Are you ready for one more incredible trading guide?

Well, lined up for you today…

…I’m broadcasting the last word showdown…

Fib Extension vs Retracement!

Although these tools might look complex on the surface, that’s only because most traders overcomplicate them…

Not only that, but there are a tonne of Fibonacci tools on the market to wander off in!…

Looks pretty confusing, right?

That’s why this guide filters out the noise, helping you get consistent with two awesome Fibonacci tools at the identical time!

You’ll cover:

- What these two Fibonacci tools are and the way they are supposed to be used out there

- The key to using each the Fibonacci extension and retracement like a professional

- An entire strategy and framework to benefit from each

- Common mistakes on using the Fib extension vs retracement (and what you need to do as a substitute)

By the tip of this guide…

You’ll master using and trading with these awesome Fibonacci wonders!

Are you ready?

Then let’s start!

Fib Extension vs Retracement: What Are They and How Do They Work?

This text focuses on these two Fibonacci tools today…

That’s right, I won’t be discussing each type of Fibonacci tool on the market.

Why?

Since the important purpose of this guide is easy:

To show you how to capture and benefit from trends straightforwardly and consistently!

Sounds good, right?

So, let’s start with Fib retracement…

Fibonacci Retracement

Principally, consider it like this.

You’ve had a terrific run-up in price, and also you’re attempting to work out how deep the pullback will go when it happens…

In truth, the Fib retracement is a wonderful tool to make use of in this case.

Why?

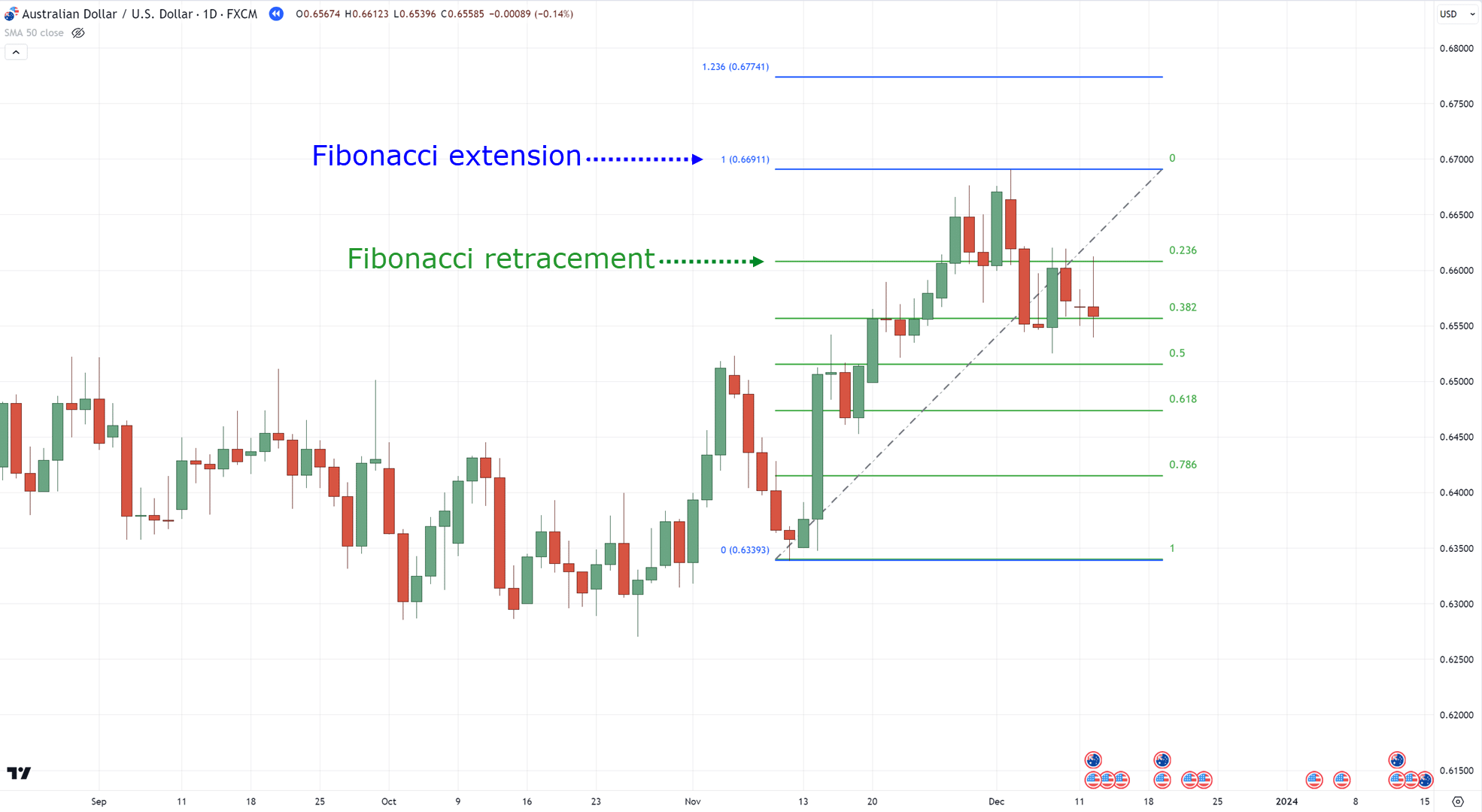

Well, by plotting a Fib retracement from the underside to the highest of the present leg…

…you’ll have the opportunity to anticipate how deep the pullback will go!…

Great, huh?

But – take note!

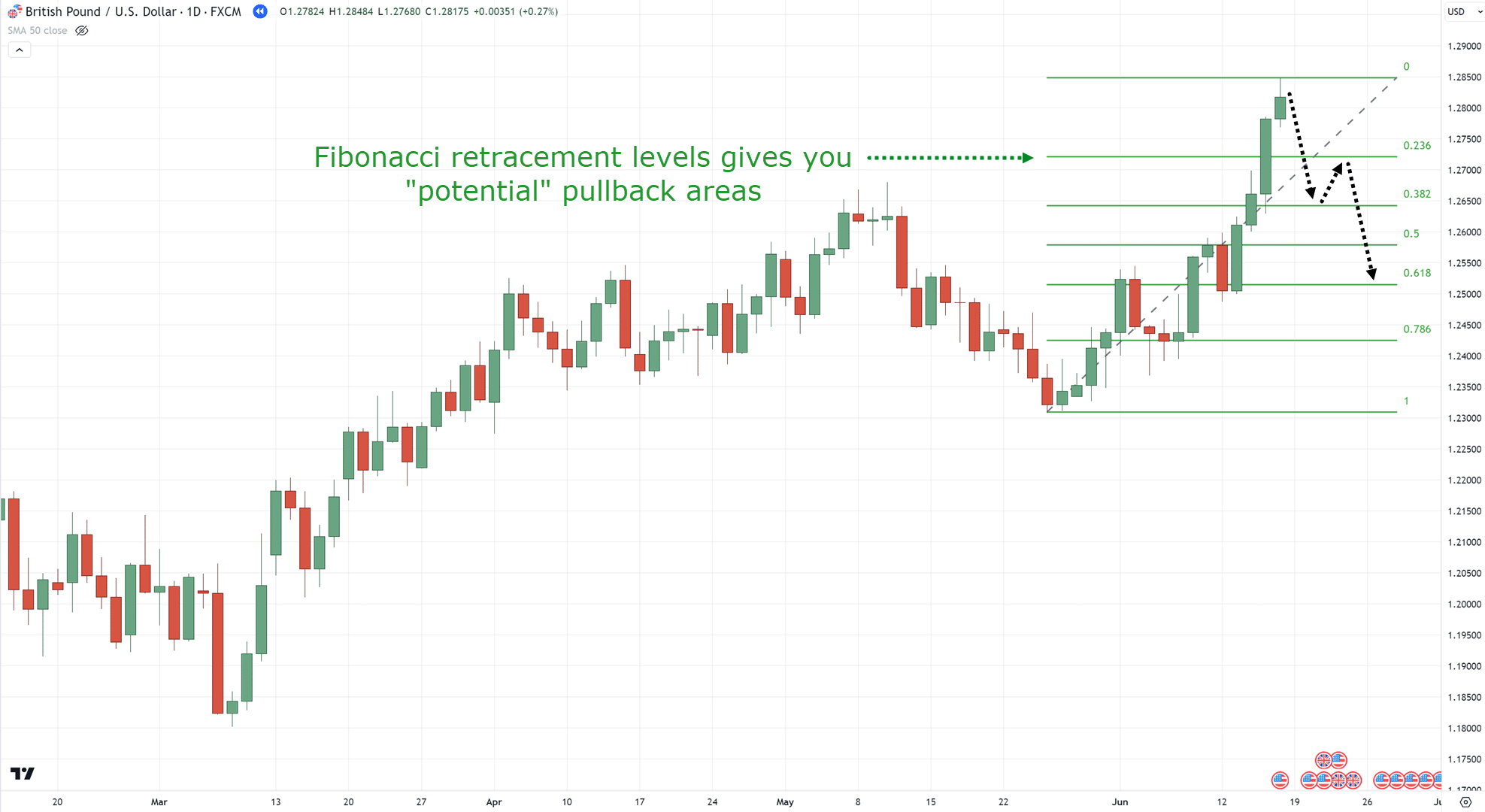

This tool doesn’t “predict” how deep pullbacks will get.

It does, nonetheless, provide you with multiple levels to trade when the market reverses from them (which I’ll let you know more about within the later section).

On the opposite side of the coin…

There may be the Fib extension, the explorer charting uncharted territories…

Fibonacci Extension

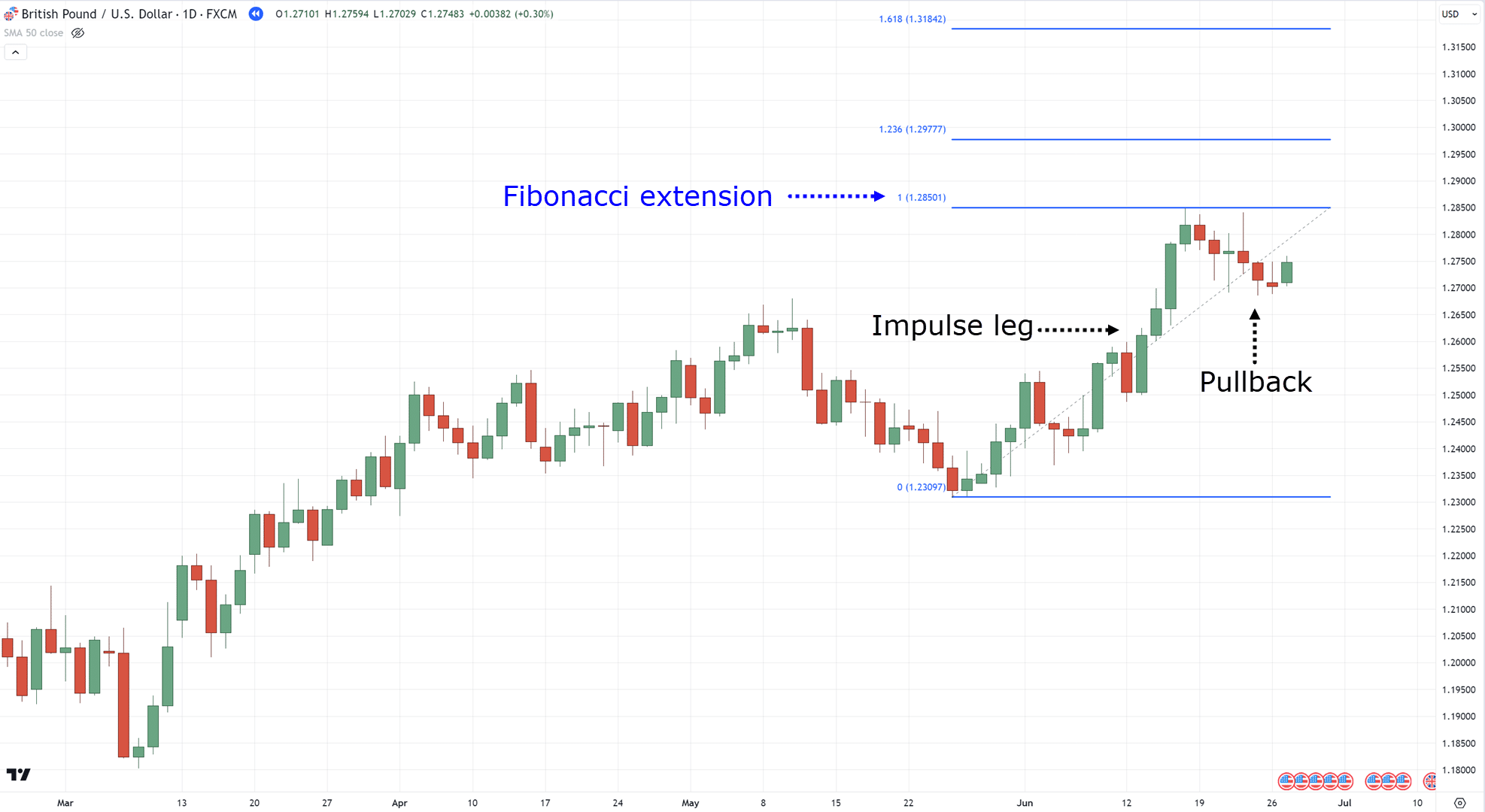

Just like the Fibonacci retracement, plot this on an existing price leg…

But as a substitute of in search of a pullback…

…it’s projecting where the worth might head next during a breakout!

Principally, the Fibonacci retracement tool is the important thing to entering pullbacks…

…while the Fibonacci extension helps you define your take-profit levels…

While each tools are a part of the Fibonacci family, they clearly serve very different roles in your trading strategy.

So, with that said…

How exactly do you utilize these tools effectively?

You’ll be able to analyze markets with all of them day, but what are the crucial steps needed to start trading?

Read on to search out out in the following section!

Fib Extension vs Retracement: The right way to Use Each Tools Like a Pro

First things first…

It’s good to get proficient in plotting these Fibonacci tools.

If it’s something you’re battling in the meanwhile, don’t panic, as there’s a incredible guide for you here.

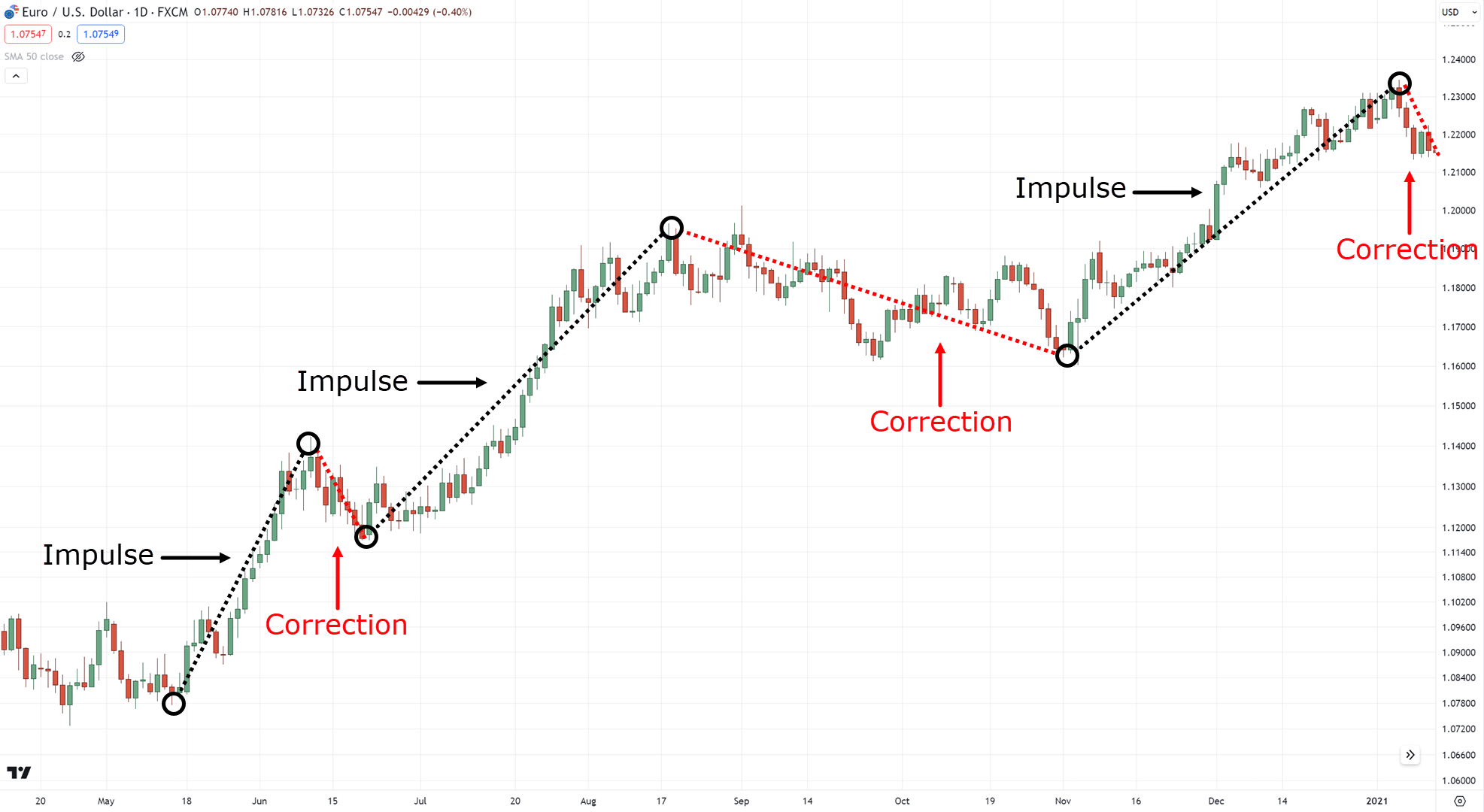

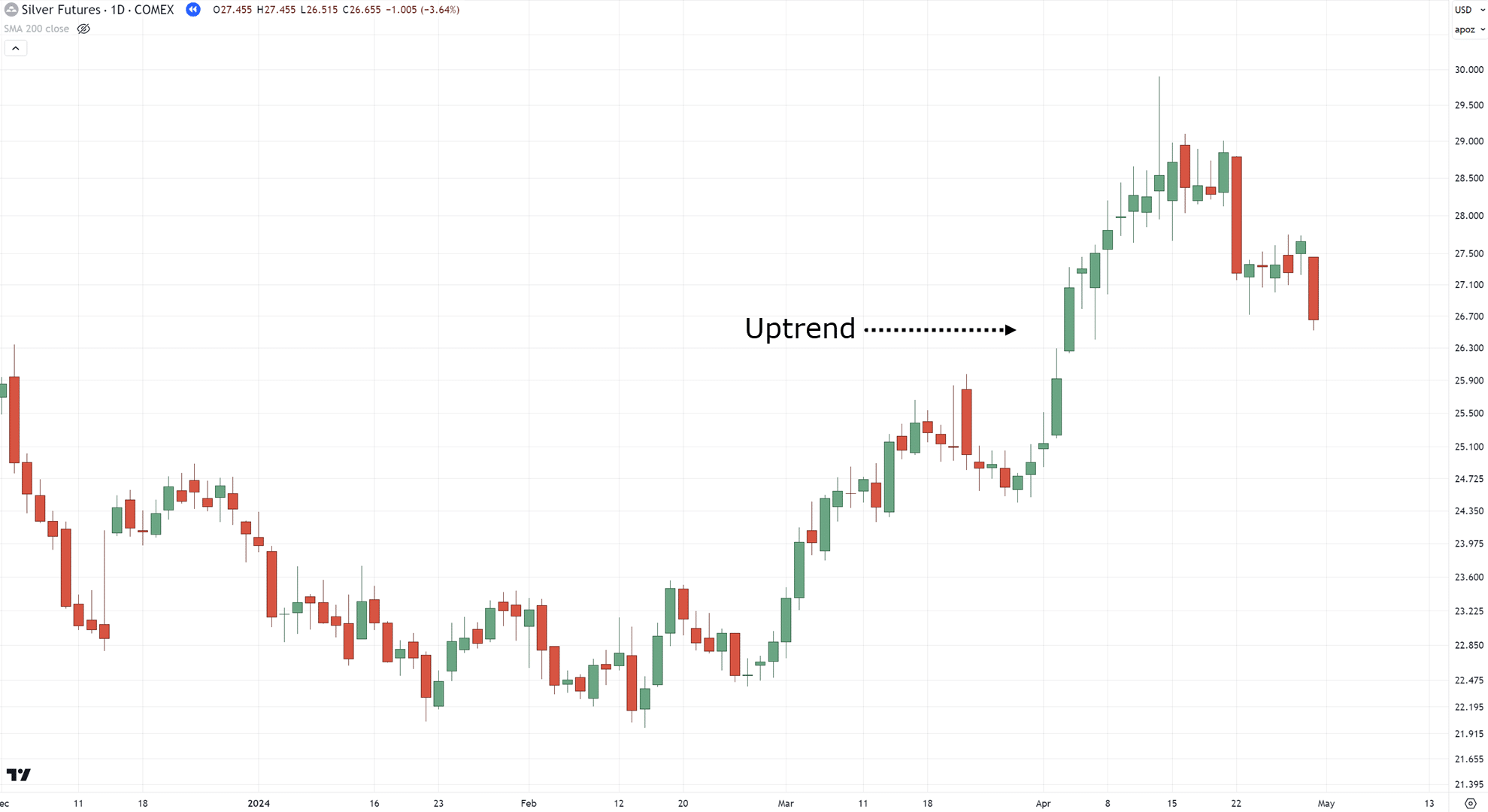

But to place things simply, you have to learn the best way to recognize “impulse moves” within the markets resembling these…

…because their tops and bottoms are your references when plotting your Fib extension vs retracement tools…

Are you able to see how they’re drawn?

So, with that out of the best way…

Listed below are the things that you must take note when using each the Fib extension vs retracement.

First up…

Define your trend first

This might be a recurring theme within the article.

In spite of everything, knowing the context of the markets is king!

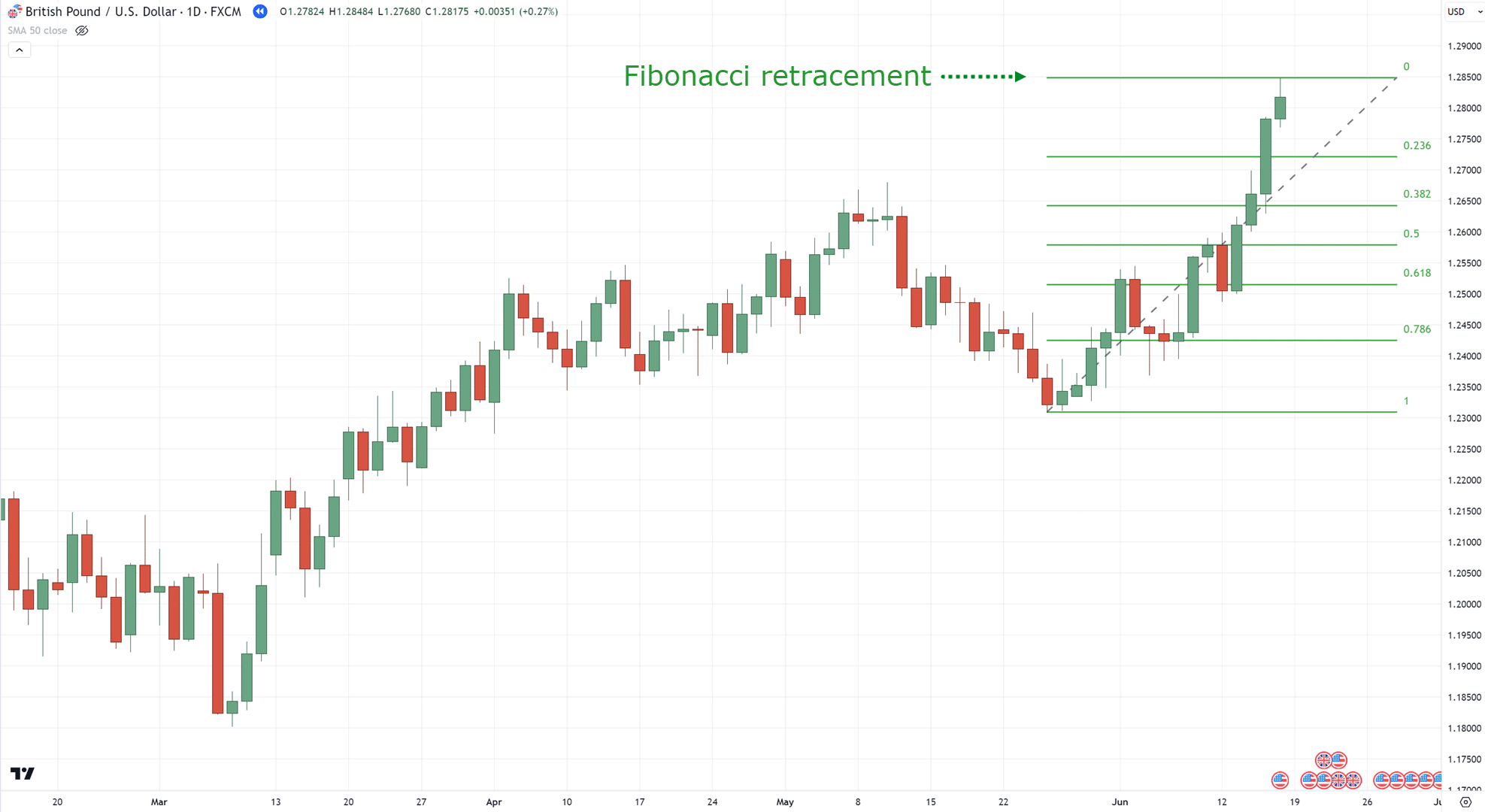

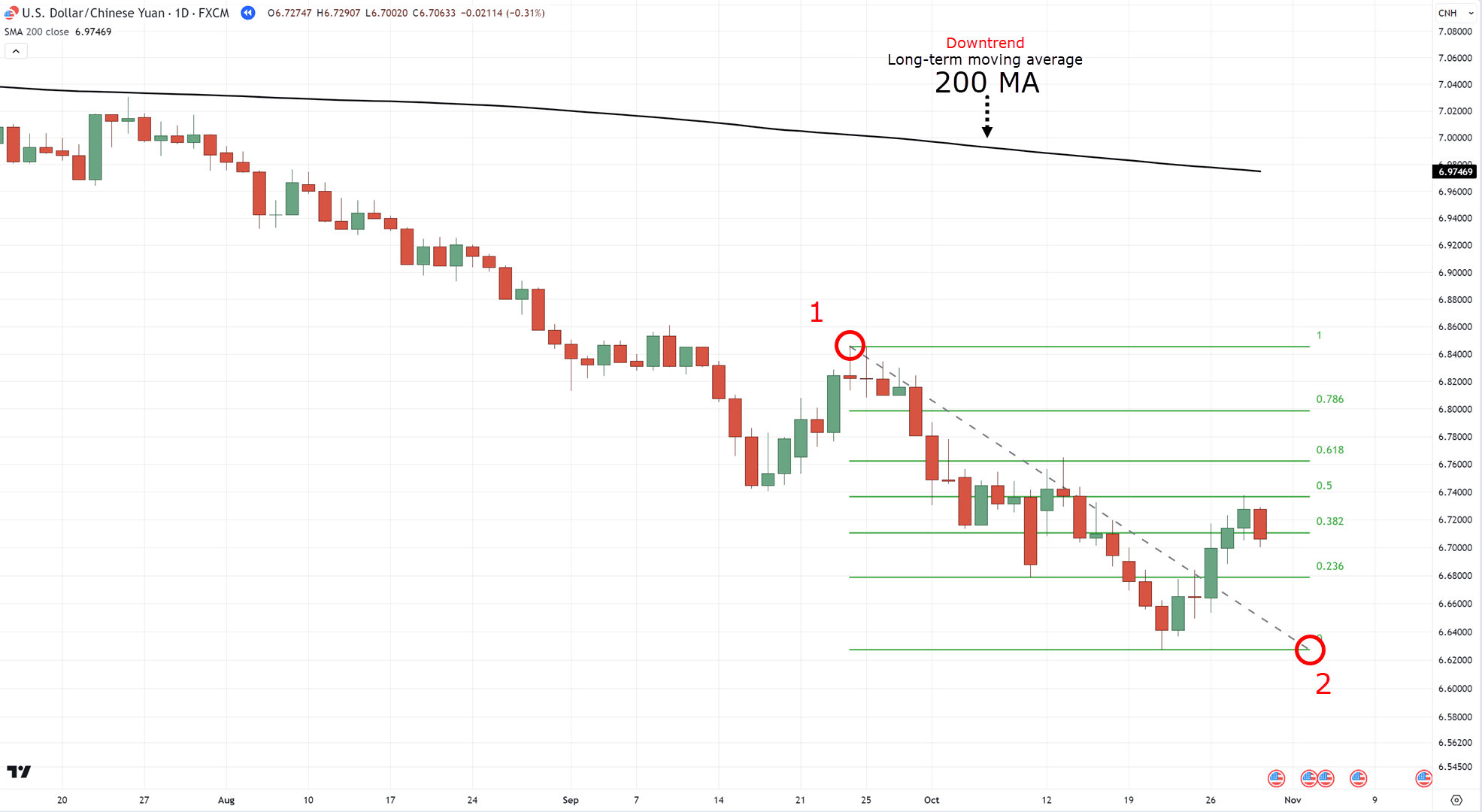

When the market is in an uptrend, place your Fibonacci from bottom to top…

…if the market is in a downtrend, then plot your Fibonacci from top to bottom as a substitute…

Easy, right?

If that you must brush up on the 200-period moving average, you’ll be able to all the time take a look at this great writeup here, too: The 200 Day Moving Average Strategy Guide

Alright, when you’ve defined your trend, the following thing you have to give attention to is…

Define your setups

Here’s a cheat code for you:

Pullback setups?

Fibonacci retracement.

Breakout setups?

Fibonacci extension.

That’s right, in case you’re trying to find those sweet pullback trades, whip out your Fibonacci retracement tool!

It’s perfect for pinpointing those levels where the market might catch its breath before continuing…

Pullback setup using the Fibonacci retracement:

And as all the time, we’re timing these setups together with the general trend.

Based on the instance, the market is in a downtrend, so we’ll be timing for shorts.

Following to date?

Because on the flip side…

For those who’re wanting to catch breakout trades, the Fibonacci extension is your best buddy!

This tool will show you how to project where the worth might head once it breaks free from its current range…

Breakout trading setup using the Fibonacci extension:

Look good?

At this point, I can hear your questions…

“So… how do I exactly enter trades?”

“When do I press the buy button?”

“Can I exploit each the Fib extension vs retracement?”

(Spoiler alert: Absolutely!)

Rest assured, my friend, in the following section, I’ll share a secret technique on the best way to mix each tools for optimum trading awesomeness…

…and answer the remaining of your excellent questions!

Fib Extension vs Retracement: A Complete Combo Strategy

Able to level up your trading game?

The key ingredient to combining each tools is referred to as the TAEE framework.

This framework is the core foundation of all trading concepts we normally teach here.

Especially when mastering each Fib extension vs retracement.

So what does this framework stand for?

TAEE stands for identifying the Trend (T), Area of Value (A), Entries (E), and Exits (E).

Here’s the best way to use it to mix Fib extension and retracement like a professional!

Step 1: Discover the Trend

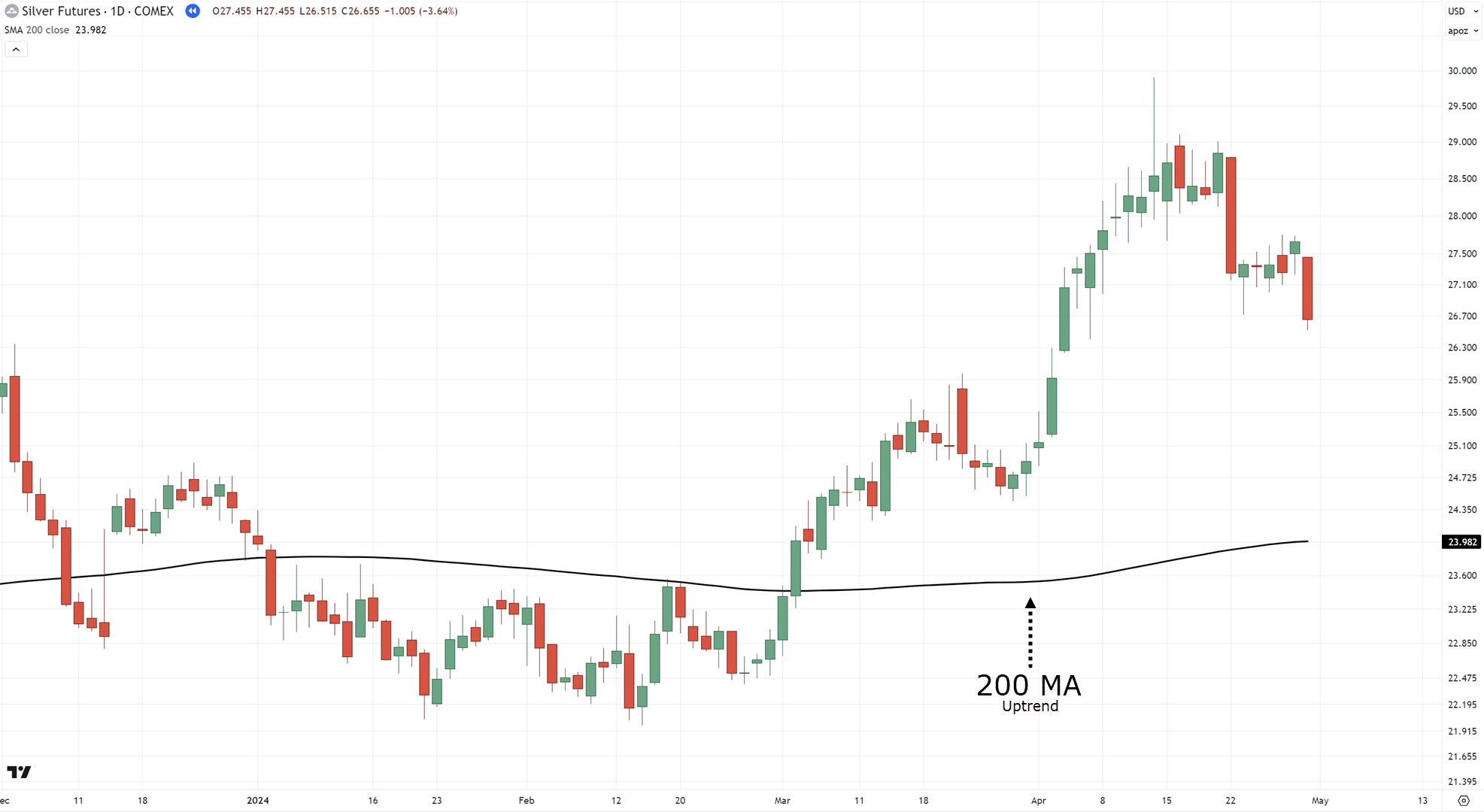

You’ve seen this before, so let’s jump straight in.

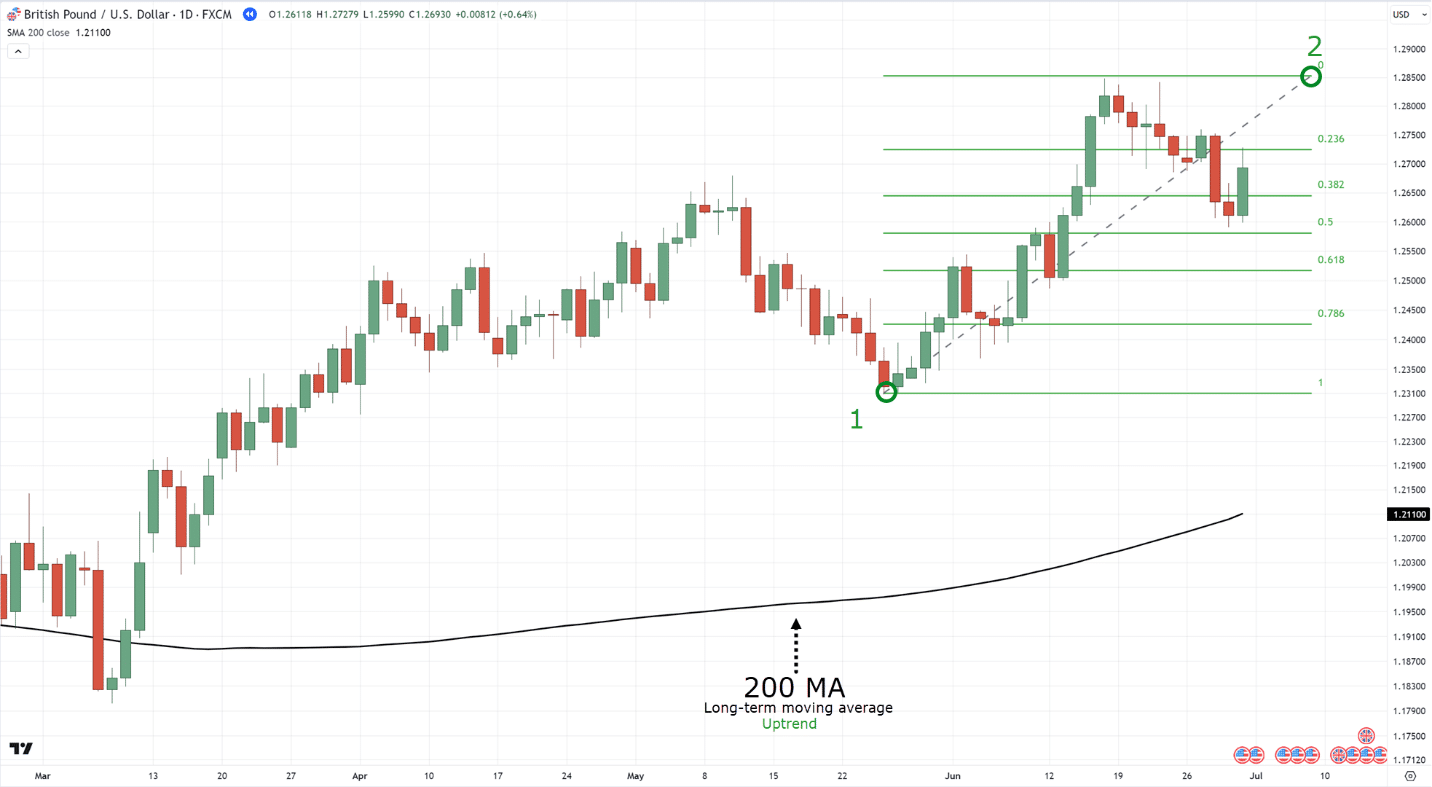

In this instance, we’ll use an uptrend…

There could be a whole lot of ways to define your trends, but on this case, I’ll use a long-term moving average period resembling the 200-period moving average.

If the worth is above the 200 MA?

Uptrend.

If the worth is below it?

Downtrend.

And in this instance?…

That’s right… it’s in an uptrend!

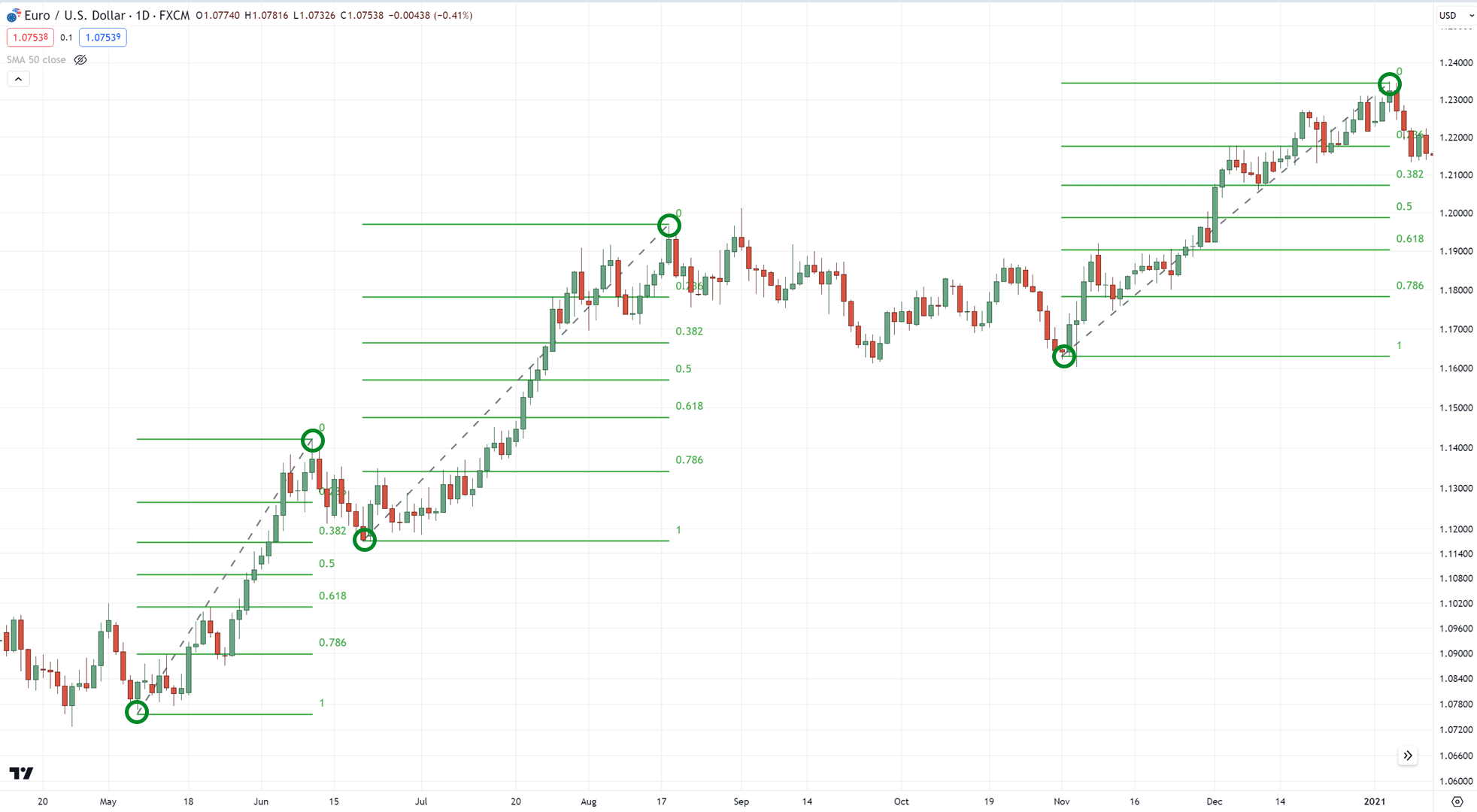

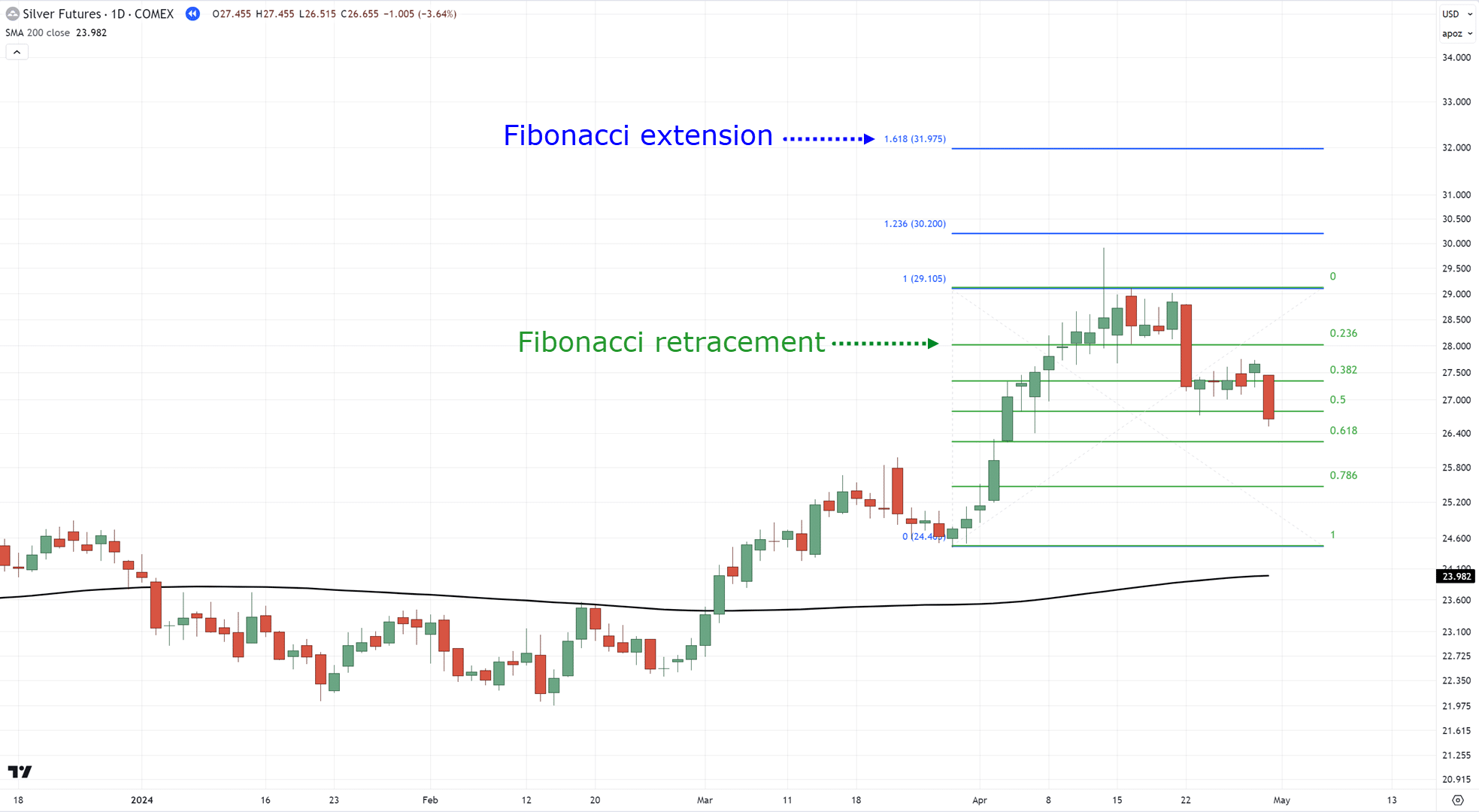

Step 2: Discover the Area of Values

That is where the magic begins.

Start by plotting each your Fib extension vs retracement on the present leg of the move…

You heard me – on each of them!

And remember, you would like to plot them from bottom to top because it’s in an uptrend:

Got it?

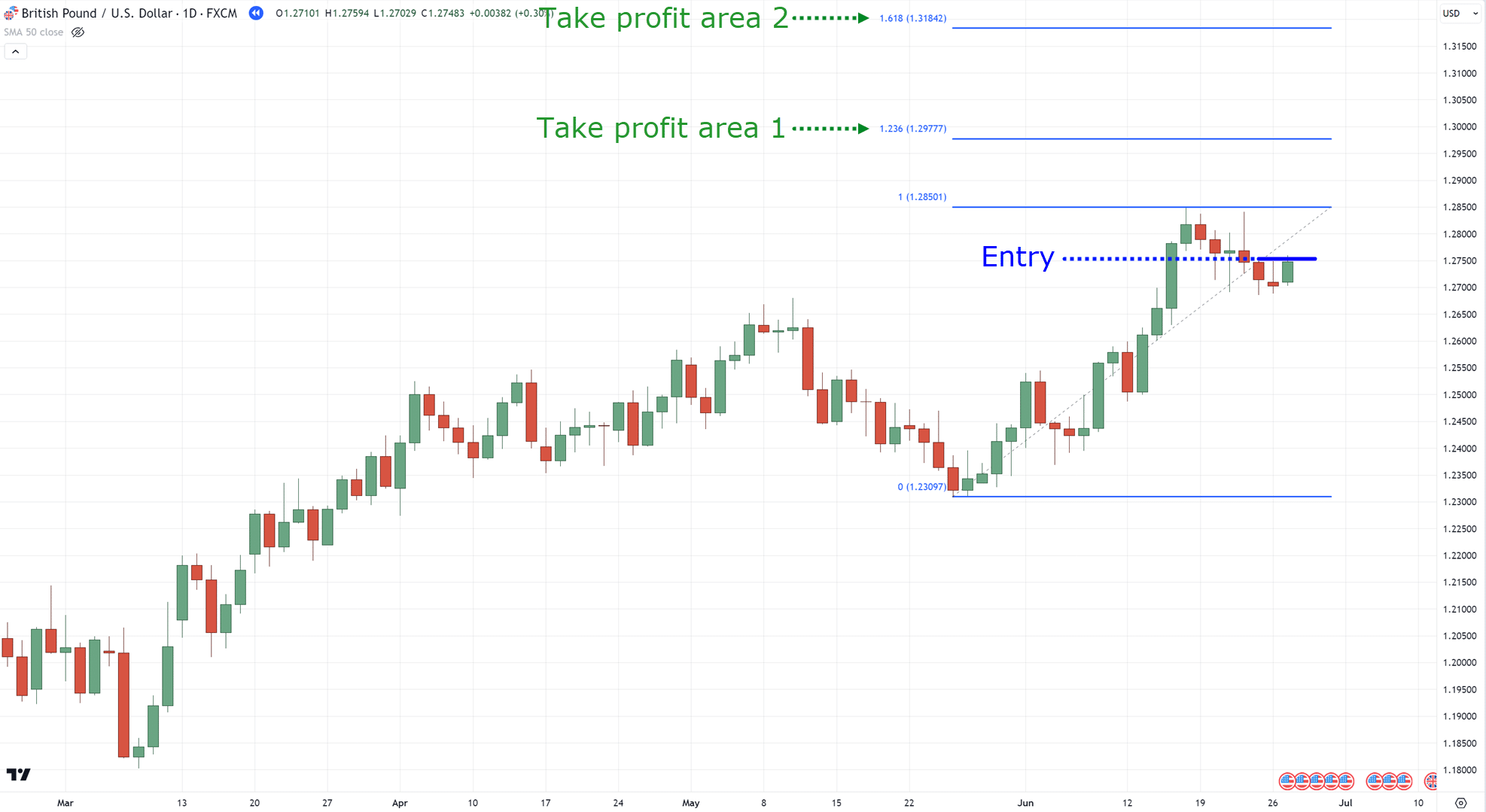

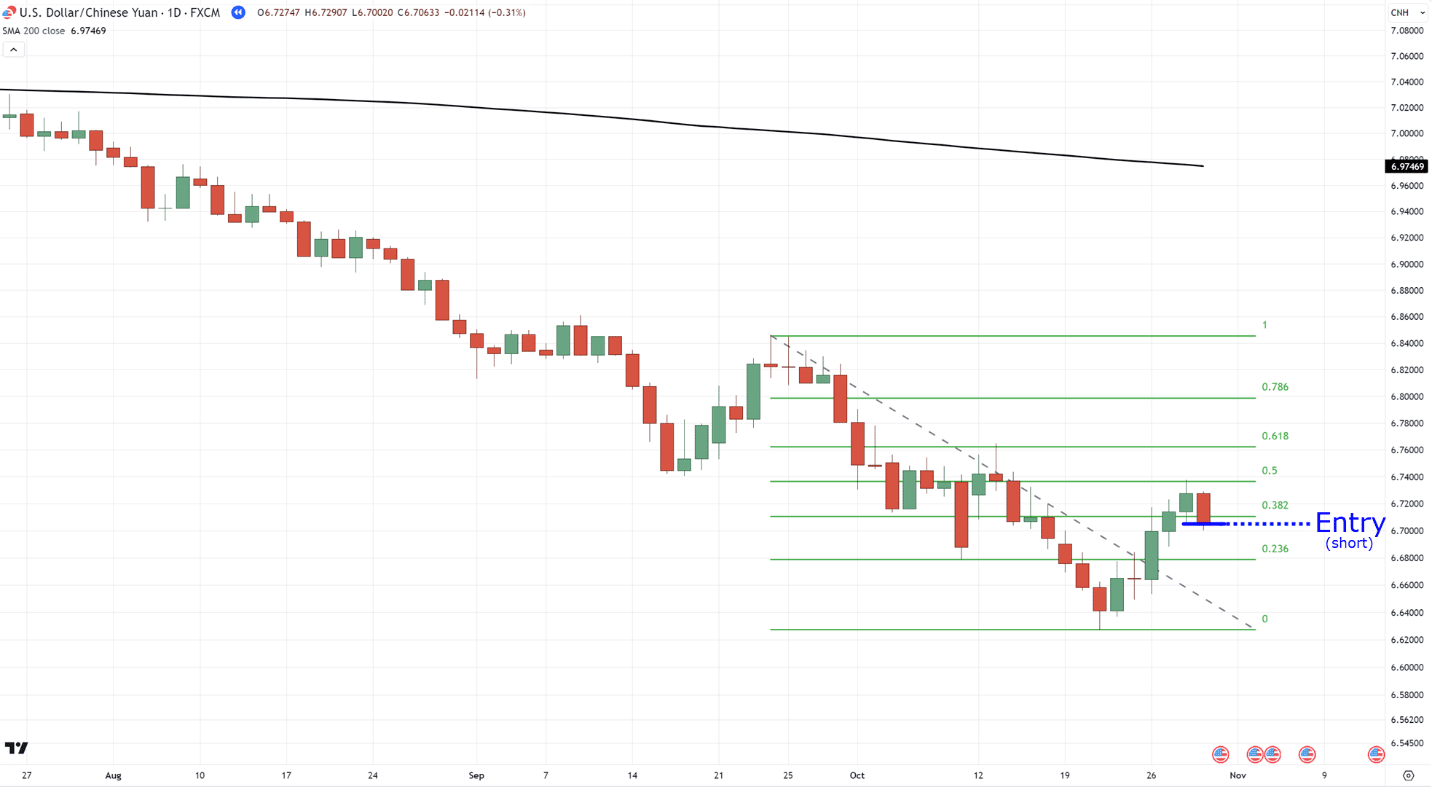

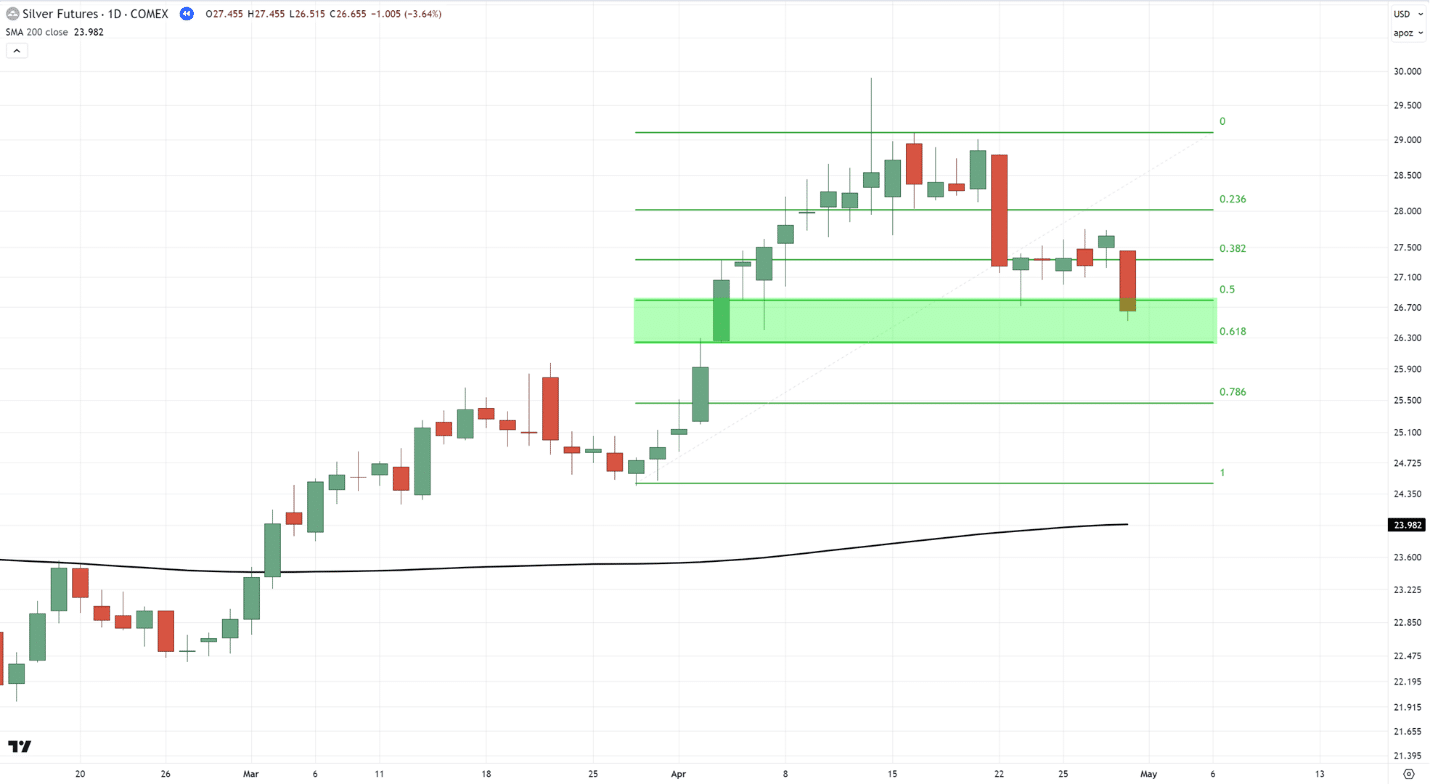

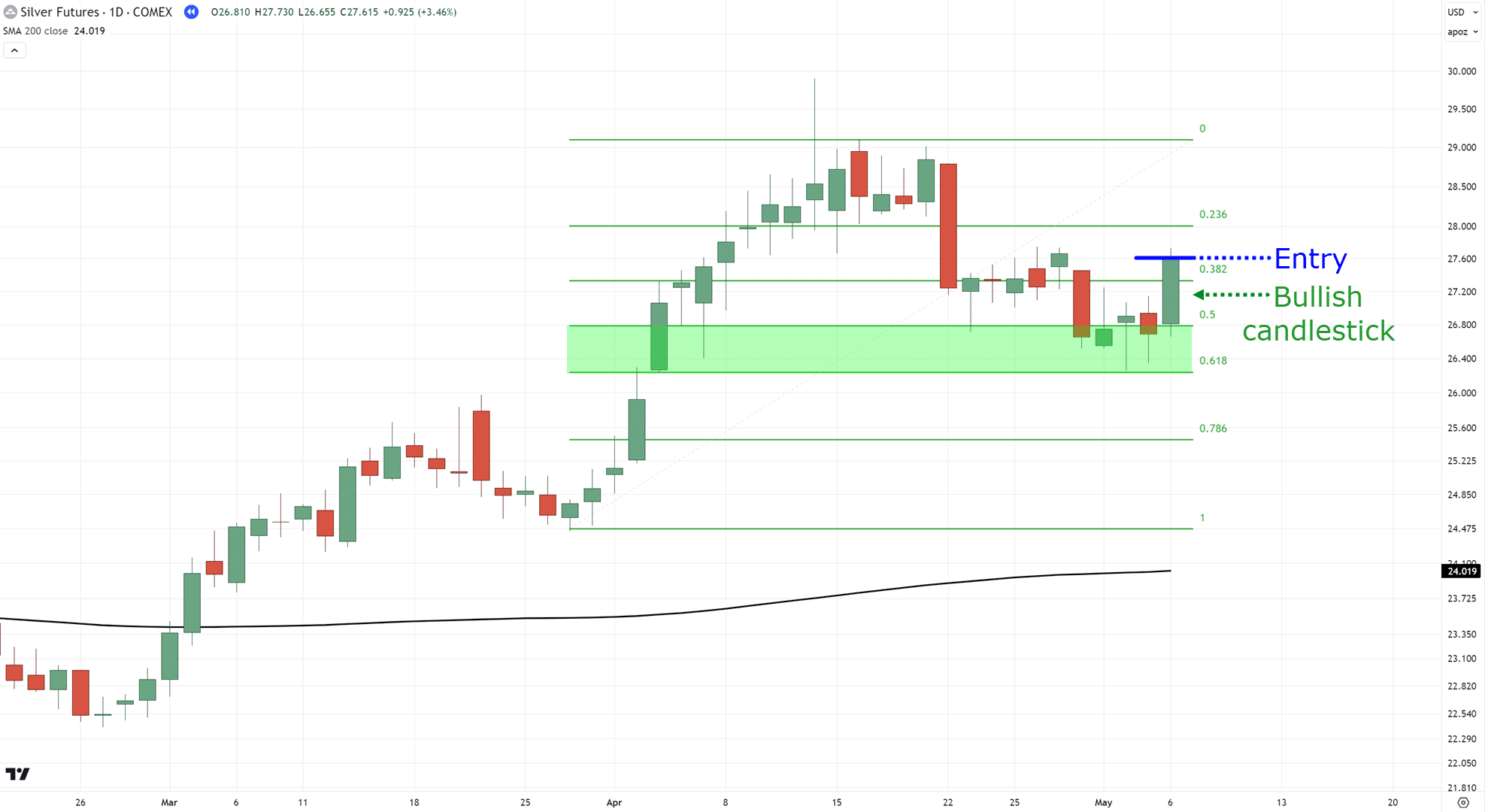

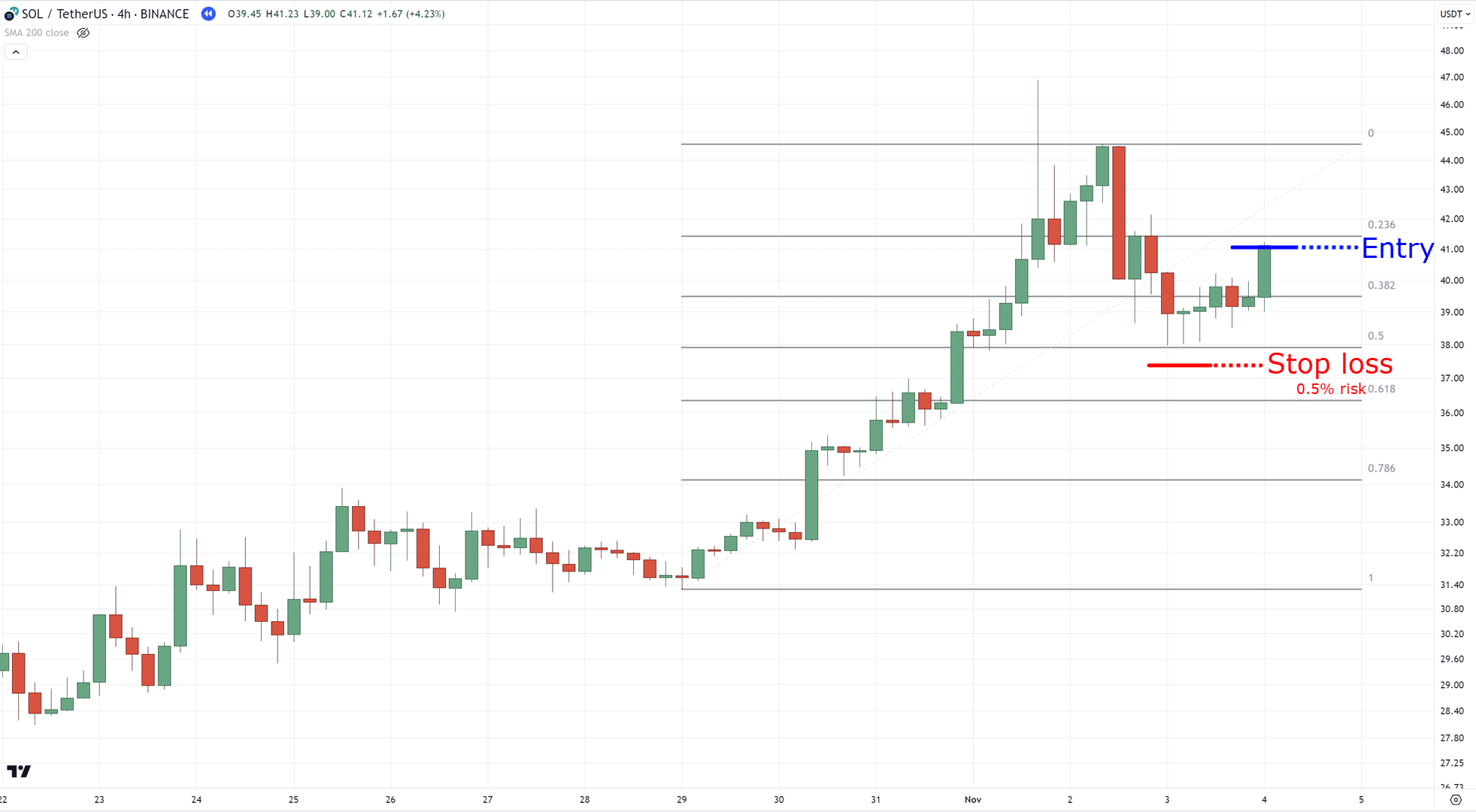

Step 3: Discover your Entries

Now, you would like to control the Fibonacci retracement first.

That is where you will see your entries!

You’ll need to wait for the worth to shut below a serious level between 50.0% and 61.8% level…

The trick is…

…waiting for the worth to shut back above the most important levels – with a powerful bullish candlestick!…

When you see that, enter at the following candle open…

…and that’s it!

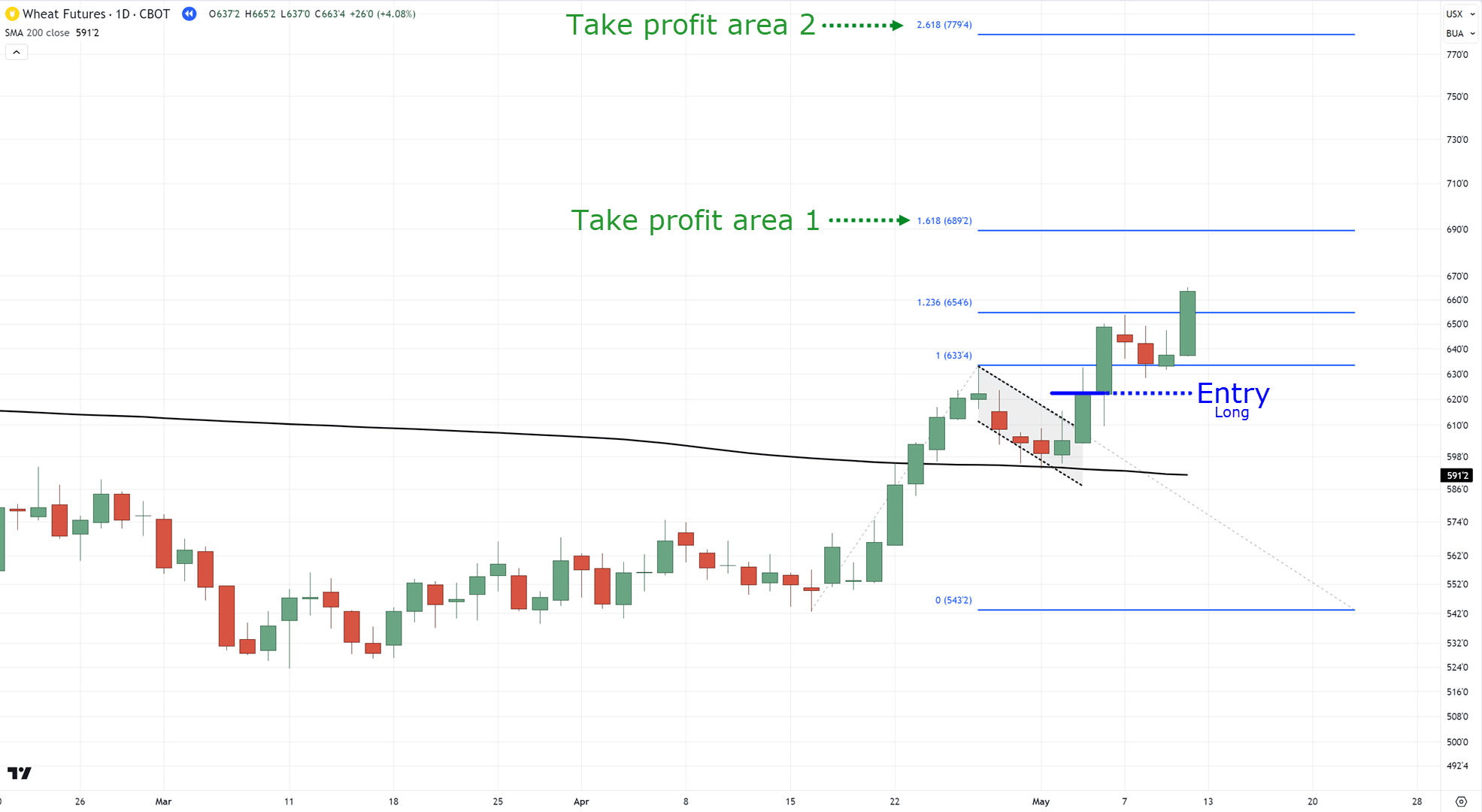

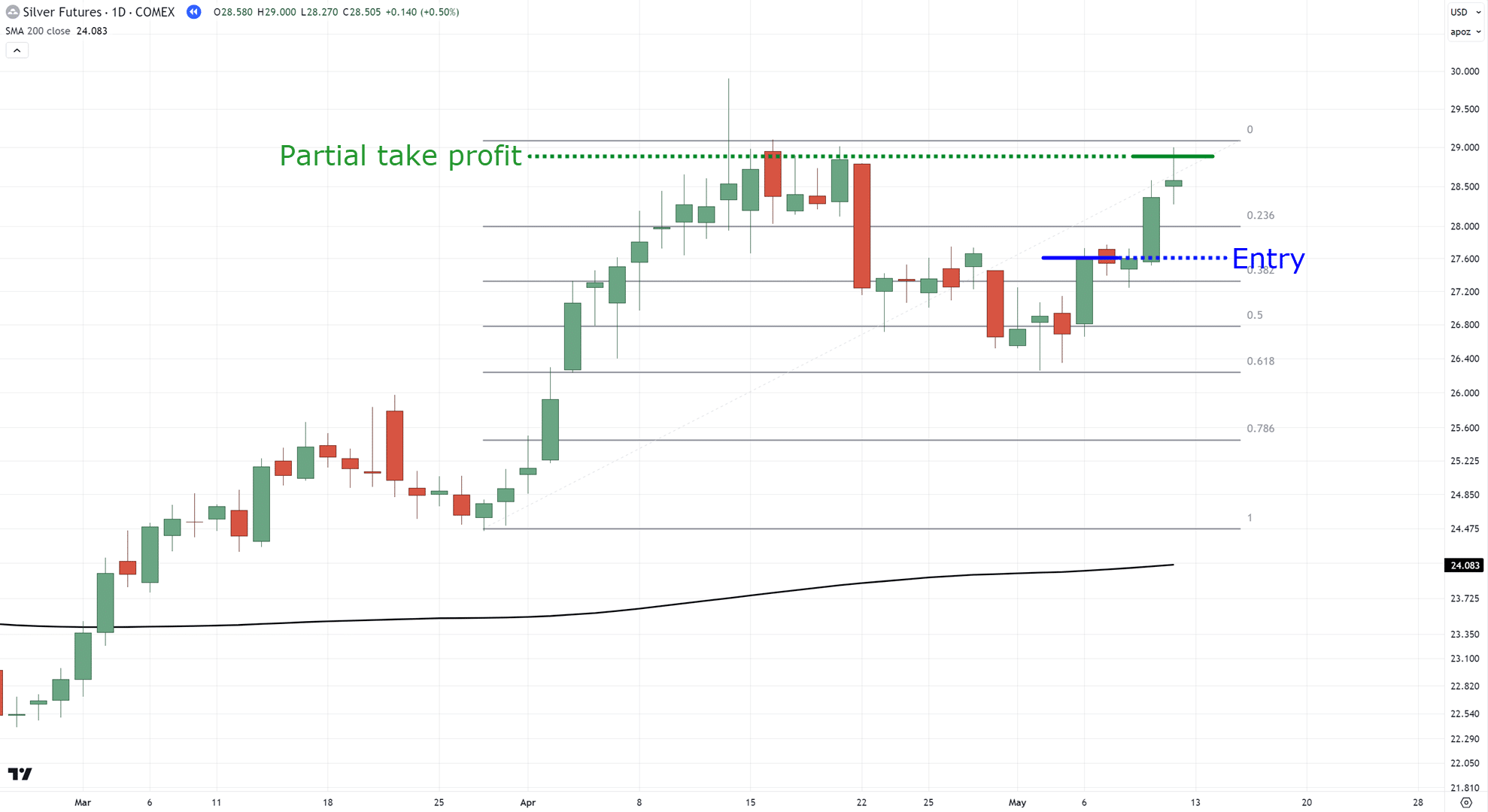

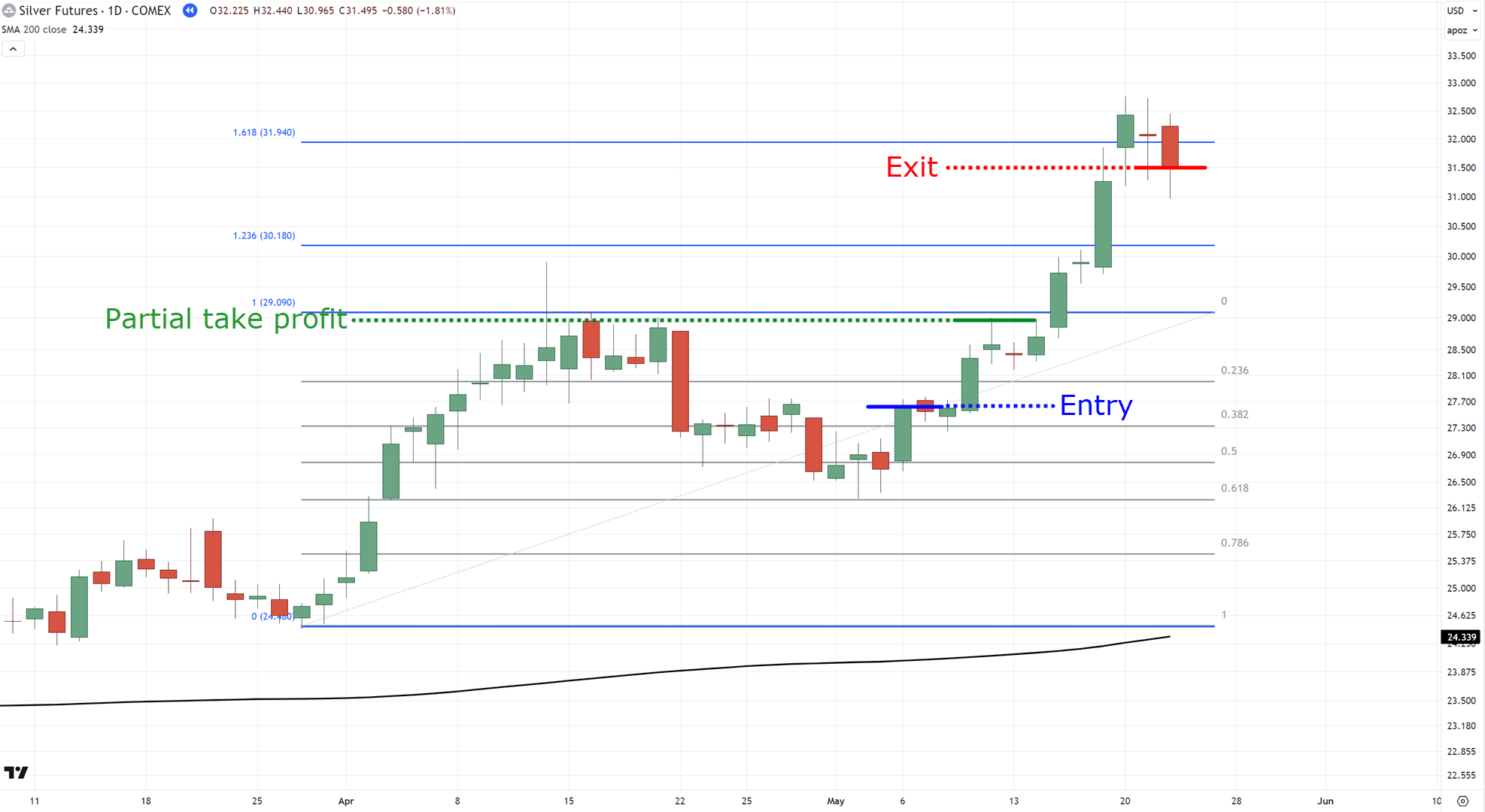

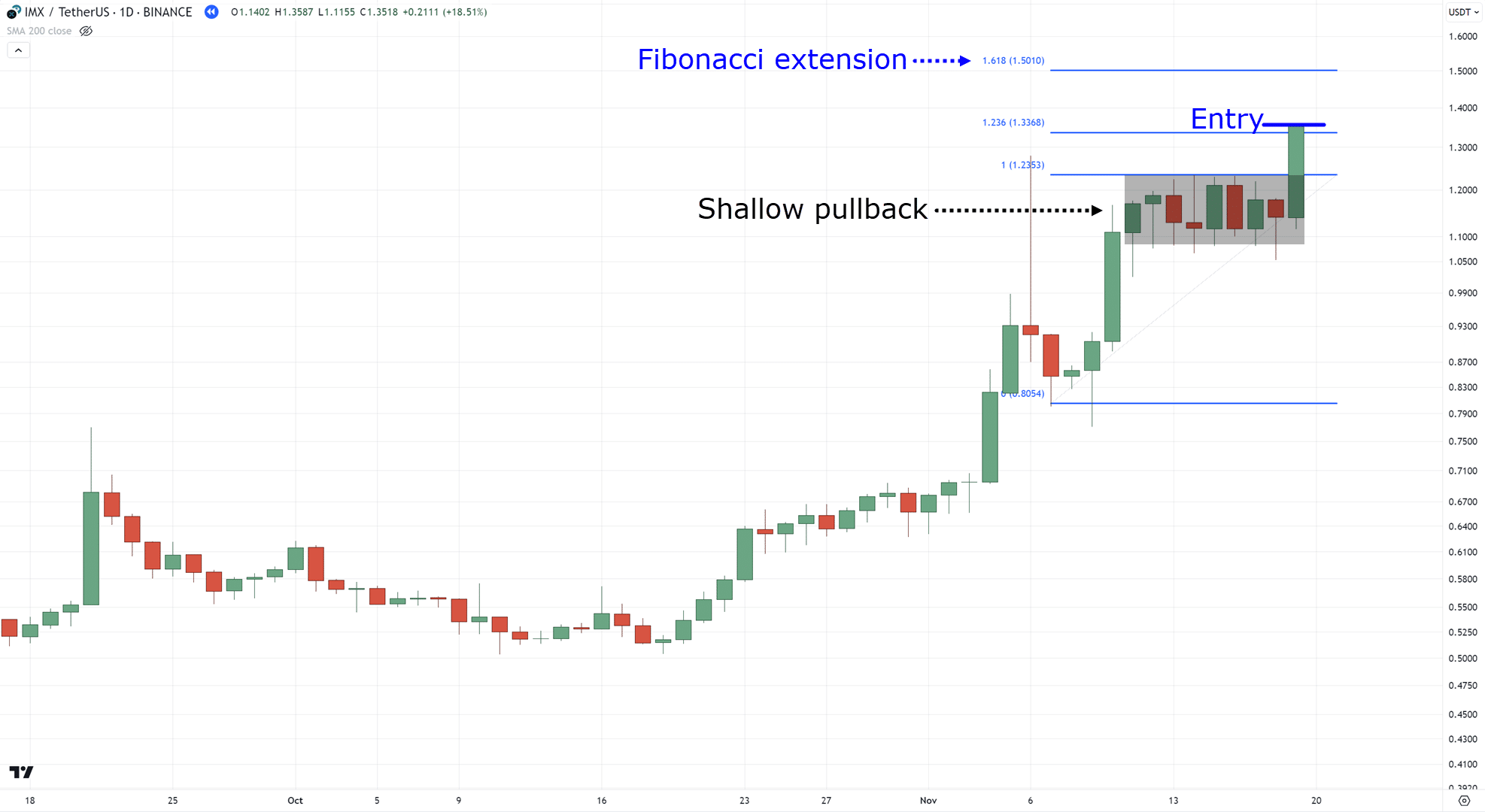

Step 4: Discover your Exits

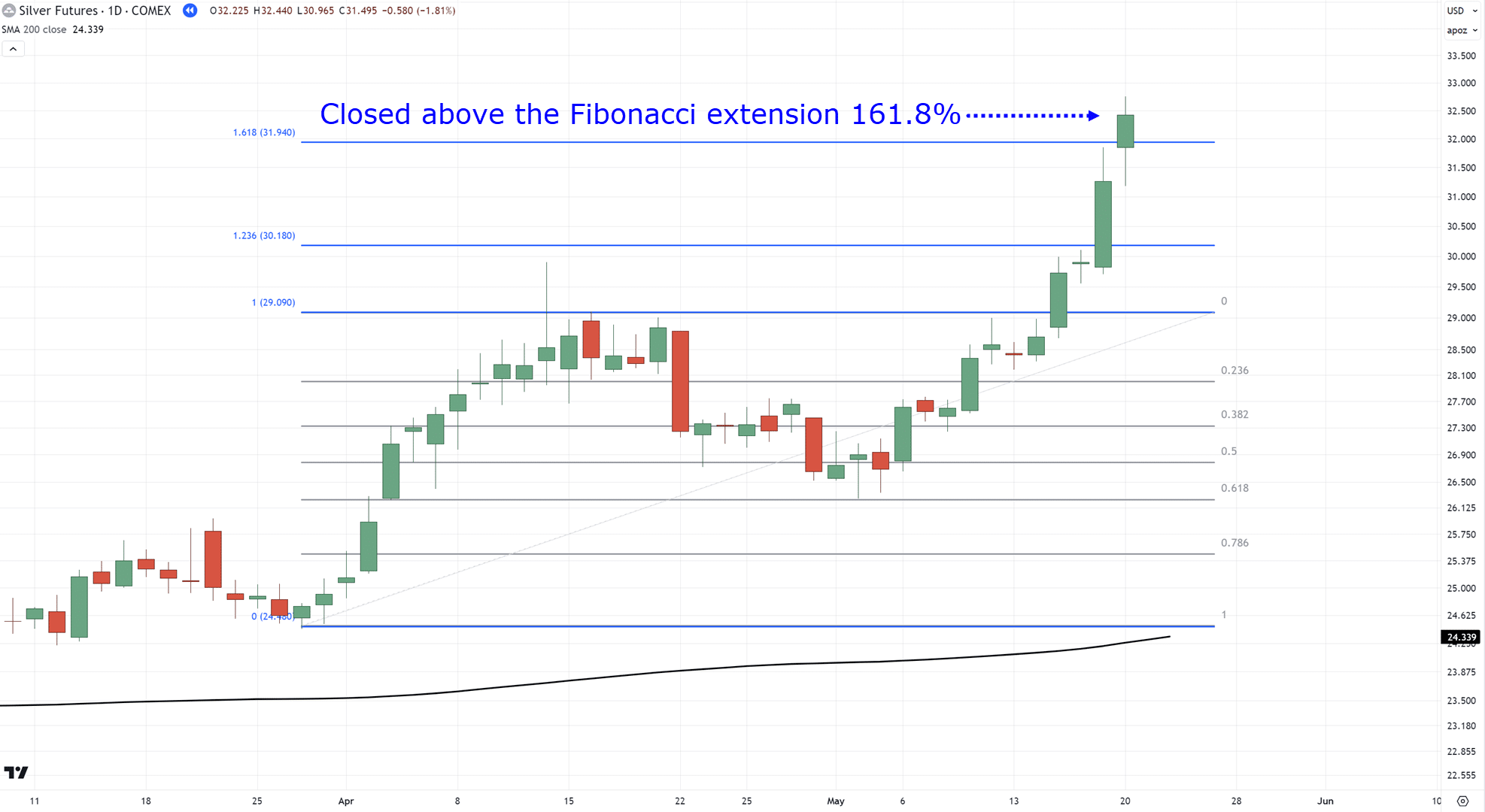

That is where the Fibonacci extension really shines.

Once the worth reaches the closest high, you’ll be able to take partial profits…

Then, for the remaining position, wait for the worth to shut above a Fibonacci extension level….

If it closes back below it, exit the trade…

Principally, this acts like a trailing stop loss, catching the breakout momentum.

At all times remember – you’re in search of strong breakouts here!

In truth, this is comparable to the way you entered the trade:

Wait to shut beyond a certain Fibonacci level…

…then enter when it closes back!

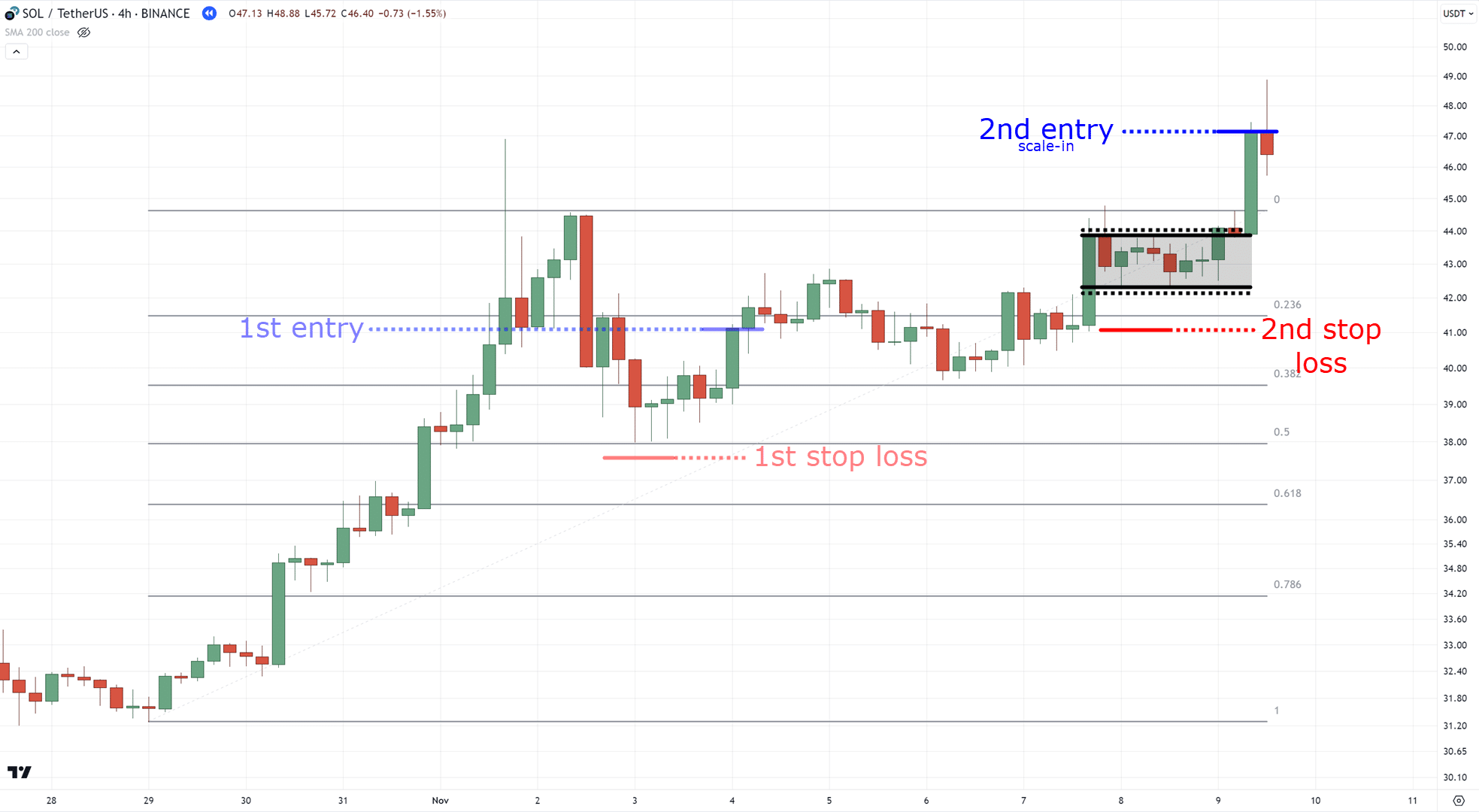

BONUS: Flexible trade management

Here’s an additional trick that may prove useful.

In your first entry, risk 0.5% in your entries with Fibonacci retracement…

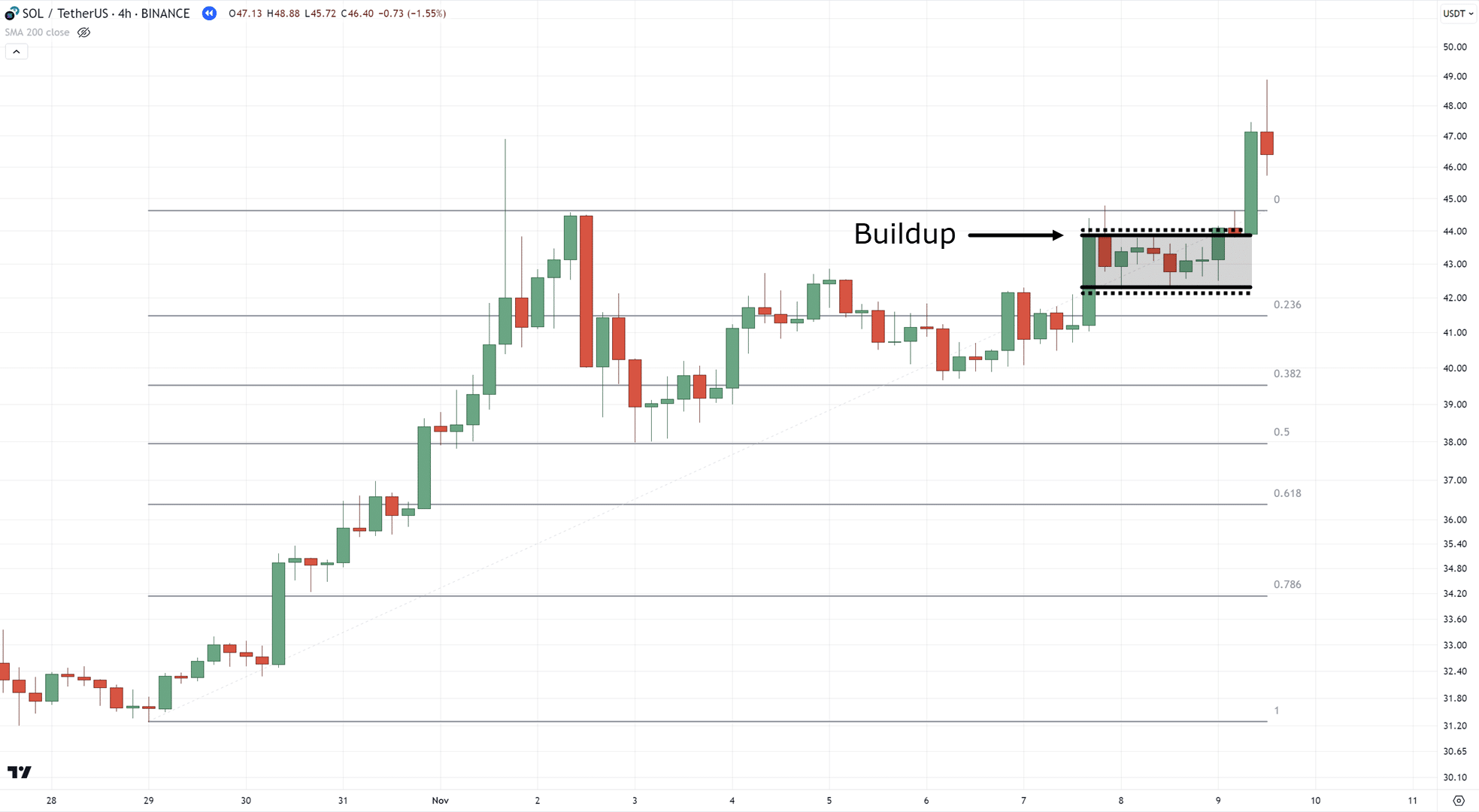

Following this, if the worth makes a build-up at resistance after which breaks out…

…scale in your trades using the Fibonacci extension to trail your stop loss!…

…you’ll be able to see there’s some real flexibility within the system!

You’ll be able to either risk small then scale in…

…or take partial profits and trail the remaining half…

…or just have fixed take profit at the closest resistance!

Pretty cool, right?

Now, in the following and final section…

I’ll share crucial DOs and DON’Ts in the case of Fib Extension vs Retracement.

And yes, you’ll need to know the best way to use it in addition to how not to make use of it!

Fib Extension vs Retracement: Things to avoid

I do know I shared with you some spicy techniques on the best way to use each tools.

Nonetheless, one thing to all the time pay attention to is to…

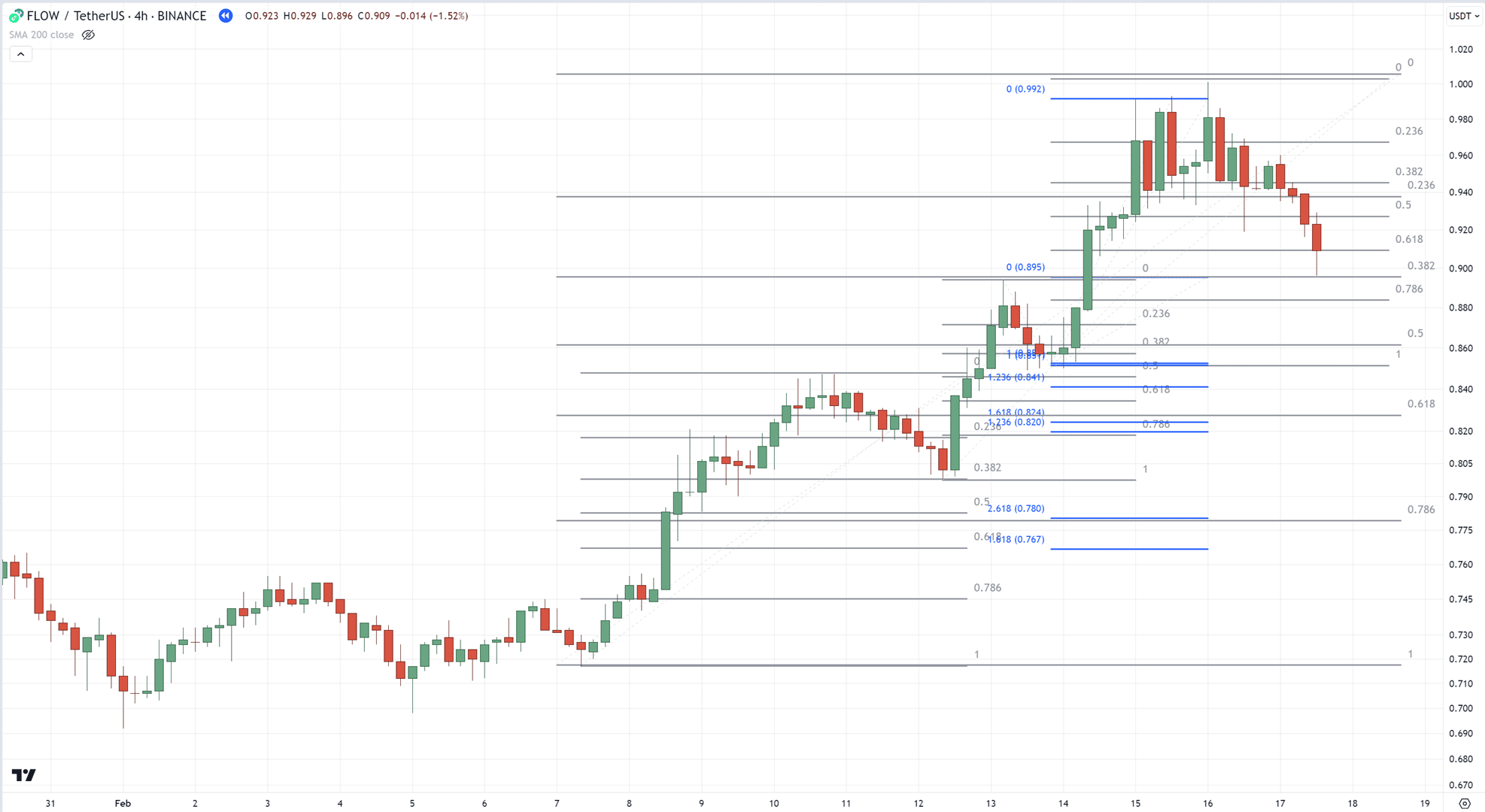

Avoid plotting too many Fibonacci in your chart

Remember…

You’re using these Fibonacci tools to show you how to trade the markets.

Which means you need to avoid plotting them like this…

(are you able to even see the numbers?)

And take a look at to plot them more like this…

And always remember, that you must give attention to the present price!

You need to all the time be plotting Fibonacci levels which might be relevant.

It’s a fully crucial point.

Now, I do know you is likely to be considering…

“But I’ve seen traders plot a ton of Fibonacci retracements and extensions to benefit from the markets!”

Sure, in case you plan to make use of the Fibonacci tools to investigate the market, then yes!

But when you would like to use it to trade the markets, then follow the golden rule:

Keep it easy!

Because simplicity brings about consistency, which results in far more reliable results.

Now…

While you should utilize each the extension and retracement together…

Do not forget that all the things relies on the context.

Don’t use the Fibonacci tools out of context

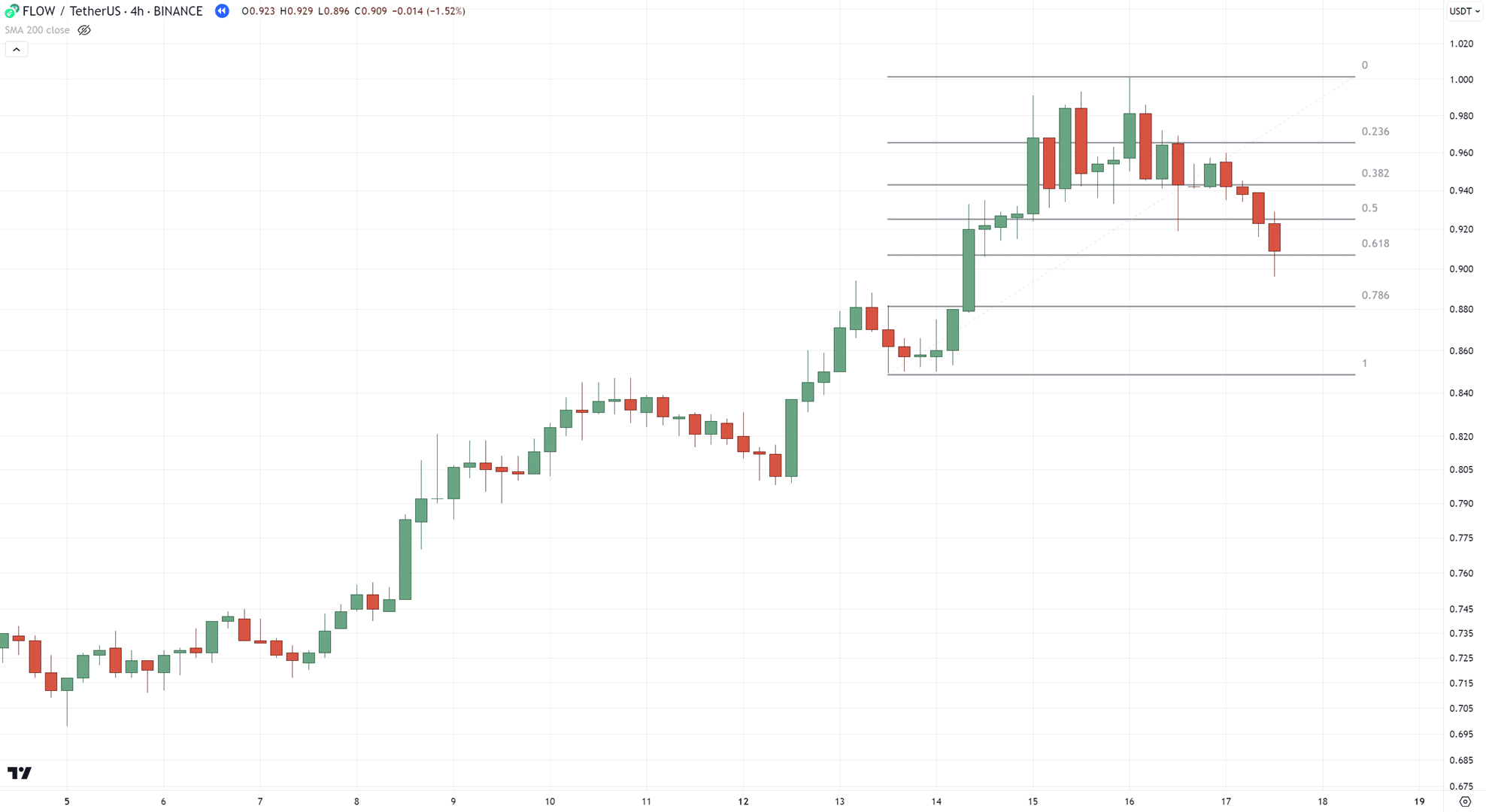

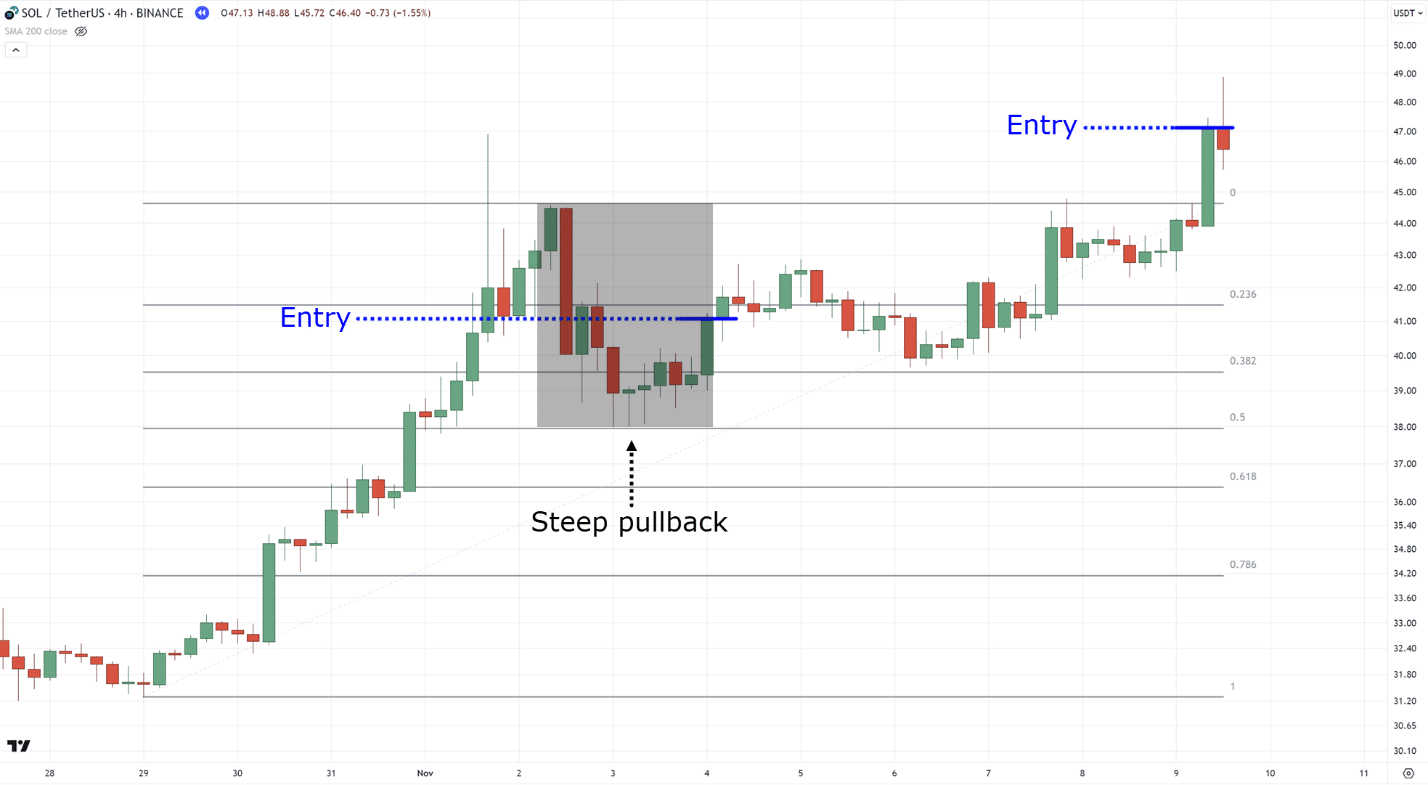

If the pullback is steep, use the Fibonacci retracement + extension combo…

But when the pullback is shallow, give attention to timing the breakout and only use the Fibonacci extension to know where to take your profits…

Which means not only do that you must know HOW to plot them…

…but additionally WHEN to plot them!

Plenty to take into consideration, right?

So let’s break it down one last time!

Conclusion

Initially, the Fib extension vs retracement tool looks like a difficult trading concept you’ve all the time desired to master but never attempted.

But as you’ve learned on this guide…

Using these tools doesn’t must be so complicated!

With a little bit of practice, you should utilize them to assist pull consistent profits from the markets.

To sum up, here’s what you’ve learned today:

- Fib retracement captures pullbacks, while Fib extension projects breakout targets, with each serving unique roles in your trading

- At all times start with identifying the trend and the setups you are attempting to capture, then use which Fibonacci tool is relevant to your setup

- Using the TAEE framework is a straightforward and repeatable step-by-step process so that you can execute in your charts

- The Fib extension vs retracement also permits you to be flexible in your risk management by scaling in or scaling out of your trades

- Avoid overcomplicated methods – keep your plots easy with the aim of trading, and don’t make a full market evaluation report

- While each the Fib extension and retracement could be used at the identical time, only use them depending on the context of the market

So, that’s just about it!

Now, over to you…

What’s your experience using these Fibonacci tools?

Are there concepts here you don’t agree on?

Or, in case you’ve been using these tools for some time already, have you ever learned anything recent along the best way?

Jump in and discuss it within the comments below!