The flagship cryptocurrency, Bitcoin, is fast approaching $31,000 following its gains over the weekend. Analyzing this price motion, crypto analyst Ali Martinez has predicted Bitcoin’s future trajectory as he suggests that the bears could regain dominance soon enough.

A Price Correction Imminent For Bitcoin

In a post shared on his X (formerly Twitter) platform, Martinez noted the potential head-and-shoulders pattern that was forming on the Bitcoin each day chart following its upward trend. This chart pattern has at all times been considered bearish because it suggests that a trend reversal is perhaps on the horizon, meaning there may very well be a dip in prices soon enough.

Source: X

Confirming this assumption, Martinez stated that the each day chart (which he shared alongside the post) “hints at a possible sell signal emerging tomorrow [October 23].” Based on him, this prediction is backed by the TD Sequential indicator, which is flashing “a green 9 candlestick.” The TD Sequential indicator helps traders discover the precise time of a possible reversal.

Martinez also alluded to the Relative Strength Index (RSI), which he mentioned has reached 74.21. He noted that this has been “a level triggering sharp corrections since March.” An RSI of over 70 also suggests that Bitcoin could also be overbought with a price correction imminent. This impending price correction can only be averted if Bitcoin manages to clock “a each day candlestick close above $31,560.”

As of the time of writing, Bitcoin is trading at around $30,700, up by over 2% within the last twenty-four hours and an extra 10% within the last seven days.

Options Market Could Contribute To Bitcoin’s Upward Momentum

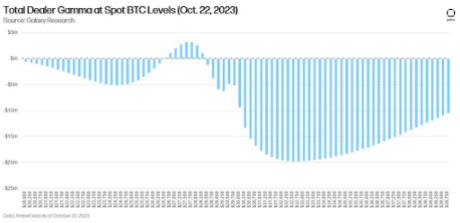

In a post on his X platform, Alex Thorn, Head of Firmwide Research, highlighted the role that options traders (short gammas particularly) could play in driving Bitcoin’s price higher within the short term.

He noted that the options market makers in Bitcoin are “increasingly short gamma as BTC spot price moves up.” This current positioning could help “amplify the explosiveness of any short-term upward move within the near term,” considering that these short gammas should buy more Bitcoin to remain “delta neutral” as Bitcoin’s price continues to rise.

From his evaluation, Thorn was simply explaining that the choice market makers could have to put ‘buy orders’ to hedge against their short positions as Bitcoin’s price continues to climb, thereby adding to buying pressure, which could cause the crypto’s price to rise higher.

Meanwhile, he believes that the long gammas could provide a security net for Bitcoin’s price within the event of a price reversal. These long gammas would should buy back spots with a purpose to remain delta-neutral, thereby providing support and helping resist any further decline (within the short term, a minimum of).

BTC bulls running out of steam | Source: BTCUSD On Tradingview.com

Featured image from Crypto Buyers Club UK, chart from Tradingview.com