A trailing stop loss is easy.

Ride the trend and capture monster profits…

Looks easy but, what else is happening here?

Well – the reality is, it’s a trading technique that may have huge effects in your trading psychology.

Imagine you’re in profit…

However the market pushes its way back to your trailing stop loss…

It’s still a profit…

…but what concerning the thought creeping into your mind?

“Rattling, if I hadn’t had a trailing stop loss and brought my profits at resistance, my profits would’ve been much larger!”

Sounds familiar, right?

It’s why in today’s trading guide, I’ll not only share with you the disadvantages of trailing stop loss but in addition provide you with the complete context behind it and techniques on what you may do as a substitute.

Specifically, you’ll learn…

- The several sorts of trailing stop loss and the perfect indicators to make use of for them

- Why trailing stop loss isn’t as pretty as you’re thinking that once you trade it in real-time

- Powerful trailing stop loss techniques and techniques to higher optimize and pick the perfect trailing stop loss for you

- A whole trailing stop loss strategy for short-term and long-term trends

Secure to say that after this training guide, you’ll never see trailing stop loss the identical way!

Are you ready?

Then let’s start.

Disadvantages of Trailing Stop Loss: What’s it and The way it Works

Let me ask you:

When you google “trailing stop loss” what do you discover?

That’s right!

Nonetheless, did you understand that there are alternative ways by which you may trail your stop loss?

Specifically, they’re:

- Trend-based indicator trailing stop loss

- Oscillator-based trailing stop loss

- Candlestick trailing stop loss

Interested to learn more?

Let me share them with you intimately…

Trend-based indicator trailing stop loss

You’ll be able to probably guess the meaning, right?

These indicators work best in trending markets.

Indicators akin to a moving average…

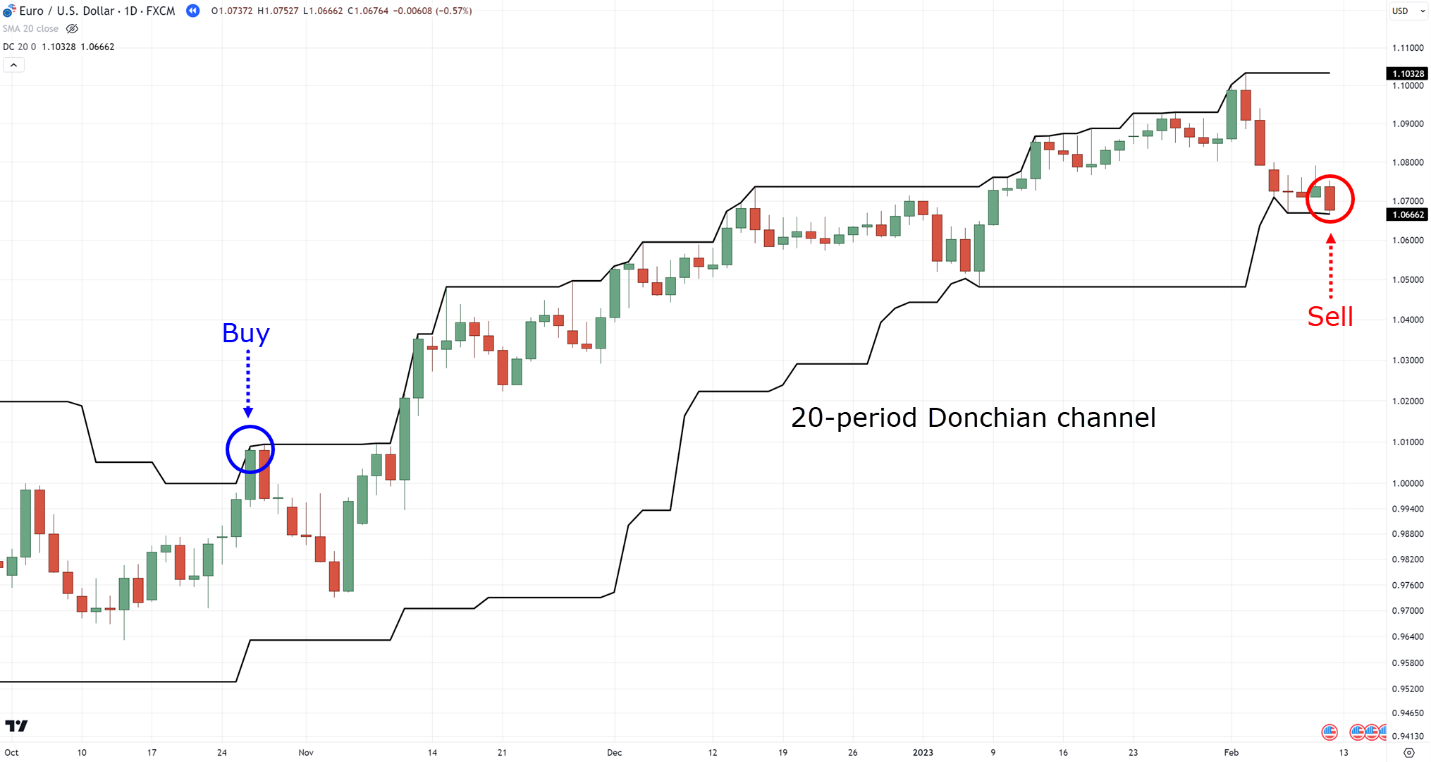

And the Donchian channel…

…each work quite effectively!

Nonetheless, they’re not the holy grail… as these indicators will falter on range markets, so be careful!

Oscillator-based trailing stop loss

Any such trailing stop loss method can work best when attempting to catch the short-term momentum of the markets.

One example is the RSI indicator, wherein you simply exit if the value closes above the overbought level…

After which wait for the value to shut below the overbought level again as an exit trigger…

It may possibly be counter-intuitive, as we are sometimes taught to purchase at oversold and sell at over-bought levels, right?

But in point of fact, the market can keep its momentum by staying at those levels for quite a while…

…opening opportunities for trailing your stop loss.

Candlestick trailing stop loss

Across all trailing stop losses on the market, this one is probably the most aggressive.

It must even be well-practiced with a view to apply properly.

But, easy methods to go about it?

Once you might be within the trade…

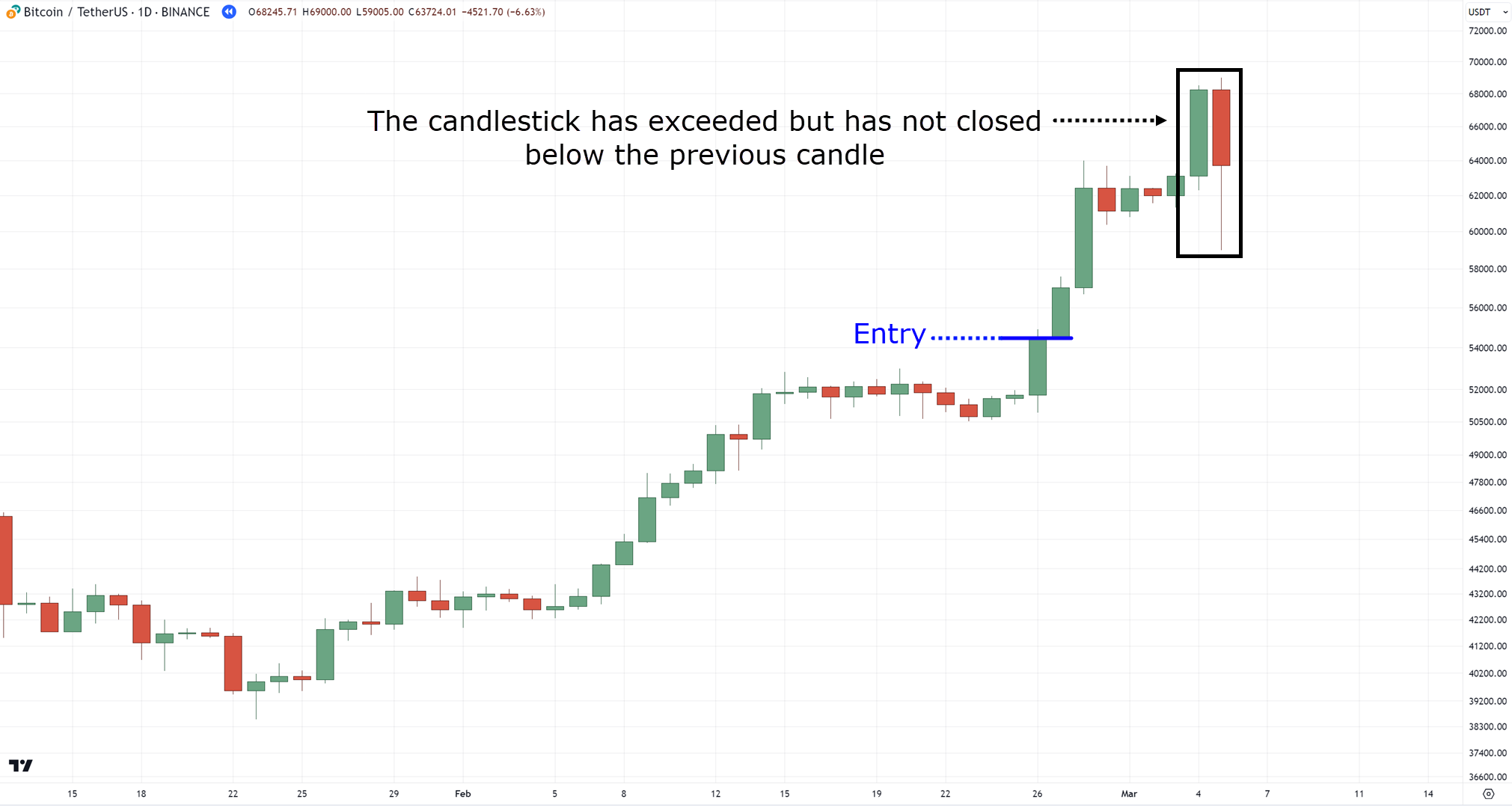

…you wait for the candlestick to shut beyond the previous candlestick…

That’s right, if the candlestick’s wicks have exceeded the previous candle, you continue to stay within the trade…

…but when it closes beyond the previous candle’s highs and lows, then you definitely exit the trade…

Again, this method could be the best to grasp because it doesn’t require any magic indicators or periods.

It’s pure candlestick!

Nonetheless, it does need a while to get used to.

So now that you just’re equipped with some knowledge…

How will you use it in live trading?

In spite of everything, seeing concepts in textbooks is at all times different from reality, right?

So, let me share the disadvantages with you in the following section…

What Are The Disadvantages Of Trailing Stop Loss?

The reality is that every one the disadvantages you’ll hear from this section are just about the associated fee of doing business.

Nonetheless, have you ever ever heard the saying:

“There isn’t any holy grail within the markets”…?

It’s why I’m going to share with you the professionals and cons of every concept shown to this point, to enable you to determine which one to decide on.

Because that’s what it takes to be a consistent trader.

Let’s start…

Disadvantages of a trend-based indicator trailing stop loss

There are two important disadvantages here.

First, you’ll often have poor risk to reward trades because the trend doesn’t push far…

Second, there’s the psychological impact of this kind of trailing stop loss.

Imagine being in serious profit, just for the market to wipe most of it away…

Ouch!

It’s par for the course when selecting this method, but it surely will not be for everybody.

Disadvantages of an oscillator-based indicator trailing stop loss

Relating to indicators, a significant drawback is fake signals.

There shall be times once you see the value break and reverses from overbought levels…

….just for the value to reverse again – back to the trend!…

Pretty darn frustrating!

But one technique to reduce that is to extend your RSI-period value to 14-period or above.

Again, this reduces it, but doesn’t eliminate the issue entirely.

Disadvantages of a candlestick-based trailing stop loss

Despite it being probably the most aggressive trailing stop loss there’s, false signals present a significant drawback.

They mean there shall be times once you’ll exit the trade on account of only a small blip…

In fact, you’d’ve made more profit for those who stayed within the trade, but that’s the way it goes!

Now you could be pondering:

“Which one is the perfect one for me?”

“I still can’t pick what form of trailing stop loss I should use.”

Don’t worry, as I actually have all of the answers for you in the following section!

How To Overcome The Disadvantages Of Trailing Stop Loss

Consider the concepts I shared with you as job applicants you’ve gotten to select from….

So, now you need to ask yourself…

“What are the factors I should consider relating to picking the perfect one?”

“Which one’s the perfect fit for me and my trading plan?”

Briefly…

Step 1: Know your trading methodology

What are different trading methods?

Well, there’s the classic trend following…

Momentum trading, where you simply plan to ride and capture the short momentum strength within the markets…

And Mean Reversion trading, which is roughly the other of momentum trading where you profit available in the market’s weakness…

In fact, there are other trading methods on the market!

But relating to trailing stop loss, these are sometimes those that you just need.

So, which trailing stop loss is most relevant for every?

Step 2: Use a relevant trailing stop loss method in your trading methodology

For trend following, you’ll want to come to a decision what sorts of trend you need to capture.

Do you need to capture short-term, medium-term, or long-term trends?

If you need to capture short-term trends, then you definitely’ll wish to use a “tight” trailing stop loss – akin to the 20 to 30-period Donchian channel trailing stop loss…

For medium-term trends, you’d wish to use a 50 to 100-period Donchian channel trailing stop loss…

Finally, for long-term trends, a 100 to 200-period Donchian channel is relevant…

Now that’s a really long trade!

Keep in mind that these are cherry-picked charts extracted from the tough reality of real world of trading…

There shall be loads of times once you will see your profits evaporate (a significant drawback of trailing stop loss)!

But you may’t deny how easy the concept is, right?

Nonetheless, it’s never about selecting the perfect period on the market – it’s all about choosing probably the most relevant indicator and period that suits your trading style.

Moving on, we’ve momentum trading.

For this, you’ve gotten two ways to trail your stop loss.

The primary is through the use of a candlestick stop.

Which means that when you enter the trade…

…you is not going to exit the trade until it closes beyond its previous candlestick…

Now, make sure that to read that again.

Even when the candlestick’s wick exceeds the previous candle, you’re still within the trade.

You’ll wish to wait for a detailed after which exit at the following bar…

Systematic and easy, right?

As previously stated, though, its major drawback is that it could be a false signal.

But for those who’re a momentum trader who wishes to capture short-term moves within the markets, then the drawback becomes a traditional cost of doing business!

The second technique to go about that is through the use of an indicator trailing stop.

You’ll be able to accomplish that by picking an oscillator and momentum-based indicator akin to the MACD, RSI, or stochastic.

Let’s take the RSI indicator for example…

When you enter a breakout trade, then you definitely’ll wish to wait for the RSI to shut above RSI 70…

(Because again, we’re adopting a momentum trading approach.)

…but only exit when it closes back below RSI 70…

Are you able to see how using an indicator-based trailing stop loss makes it more objective and systematic?

Well, how about mean reversion trading?

It’s actually much more easy – as you should utilize the identical tools I shared with you previously.

The one difference is that you just’re entering on a pullback as a substitute of a breakout.

Specifically, for those who’ve entered a pullback trade…

…you’ll wish to wait for the value to shut above 50, only exiting when the value closes below 50 again…

Same concept as some time ago, right?

Except this time, again, you’re entering on a pullback.

Now, I’ve shared numerous techniques and ideas in a brief period of time.

I feel if you need to learn in depth concerning the trading methodologies I’ve shared with you, you must try these links:

Trend Following Trading Strategy Guide

The Essential Guide to Momentum Trading

High Probability Trading: The Definitive Guide to Trading Pullbacks and Breakouts

With that said, let me shell out some truths about trailing stop loss in the following section…

Disadvantages Of Trailing Stop Loss: Must you use a trailing stop loss?

Truthfully, Trailing stop loss is just not for everybody.

But how will you tell?

It’s worthwhile to consider the next…

You’re used to and are willing to delay your gratification

It’s true.

Having a trailing stop loss can assist you to capture monster trends.

But as a rule, you’ll encounter failed trades almost half of the time.

So, let me ask you…

Are you willing to endure loads of losing and breakeven trades before finding a monster trend?

Or are you more comfortable taking a set goal profit to scale back the uncertainty in your mind?

I’m sure my query highlights how all the pieces has its pros and cons.

But with this guide, I hope you may see there are alternatives on the market!

With that said, let’s do a fast recap of what you’ve learned today.

Conclusion

Every thing that I’ve shared today is just not so that you can completely avoid stop losses but for you to achieve a greater understanding of their concept.

The variability of trailing stop losses means they should not all created the identical – each has its own quirks.

So, here’s what you’ve learned today:

- Various sorts of trailing stop loss exist, including trend-based, oscillator-based, and candlestick indicators.

- Each type has drawbacks akin to forfeiting profits, false signals, and inappropriate usage during certain market conditions.

- Matching the trailing stop loss method to your trading strategy helps mitigate its disadvantages.

- Trailing stop loss may not suit everyone, so at all times weigh its pros and cons against your trading style.

Now it’s over to you!

Do you comply with the disadvantages of a trailing stop loss I shared with you?

Also, d you regularly change your trailing stop loss depending available on the market condition?

Or perhaps you simply use one, to be as consistent as possible?

I sit up for your response within the comments below!