a transparent downtrend on the AUD/USD 1-hour chart.

Price has dropped to a level where it appears to be consolidating – falling inside a spread.

You possibly can see it as price bounces between the newly formed support level and multiple rejections at higher levels.

Given this setup, I’d say it’s OK to assume that price could stay inside these boundaries…

…and it’s here the repeated rejections on the support level suggest potential trading opportunities!

If price rejects again from this support level, it may be price serious about a trade, right?

I mean, if it’s bounced there before, it could well bounce there again.

Let’s attempt to work out the potential entry and setup for this trade…

AUD/USD 1 Hour Chart Entry:

Have a look at how price returns to the support level where rejection candles form, indicating potential buying interest.

For this case, place your stop loss below the support level and take profits on the closer boundary of the resistance to forestall any front-running…

AUD/USD 1 Hour Chart Take Profit:

And what do you understand!

Price successfully rebounds from the lower boundary and reaches your profit goal!

Now, what’s great about this setup is that it already presents additional trading prospects.

For following trades, consider waiting for candles to point out rejection at these two zones before entering positions, relatively than relying solely on buy or sell orders at these levels.

The diagram below shows how the range might develop over time…

AUD/USD 1 Hour Chart Range Trades:

See how waiting for price to reject the degrees gives you the possibility to capture more of the move?

It also gives you the space to attend for the correct time to enter the trade, minimizing the danger of entering before a fakeout or if price is able to break through.

And the sweetness is, even when the range eventually breaks, if you happen to lose one trade, it just becomes the associated fee of trading the range.

With the 5 to 7 successful trades beforehand; the one loss is solely a part of the method!

Let’s take a have a look at one other example…

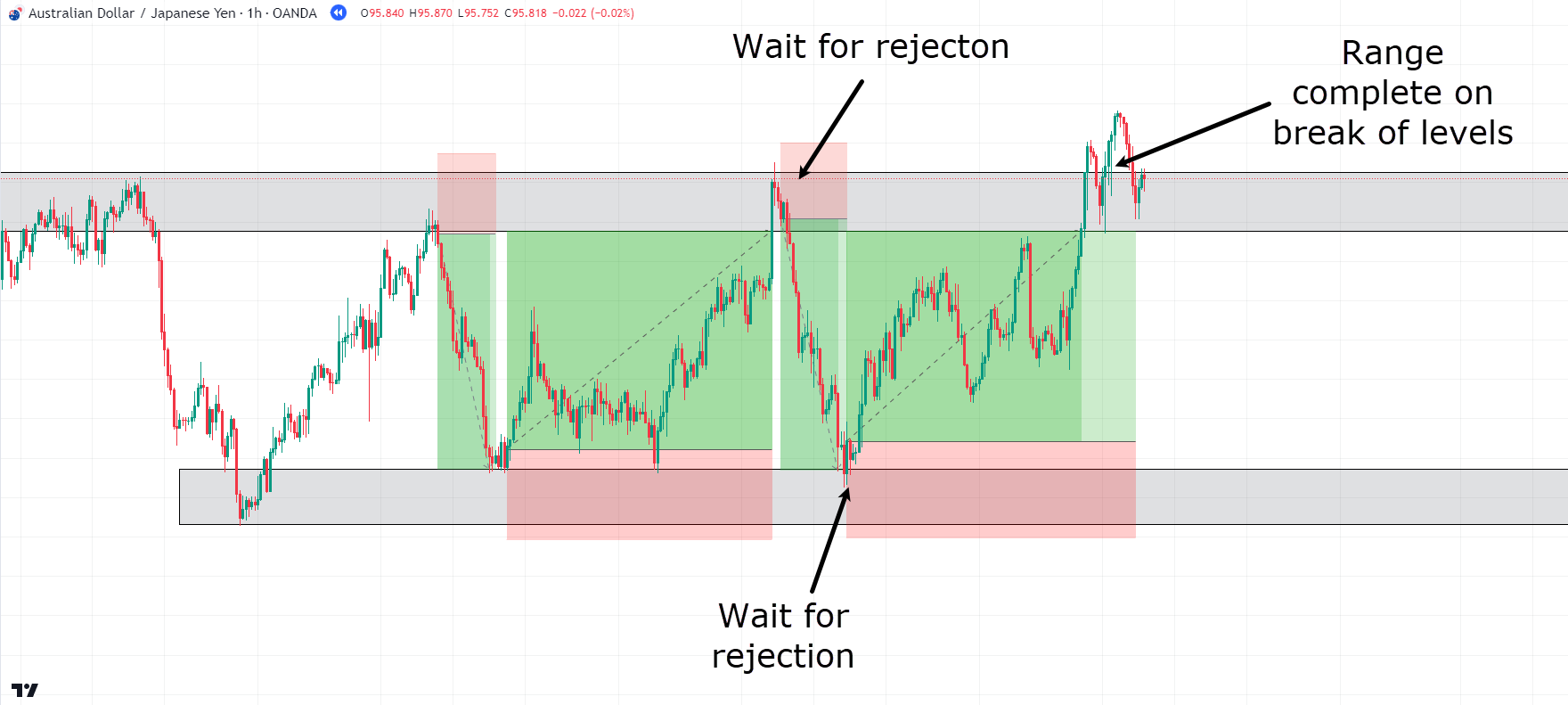

AUD/JPY 1-Hour Range Chart:

Again, you possibly can see price in a downtrend that makes an initial low.

Next, price comes back up and forms a high followed by a recent low.

These are the boundaries you have to discover to trade inside!…

AUD/JPY 1-Hour Range Entry:

Identical to last time, you possibly can enter when price rejects the zone.

Simply place your stop loss above the zone and goal the highest of the support zone for take profit…

AUD/JPY 1-Hour Range Take Profit:

As price moves away from the range high, it quickly heads towards the range low, presenting a recent opportunity to enter a protracted position from the underside of the range…

AUD/JPY 1-Hour Range Trades 2 and three:

The subsequent trade takes a bit longer to play out, even coming back to check the support zone again before returning to the range high…

But at this point, you possibly can believe within the boundaries of the range – so proceed trading it with conviction…

AUD/JPY 1-Hour Range Completion:

Over time, more opportunities for range trades emerge until, eventually price breaks through the highest level as an alternative of rejecting it.

So, this marks the completion of the range!

It’s signalling that it’s time to either seek other range trades on other pairs or adopt a distinct approach on this market. (breakouts, perhaps?)

All good to this point?

Let’s examine an example with a reality check…

USD/CHF 1-Hour Range Example:

Identical to in previous examples, you possibly can see that a spread has formed on the USD/CHF pair.

Despite a big wick that pierced through the upper boundary, price still showed rejection, keeping throughout the defined upper and lower boundaries.

To this point so good, right?

Let’s assume you took a trade from the primary opportunity on the range low…

USD/CHF 1-Hour Range Entry:

As you possibly can see, the primary trade would have taken a while but eventually reached its goal.

Price then began to reject the top quality, offering one other trade opportunity…

Nevertheless!

Price never retraced back to the range low…

Although the trade initially moved into profit, price steadily climbed back as much as the top quality.

Are you able to see a buildup before price breaks through the range high and continues in an uptrend?

At that time, it’s time for an early exit from the trade!

With that in mind, let’s discuss some limitations.

Limitations

Can Take a Long Time to Unfold

Range trading strategies demand some serious patience!

These trades depend on price moving between support and resistance levels… but they’ll sometimes take their sweet time to get there.

It means you’ve to be prepared for potentially long holding periods, and price may sometimes go in favor or against your positions – on a day by day basis, even.

It’s crucial to withstand the temptation to make impulsive trades outside the established areas of value.

At all times keep in mind that patience is commonly rewarded with higher accuracy and lower-risk trades.

May Not Reach Profit Targets

One other limitation of range trading is the likelihood that price movements may not reach the profit targets you think that they are going to.

It might be due to what traders call “front running,” where traders exit their positions barely before prices hit support or resistance levels.

In these cases, chances are you’ll be required to regulate your strategies by setting more conservative targets.

Trailing Stop Loss Limitation

While using a trailing stop loss might seem to be an easy solution to being front-run on the highs and lows of the range, it could possibly be difficult in practice!

In real-world trading, prices often fluctuate in each directions as they move toward key areas of value.

Although a trailing stop can lock in profits, there’s all the time a risk that it is going to achieve this prematurely, limiting your ability to get one of the best risk-to-reward ratio.

Pro Suggestions

Candlestick Patterns

Candlestick patterns play a vital role in figuring out possible reversal points at range highs and lows in range trading strategies.

Search for specific patterns like doji, engulfing patterns, or hammer patterns near the range boundaries.

As an example, a doji candlestick forming at a spread high followed by a bearish engulfing pattern might indicate indecision amongst traders, followed by bearish momentum.

This increases the probability of a reversal in price movement, signalling a possible opportunity to sell.

Conversely, a hammer pattern appearing at a spread low could suggest a bullish reversal, presenting a possibility for purchasing.

Technical Indicators

Technical indicators reminiscent of the Relative Strength Index (RSI) and the Stochastic Oscillator are also great additions for range traders.

These indicators measure the momentum and strength of price movements, they usually can provide help to work out overbought and oversold conditions throughout the range.

When the RSI or Stochastic Oscillator reaches extreme levels (e.g., above 70 for overbought or below 30 for oversold), it serves as a confirmation signal for potential reversals.

As an example, if the RSI indicates overbought conditions as the value gets closer to the upper boundary of the range, it strengthens the possibility of a reversal and might mean it’s time to sell!

Adding these technical indicators to your evaluation improves the accuracy of your entries and exits, making your range trading strategy more practical.

Conclusion

In conclusion, understanding trading strategies shouldn’t be nearly learning techniques; it’s about constructing a solid core to your success within the markets.

Throughout this text, you’ve explored three essential trading strategies:

- The Break and Retest Strategy

- The Breakout Strategy

- The Range Strategy.

You’ve learned how the break and retest strategy provides extra confirmation before a possible trend continuation, offering great risk-to-reward opportunities…

I discussed how volatility and momentum within the breakout strategy enable you to capture strong moves quickly…

Finally, you saw the best way to analyze the range strategy, allowing you to trade the markets after they aren’t trending, and capturing multiple successful trades off the identical level…

So now you’ve a technique for all market conditions – what are you waiting for?!

Remember, mastering trading strategies takes practice and adaptation to market dynamics.

With all that said, did I miss anything?

Or do you’ve experience with these strategies already?

Share your thoughts within the comments below!