That is one setup you’ll be able to look to trade the triple top pattern.

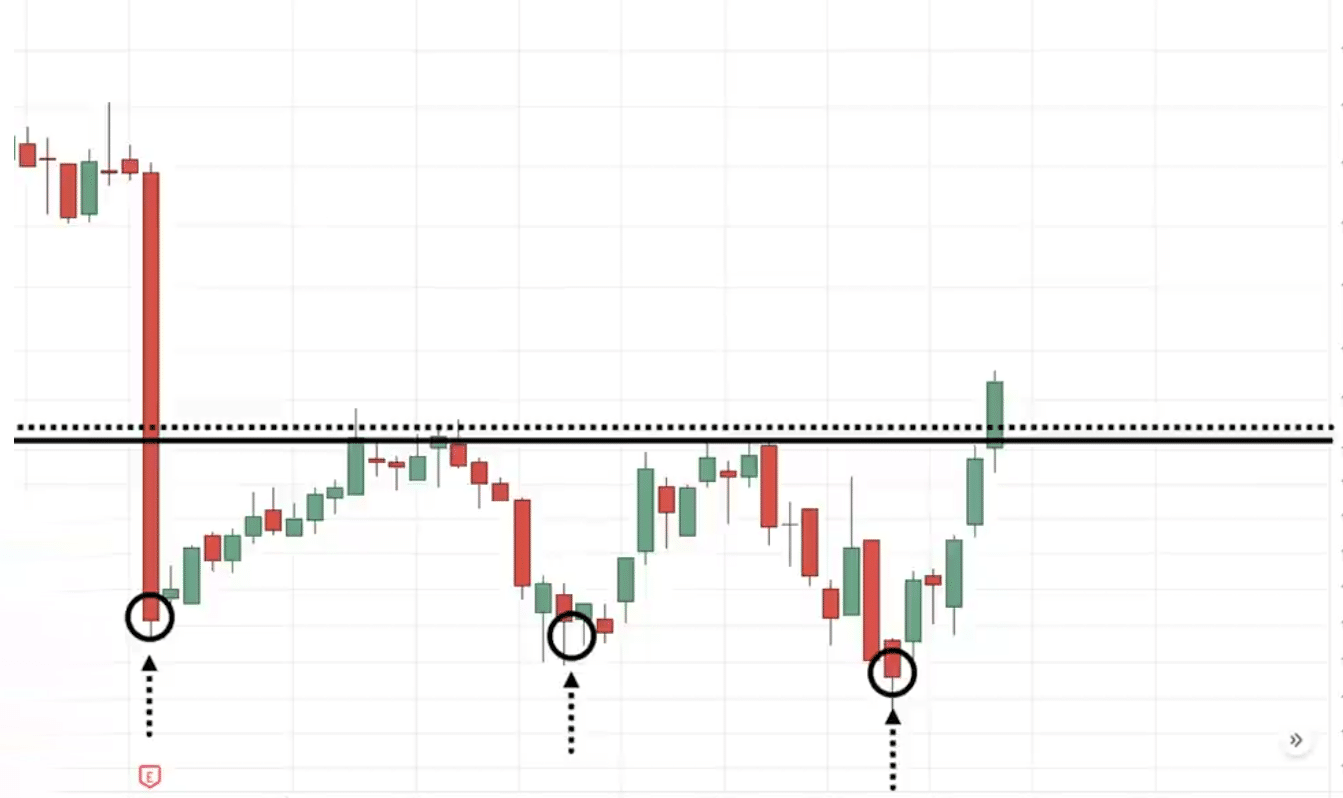

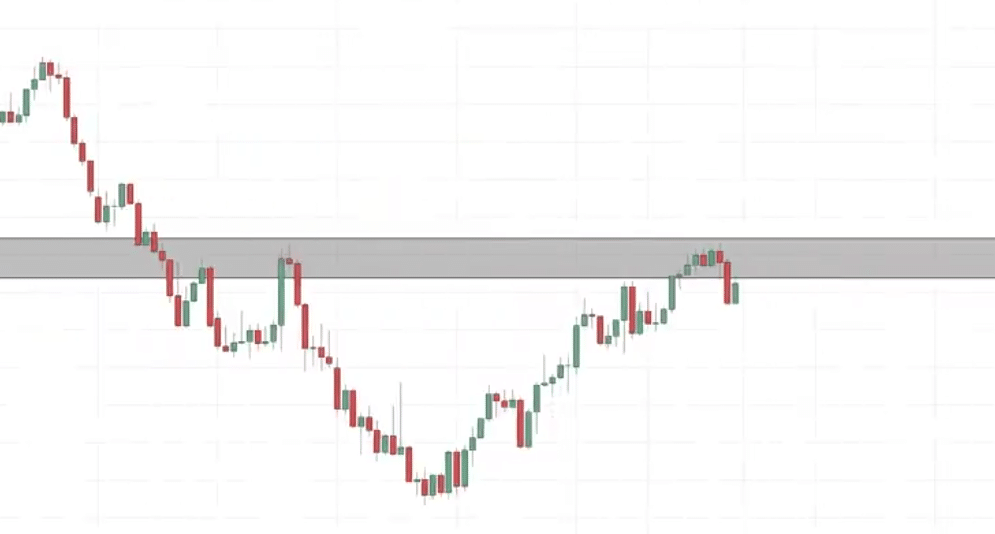

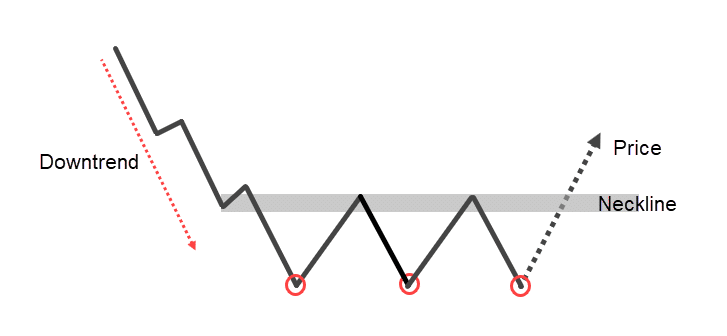

Triple Bottom Chart Pattern

It’s best to know what to anticipate…

This can be a bullish reversal pattern.

The market is in a downtrend then it makes a low, bounces up higher, comes down and retests the lows, bounces up higher retests the lows once more.

Considering it will break.

The sellers thought…

“Hey, that is our time, It’s victory”

Guess what?

The market bounces up higher after which they fail to take the worth lower.

At this point, you have got to attend for what we call the neckline.

If the worth breaks above the neckline, that is where we are saying the triple bottom pattern is confirmed and the market could head up higher.

Chart Example:

You notice how cute these three bounces are. The three attempts to drive the worth down however the market refused.

What’s that telling you?

If it will probably’t go down then it probably should go up higher.

How will you trade the triple bottom pattern?

You should utilize the break and retest, the first pullback.

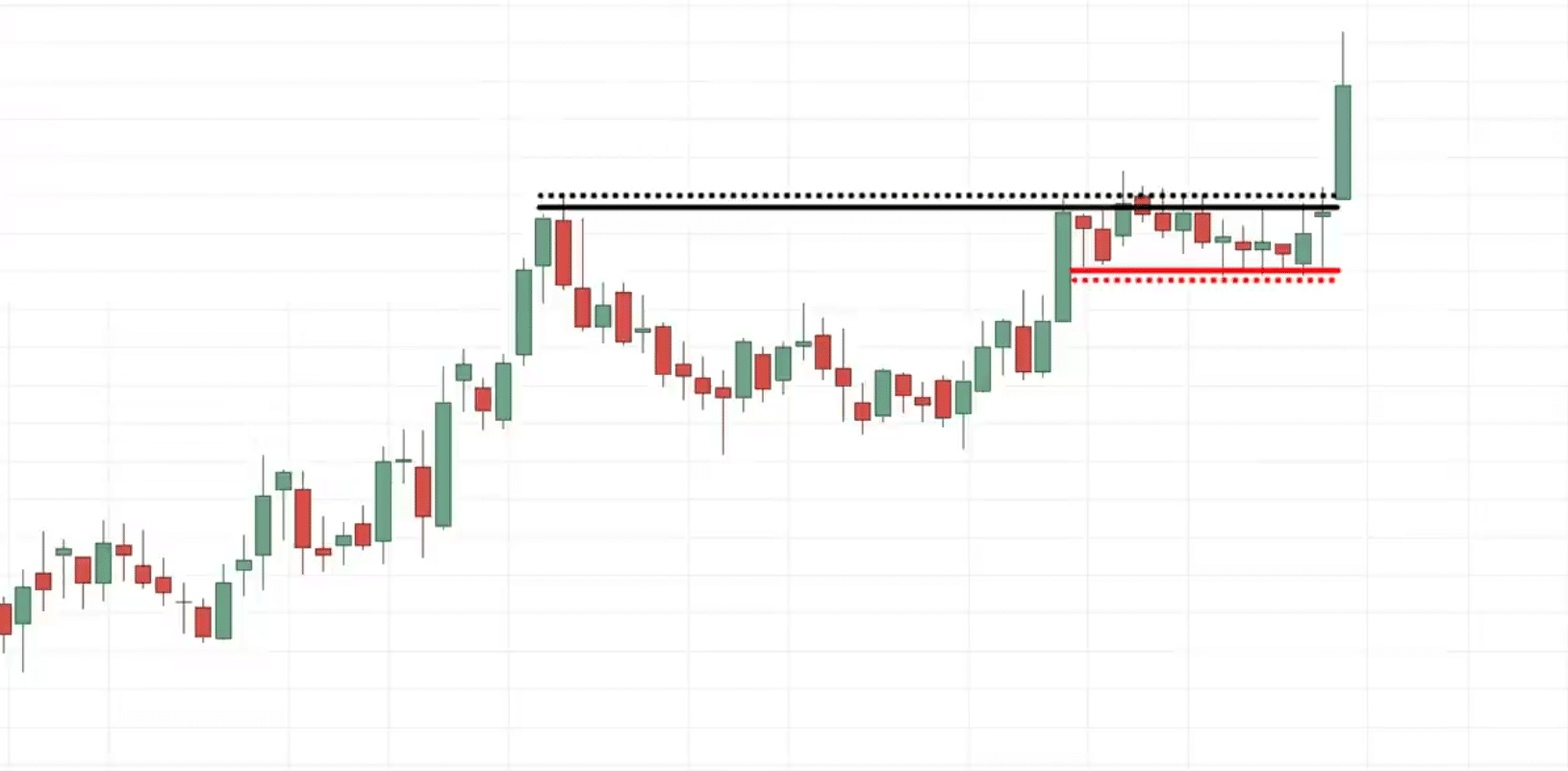

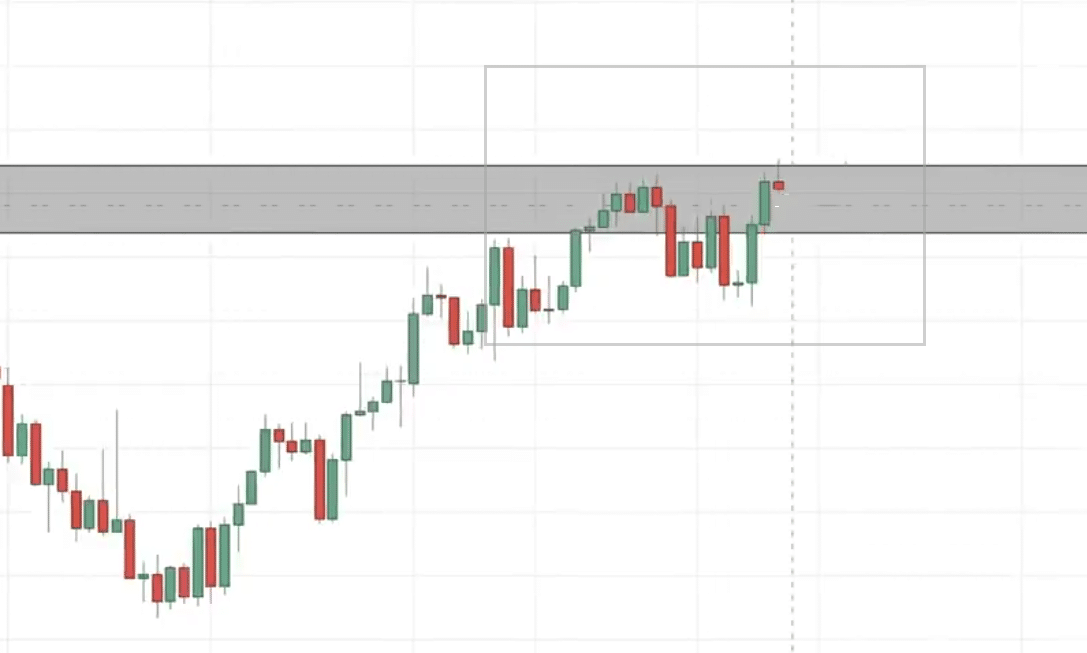

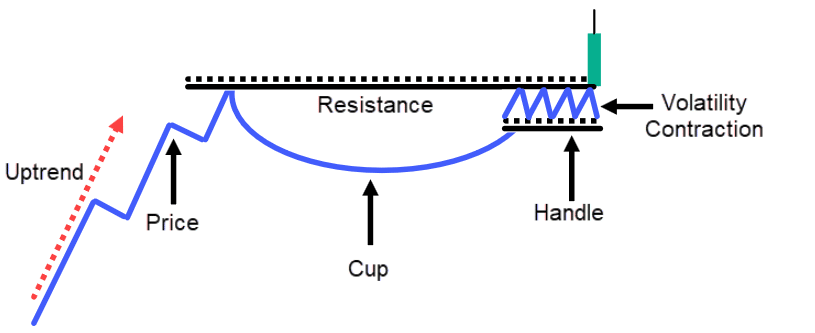

Cup and Handle Chart Pattern

This can be a bullish trend continuation pattern.

The market is in an uptrend. goes up higher makes a pullback, goes up higher makes a pullback goes up higher.

This time, once you see a cup and handle pattern forming, you’ll notice that the pullback is for much longer when it comes to duration in comparison with the sooner pullback.

Then it starts to consolidate barely.

The market remains to be bullish.

Sellers couldn’t push the worth any lower. It has difficulty breaking the swing low

This tells you that the general market remains to be bullish after which at this point you’ll be able to draw the world of resistance or the neckline.

When the market breaks above the world of resistance, we’ll say that the cup and handle pattern is formed, and the market is prone to proceed up higher.

Chart Example:

You notice how the market is in an uptrend, makes a pullback, and goes up.

This time you notice the duration is for much longer in comparison with the previous pullback, then it tried to interrupt out of the high but couldn’t.

As a substitute, it formed a consolidation, and when the worth breaks above the high, that is where we are saying the cup and handle patterns are complete and the market could go up higher.

How do you trade the cup and handle pattern?

You may trade this through the use of the break and retest or the primary pullback.

But one other way you’ll be able to trade it’s…

Notice how tight the consolidation is for this cup and handle pattern.

What you’ll be able to do is that once you notice the handle may be very nice and tight. That is what we call a volatility contraction.

It’s also referred to as build-up.

Where the buyers and sellers are in equilibrium storing potential energy to make the following move.

Since you understand the direction of the trend you most likely wish to be within the direction of the trend.

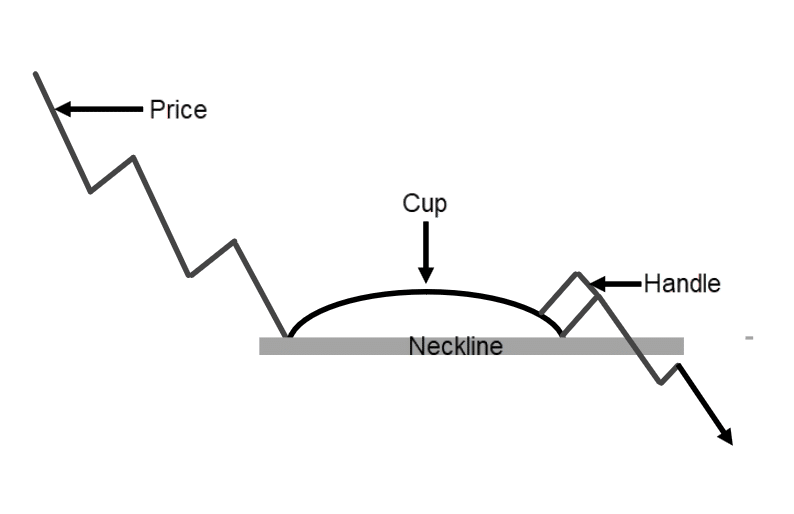

Inverted cup and handle pattern

This can be a bearish trend continuation chart pattern.

The market is in a downtrend. It hits lower after which makes a pullback, this time across the pullback is longer than the preceding pullback.

It makes one other pullback, it’s so weak that it couldn’t even take out this previous swing high

At this point, you have got what we call a neckline or an area of support.

If the market comes down lower and breaks below these lows of support, you’ll be able to expect the worth to hit lower.

Chart Example:

Imagine a cup and handle without consolidation, the following logical place to set your stop loss could be on the swing high which goes to be large.

But a consolidation gives you a relevant place to set a decent stop loss, which offers you a good risk to reward on the trade.

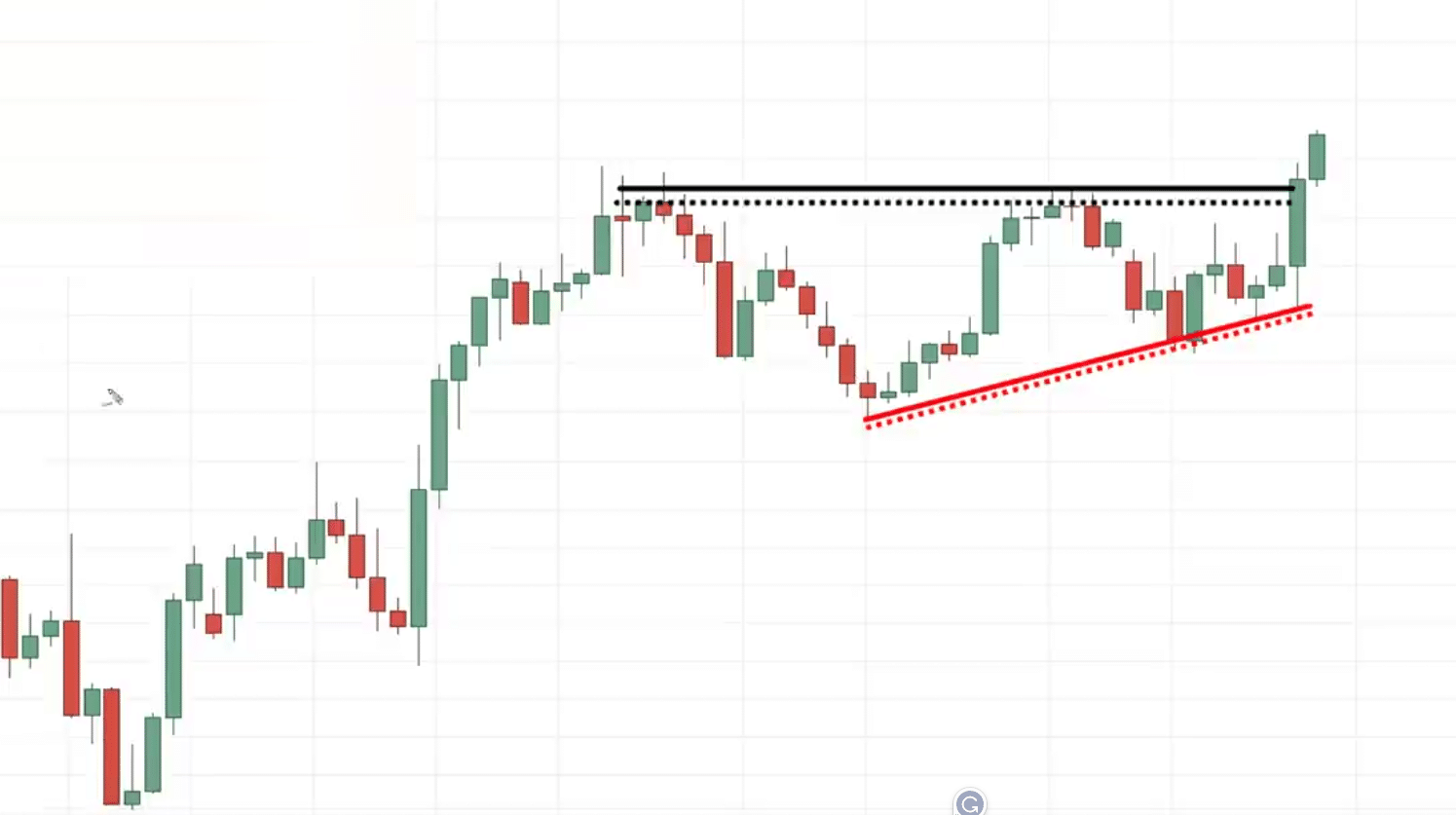

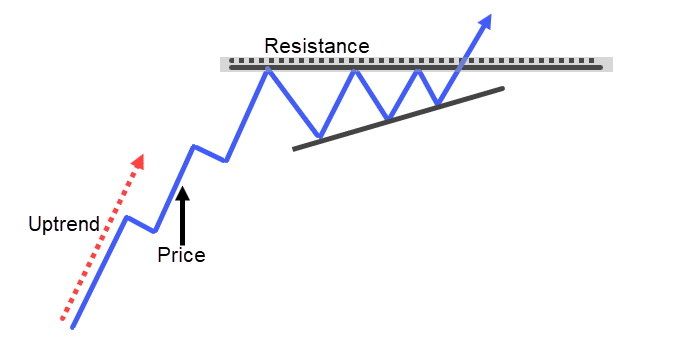

Ascending Triangle Pattern

That is one among my favorite chart patterns to trade since it’s a bullish trend continuation chart pattern.

I find that it’s probably the most powerful ones to trade.

The psychology behind this pattern is just so significant.

How the Ascending Triangle Pattern works

The market is in an uptrend, goes up higher makes a pullback, then it starts to go up higher again but fails to accomplish that then makes one other pullback.

What’s interesting is that this pullback, now didn’t take out these lows.

At this point, you have got what we call an area of resistance and sometimes we may need one other smaller pullback before the worth breaks out higher.

When it breaks out, that is what we call an ascending triangle chart.

To me is an indication of strength since it tells you that…

“The buyers are willing to fight to final for each inch attempting to push the market up higher”

You may see the client is attempting to push the worth up higher even in front of resistance, they’re still willing to purchase at these higher prices.

Why would people wish to buy in front of resistance?

Probably because they expect higher prices to come back, that’s why you’re willing to purchase in front of resistance because you’re thinking that that the market is prone to break out.

Before it breaks out, you quickly get on board.

This can be a sign of strength.

Imagine someone shorts at resistance, where will your stop loss be?

Probably your stop loss goes to be above the best of resistance.

That’s what most gurus will inform you to place your stop loss above resistance. Imagine when the worth breaks above the resistance, it’s going to hit this cluster of stop loss.

When it hits that cluster of stop loss, that is robust buying pressure to push the worth further up.

That is why I really like trading the ascending triangle chart pattern.

Chart Example:

How will you trade the ascending triangle chart pattern?

You may look to trade the retest the break and retest.

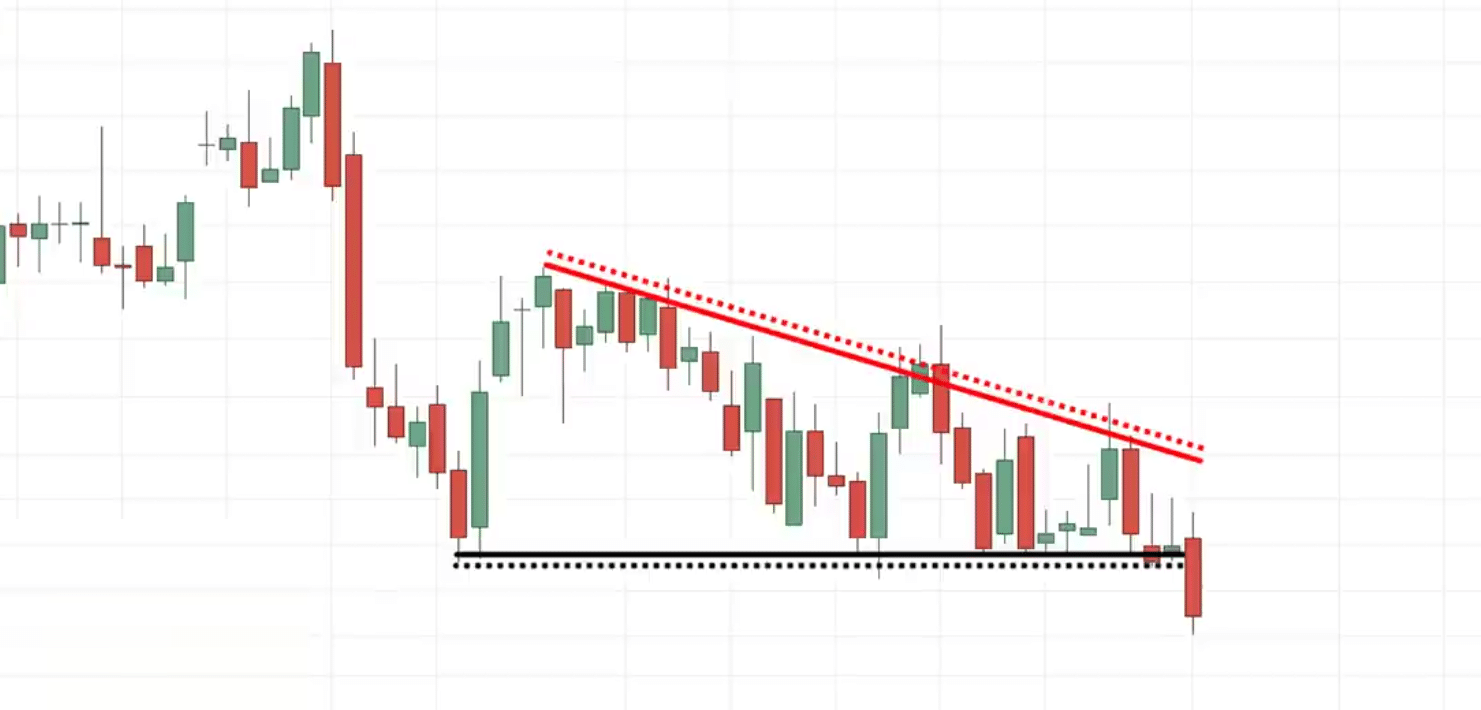

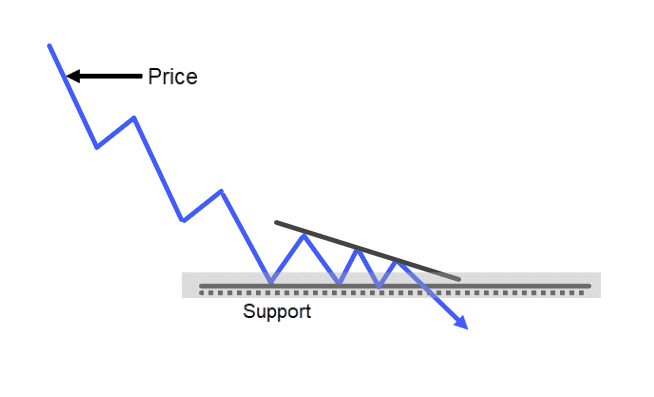

Descending Triangle Pattern

This can be a bearish trend continuation chart pattern.

It’s just the inverse of the sooner one.

Chart Example

How will you trade the descending triangle chart pattern?

You should utilize the break and retest strategy as shared earlier or the primary pullback strategy

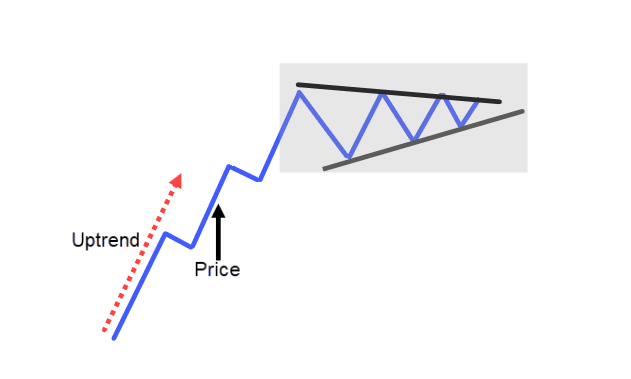

Bullish Pennant chart pattern

This can be a bullish trend continuation pattern.

The market is in an uptrend, goes up makes a pullback but can’t break out of the highs. You may see that the volatility of the market is shrinking in the event you just connect the lines

This looks like a smaller asymmetrical triangle pattern.

This sort of price motion tells you that the volatility of the market is getting smaller.

As you understand the volatility available in the market is rarely constant. It moves from a period of high to low and vice versa.

That is what we call it bullish pennant.

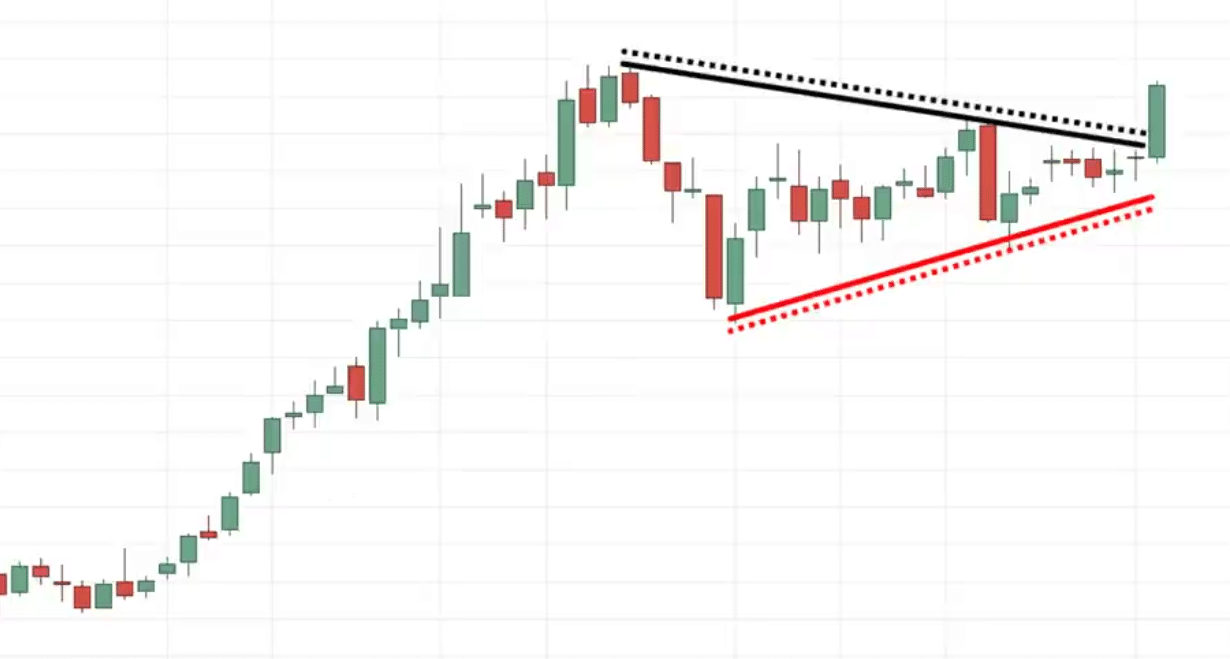

Chart Example:

Often, once you trade such trend continuation chart patterns it’s useful to trail your stop loss. You should utilize things like a moving average to trail your stop loss

You may hold that position until the worth breaks and shut below your moving average in order that’s one method to go about trailing your stop loss.

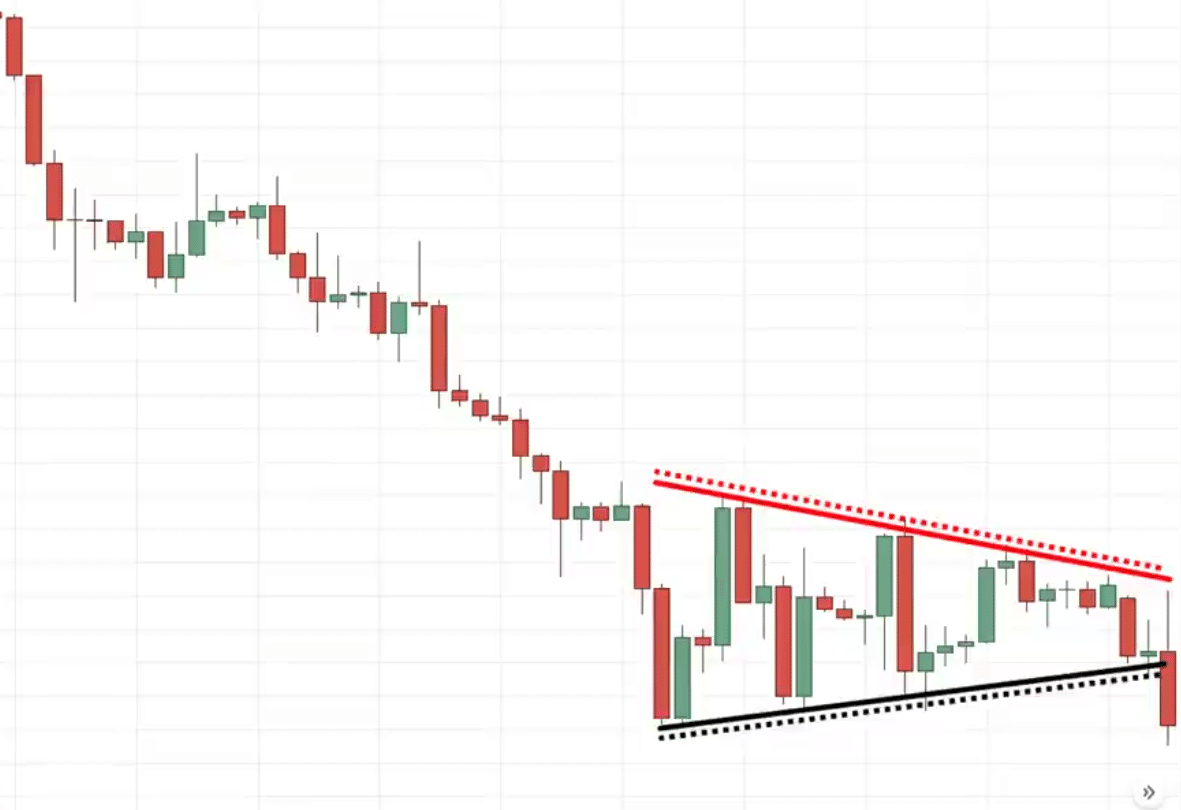

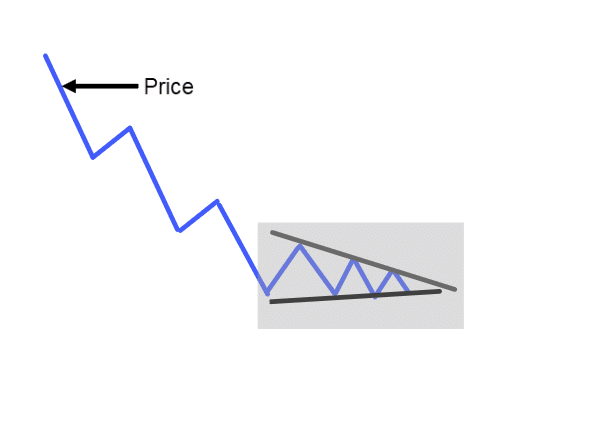

Bearish Pennant Chart Pattern

This can be a bearish trend continuation chart pattern.

The market is in a downtrend, goes down lower makes a pullback tries to move down lower but can’t break below the lows then pulls back up higher but again fails to interrupt out of the highs.

Then it hits down lower again and might’t take up the low before it makes a slight pullback which again fails to take out these highs after which goes down lower once more.

At this point, you’ll be able to connect the highs and the lows.

At this point, the volatility of the market is shrinking.

If the worth breaks and closes below, we’ll say that the bearish pennant is confirmed and the market could go down.

Chart Example

You would possibly hear me saying things like “could”

I’ll never say things like guaranteed, that doesn’t work in trading.

We’re coping with probabilities, never certainty.

Trading strategies for chart patterns

First on the strategy…

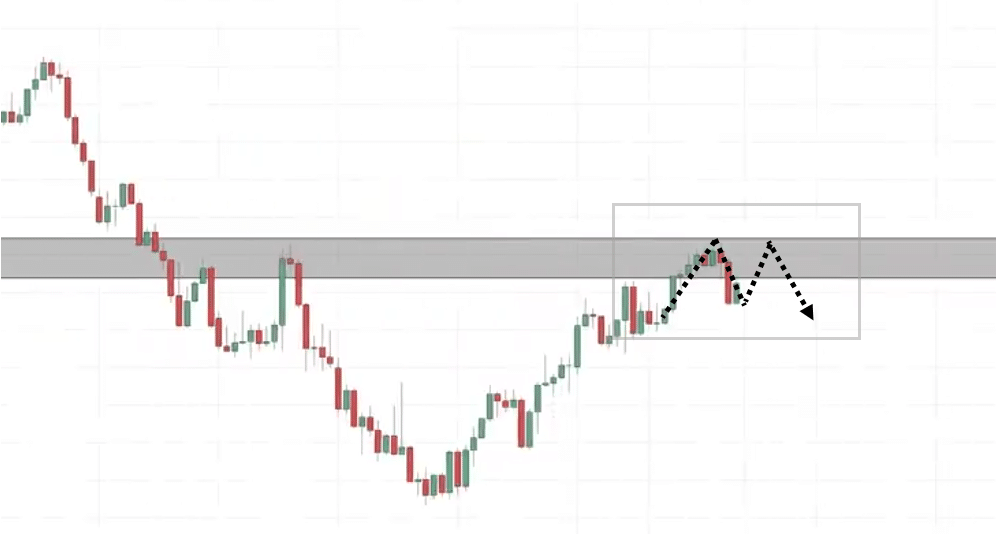

Double Top False Break

In case you recall earlier, I talked in regards to the double top chart pattern and there’s a method that you may use to enter your trade with low risk even before the worth breaks below the neckline.

How do you do it?

Let me explain in this instance…

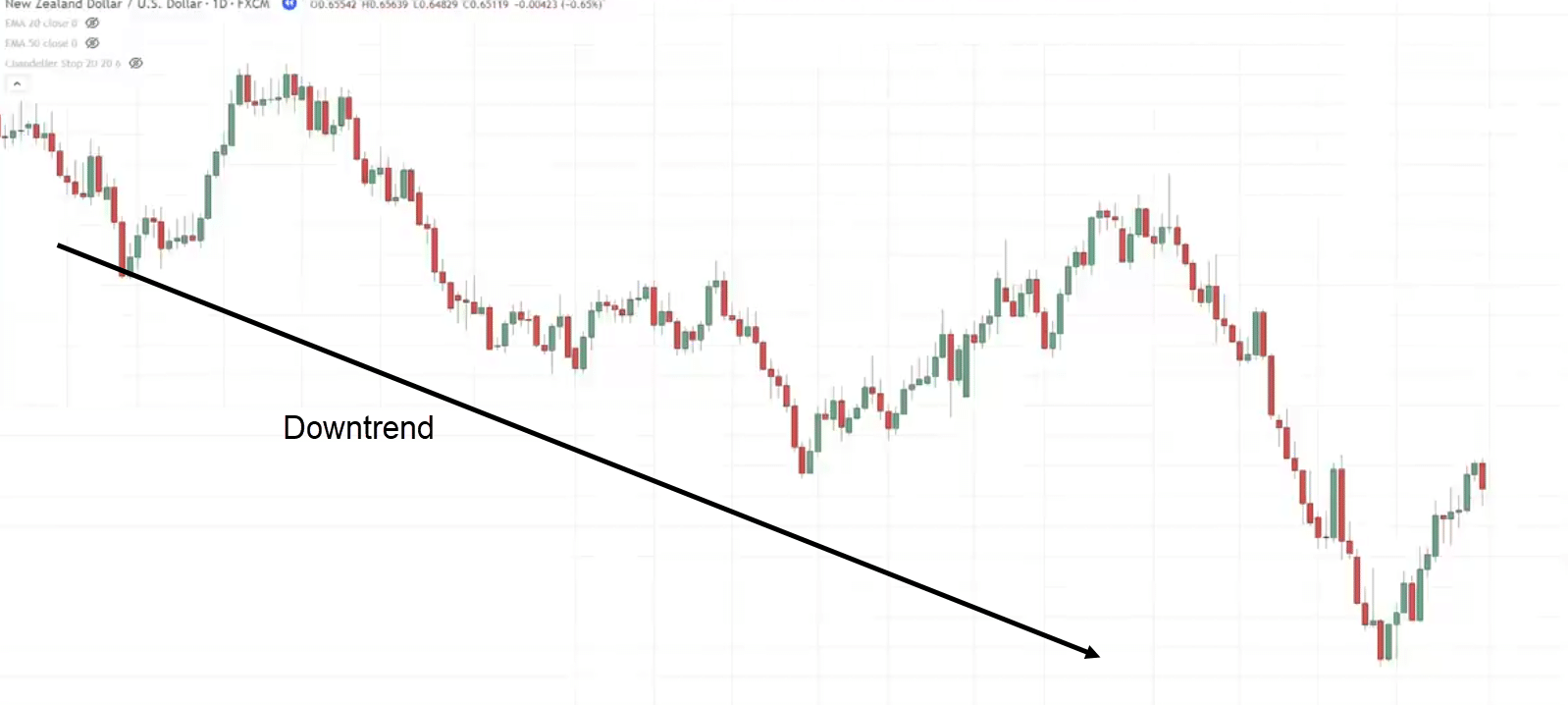

You may see that the general trend of this market is in a downtrend and what’s interesting is that this market has come towards an area of value.

In case you’re not accustomed to that term, it simply means areas on the chart where buying or selling pressure could are available in.

As you understand resistance is an area where selling pressure could are available in to push the worth lower.

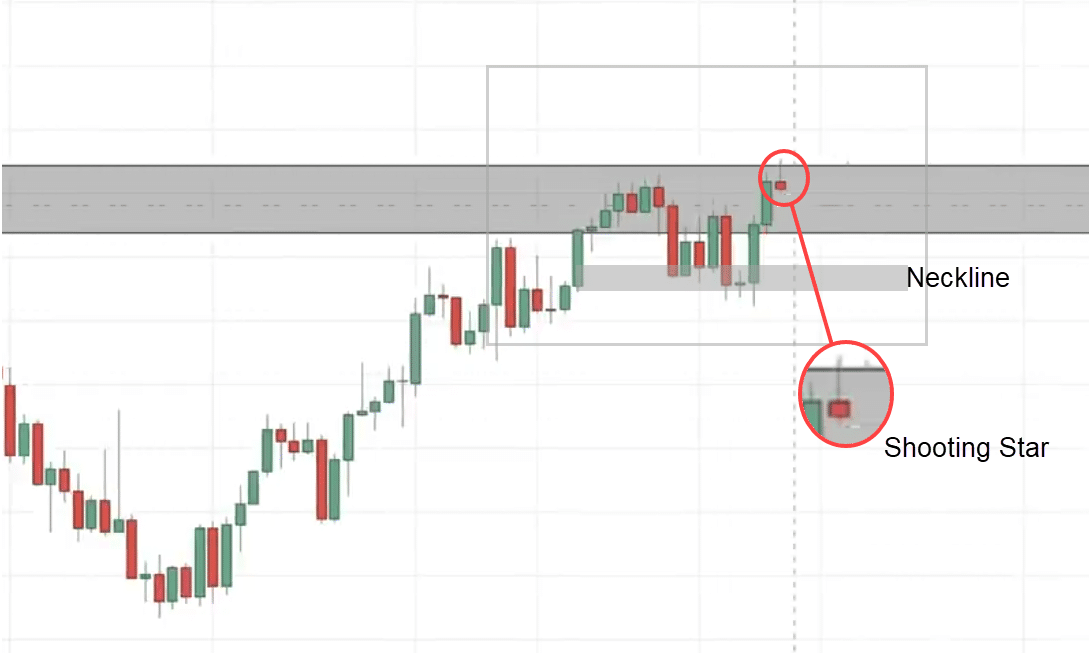

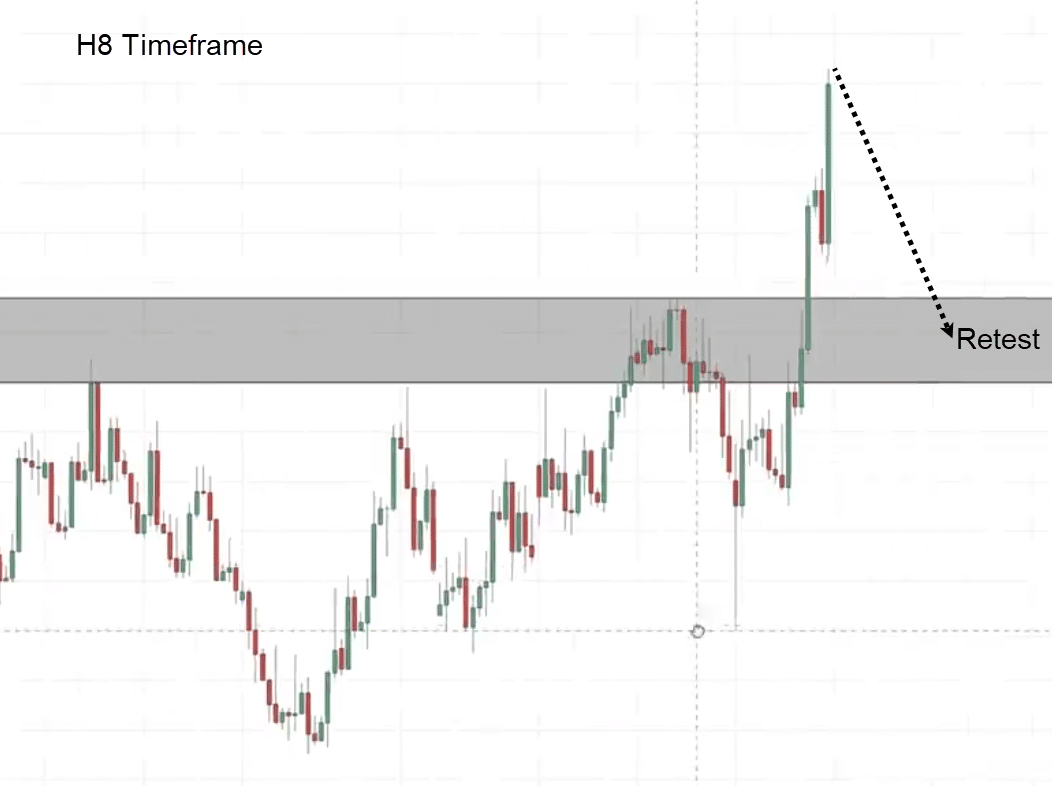

Once I see this on the each day timeframe, I would like to go right down to a lower timeframe just like the 8-hour timeframe, and search for this specific chart pattern.

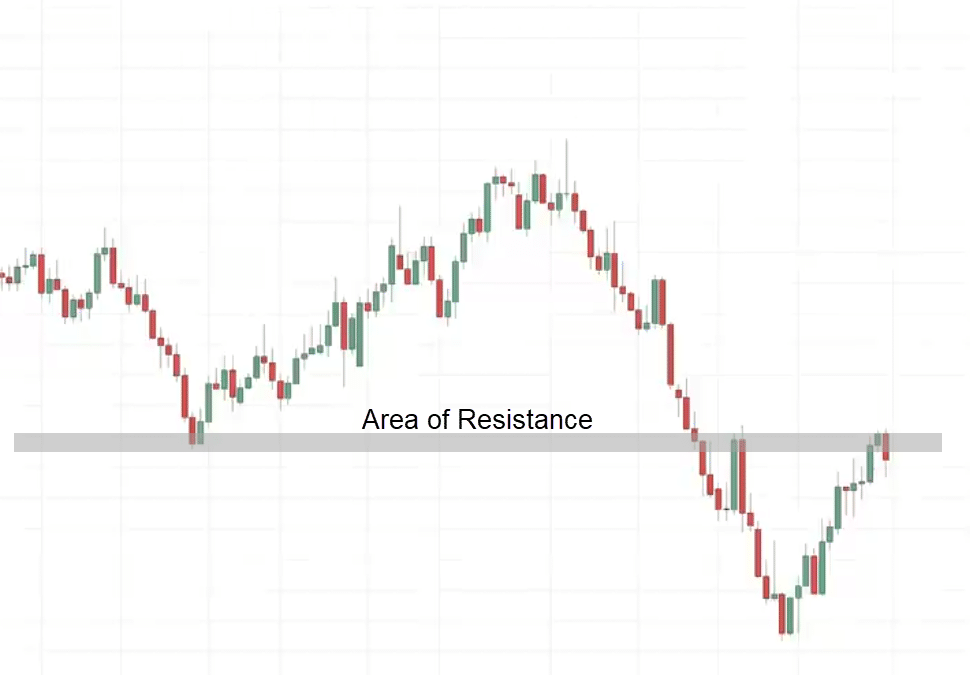

You see that this market is respecting this area of resistance

8-Hour Timeframe:

In case you take a look at probably the most recent price motion, what do you see?

You will note that it’s a bit too early. Half of the double-top pattern is already being formed.

We could get one other one coming.

What we’re searching for is the second portion to form to indicate us a bearish price rejection.

Let’s see what happens…

On this case, the market goes down and starts to rally higher.

We’re back on the highs again.

The double-top pattern is near completion.

That is valid provided that it breaks below the neckline. That is what I mean:

But since we’ve quite a few aspects working in our favor…

Is it possible to enter the trade before the worth reaches the neckline?

Yes.

How do you do this?

the general market on the each day timeframe, it’s in a downtrend and that is an area of resistance that I actually have highlighted.

You may see we’ve an entry trigger referred to as the shooting star. Telling you that the sellers are stepping in and about to push the worth lower.

That is an entry trigger to go short.

What you’ll be able to do is go short on the following candle open.

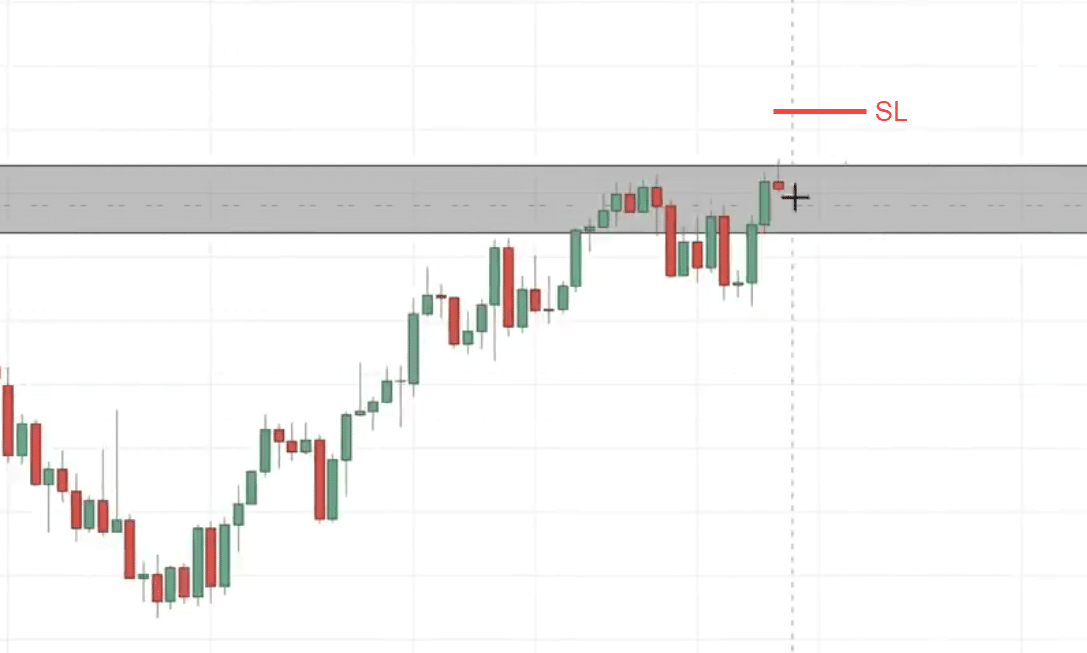

I set my stop loss a distance away from the worth structure. a distance away from the highs the gap away from resistance:

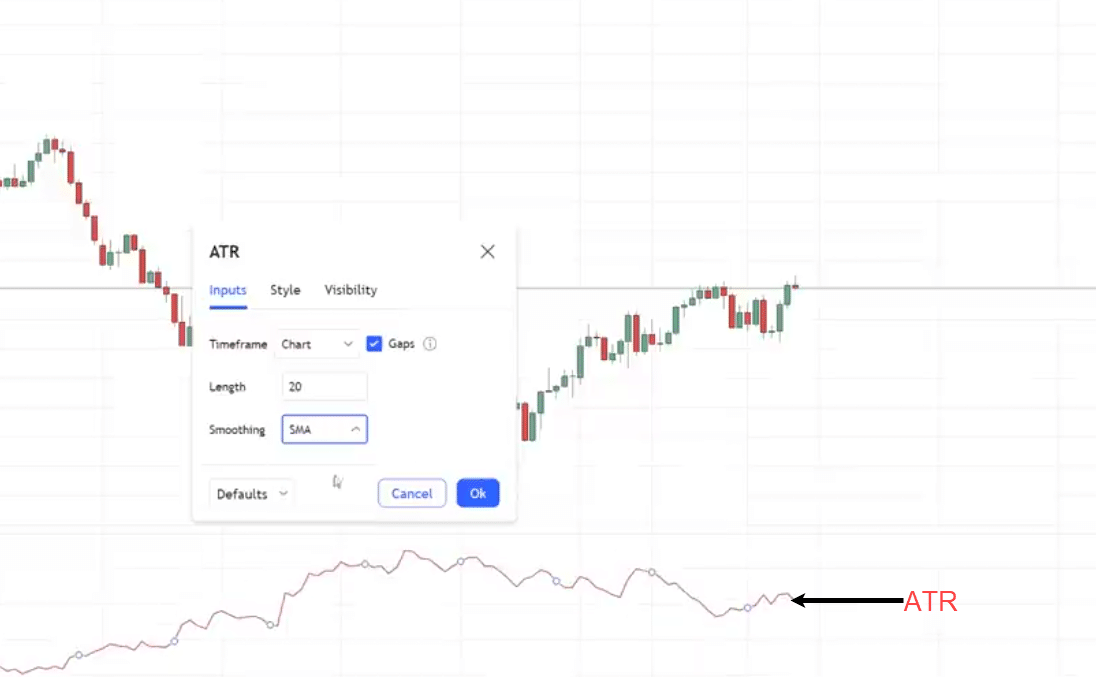

You should utilize an indicator called the common true range ATR

I wish to use a 20-period SMA for the ATR.

What about our goal?

Because you are actually trading even before the double top pattern is accomplished, you’ll be able to be in profit before the worth breaks below the neckline.

Here’s the thing in regards to the neckline…

Sometimes it’s not the perfect time to short the market because the worth breaks below the neckline.

In case you take into consideration this logically, the neckline is an area of support.

The value would re-test the neckline after which bounce up higher and proceed.

That would occur.

If you desire to be a little bit conservative, you’ll be able to have your goal on the neckline where people need to short the market in an uptrend.

You may take profit and exit half of your position.

Hopefully, this illustrates the facility of trading the double-top pattern.

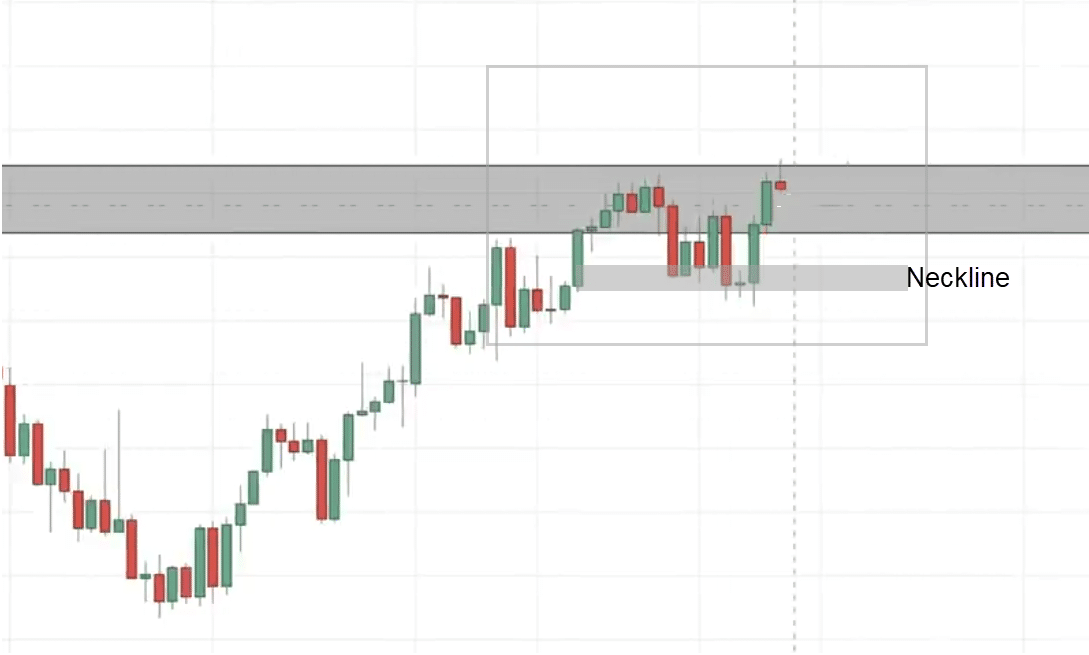

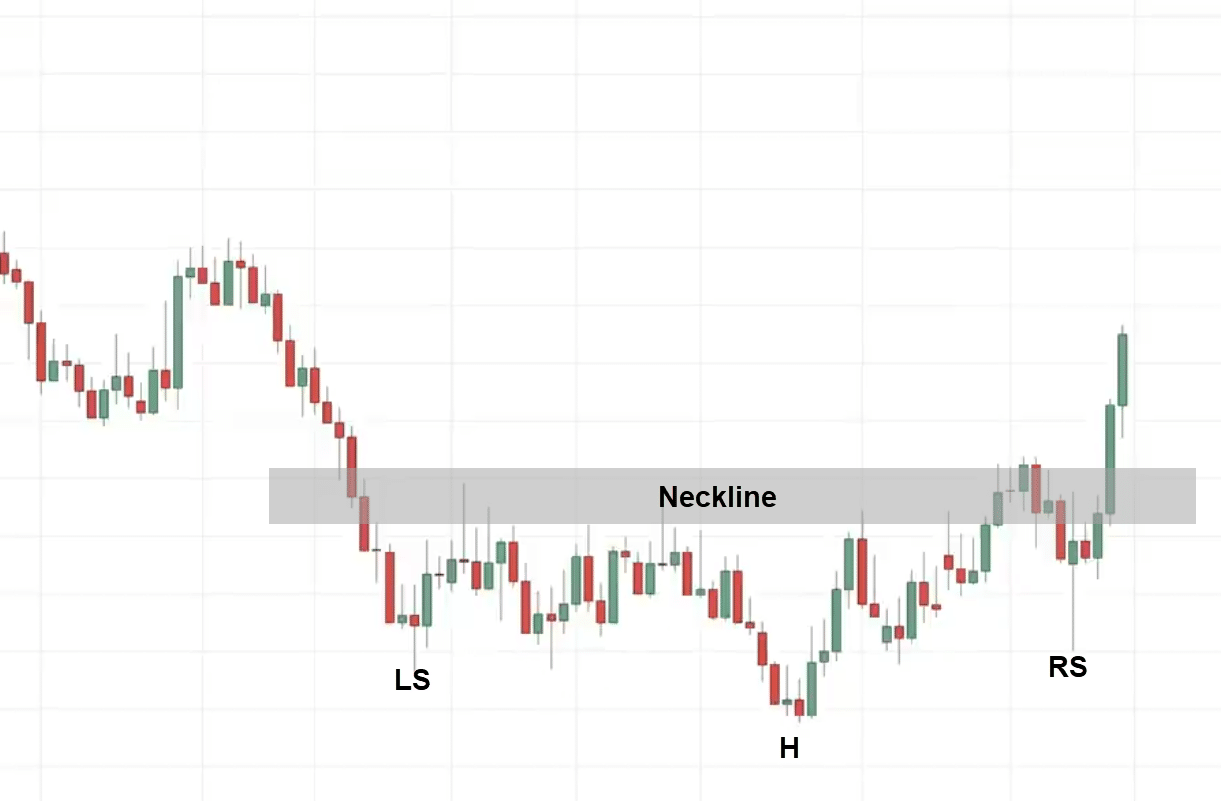

Inverse Head and Shoulders pattern

EURCAD Each day

We have now an inverse head and shoulder pattern, there’s a left and right shoulder and this is able to be the neckline.

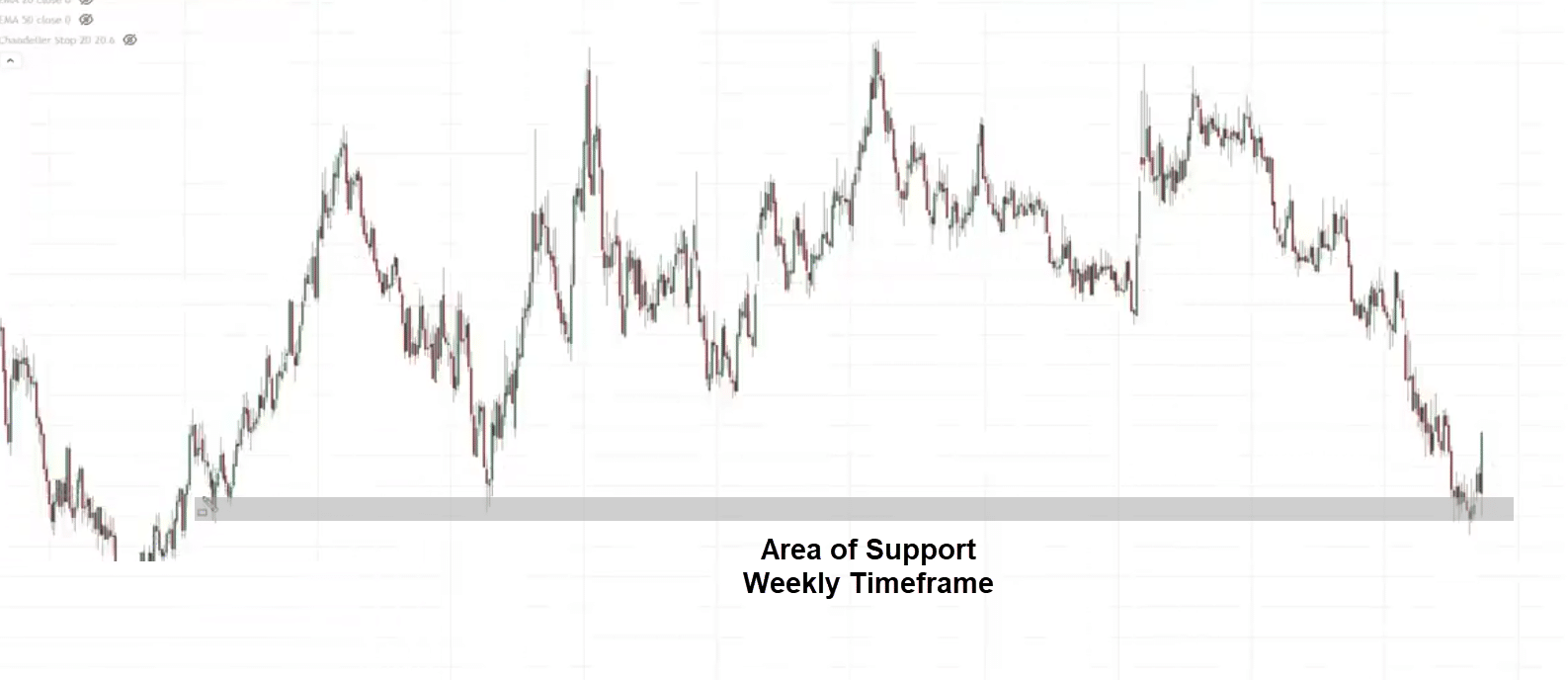

One thing I would like to spotlight is that, to know whether the market is prone to reverse or not, you desire to see where the reversal pattern has formed.

Is it leaning against any higher timeframe price structure?

Example

On the each day timeframe, in the event you take a look at the weekly timeframe you’ll notice that the inverse head and shoulder pattern leans on the areas of support on the weekly timeframe.

This is critical and may very well be the long-term reversal on a better timeframe.

Let’s learn the way can we get on board a trade with low risk to trade this reversal chart pattern.

Going back to the each day timeframe.

The following thing that you may do is that if you desire to discover a low-risk entry, you’ll be able to go right down to a lower timeframe just like the 8-hour timeframe, and search for an entry trigger to go long.

My game plan over here is that since I do know that is an area of value, The neckline could grow to be previous resistance which could grow to be support.

I’m searching for trading opportunities across the neckline.

What I’m pondering of is for the market to do a retest into this area, come back in, after which close back above it giving me an entry trigger to go long

The market appears to be breaking down, it retests the lows.

You need to be listening to this level because this can be a swing low and buyers could are available in to push the worth higher.

What we’re searching for is a rejection for the worth to shut bullishly above the lows signaling buying pressure is coming in and the market could go up higher nevertheless it failed.

The market broke lower:

Let’s see what happens next:

That is what I call a false break.

You may see that the market took out these lows making traders think that…

“That is going to be a breakdown”

This to me is an entry trigger to go long.

Here’s what I’ll do…

Let’s put it in green that’s our entry price point

Then as for our stop loss, we set at a distance below the lows using the ATR method I shared with you.

We will have our first goal just before the recent swing high.

What’s significant about this entry trigger is that once you trade this inverse head and shoulders pattern, you’re not just buying the breakout of this neckline.