Do you ever have that feeling where you possibly can see the direction of price movement on a chart but aren’t sure when to enter?

Perhaps you’ve seen a trade move exactly as predicted, but your timing left you on the sidelines?

Identifying key reversal areas and triggers is usually a challenge, right?

Well, there’s no must worry any longer.

I’ve got something to allow you to pinpoint your entries and make trades with confidence…

The Tweezer Bottom Pattern!

Here’s what you’ll learn in this text:

- A breakdown of the Tweezer Bottom Pattern, revealing the way it represents a shift in momentum.

- Profitable strategies for trading the Tweezer Bottom pattern in an already trending market.

- Techniques for capturing substantial profits using the Tweezer Bottom trend reversal strategy.

- What to do when your trade doesn’t go as planned.

- Common mistakes to avoid when trading the pattern, enhancing your success rate.

Sound good?

Great! Then let’s start!

What’s the Tweezer Bottom pattern?

The tweezer bottom pattern is a candlestick pattern that each trader must have of their toolbox.

It consists of two candlesticks with equal lows, one appearing immediately after the opposite.

The best technique to visualize the Tweezer Bottom is by pondering of it as a shift in momentum.

Let’s take a take a look at what I mean by this.

Short-term shift in momentum

All of it boils all the way down to the Tweezer Bottom pattern representing a big short-term change in momentum.

Let’s walk through an example of this momentum shift…

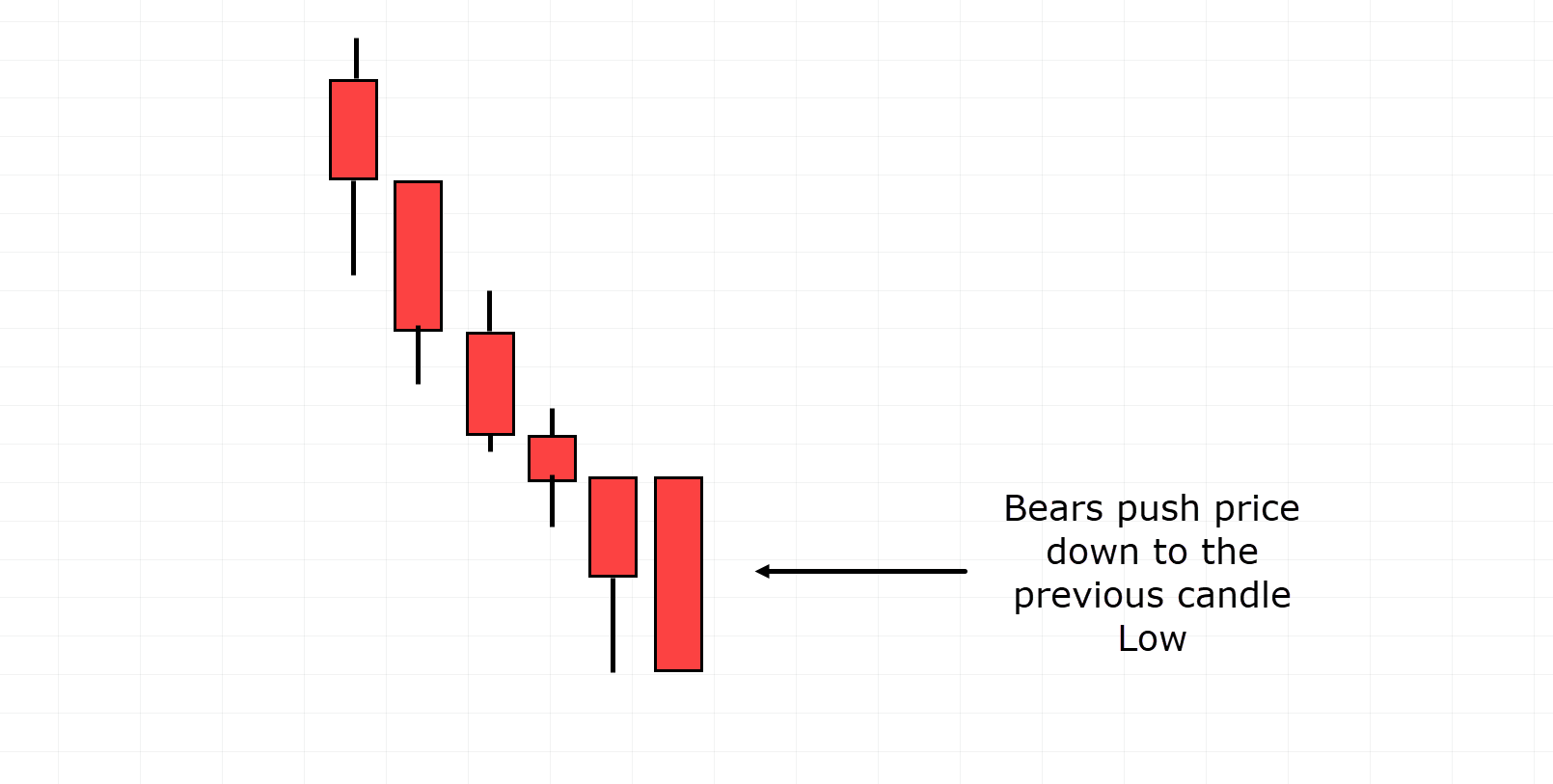

Shift In Momentum Example #1:

Price makes a powerful move down in a downtrend, forming a candle with a noticeable wick below.

This candlestick may be considered a hammer, showing clear rejection at this level.

Here’s one other example…

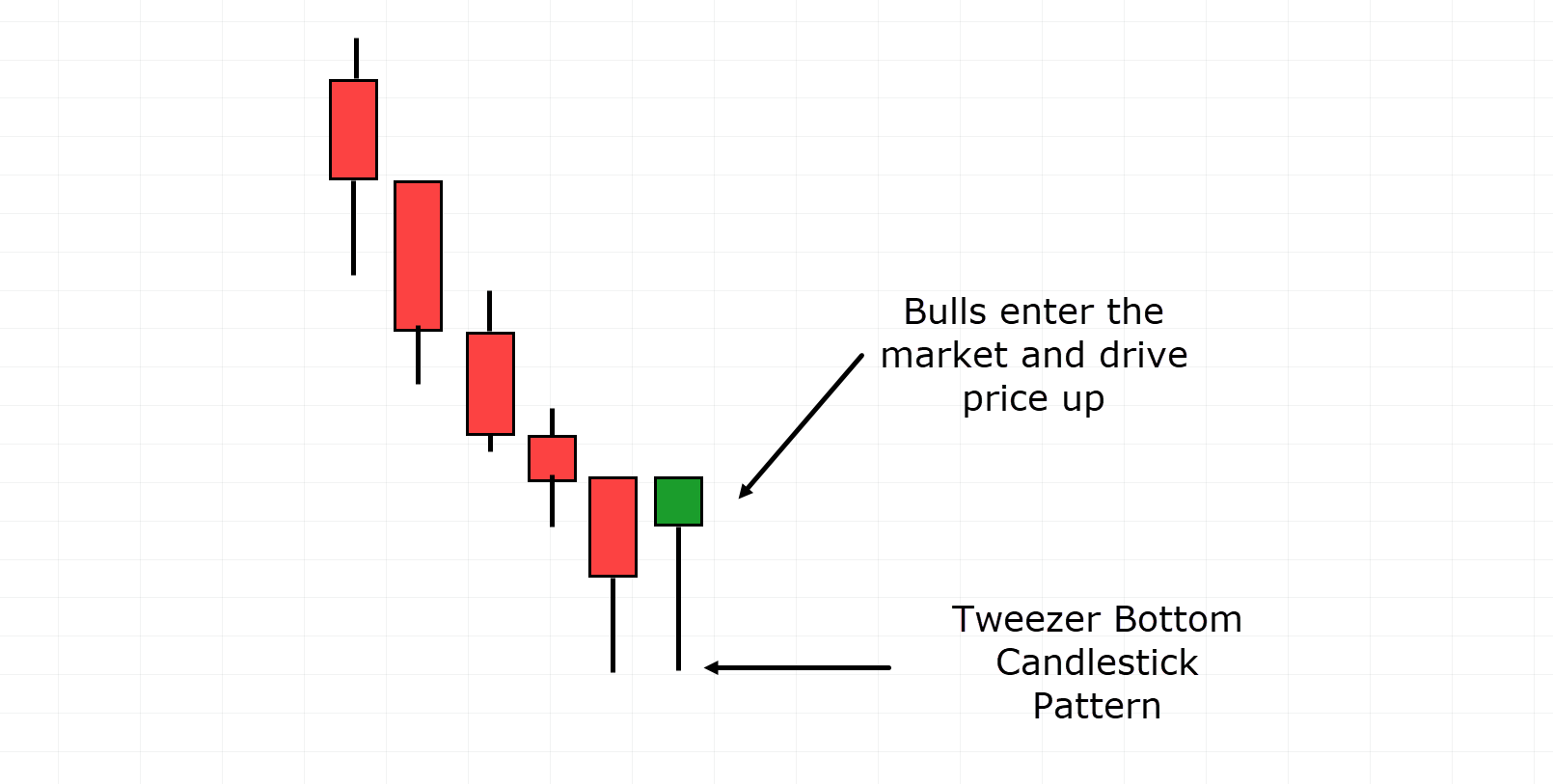

Shift In Momentum Example #2:

Throughout the next candle, bears try and move the value below the wick of the previous rejection candle.

Nonetheless, in its try and move below the wick, buyers step in and drive the value back up.

This forms the tweezer bottom candlestick pattern, indicating that bears did not push market prices lower on each occasions.

Let’s take a look at one other…

Shift In Momentum Example #3:

On this case, the bears have been unsuccessful in maintaining the bearish momentum.

Whether that is only a temporary pause in the general downtrend or not, one thing is clear—there was a momentum shift in each case.

Don’t forget that the Tweezer Bottom Pattern can are available all sizes and shapes, this is only one example of many, as illustrated within the variations diagram!

Nevertheless, momentum shifts provide invaluable insight into potential market reversals.

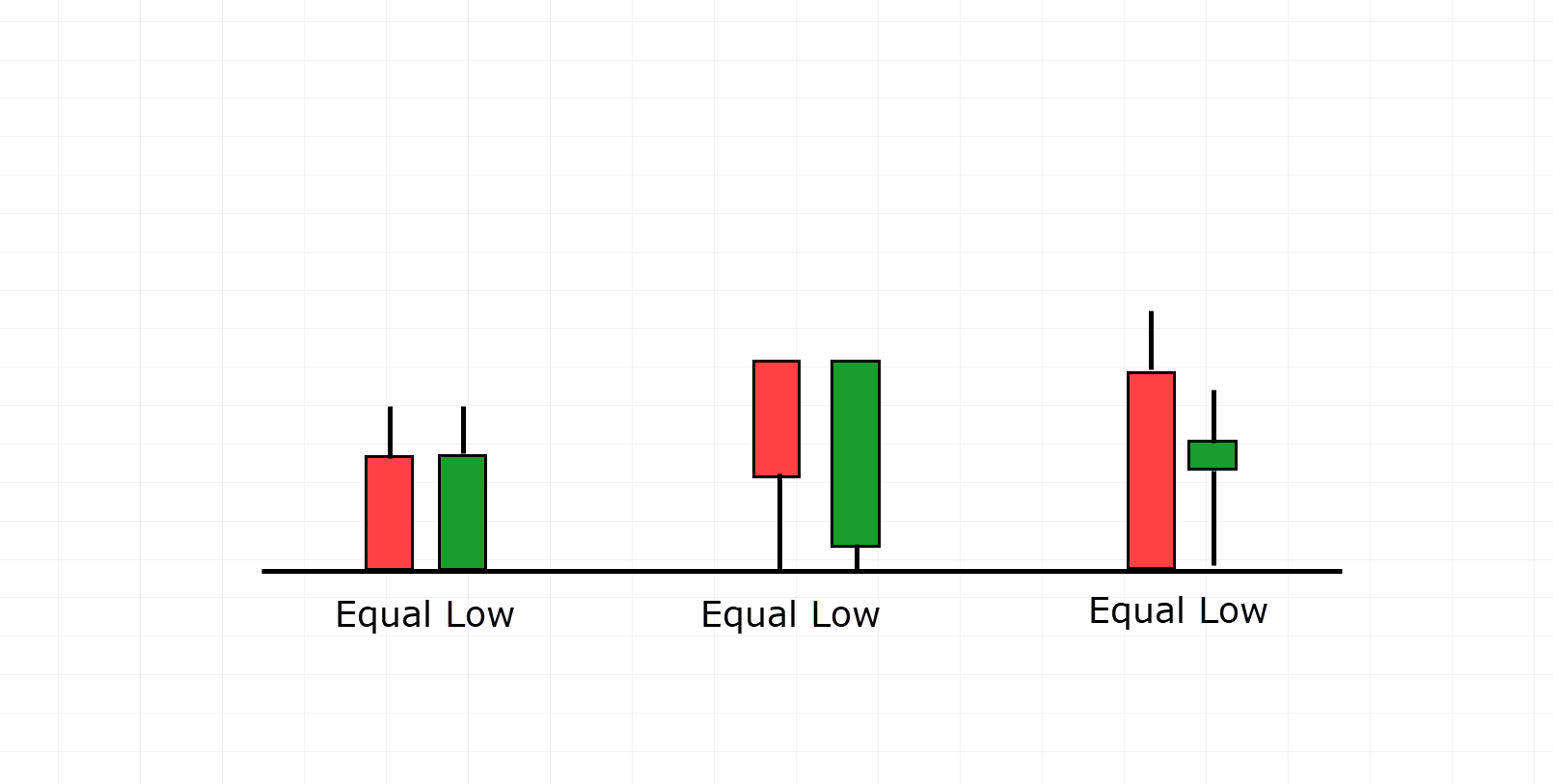

Tweezer Bottom Variations

It’s crucial to grasp that these candles can are available various sizes and shapes; what matters more is that the 2 lows of the candlesticks are the identical, or not less than very close!

Let’s take a look at some examples for instance my point…

Tweezer Bottom Variations:

Notice how these examples vary in shape and size, yet the lows of the candles are nearly equivalent.

These examples perfectly illustrate what I’m searching for when identifying the Tweezer Bottom Candlestick Pattern.

As a trader, I don’t want you to turn out to be excessively fixated on whether the lows are precisely the identical within the tweezer bottom. As an alternative, deal with the proven fact that they’ve very similar lows.

With that time clear, let’s delve into why this pattern is a invaluable tool.

How the Tweezer Bottom is Low TF Support

Let me ask you one other query:

What do you think that the Tweezer Bottom is definitely representing?

Well, in its simplest form, the Tweezer Bottom signifies a lower timeframe support level.

Let’s illustrate this on the charts.

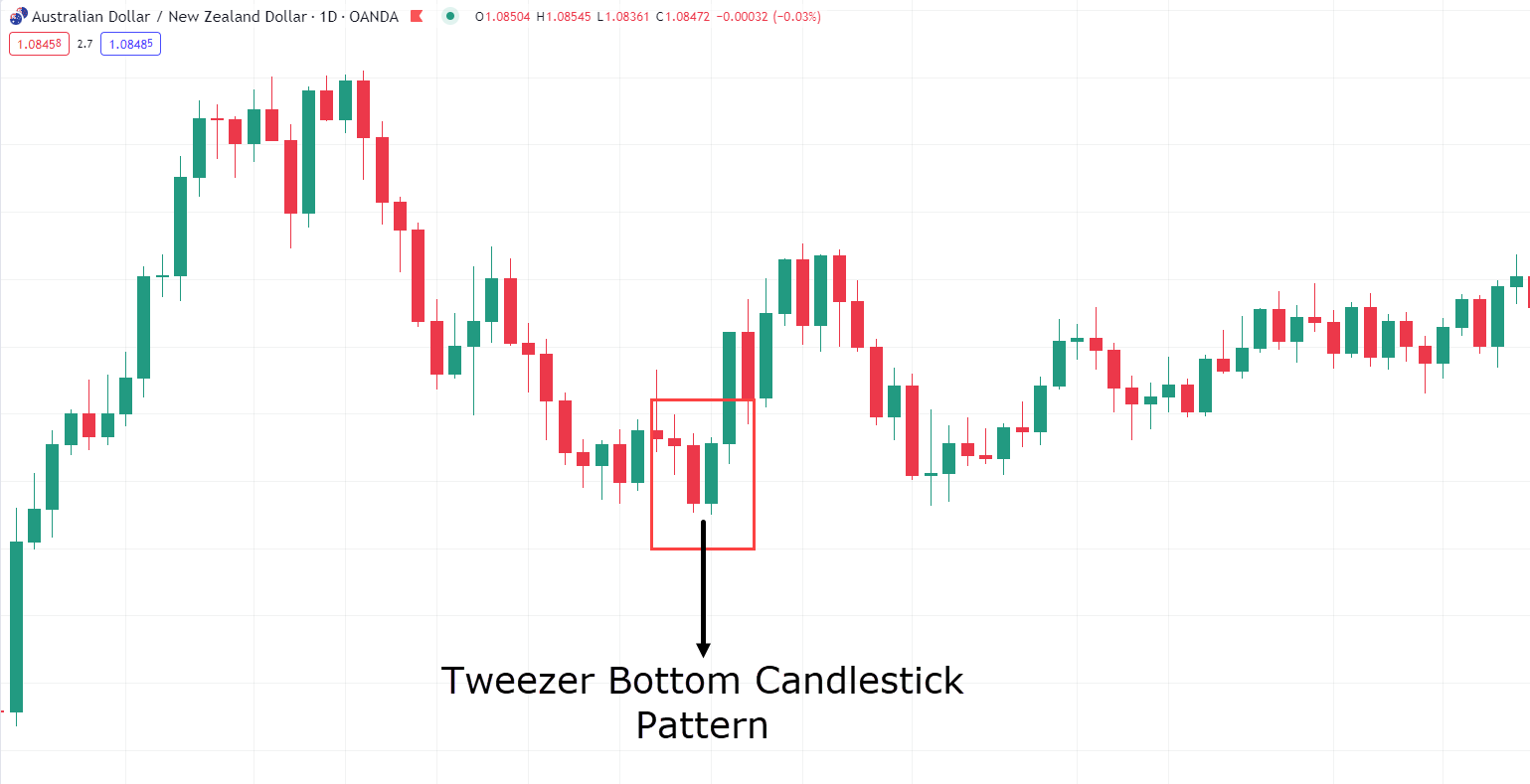

Take a take a look at this Day by day AUD/NZD chart…

AUD/NZD Day by day Chart Tweezer Bottom:

Clearly, a Tweezer Bottom Candlestick Pattern has formed on the chart.

Now, zoom in for a better look…

AUD/NZD 1-Hour Timeframe Chart Support Level:

On the 1-hour timeframe chart, you possibly can observe the formation of a support level. This candlestick arrangement resembles a double bottom.

Describing the Tweezer Bottom Candlestick pattern as a shift in momentum is fitting.

The Tweezer Bottom often pinpoints the ultimate point at which a support level was established on a lower timeframe when the value bounces.

If momentum continues, there’s an actual probability of catching the underside of a trend!

I’ll dive deeper into the small print of this later within the article.

Frequency

A notable advantage of the Tweezer Bottom is its regular occurrence in comparison with other candlestick pattern formations.

As you descend into lower timeframes, you’ll see it appear much more ceaselessly.

Nonetheless, it’s crucial to be mindful that I place a better value on signals from higher timeframes than those from lower timeframes.

Candle Strengths

Finally, the momentum behind the second candle can ceaselessly provide additional support on your trade setup.

For instance, if the value falls and forms two doji-like candles which might be indeed tweezer bottoms, the strength here could simply indicate a temporary pause before continuing downward.

Nonetheless, if the value falls to a zone, forms a hammer, after which forms a bullish engulfing candle because the follow-through, the probabilities of the bulls winning the battle for momentum increase dramatically!

Tweezer Bottom Pullback Strategy

So, how do I work out what I’m taking a look at?

Well, there are two major approaches I prefer to take when analyzing Tweezer Bottoms.

Firstly, I examine the Tweezer Bottom in a pullback scenario.

This involves searching for the tweezer bottom pattern in an uptrend when there are temporary pullbacks in price.

These are excellent trading opportunities as they will let you trade with the trend while providing extra confirmation that the value is able to proceed within the trend direction, having established support on the lower timeframe.

The second way I trade the Tweezer Bottom is as a reversal pattern for a bigger overall trend.

Although this approach tends to be on higher timeframes, identifying these areas on lower timeframes could be a particularly profitable exercise in capturing the shift in momentum for an extended timeframe.

Now, let’s explore the pullback scenarios first!…

AUD/JPY 1 Hour Timeframe Chart Example #1:

Here, you possibly can observe a typical uptrend on the 1-hour timeframe for the forex pair AUD/JPY.

In an uptrend, it’s common for the market to maneuver in a wave-like pattern as the value step by step climbs higher.

As you possibly can see, the value has formed a neighborhood support area, where the value then bounced and moved to form a better high.

The pullback into the support zone provides a wonderful opportunity to purchase at a greater price than simply buying at the brand new highs.

Let’s wait for a Tweezer Bottom pattern to form and see what happens…

AUD/JPY 1 Hour Timeframe Chart Tweezer Bottom:

As depicted within the chart, the Tweezer Bottom has formed on the local support area.

This formation could indicate that the value isn’t willing to go any lower, and the bulls have are available to verify this area as support.

Now, let’s take an extended trade from this area and see what happens…

AUD/JPY 1 Hour Timeframe Chart Take Profit:

As illustrated, the value step by step made its way up, forming higher highs and better lows from the Tweezer Bottom.

Now, for these pullback trades, I prefer to use a moving average as a trailing stop loss to take my profits.

As price normally acts above the MA50 during a trend, it is smart to take profit as price begins to breach the moving average…

Using this method, you’ll have captured a whopping 5RR trade by simply exiting as price began to breach the moving average!

I invite you to check out different moving averages on different timeframes to see what works best on your trading strategy…

This instance just demonstrates how the Tweezer Bottom pattern could be successful in pinpointing the purpose at which the value is able to proceed within the direction of the general trend.

Now, let’s explore one other example to strengthen this point further!…

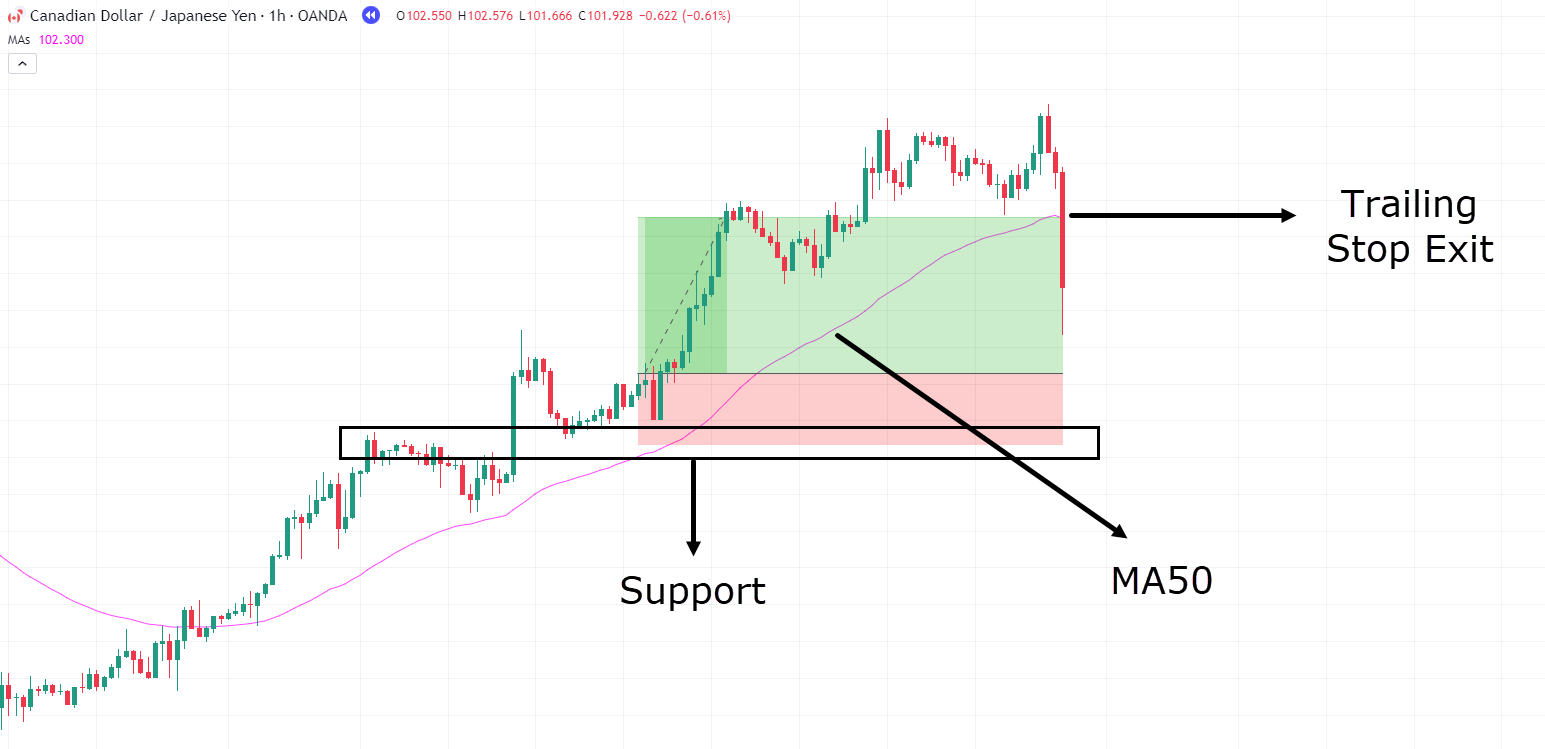

CAD/JPY 1 Hour Timeframe Chart Example #2:

Here, you possibly can observe one other uptrend, this time on the CAD/JPY pair.

On this scenario, price has formed a break and retest of structure…

…and with this temporary pullback, the value is presenting us with a buying opportunity, as local resistance has now turn out to be support.

Let’s zoom in and wait to see if any pattern forms that lets you take a trade…

CAD/JPY 1 Hour Timeframe Entry:

Notice how the Tweezer Bottom pattern can are available all different sizes and shapes?

On this case, as a substitute of two small hammer-like candles as seen within the previous example, there may be a reasonably strong bearish candle followed by a bullish engulfing candle that swallows the complete bear candle.

Here you’ve got two bullish candlestick patterns in a single, the Bullish Engulfing pattern and the Tweezer Bottom pattern!

Now, let’s see the way it played out!…

CAD/JPY 1 Hour Timeframe Chart Example Take Profit:

As illustrated, the value shot up from the support level and the Tweezer Bottom and created latest highs.

Identical to within the previous example, the MA50 was used as a trailing stop loss – stopping you out of the trade at roughly 2RR.

So, with a greater idea of learn how to trade these patterns in an uptrend, what about picking reversals at the underside of downtrends?

Now, you may be wondering how different they could be if the pattern is similar…

And the honest answer is… very different!

The reversal Tweezer pattern involves more risk, however it also allows the trader to capture potentially large profits.

If done properly, you possibly can discover the reversal points of a downtrend that might mark the beginning of a latest uptrend.

Don’t consider me?

Let’s take a take a look at an example…

Tweezer Bottom Reversal Pattern Strategy

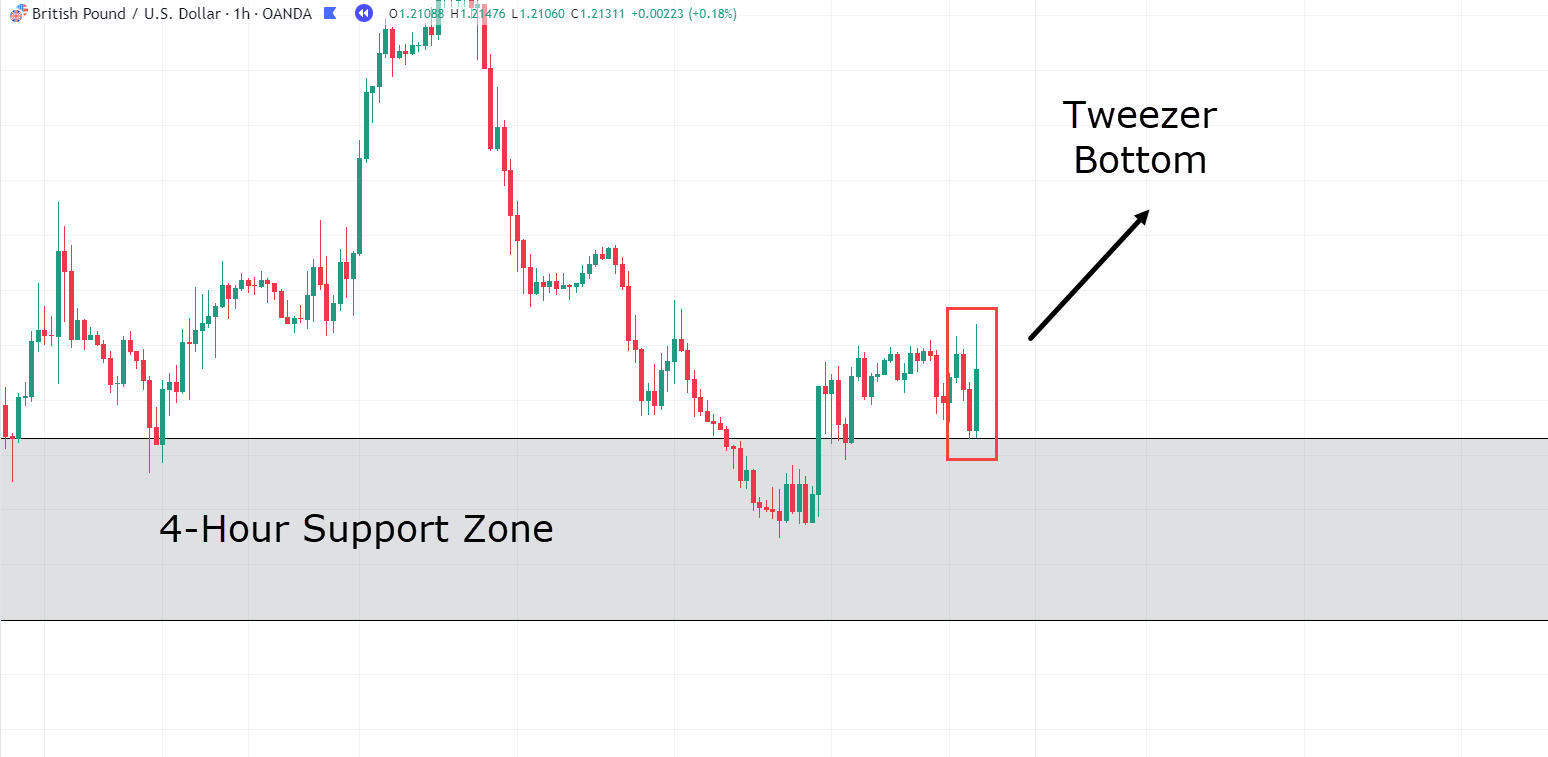

GBP/USD 4-Hour Chart Support Level:

Here is the 4-hour chart of GBP/USD, clearly depicting a downtrend.

Nonetheless, something curious is occurring in the most recent price motion…

Notice how the value has briefly halted its strong downward momentum and began to form what appears to be a support?

This 4-hour support level has experienced just a few bounces.

Let’s zoom in and take a better take a look at what price is doing on the 1-hour timeframe!…

GBP/USD 1-Hour Chart Tweezer Bottom:

As you possibly can see, the value continues to carry over this 4-hour level.

On this lower timeframe, I prefer to search for Tweezer Bottoms that show a big sign of strength from the bulls.

On this scenario, you’ve got the 4-hour support level still holding for just a few weeks.

But what’s more interesting is the proven fact that a Tweezer Bottom Pattern has occurred on the 1-hour timeframe.

The second candle of the Tweezer Bottom engulfs the previous bear candle, providing you, because the trader, with insight that the value can have finally found some bullish momentum!

Let’s take the trade!…

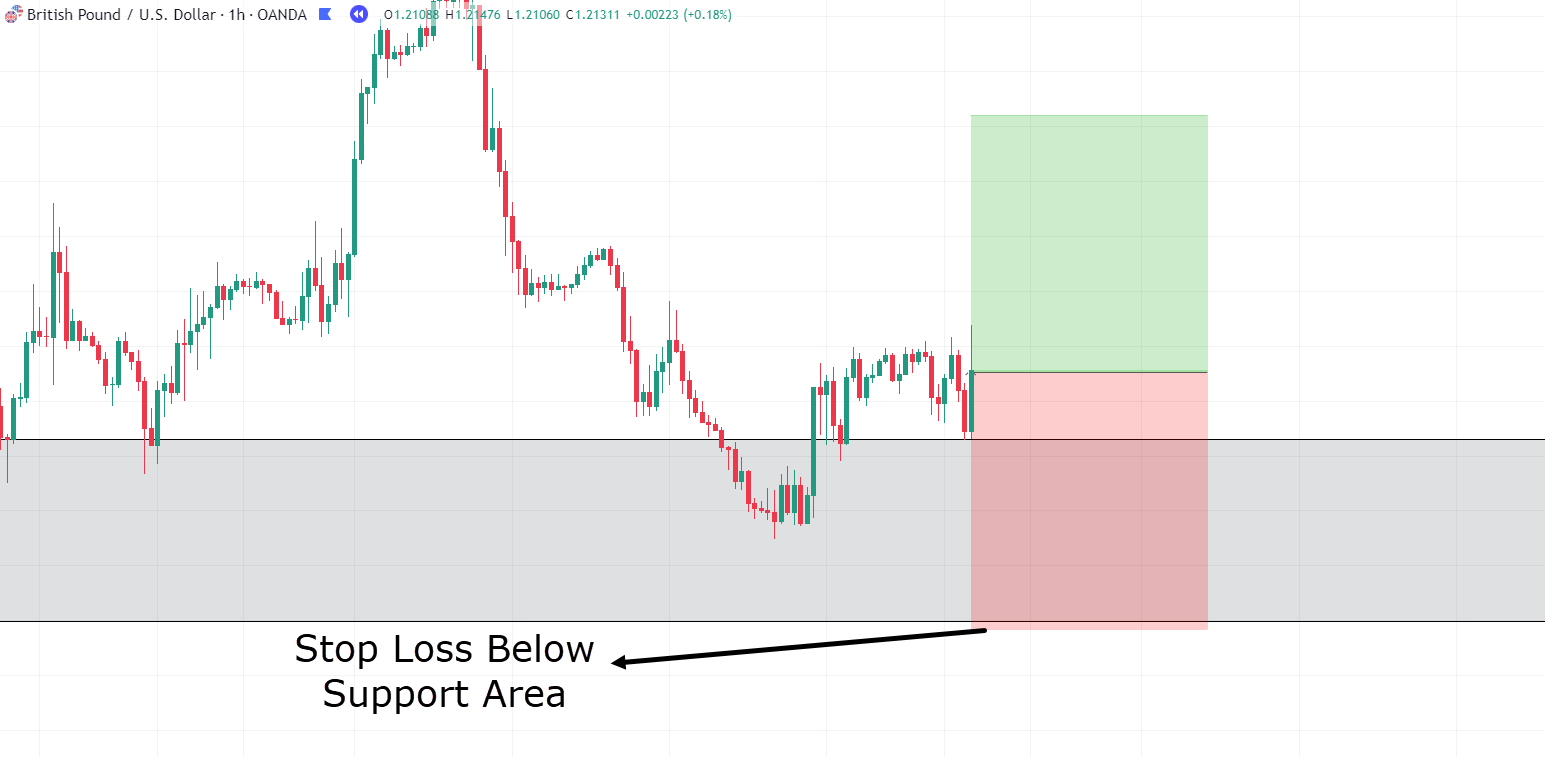

GBP/USD 1-Hour Chart Tweezer Bottom Entry:

For this instance, I even have chosen to place my stop loss just under the 4-hour support level, allowing the trade some room to breathe.

I prefer to stay on the side of caution, especially when trying to choose trend reversals, as the foremost strength behind this trade is the 4-hour zone as a result of its presence on the upper timeframe.

Should you desired to tackle more risk, you would place the stop loss below the Tweezer Bottom or somewhere nearby that is smart to you!

Taking profits with the Reversal Pattern becomes barely less straightforward because, after a substantial downtrend, price is never acting above the moving averages.

This results in you having to decide on some different exit strategies.

It might be things like a better timeframe moving average being breached, a crossover between multiple moving averages, taking profits at previous resistances, or a Fibonacci extension.

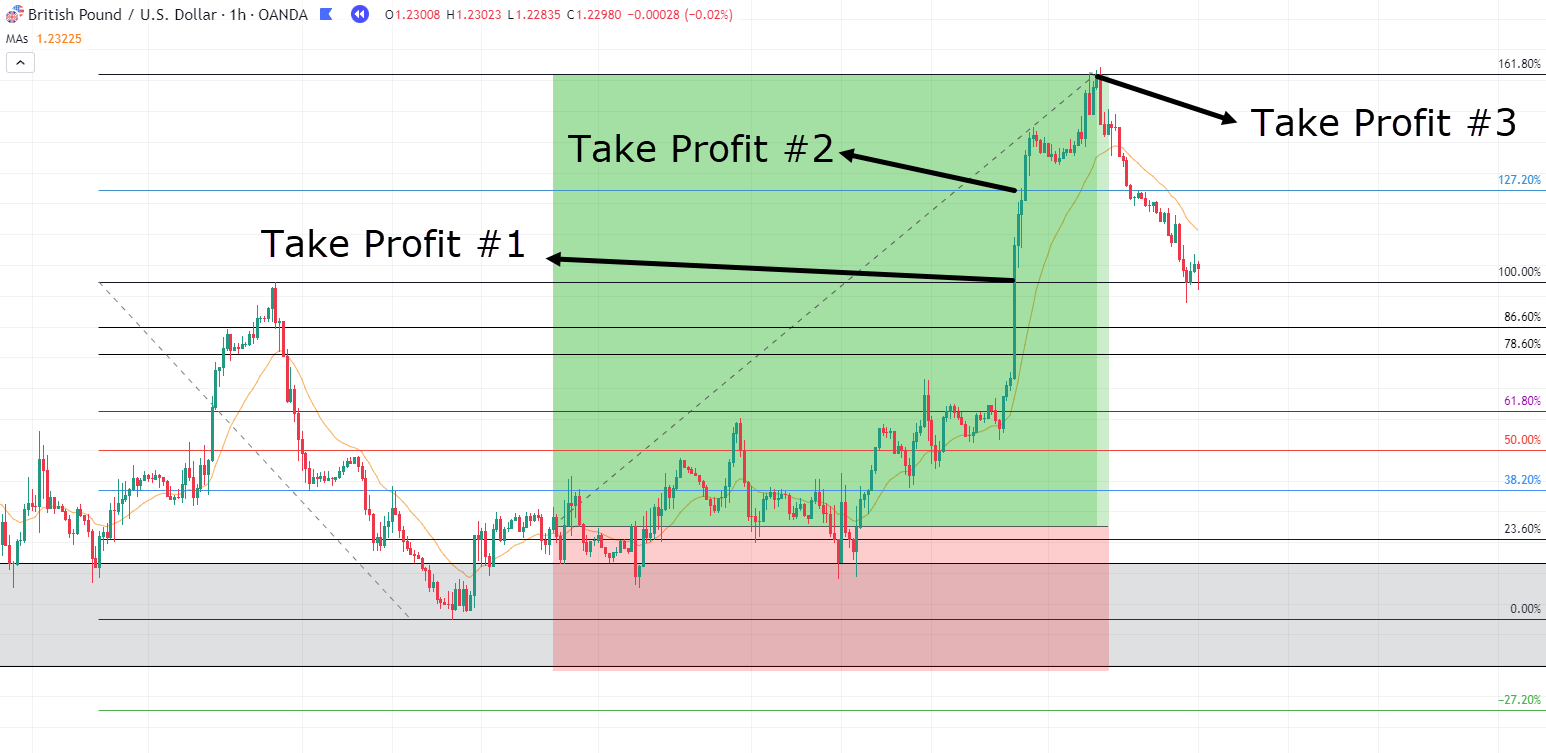

For this instance, I used the Fibonacci tool to search out Fibonacci extensions on the 1hr timeframe for my take profits at multiple points along the way in which…

GBP/USD 4-Hour Chart Tweezer Bottom Result:

As you possibly can see, the value eventually shifted upward and commenced to form a latest uptrend.

Alright, to take care of realistic expectations, let’s walk through yet another example!…

AUD/CAD 1-Hour Timeframe:

In this instance, a transparent support level has formed.

Probably the most recent price motion presents an affordable trading opportunity, with the Tweezer Bottom pattern forming at support.

Let’s enter this trade…

AUD/CAD 1-Hour Timeframe Entry:

Oh no!

After the trade was entered, the value actually continued to drop!

There are just a few options. Price isn’t acting the way in which you necessarily expected it to, however it also hasn’t closed below the support level.

This might warrant you exiting the trade early and searching for some more confirmation.

Nonetheless, for the sake of this instance, let’s say you stayed within the trade…

AUD/CAD 1-Hour Timeframe Stop Loss:

Uh oh, our gut feeling was right!

So, unfortunately, this trade didn’t work out.

But guess what?

That’s okay!

…because not every trade goes to work perfectly.

The necessary thing here is gaining experience so you understand when the trade isn’t working the way in which you’re feeling it should.

As stated in the instance, when the value continued lower after the entry on the Tweezer Bottom Pattern, you were presented with the chance to either keep on with the trade or close the trade early and wait for some more confirmation.

Over time, you’ll higher hone your skills to get the intuition to grasp the secrets the market is attempting to let you know. If a trade shouldn’t be acting the way in which you expect it to, close the trade and wait for price motion that makes more sense, or move to a totally different trading setup.

The market will at all times be there, so be patient and protect your capital!

Now that you understand learn how to successfully trade the Tweezer Bottom Pattern, let’s take a look at some mistakes to avoid when trading it…

Mistakes to avoid when trading Tweezer Bottom

Don’t Use the Tweezer Bottom Pattern in Isolation

The Tweezer Bottom pattern signals a possible shift in momentum, however it’s not a standalone solution.

Enhance your success by combining the pattern with other indicators like moving averages and support/resistance levels.

When utilized in conjunction, it becomes a robust tool in your trading arsenal.

Don’t rush into trades!

Patience is essential when trading the Tweezer Bottom Pattern.

Waiting for added confirmation, akin to bullish engulfing patterns or reclaims of local support, increases confidence within the trade end result.

Extra confirmation, especially when supported by buying momentum, strengthens the indication that prices will proceed to rise.

So be patient and wait for a sturdy setup.

Exit When the Trade Isn’t Going as Planned

It’s necessary to acknowledge that the Tweezer Bottom isn’t a one-size-fits-all solution.

In the instance provided, the momentum shift from bear to bull failed, and the bulls couldn’t sustain momentum within the candle following the Tweezer Bottom.

Accept that not every trade will go as expected.

If the trade isn’t unfolding as planned, consider exiting to guard your capital. Remember, certainty in trading outcomes is rarely 100%.

Conclusion

In conclusion, the Tweezer Bottom pattern emerges as a robust tool for traders, precisely identifying moments of momentum shift from bears to bulls.

Whether applied in trending markets or to pinpoint reversals, mastering this pattern is essential to trading success.

Throughout this text, you’ve acquired the knowledge to not only trade the Tweezer Bottom effectively but additionally to keep away from common pitfalls.

You furthermore mght saw learn how to adapt the pattern to diverse market conditions and gained insights into waiting patiently for optimal trade setups.

So, to summarize:

- The Tweezer Bottom vividly illustrates the transition from bearish to bullish momentum.

- The way to trade the Tweezer Bottom in an already trending market.

- Knowing what signs to search for when anticipating a shift from downtrends to uptrends.

- Learning the importance of patience in trade execution and knowing when the value isn’t behaving as expected.

- Acknowledging and steering clear of the common mistakes traders often make when working with the Tweezer Bottom pattern.

With this newfound knowledge, you now possess an extra tool in your trading arsenal.

I encourage you to include the Tweezer Bottom into your strategy, considering all features discussed here, to boost your success rate.

So, what are your thoughts on the Tweezer Bottom Pattern?

Have you ever begun to know the way it signifies a shift from bear to bull?

Have you ever used other candlestick patterns, just like the Tweezer Top Pattern? (Perhaps Link to the Tweezer Top Pattern Article)

Be happy to share your insights within the comments below!