Indeed, the Bitcoin price has been on a hot streak in recent weeks, returning to its past heights most investors have turn into accustomed to. Nevertheless, the past week was a somewhat quiet one for the premier cryptocurrency, because it was for many of the digital asset market.

Interestingly, the newest on-chain insights suggest that the crypto market, specifically the Bitcoin market, may not be inactive for too long.

BTC Price Momentum Shifts To Positive – Impact On Price?

In a recent post on the X platform, popular crypto pundit Ali Martinez revealed that Bitcoin miner capitulation has seemingly come to an end. This on-chain remark is predicated on a shift within the Glassnode Hash Ribbon indicator, which measures BTC’s hash rate.

Related Reading

Typically, the Hash Ribbon features two moving averages; including the short-term (30-day) and long-term (60-day) hash rate. A cross of the short-term moving average below the long-term moving average implies miner capitulation, which is characterised by widespread sell-offs by miners.

However, when the 60-day ribbon falls under the 30-day ribbon, it indicates the top of capitulation and the potential start of a recovery phase for the network. As shown within the chart below, this positive cross appears to be the present situation for Bitcoin, signaling an optimistic future for the flagship cryptocurrency.

A chart showing the BTC Hash Ribbon | Source: Ali_charts/X

Ultimately, because of this Bitcoin miners are returning to the network and restarting operations, as they turn into more profitable. From a historical standpoint, the top of miner capitulation is a bullish sign, because it often precedes significant price leaps for the premier cryptocurrency. Martinez highlighted this in his post on X, saying “this might present good buying opportunities.”

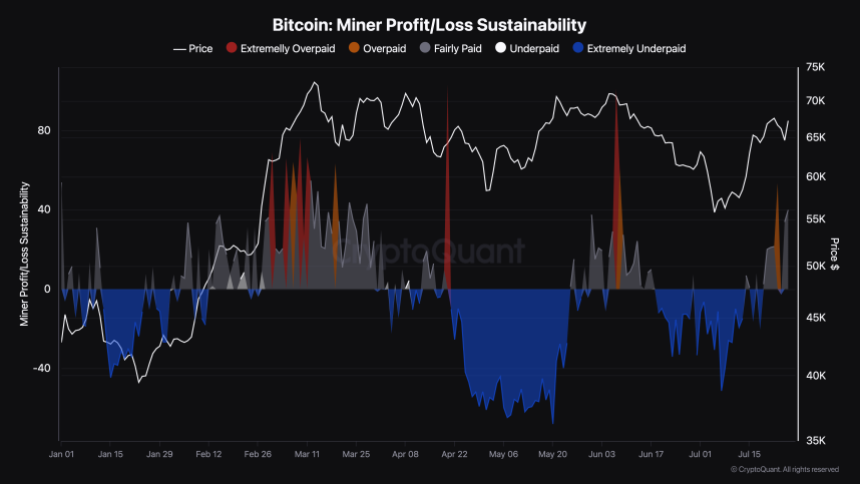

One other indicator that supports this on-chain revelation is the Bitcoin Miner Profit/Loss Sustainability metric, which measures how fair miner revenues are. In line with the newest data from CryptoQuant, the BTC miners have been making some profit over the past few days, putting them within the fairly paid region of the indicator.

Source: CryptoQuant

Source: CryptoQuant

Bitcoin Price At A Glance

As of this writing, the value of Bitcoin stands at around $68,230, reflecting a mere 0.7% increase within the last 24 hours. As earlier inferred, the premier cryptocurrency had an uneventful week when it comes to price motion, dancing between the $64,000 and $68,000 range.

Related Reading

In line with data from CoinGecko, the BTC price increased by barely 1% previously week. Nevertheless, the cryptocurrency retained its position as the biggest digital asset within the sector, with a market capitalization of greater than $1.33 trillion.

The worth of BTC on the each day timeframe | Source: BTCUSDT chart on TradingView

Featured image from iStock, chart from TradingView