In an evaluation released on Monday, ASXN, an emerging crypto research firm, outlines the dynamics of worldwide Bitcoin adoption through the lens of game theory. The report titled “The Game Theory of Bitcoin Adoption Amongst Nations” provides an examination of how nations can leverage mathematical game theory to strategically adopt Bitcoin.

The report follows on the heels of Donald Trump’s announcement on the Bitcoin 2024 conference that he’ll convert all BTC’s owned by the US government through enforcement actions right into a “strategic Bitcoin stockpile”.

Bitcoin Game Theory Explained

The report begins by framing BTC adoption inside the broader context of game theory, a discipline that evaluates the strategic decisions made by individuals or entities under conditions of uncertainty and competing interests. In keeping with ASXN, “Game theory provides a structured framework to predict the outcomes of nation-level strategies in adopting digital currencies, considering not only the economic advantages and technological advancements but in addition the potential geopolitical shifts.”

Related Reading

In keeping with the concept of ‘First Mover Advantage’, early adoption of BTC can position nations advantageously on several fronts. The report states, “Nations acting as first movers within the Bitcoin arena may set precedents in legal and regulatory frameworks, attract global crypto enterprises, and secure a big share of the blockchain innovation landscape.”

Nonetheless, it contrasts these benefits with the pitfalls of premature regulatory frameworks and the volatility of Bitcoin’s market value, which could pose substantial risks to national economies. The report adds, “Once just a few influential nations adopt Bitcoin, others will follow suit to avoid being left behind – making a bandwagon effect. This effect is driven by each the returns to adoption in addition to the risks of non adoption. That is when the Bitcoin adoption cycle enters the steepest a part of the s-curve.”

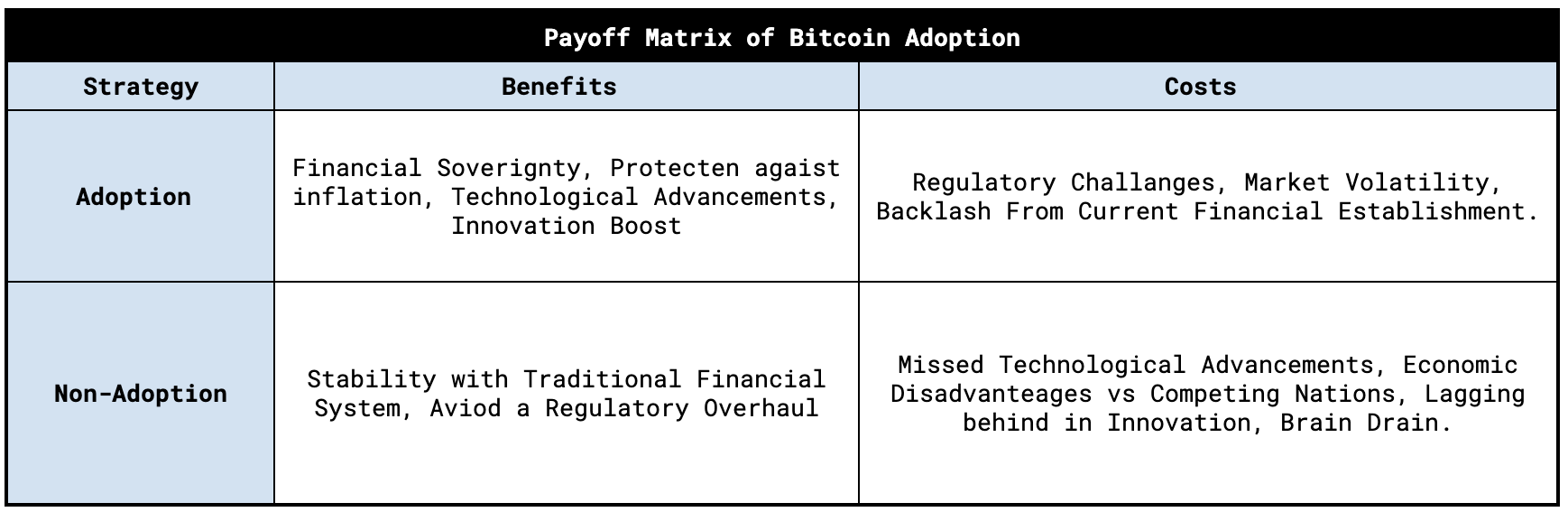

S curve adoption | Source: X @asxn_r

The ‘Payoff Matrix’—a fundamental tool in game theory—is applied by ASXN to dissect the decision-making technique of countries considering Bitcoin adoption for nations. ASXN elaborates on how this matrix helps countries assess the potential returns and risks related to various strategic decisions. “Each nation faces a singular matrix based on its economic structure, political climate, and market dynamics. The optimal strategy, while generally skewing towards adoption resulting from the projected global ascendancy of cryptocurrencies, must still be tailored to individual national circumstances,” the report elaborates.

Payoff matrix of Bitcoin adoption | Source: X @asxn_r

Payoff matrix of Bitcoin adoption | Source: X @asxn_r

Moreover, the report also introduces the concept of the ‘Best Response Function’ within the context of Bitcoin adoption, explaining how nations develop strategies by anticipating the choices of others. “A nation’s strategy is influenced not only by its direct gains from adopting Bitcoin but in addition by the expected actions of other nations, which could alter the worldwide economic and technological landscape,” the report states.

Related Reading

The researchers add how the bandwagon effect could play out; “The logic plays out something like – Nation 1 assesses the associated fee profit trade off and decides on adoption. Nation 1 realizes that each one other nations are also going to decide on adoption, Nation 1 concluded that, on condition that all nations will select adoption, they need to increase adoption speed in order to not lose competitive edge. Slowly, then abruptly.”

ASXN uses several real-world applications for example the theoretical concepts discussed. The case of El Salvador is examined in depth, showcasing how its early adoption has influenced other nations’ perceptions and techniques towards Bitcoin. The evaluation extends to how Wisconsin’s pension fund investment in Bitcoin ETFs reflects a broader trend of sub-national entities assessing cryptocurrency as a viable component of their financial strategies, and the substantial commitment by MicroStrategy is highlighted as a company parallel to national strategies.

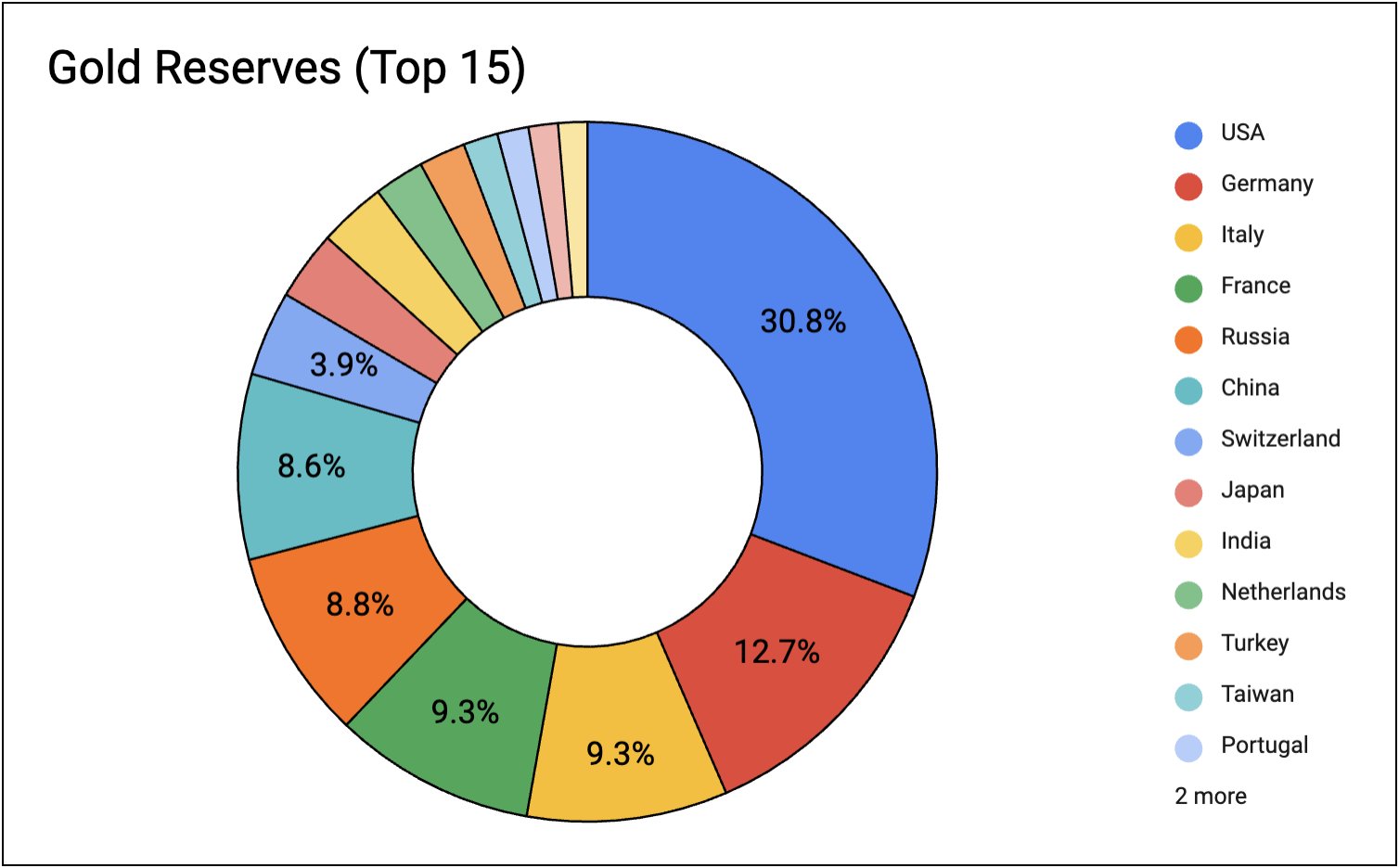

Looking forward, the report discusses the potential future trajectories of Bitcoin adoption, influenced by each technological advancements and evolving geopolitical dynamics. It specifically addresses Robert Kennedy Jr.’s proposal at Bitcoin Nashville 2024 to accumulate 550 BTC each day until the US amasses 4 million BTC, which represents 19% of the whole available BTC supply. This approach goals to reflect the proportion of worldwide gold reserves that the US currently maintains compared to other countries.

Gold reserves top 15 | Source: X @asxn_r

Gold reserves top 15 | Source: X @asxn_r

And the Bitcoin game theory is already playing out. “Whilst the ideas Trump presented at Bitcoin Nashville may or may not occur, the straightforward fact he publicly acknowledged Bitcoin & it’s properties is a win & we’re already seeing early signs of the results of this,” the researchers conclude.

They seek advice from Johnny Ng, a member of Hong Kong’s Legislative Council, who has been advocating for the incorporation of Bitcoin into the town’s financial reserves following Trump’s announcement.

At press time, BTC traded at $66,660.

BTC price, 1-week chart | Source: BTCUSDT on TradingView.com

BTC price, 1-week chart | Source: BTCUSDT on TradingView.com

Featured image created with DALL·E, chart from TradingView.com