Let me ask you…

What’s a well-liked trading tip you ways hear?

That’s right.

“The trend is your friend”

“Trade the trail of least resistance”

“Never trade against the trend”

And in fact, to most extent…

This conventional trading wisdom is pretty vital!

But for today’s guide…

I’ll teach you the dark arts of technical evaluation, something that goes against conventional trading wisdom:

Trend reversals.

I’ll teach you not only the way to properly spot them but additionally provide you with the essential trend reversal indicator it’s worthwhile to make the most of them.

Sounds good?

So, here’s what you’ll learn today…

- What’s a trend reversal and the way to exactly discover one so that you avoid getting “trapped” with false signals

- An important criterion to be mindful when selecting trend reversal indicator or indicators generally

- The Donchian channel, a flexible trend reversal indicator that works each in catching trends and trend reversals

- A zigzag indicator that ensures you never second-guess yourself again when timing reversals

- An all-in-one Supertrend indicator that spits all the suitable trend reversal signals so that you can take

Wow, that’s rather a lot to debate!

That’s why at the tip of this trading guide…

You’ll end up being a master of trend reversal indicator.

Sounds good?

Then let’s start!

Trend reversal indicator: consistently spot trend reversals out there

You realize what a trend looks like, right?

Good.

How a few trend reversal?

Yep, that’s right!

But here’s the query…

“When” does the trend reversal occur?

Sure, you possibly can point to this as the beginning of a trend reversal.

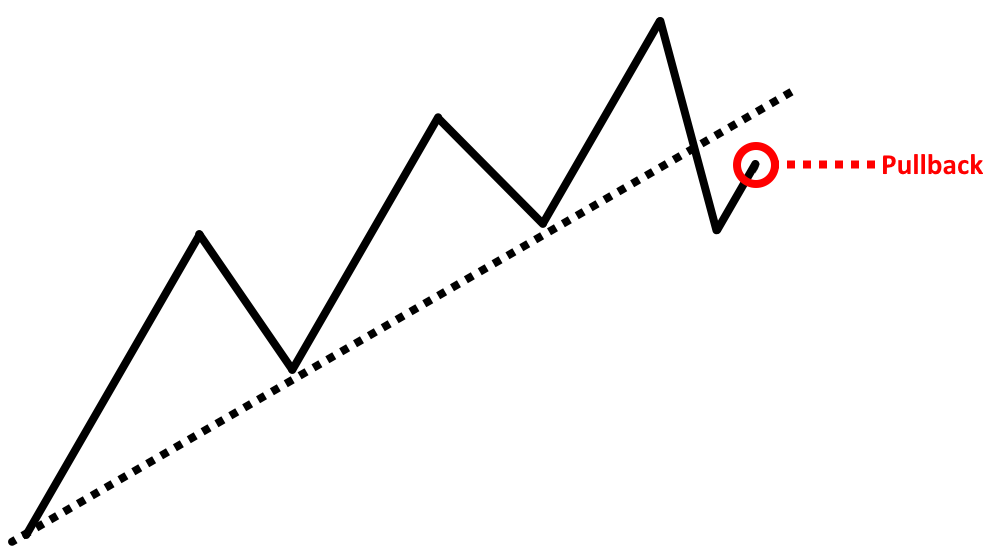

But how sure are you that it’s not only a pullback?

Yep, we are able to never be certain!

You’d just be guessing!

So, when exactly can we are saying that a trend reversal is going on?

Here’s how…

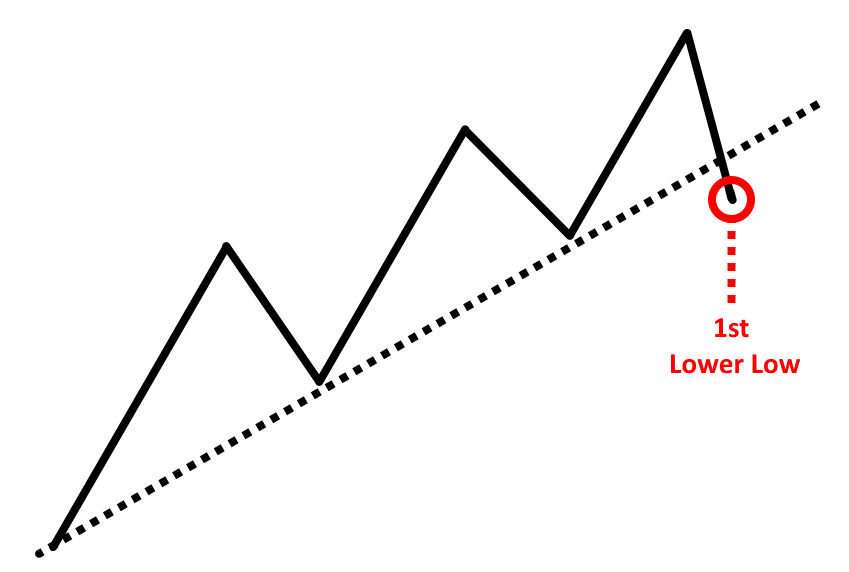

Break of the trend line and two recent lower lows

To place it simply…

You’d first want the value to interrupt the trend line of the trend.

Which now counts as the primary lower low!

But in case you recall…

It’s often too early to call this a trend reversal.

So, what do you do?

Wait for the value to tug back…

Then BOOM!

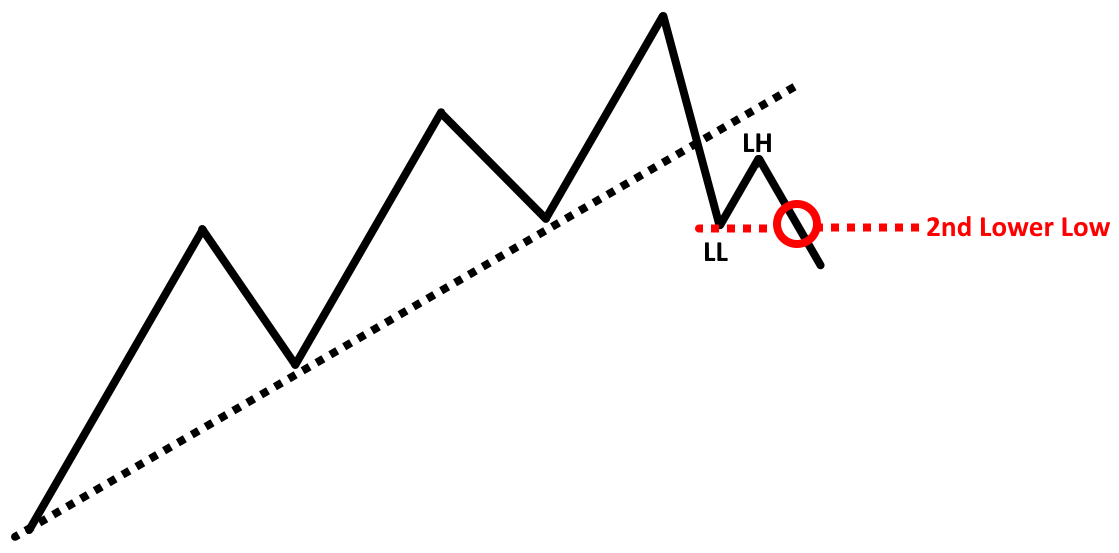

Wait for the value to make a 2nd lower low!

So, to place things in perspective…

A trend reversal is valid once it closes below the 2nd lower low.

Or, on this case…

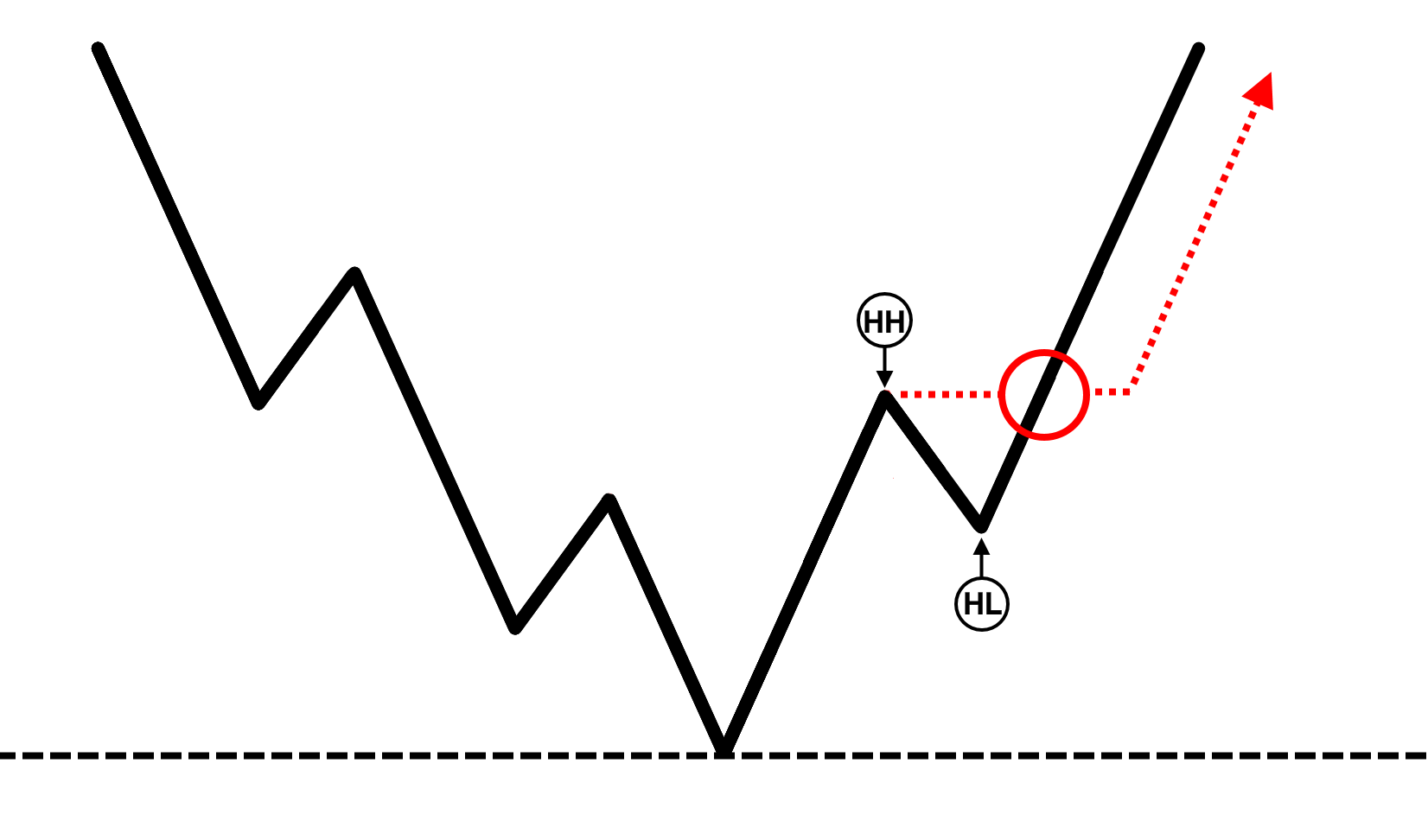

A 2nd higher high for bullish trend reversals:

Is smart?

Now that the nitty-gritty details on what a trend reversal is and when it happens…

It’s time to simplify things.

That’s right.

All the pieces any longer shall be much simpler as I share with you a trend reversal indicator that ought to make your life easier.

So, are you interested?

If that’s the case, then keep reading, and let’s start…

What do it’s worthwhile to search for on a trend reversal indicator?

Repeat after me:

Indicators shouldn’t simplify and never complicate your trading.

How so?

Because trading indicators are tools!

And tools should make our trading much easier!

It just is sensible, right?

And that, my friend

That is the very first thing we’re in search of in a trend reversal indicator…

The indicator should be easy to know

No, you is likely to be wondering:

“Shouldn’t we just search for a buy and sell signal?”

Sure!

Nevertheless…

I would like you to be mindful that you just are trusting your hard-earned money with these indicators.

So, it only is sensible for you to know them, right?

That’s the reason in case you can’t understand how your indicator produces its signals…

Then you definately is not going to have the boldness to be consistent with that indicator when losses come your way.

Is smart?

The following thing we’re in search of on a trend reversal indicator is that…

It should be free and accessible

Excellent news, am I right?

Since the goal here is that after you have got finished reading this trading guide…

You’ll give you the option to immediately apply something to your trading plan.

Finally, the final thing we’re in search of on a trend reversal indicator is…

The indicator must fulfill the principle behind detecting trend reversals systematically

Remember the instance I showed you before?

That’s right, we wish to search out a trend reversal indicator that goals to systematize this.

Because, in spite of everything…

Trading indicators should make our lives easier by detecting trend reversals.

And that my friend is what we’re in search of.

So, the primary one on the list is…

Trend reversal indicator #1: The Donchian Channel

“Wait a minute, the Donchian channel is a trend-following indicator, right?”

You’re not mistaken!

But that’s what makes this indicator special…

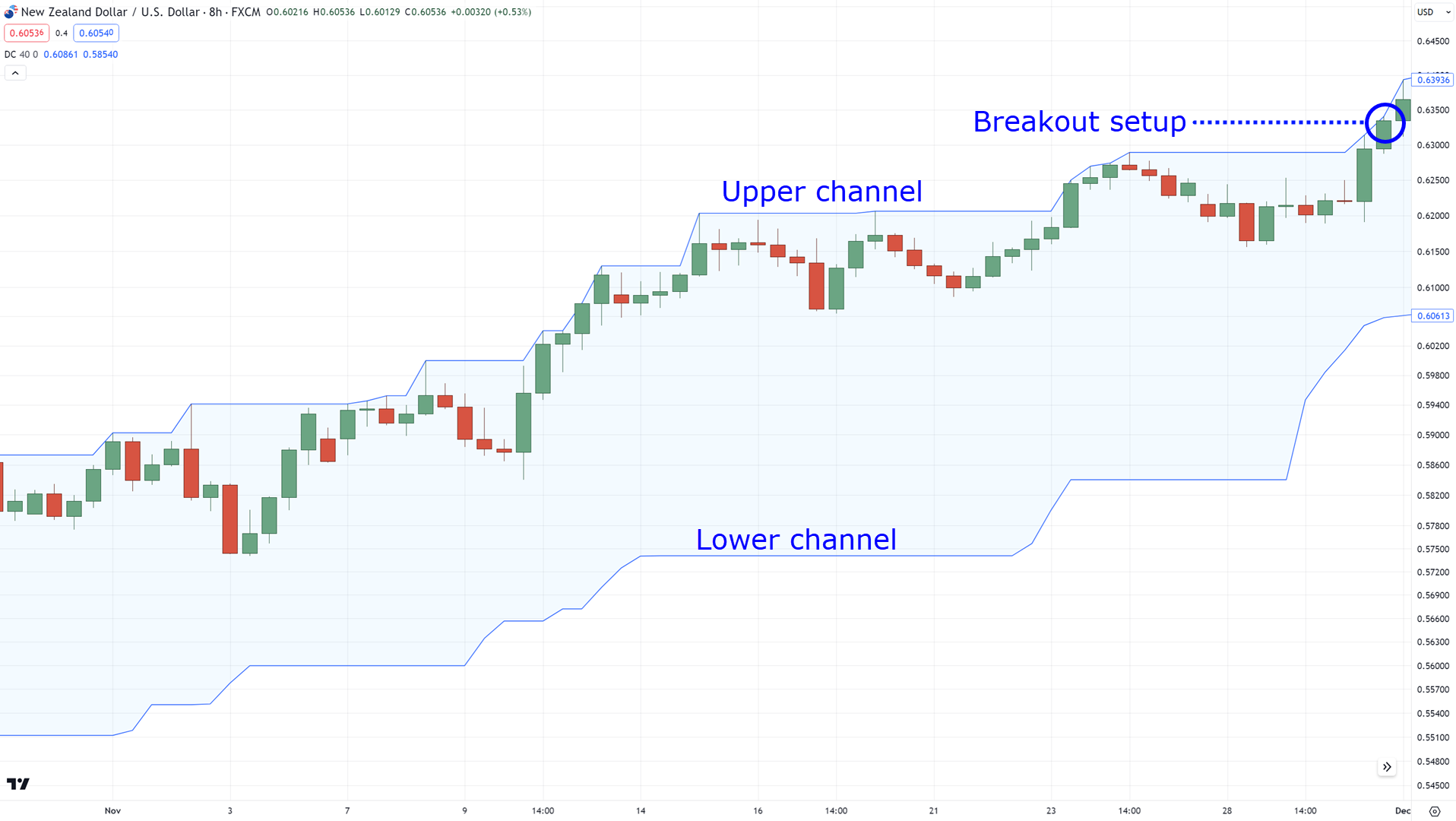

You need to use it to time breakouts:

And time trend reversals:

Pretty awesome, right?

So, to get straight to the purpose:

How will you trade trend reversals using the Donchian channel?

Step one is to search for a valid uptrend:

If you happen to’re an avid user of this indicator, I wouldn’t be surprised in case you’re already within the trade!

Now, one thing to pay attention to is that the value should be continually near the upper channel (I’ll explain more later):

Got it?

So, the following step is to attend for it to shut below the lower channel:

Then wait for a bearish flag pattern to form at or above the lower channel, and break below it:

Before setting your entries on the break of the flag pattern stop loss on the upper channel.

Here’s what I mean:

At this point, I feel like you have already got plenty of questions in your mind:

“Why do we want to attend for a flag pattern”

“Why aren’t there any take profit levels?”

Don’t worry, my friend as I’ll answer them for you.

First, the rationale why we wait for a flag pattern to form is in order that we don’t develop into overly depending on the indicator itself.

Because in case you recall…

We use indicators to make our life easier, but at the identical time accomplish the principle that we’re in search of in a trend reversal:

It’s all beginning to make sense now, right?

And now you is likely to be wondering…

“What’s the perfect trend reversal indicator period to make use of?”

Now, here comes the vital part…

It relies on the variety of trend you wish to capture

Here is the reality:

Not all trends are equal.

There are strong trends:

Healthy trends:

And weak trends:

So, the goal is to discover the suitable period that will be relevant to the variety of trend you wish to capture!

P.S. I took the Donchian channel out of the instance so you need to use it as a reference moving forward.

Because of this if you wish to capture short-term trend reversals…

You’d need to use a 20 to 40-period Donchian channel.

For healthy trends, around 40 to 80-period.

Finally, for weak trends, around 80 to 200-period.

So, select what variety of trend you wish to capture, (no matter timeframe) and work yourself from there.

This is very important.

Because this idea applies to the entire trend reversal indicators will discuss today.

With that said, are you ready for the following trend reversal indicator?

If that’s the case, then keep reading.

Trend Reversal Indicator #2: Zigzag Indicator

If you happen to desire a more practical trend reversal indicator then that is for you.

Because in case you recall…

What makes a legitimate trend reversal is when the value makes two lower lows:

And do what the zigzag indicator does?

It practically visualizes it!

You never must second-guess yourself again!

It’s all done for you mechanically!

Oh, and by the way in which, this doesn’t count because the 1st lower low:

Why?

Because at the moment, it was still regarded as a better low!

The one time it might be regarded as a lower low is that if it has exceeded the “previous low” as seen here:

Just in case you’re still having a tough time you possibly can take a look at this guide here.

So, how do you trade with this trend reversal indicator?

trade trend reversals with the zigzag indicator

For this one, it is kind of easy.

You simply must wait for the value to shut and make a 2nd lower low:

Sure, you possibly can wait for a flag pattern to form similar to within the last trend reversal indicator which is great.

Nevertheless, if the value makes a second lower low, it’s already counted as a legitimate trend reversal with or with out a flag pattern.

Pretty easy, right?

So where can we go from here?

In your loss, what you possibly can do is add one ATR above the highs:

Ask to your take profits, you do have a few options!

The primary option is to take profit before the closest area of support:

Or wait for a price to make the primary higher high:

Now, I don’t want to indicate you the end result of this trade as I don’t want you to form a bias on which profit method to make use of.

But either method does have an edge within the markets!

So how in regards to the period?

Which setting to make use of for the zigzag indicator?

Unfortunately, it will not be so simple as it seems.

Because the period directly relies on what timeframe and market you’re trading at!

Nonetheless, you need to use the metrics below as a suggestion:

Stocks on D1 = Deviation (%) 8 to 10

Futures on D1 = Deviation (%) 3 to eight

Forex on the D1 = Deviation (%) 1 to three

If you wish to learn more, those values got here from this text here.

Sounds good?

And by the way in which…

If you wish to learn more in regards to the average true range, you can even take a look at this guide here.

Which I suggest you do.

Why?

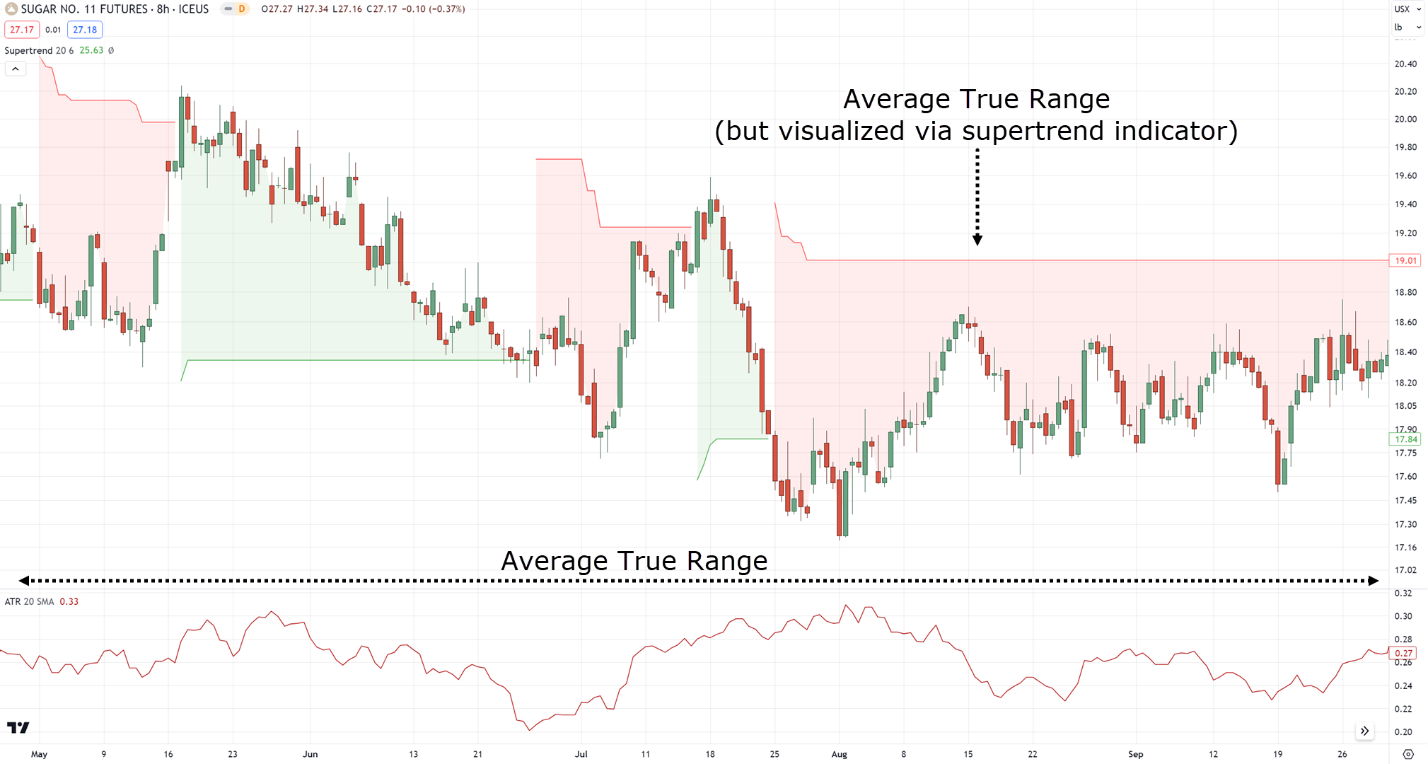

Because the following trend reversal indicator is comparable to the common true range, but with superpowers.

Let me share with you in the following section…

Trend reversal indicator #3: Supertrend indicator

Despite it being a trend indicator…

I’d must, unfortunately, rename this indicator to a Supertrend reversal indicator!

Because that’s what we shall be using this indicator for today.

This indicator is pretty easy!

Since it’s simply a visualized the ATR in your chart:

It simply adds a formula in a way that tells you if the trend has exceeded a certain volatility for it to reverse its signal.

If you happen to are getting some hints without delay, that’s right.

The moment the trend reversal indicator changes signal…

We’re to enter the trade with our initial stop right on the indicator:

Pretty rattling easy!

And take profits?

Simply wait for the indicator to change signals again!

Now, resulting from the simplicity of this strategy, we’re touching the realms of systematic trading.

So, backtesting that is crucial.

Nonetheless, to finish this guide I’ll be sharing with you which ones settings to make use of for this trend reversal indicator.

Which settings to make use of for the Supertrend indicator

Much like what we have now discussed within the Donchian Channel…

All of it boils all the way down to what type of trend reversals you’re in search of.

If you happen to are in search of trend reversals in a powerful trend, then you wish to use a multiplier of 2 ATR to 4 ATR.

For medium-term trend reversals, a multiplier of 4 to six could be good.

Finally, if you wish to capture, long-term trend reversals, then a multiplier of 6 to eight could be preferred:

Again, it’s not about selecting the perfect indicator settings on the market…

But select which type of trend reversals you wish to capture and search for an indicator setting that matches that.

Is smart?

So, there you go!

Three trend reversal indicators that will let you capture and trade trend reversals!

With that said…

If you wish to learn more in regards to the Supertrend indicator, you’d want to envision this out.

Nonetheless, let’s have a conclusion on what you’ve learned today…

Conclusion

Now in fact…

I’ve only shown you a cherry chart to indicate you concepts.

Nevertheless, in the actual world of trading, there shall be losses.

There shall be times of confusion where you will not be sure, whether or to not take the trade.

And for this reason it’s crucial to backtest these concepts before risking your hard-earned money.

Got it?

With that said, here’s what you have got learned today…

- A trend reversal is valid when the value closes and makes a 2nd lower low

- What makes a great trend reversal indicator is when it is straightforward to know and accessible

- You need to use the Donchian Channel to identify and trade trend reversals when it makes a flag pattern around its lower channel and using the upper channel as a trailing stop loss

- The zigzag indicator is a close-to-price-action indicator that mechanically spots market structures for trend reversals

- The supertrend indicator is an ATR indicator but visualized on the chart, its simplicity gives you systematic trend reversal setups

Now over to you…

How do you normally trade trend reversals?

Do you employ any indicators in any respect?

If that’s the case, which of them do you employ to capture trend reversals?

Let me know within the comments below!