Crypto investors are keeping a detailed eye on Ripple (XRP) as technical indicators paint a concerning picture for the altcoin’s price. After closing below its 20-day exponential moving average (EMA) for 4 consecutive days, XRP has entered what many analysts interpret as a bearish zone.

Related Reading

This technical indicator suggests a possible shift in market sentiment, with the common price of XRP over the past 20 days acting as a resistance level. With the present price trading below this key benchmark, analysts fear a decline in demand might be imminent.

On the time of writing, XRP was trading at $0.52, down 0.3% and three.1% within the last 24 hours and 7 days, respectively, data from Coingecko shows.

Demand For XRP Loses Steam

Adding fuel to the bearish fire are XRP’s momentum indicators, which offer insights into the strength and direction of price movements. Each the Relative Strength Index (RSI) and Money Flow Index (MFI) are currently positioned below their neutral points. This means that purchasing pressure behind XRP is waning, with investors potentially seeking to offload their holdings reasonably than accumulate more.

Source: Santiment

Further dampening the mood is a major drop in XRP’s lively on-chain addresses. In keeping with data from Santiment, the variety of day by day lively addresses on the XRP network has cratered by 30% over the past month. This decline is usually seen as a precursor to a price slump, because it indicates a decrease in overall network activity and user engagement.

Profit Amidst The Gloom?

Nevertheless, there are some glimmers of hope for XRP bulls. An interesting data point reveals that day by day traders are still managing to show a profit. An evaluation of XRP’s day by day transaction volume in profit in comparison with loss shows that for each transaction ending in a loss, 1.16 transactions yield profits. This means that despite the general bearish sentiment, short-term trading opportunities might exist for expert investors who can capitalize on market volatility.

XRP market cap currently at $28 billion. Chart: TradingView.com

MVRV Ratio Offers A Different Perspective

One other factor that would entice some investors is the negative Market Value to Realised Value (MVRV) ratio for XRP. This metric essentially compares the present market price of XRP with the common price at which all XRP tokens were acquired.

A negative MVRV ratio suggests that XRP is currently undervalued, potentially presenting a buying opportunity for investors in search of assets trading below their historical price points.

Related Reading

XRP Price Forecast

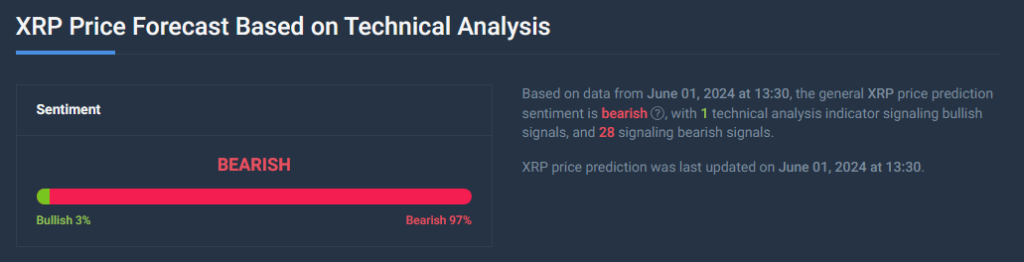

Meanwhile, the present XRP price prediction indicates a 20% rise to $0.626627 by July 1, 2024, despite a bearish market sentiment reflected by technical indicators. The Fear & Greed Index at 72 shows high investor greed, suggesting strong buying behavior but additionally a risk of overbought conditions and potential price corrections if sentiment shifts.

Source: CoinCodex

Source: CoinCodex

During the last 30 days, XRP has had almost an equal variety of days with price increases (47%). This shows a balance between buying and selling pressures.

The value has fluctuated by 2%, indicating mostly stable but noticeable changes. This balance suggests the market is regular, contributing to the present bearish outlook despite a positive long-term price prediction.

Featured image from Verywell Mind, chart from TradingView