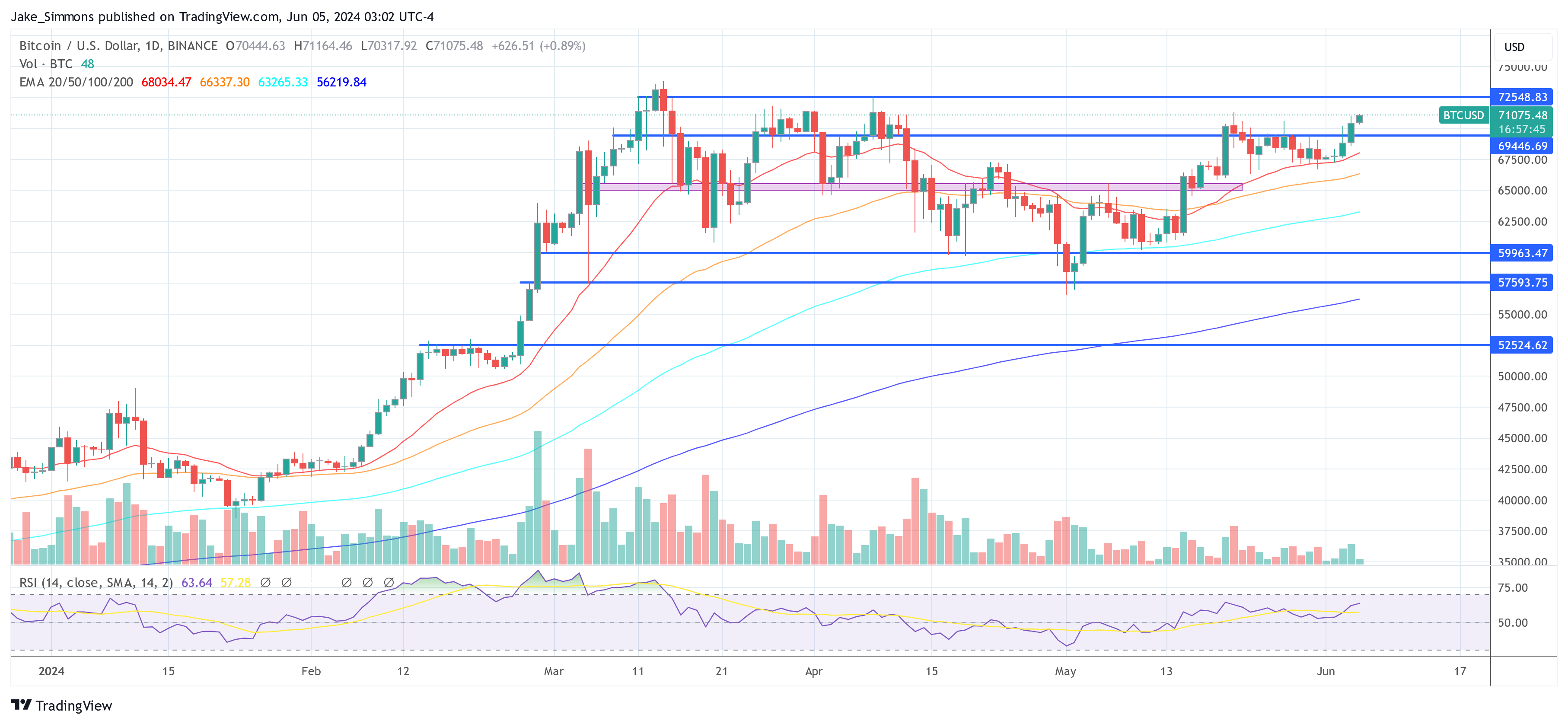

Bitcoin has surged 2.9% within the last 24 hours, reaching a high of $71,166 on Binance today, marking the very best price since May 21. This rally appears to be primarily fueled by robust inflows into US spot Bitcoin ETFs, with the sector experiencing its sixteenth consecutive day of net inflows.

Why Is The Bitcoin Price Up Today?

Yesterday alone, these ETFs saw an inflow of $886.6 million, with Fidelity leading at $378.7 million—setting a latest record for the fund. BlackRock wasn’t far behind, with substantial inflows totaling $274.4 million. Other significant contributions included Ark with $138.7 million, Bitwise at $61 million, and the Grayscale Bitcoin and VanEck Bitcoin Trust recording $28.2 million and $4 million respectively.

Good morning fellow hodlers,

We had an absolute insane day of inflows yesterday with $886.6 million of inflows (that’s ~12 500 BTC)

Fidelity did $378.7 million, Blackrock did $274.4 million, Ark did $138.7 million and Bitwise 61 million.

Even $GBTC had inflows value of $28.2… pic.twitter.com/KaDdmTrq9p

— WhalePanda (@WhalePanda) June 5, 2024

The sustained interest is further evidenced as BlackRock’s iShares Bitcoin ETF surpassed $20 billion in assets, becoming the fastest ETF to achieve this milestone, reflecting significant momentum and investor enthusiasm.

Related Reading

Eric Balchunas, a Bloomberg ETF analyst, emphasized the dimensions of those inflows, stating, “Fidelity not messing around, big-time flows throughout today for The Ten, nearly $1b in total. Second best day ever, since Mid-March. $3.3b in past 4wks, net YTD at $15b (which was top end of our 12mo est). The ‘third wave’ is popping right into a tidal wave.”

Despite the positive inflow dynamics, Byzantine General (@ByzGeneral), a distinguished crypto analyst, observed that the value surge might have been more pronounced. He highlighted the presence of considerable passive supply on spot exchanges, which might need tempered the value increase.

Related Reading

He noted yesterday, “High volume today, and the perps basis actually went down a bit. I feel that we got good ETF flows today, but… They’re buying into lots of passive supply on spot exchanges.” He further commented today, “What did I say, big ETF inflows. But due to the entire passive supply it’s like an unstoppable force colliding with an immovable object.”

BTC volume delta and cumulative volume delta | Source: X @ByzGeneral

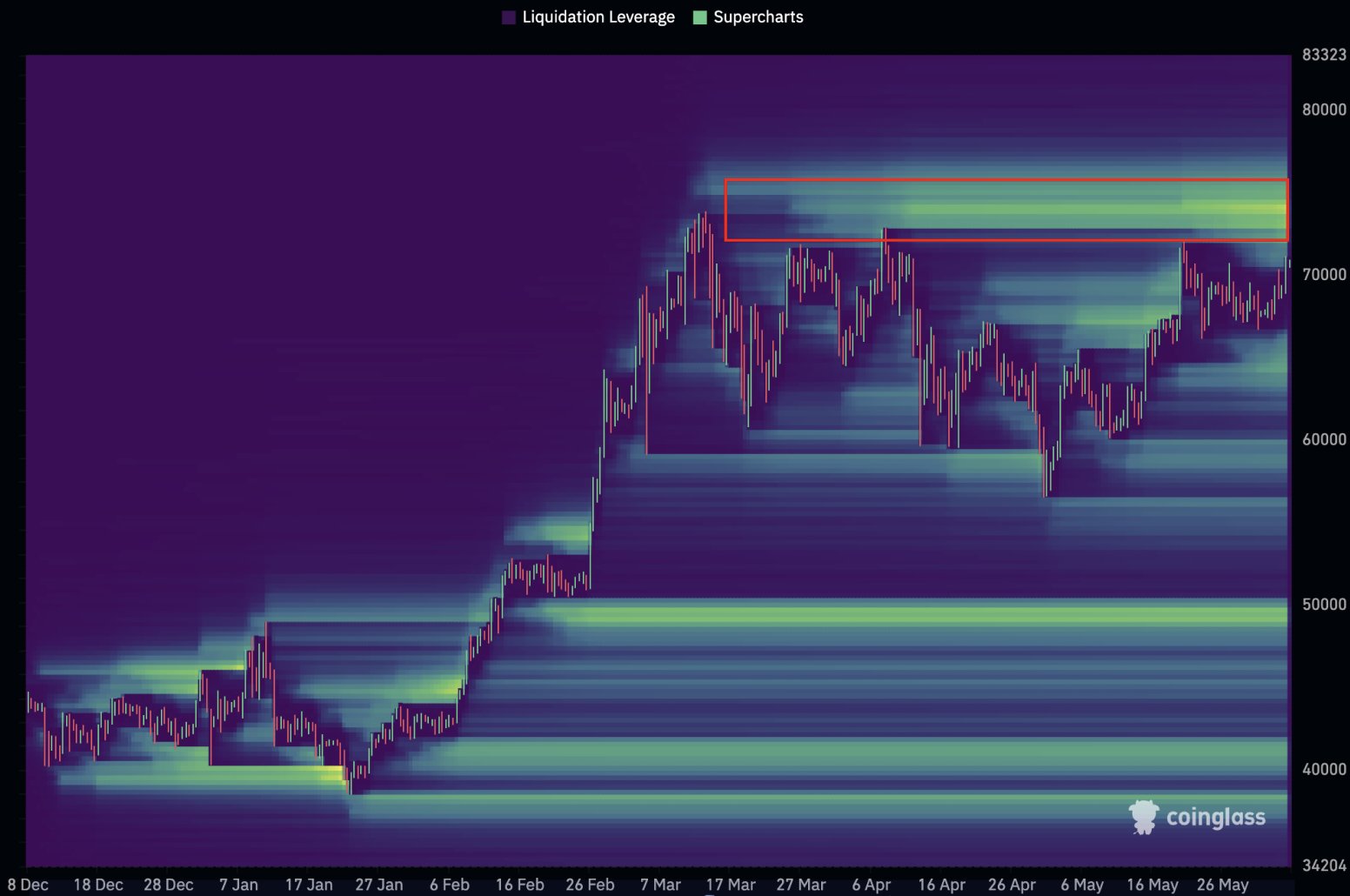

Furthermore, it’s essential to notice that the value increase was not driven by the liquidation of short positions within the BTC futures market, which saw only $27.58 million in shorts liquidated within the last 24 hours, in accordance with Coinglass data.

Nevertheless, Willy Woo, a renowned on-chain analyst, warned that a continued rise could trigger a major short squeeze. Woo said via X, “Tapping 72k is the fuse that’s set to begin a liquidation cascade. $1.5b of short positions able to be liquidated all the best way as much as $75k and a latest all time high.”

Bitcoin Liquidation Heatmap | Source: X @woonomic

Bitcoin Liquidation Heatmap | Source: X @woonomic

At press time, BTC traded at $71,075.

Bitcoin price surpasses $71,000, 1-day chart | Source: BTCUSD on TradingView.com

Bitcoin price surpasses $71,000, 1-day chart | Source: BTCUSD on TradingView.com

Featured image created with DALL·E, chart from TradingView.com