There are lots of sorts of markets world wide which you can trade right away.

The Crypto market, the Agriculture market, the Bond market, and the list goes on!

Nonetheless…

Two markets that may are likely to be compared throughout the years are Forex and the Stock market.

And whether you’re a newbie trade or a seasoned trader…

This “battle” of comparison just never ends!

That’s why in today’s guide…

We’ll be selecting which market is the “best.”

Sounds good?

So, here’s what’s in store for you:

- What are the Forex and the Stock market (and a few interesting facts about them)

- The best way to select which timeframes to trade for each the Forex and the Stock market

- The key to selecting which Stock and Forex pairs to trade

- An important skill in trading each the Stock and Forex

- The best way to determine the perfect market to trade (and the best way to trade them each)

Ready yourself…

As that is going to be quite a journey.

So, let’s start!

Forex market vs stock market: What are they?

At this point…

I’m sure you’re already a professional on what these markets mean.

Because a fast google will simply inform you that:

Forex is a decentralized market that enables the trading of other currencies.

While the Stock market is an equity market that lets you acquire and trade shares of firms.

Cool.

But setting aside the classic dictionary terms…

How do these markets work?

How do these markets apply to us?

So, on this section, let me offer you a fast (and interesting) refresher on what these markets are.

We could?

First…

The Forex Market

The Foreign Exchange market is a decentralized global market that lets you trade or exchange currencies world wide.

For instance:

You reside in India and also you’re planning to travel to the US.

Subsequently, you’ll want to convert your Indian Rupees to US Dollars, right?

So, what do you do?

You go to the cash changer!

Now, how does the cash changer determine the exchange rate of your local currency to the US dollar?

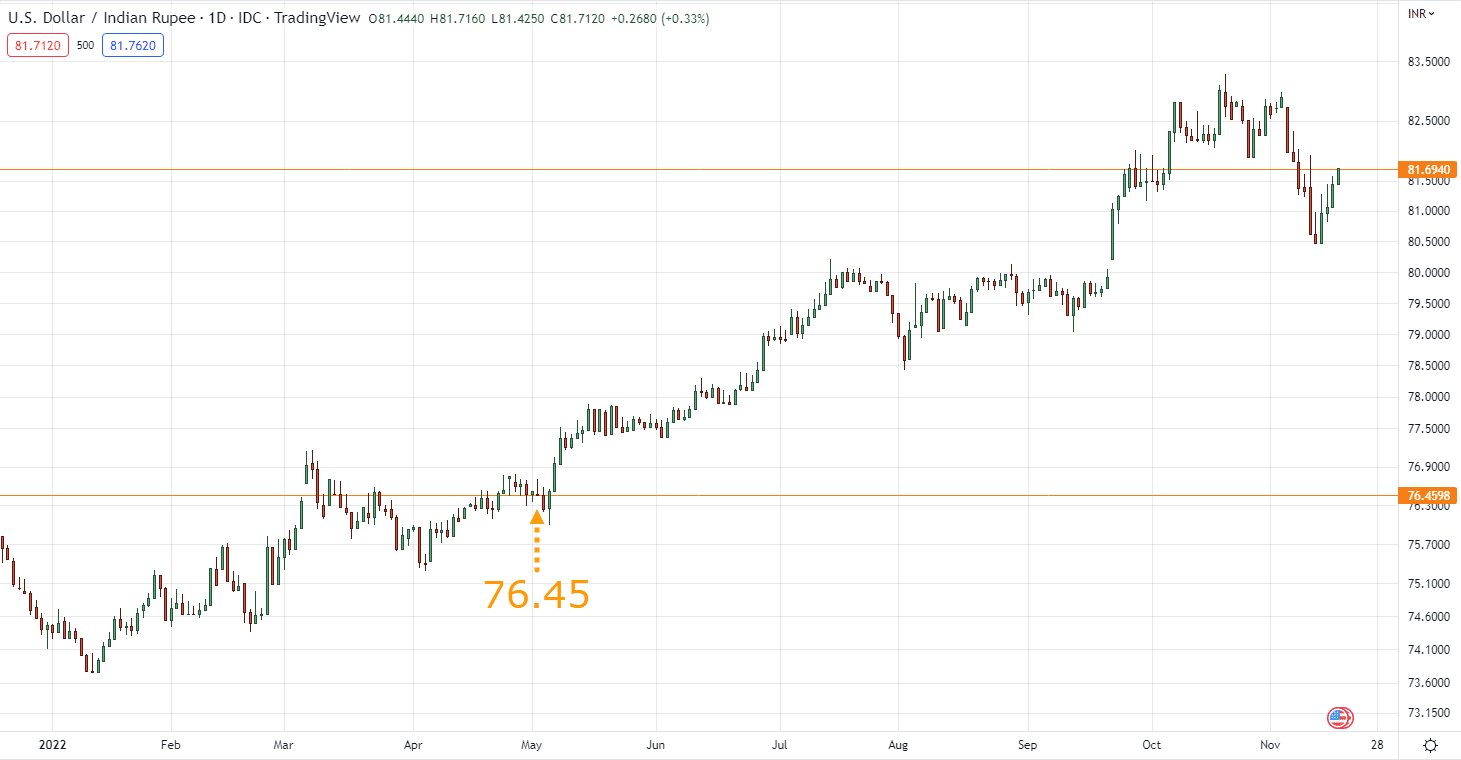

By taking a look at Forex on USDINR after all:

So, if you could have 20,000 Indian Rupees in your pocket, you’d expect to have around 245 US Dollars.

But here’s the thing…

Forex is rarely static.

Meaning, should you bought US Dollars along with your 20,000 Indian Rupees…

You’d probably have 262 US Dollars!

And that is just certainly one of the examples of how Forex is present in our day by day lives.

Meaning, Forex isn’t nearly planning your travels to go to other countries.

It will possibly even be about increasing the costs of your imported products comparable to:

- Gadgets

- Apparels

- Luxury Items

But however…

Do you remember once I said “decentralized?”

You’ve probably heard it already for the crypto markets.

What does decentralized mean for Forex?

Easy.

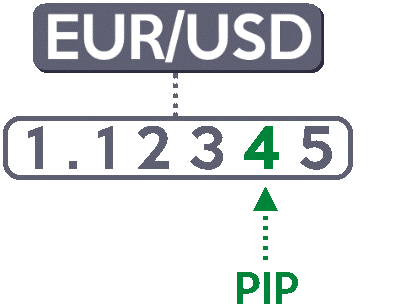

It only implies that multiple banks world wide are keeping Forex up and running.

It means Forex is open 24 hours a day, and 5 times every week!

Source: Forex Factory

In order you possibly can see, once the Recent York session ends…

Forex session would then be handed to the banks in Sydney where Forex would proceed trading!

In contrast, there’s the market comparable to the…

The Stock Market

Why in contrast you might ask?

Because the Forex market is a decentralized global market, meaning, there’s just one Forex market on the planet…

The stock market however is a centralized market where you get to own a portion of an organization’s share.

That’s right.

It’s like getting a bit of the massive pie as they are saying.

Mainly…

The stock market lets you put your money in “public” firms comparable to:

- Apple

- Microsoft

- Tesla

- Netflix

- And hundreds of more stocks…

And you possibly can be an element of those firms’ growth (and in addition their decline if it comes).

If their share price goes up?

You make a profit.

If their share price goes down?

You lose money.

Now, here’s a fun fact…

What if you could have an enormous piece of the pie like buying 50% of the shares available for one company?

On this case, you can be entitled to make decisions in the corporate, attend annual investor meetings, or possibly have perks.

Though you’d be tightly regulated by the Securities of Exchange Commission since you possibly can (obviously) manipulate stock prices.

In fact…

It’s unlikely for retail traders such as you and me to get an enormous chunk of it, though.

But in easy terms, the stock market allows you and other tens of millions of investors to bet on an organization’s growth by acquiring a “share.”

Easy stuff, right?

Now here’s the thing:

I do know that these markets are more complex than what I’ve explained.

So, if this section has got you hooked then you definitely’re free to ascertain out these courses here that explains these markets in-depth:

Forex Trading Course for Beginners (Free)

Stock Trading Course for Beginners (Free)

But should you think you’re able to charge head-on into what this training guide is all about…

Then let’s tie these markets together and determine how they’re different from one another.

We could?

So, what’s the difference between the 2 markets?

Well, it’s one thing to know the difference between the 2 markets.

Nevertheless it’s one other to find out essentially the most CRUCIAL difference!

What do I mean?

It implies that knowing these three differences almost means life and death to your trading portfolio.

“Are you serious?”

You bet!

So, what are these crucial differences?

They’re:

- Timeframe flexibility

- Liquidity and volatility

- Risk management

Let me explain…

Forex market vs stock market: Which market offers timeframe flexibility?

Here’s the underside line:

You will have more flexibility in selecting the timeframes to trade on Forex than the Stock market.

Why?

Since the Stock market is just open for lower than 8 hours.

Forex, nonetheless?

Is open 24 hours!

That offers the 8-hour and the 4-hour timeframe in Forex more information or data!

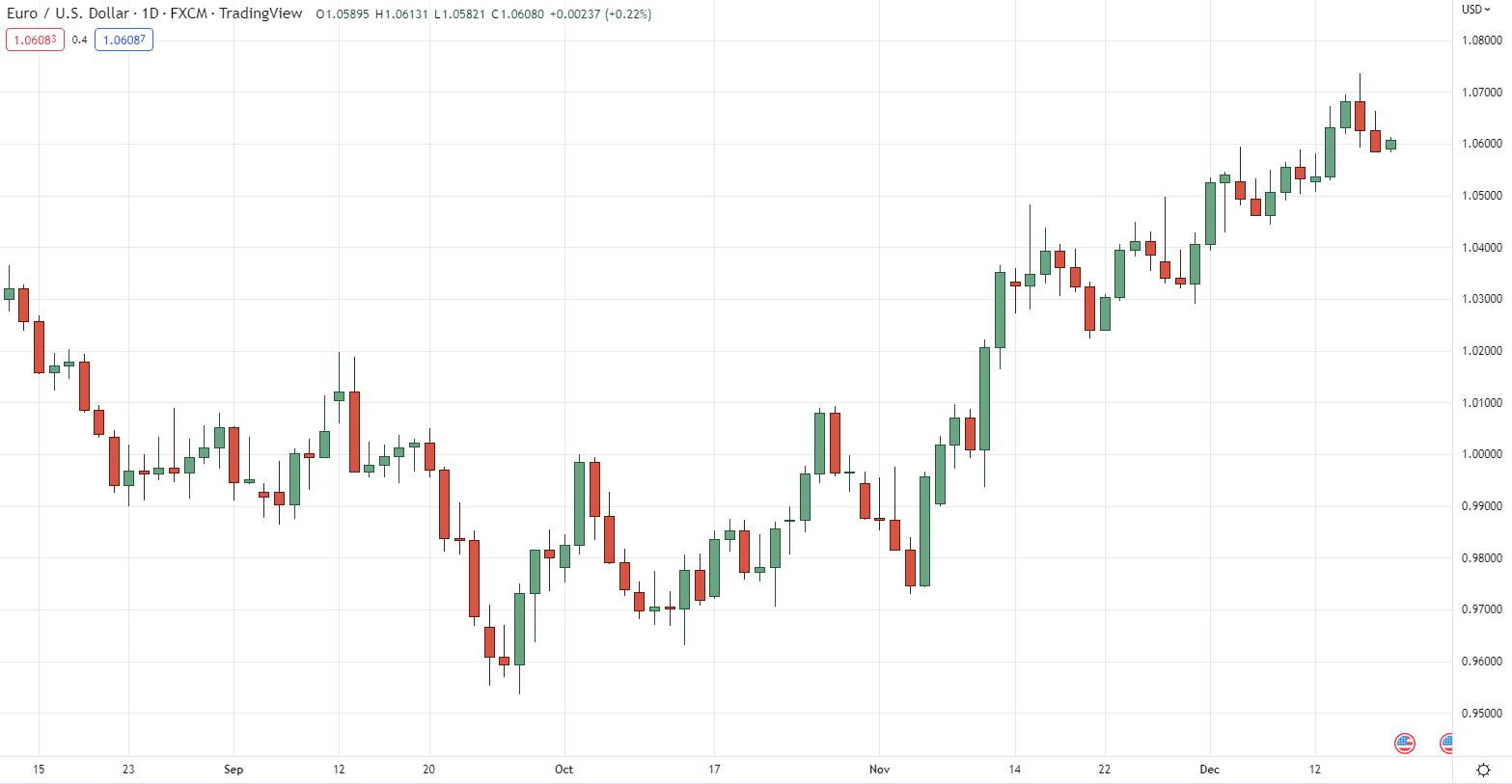

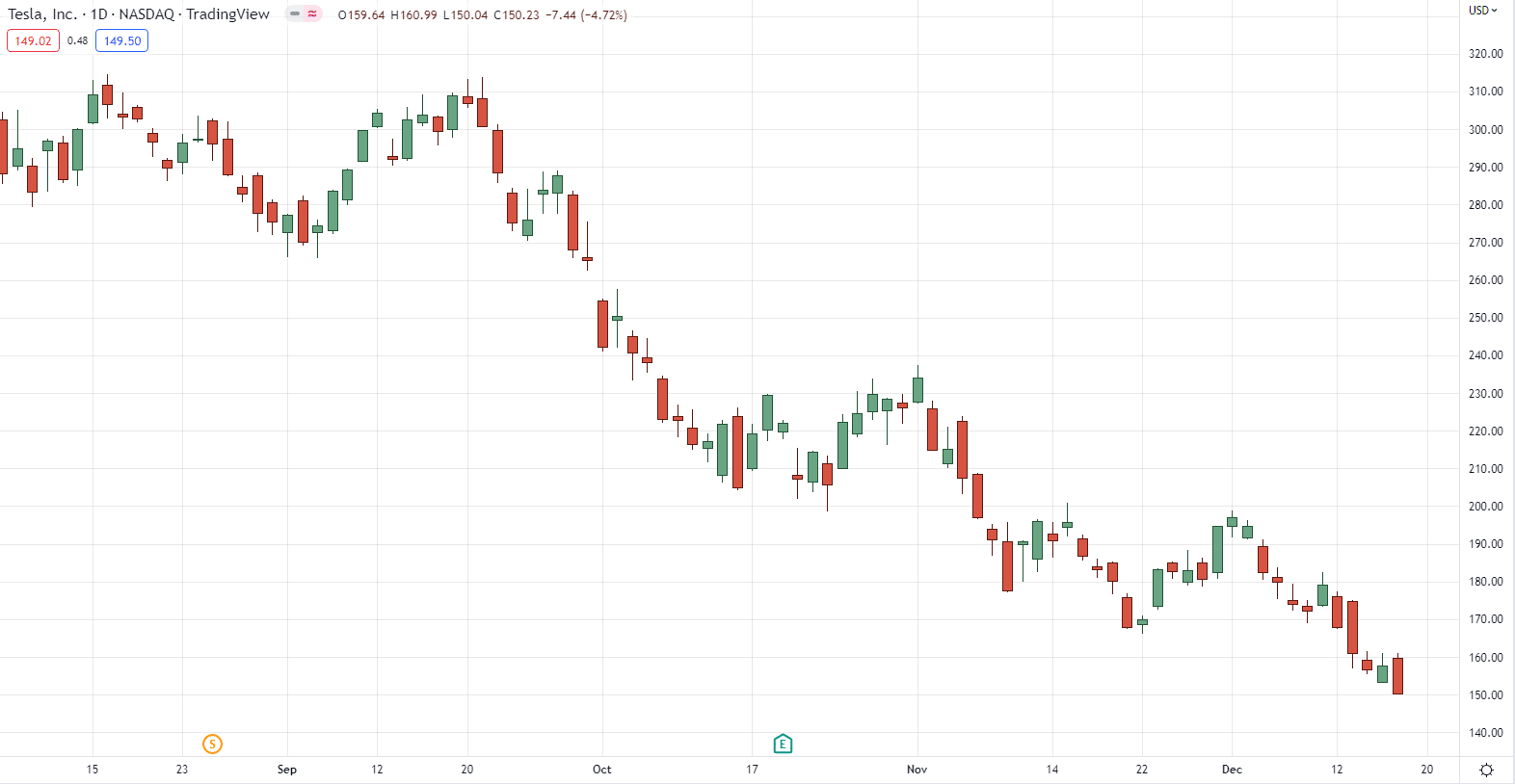

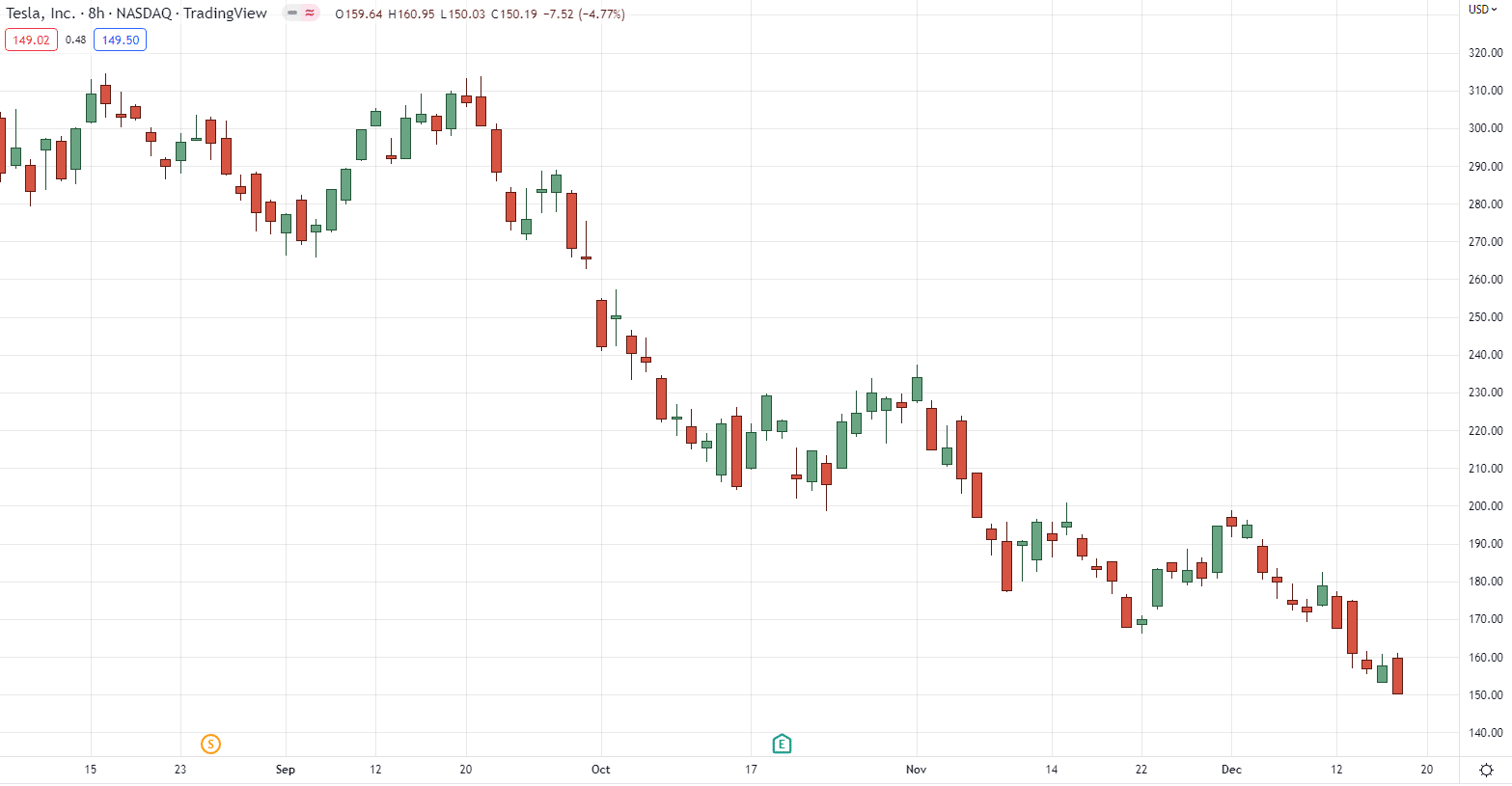

Here’s an example of EURUSD on the day by day:

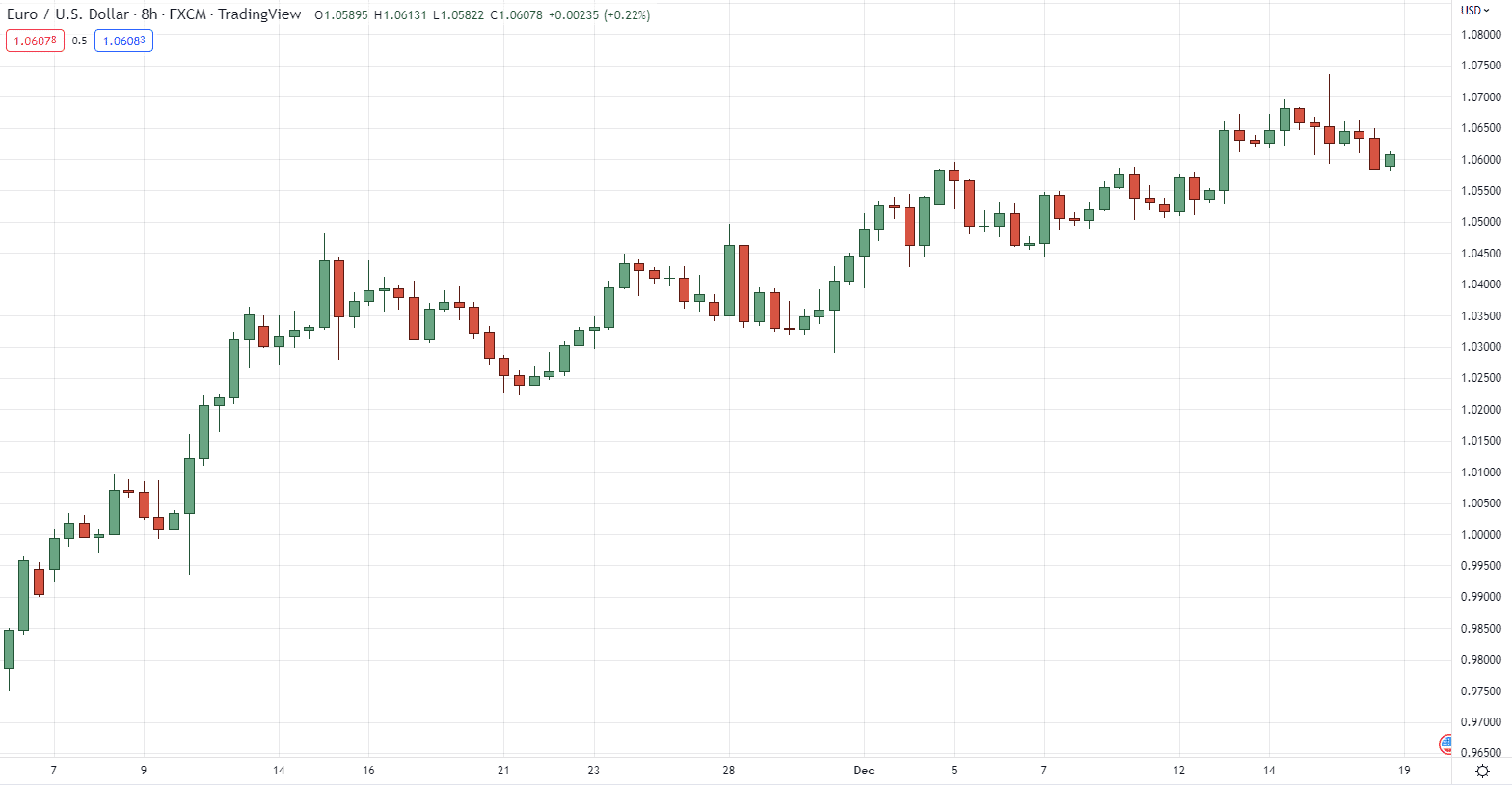

Then as we go all the way down to the 8-hour timeframe, you possibly can see that the candles are different from one another:

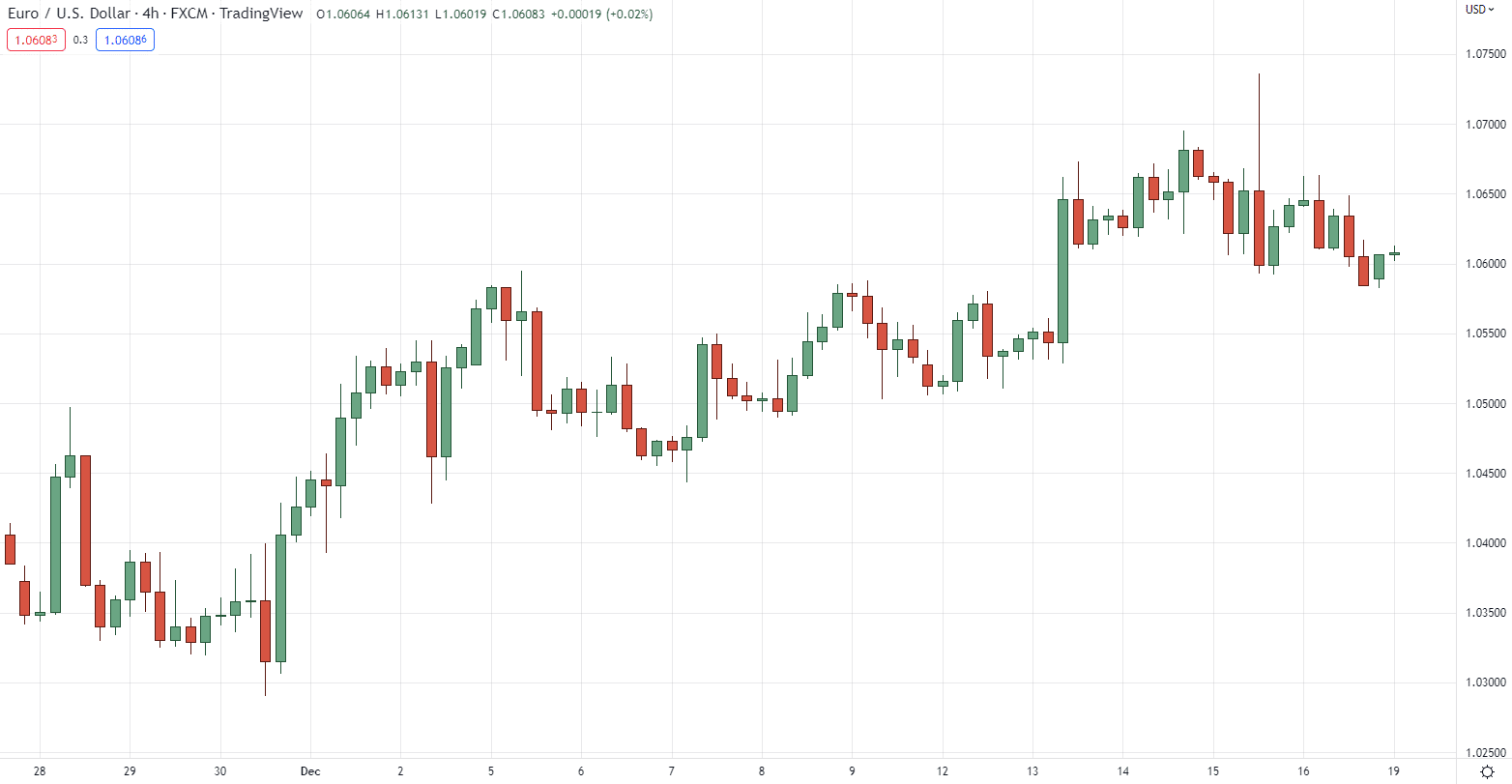

And within the 4-hour timeframe, you possibly can precisely see what’s occurring at this timeframe in comparison with the upper timeframe:

You see, it’s like looking into a complete recent world!

How concerning the Stock market?

Recall…

It’s open lower than 8 hours a day for every week.

So, if the day by day timeframe on a stock looks like this:

Here’s what it looks like on the 8-hour timeframe:

I realize it nothing has modified, but it surely’s literally the 8-hour timeframe!

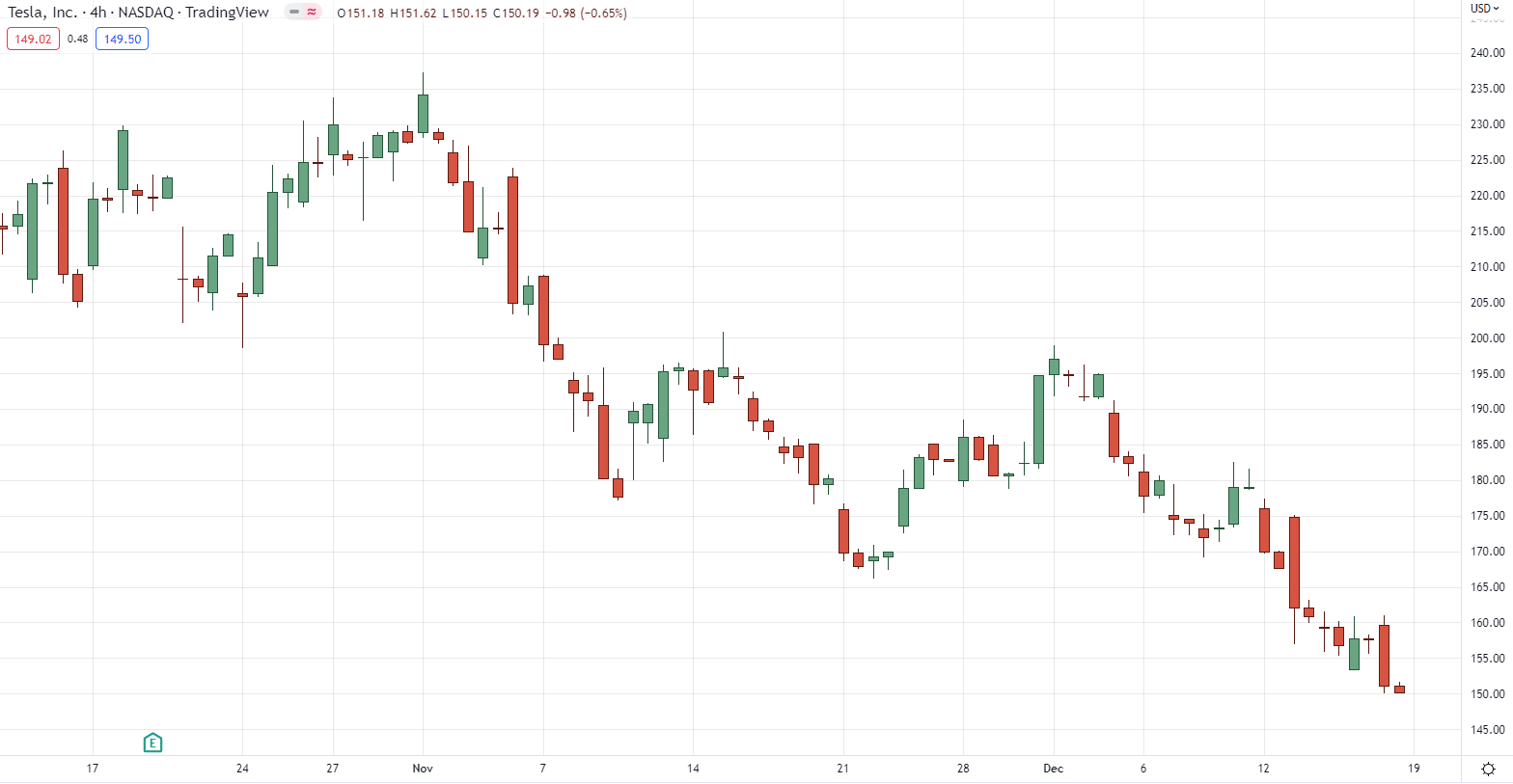

And now, the 4-hour timeframe:

They barely make any difference!

But after all, there’s an answer to this.

Solution #1

Concentrate on the upper timeframes only comparable to the day by day.

Or…

Solution #2

Trade on the lower timeframes comparable to the 1-hour timeframe.

Avoid the center like a plague!

Are you able to see how useful the data these timeframes are telling you?

Now you is perhaps wondering:

“How is timeframe flexibility essential?”

“Are these just useless stuff?”

“How can I exploit this in my trading?”

I understand how you are feeling.

But the explanation why timeframe flexibility is that it lets you do transition trading.

What does transition trading mean you may ask?

Let me offer you an example…

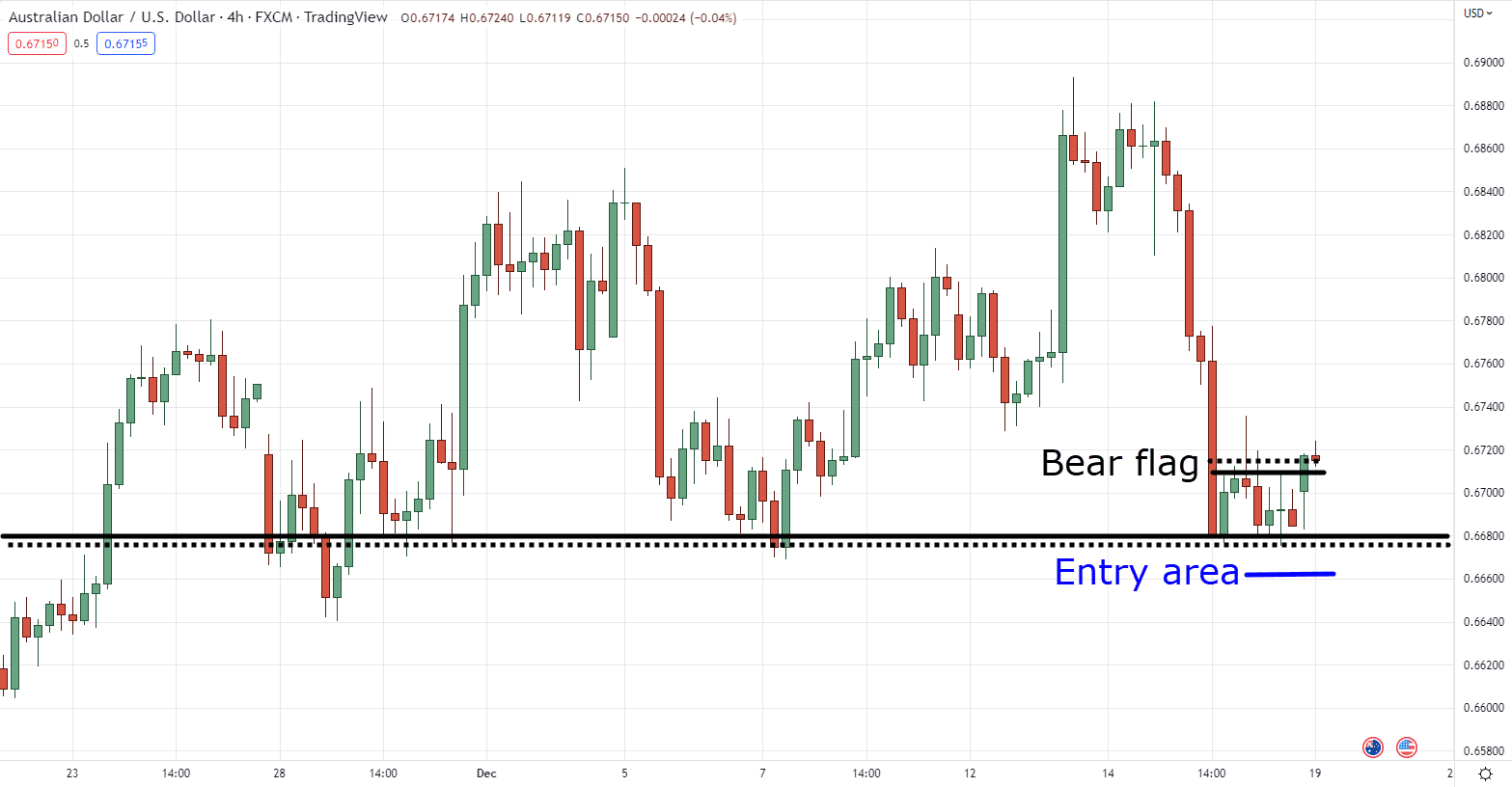

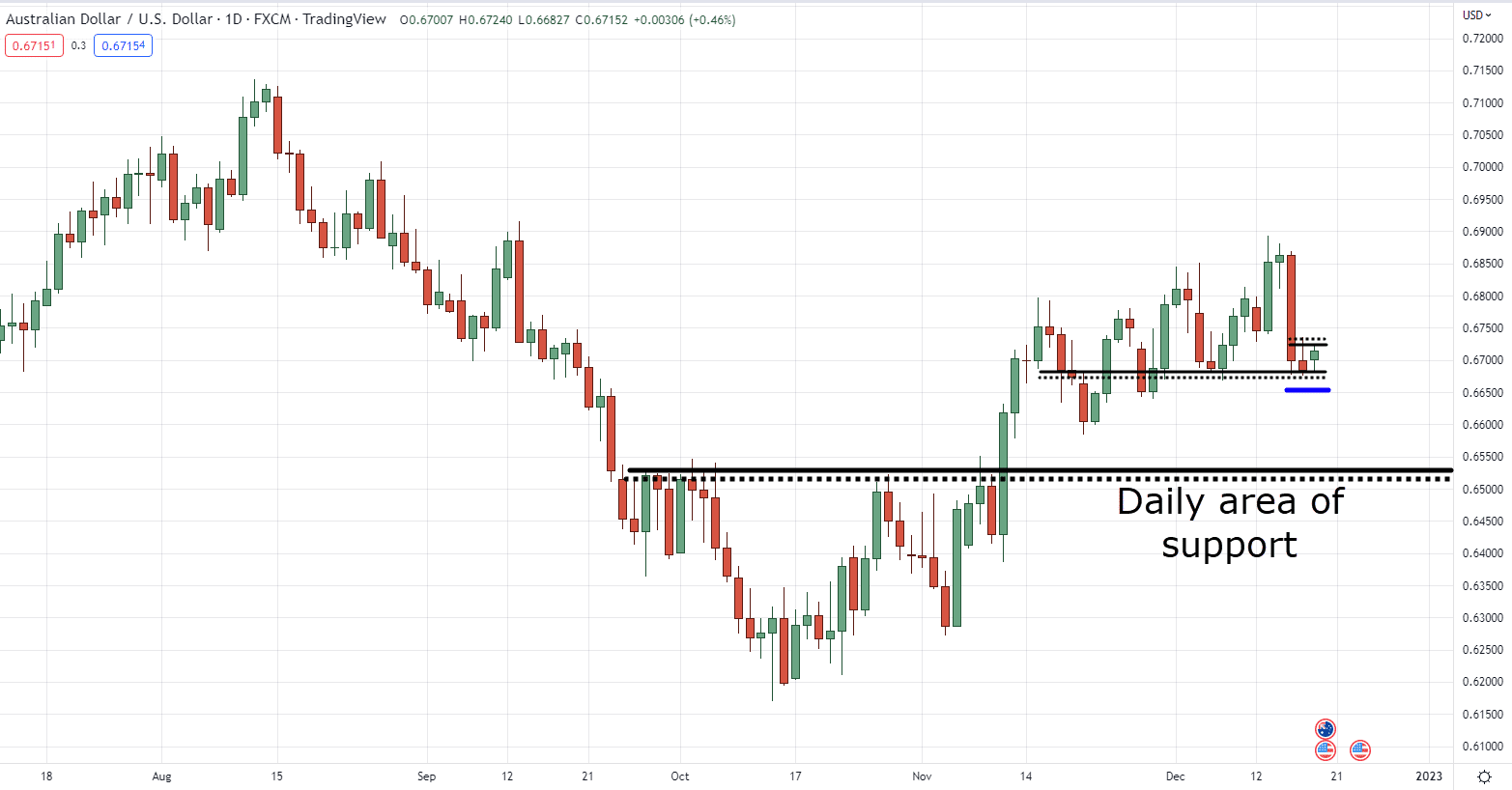

Let’s say that you simply’re a swing trader trying to enter this Forex pair within the 4-hour timeframe:

But as you possibly can see…

There are not any support levels to be seen!

Where would you are taking your profits!

But wait…

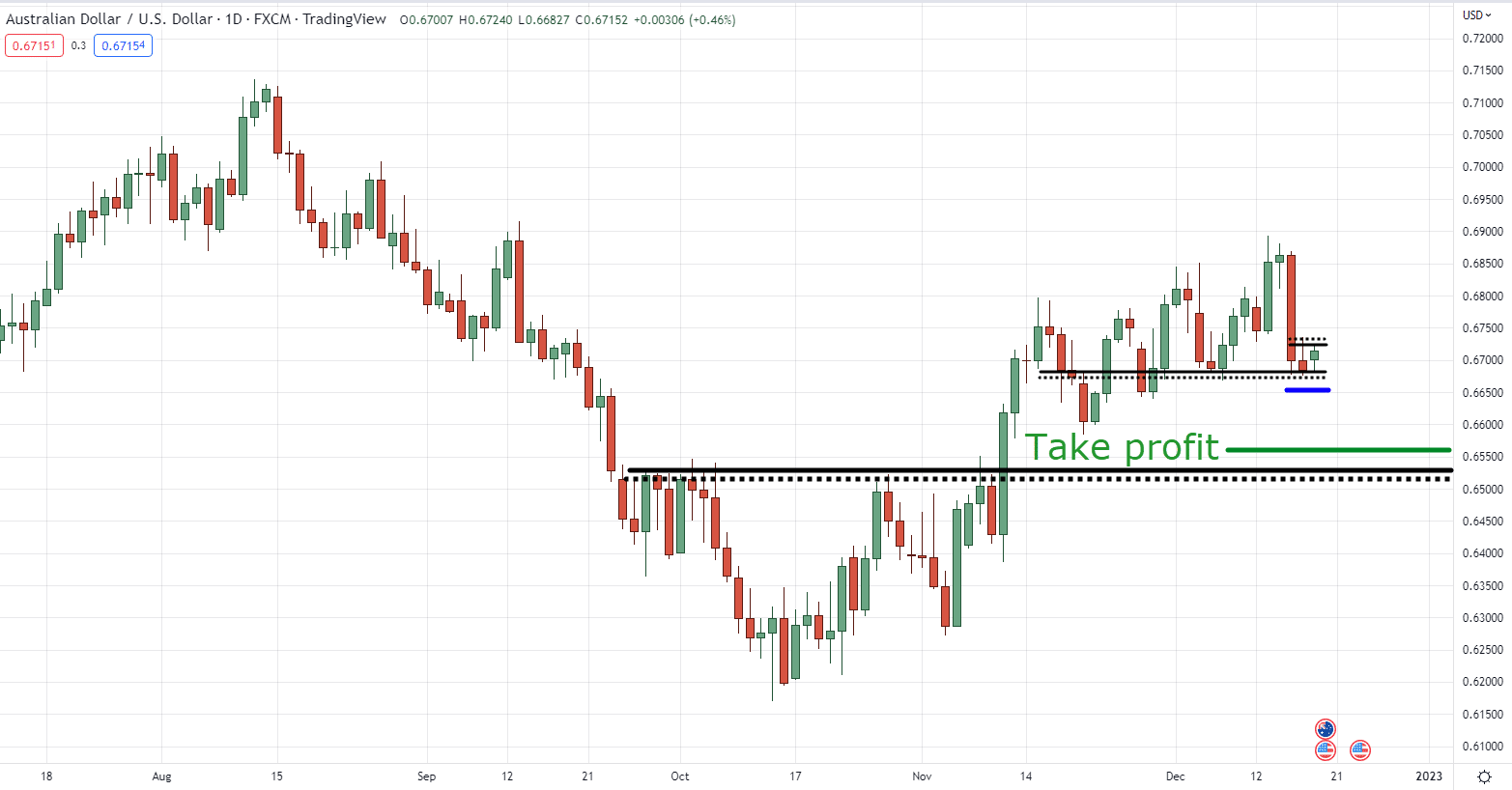

What should you take a look at the day by day timeframe, would this transformation anything?

Boom!

Now that major levels may be seen, you now can base these resistance levels as your reference to take your profits!

Not only that, but this greatly improves your risk-to-reward ratio!

Sure, transition trading remains to be possible to do on the Stock markets.

Nonetheless, you’d fairly be comparing two timeframes on a smaller scale comparable to the 1-hour and the 4-hour timeframe.

Since it wouldn’t make sense so that you can enter on the 1-hour timeframe after which search for take profit levels on the day by day timeframe!

Is smart?

Learning something recent?

Now, since I discussed the lower timeframes…

You’d be surprised how the lower timeframes may be very different in each the Stock and the Forex markets.

Let me inform you why in the subsequent section…

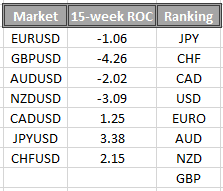

Forex market vs stock market: How liquidity and volatility work

Forex is similar to being a judge of America’s best dance crew!

Let me offer you an example…

As you understand, the US Dollar’s strength has been increasing for just about all of 2022.

So, what do you do?

You concentrate on USD pairs after all!

As you possibly can see, As a substitute of trying to select a single stock or a single singer…

You could concentrate on selecting a certain currency, a complete dance crew!

Because similar to the previous example, a time will come when a certain dance crew will not be famous or be within the highlight.

The identical thing with a certain currency.

So, if the USD starts to weaken however the British Pound (GBP) starts to strengthen…

Then we concentrate on GBP pairs to trade.

(Thankfully, the Jabbawockeez are still famous, but you get the purpose)

So, how can we search for the perfect dance crew–

I mean…

How can we search for the perfect currencies to trade?

Well, a currency strength meter, after all!

Now, we have already got a super-duper comprehensive guide on how you possibly can create and use your currency strength meter.

In order much as I would like to debate it in today’s guide, it’s best to test it out here:

The Essential Guide to Currency Strength Meter

So now…

How concerning the Stock market?

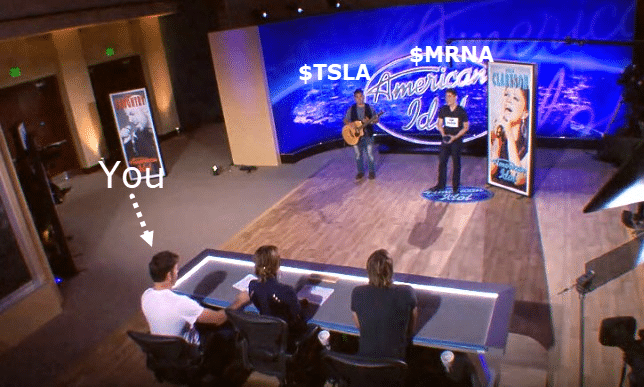

The Stock market is similar to an American Idol audition.

Where there are millions of singers to pick from!

Some singers get rejected.

While some are ok to get them into the show.

What happens eventually?

They get the highlight!

Regardless that there could possibly be one winner on the show, plenty of them get famous!

Now…

What happens when someone wins the show?

That’s right, the show starts a recent season, and possibly a lot of the singers from the previous season could be forgotten.

And it’s the identical with the stock market.

The stock market is similar to a show where out of the hundreds of stocks on the market…

Some stocks get famous!

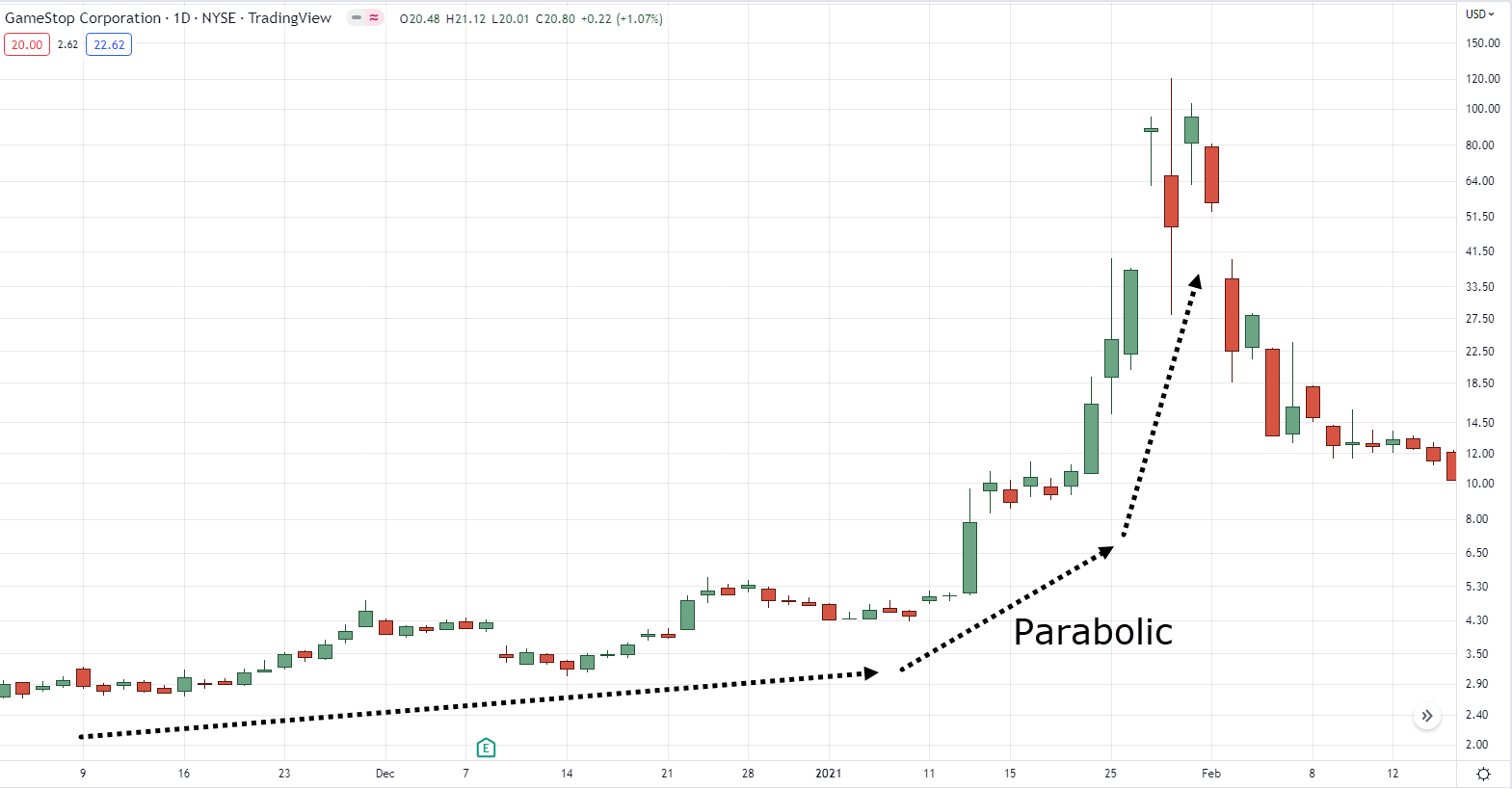

And what happens when a stock is known?

They shoot up in price!

They gain liquidity and volatility similar to GME when it was everywhere in the news!

And what happens if a stock isn’t within the highlight?

You guessed it.

Their chart looks like Morse code…

Who the heck would even trade this?

There’s no liquidity or volatility!

So…

How do judges differentiate good singers from bad ones out of the hundreds of singers on the market?

Identical to the currency strength meter for Forex…

How do YOU differentiate good stocks from bad stocks out of the hundreds of stocks on the market?

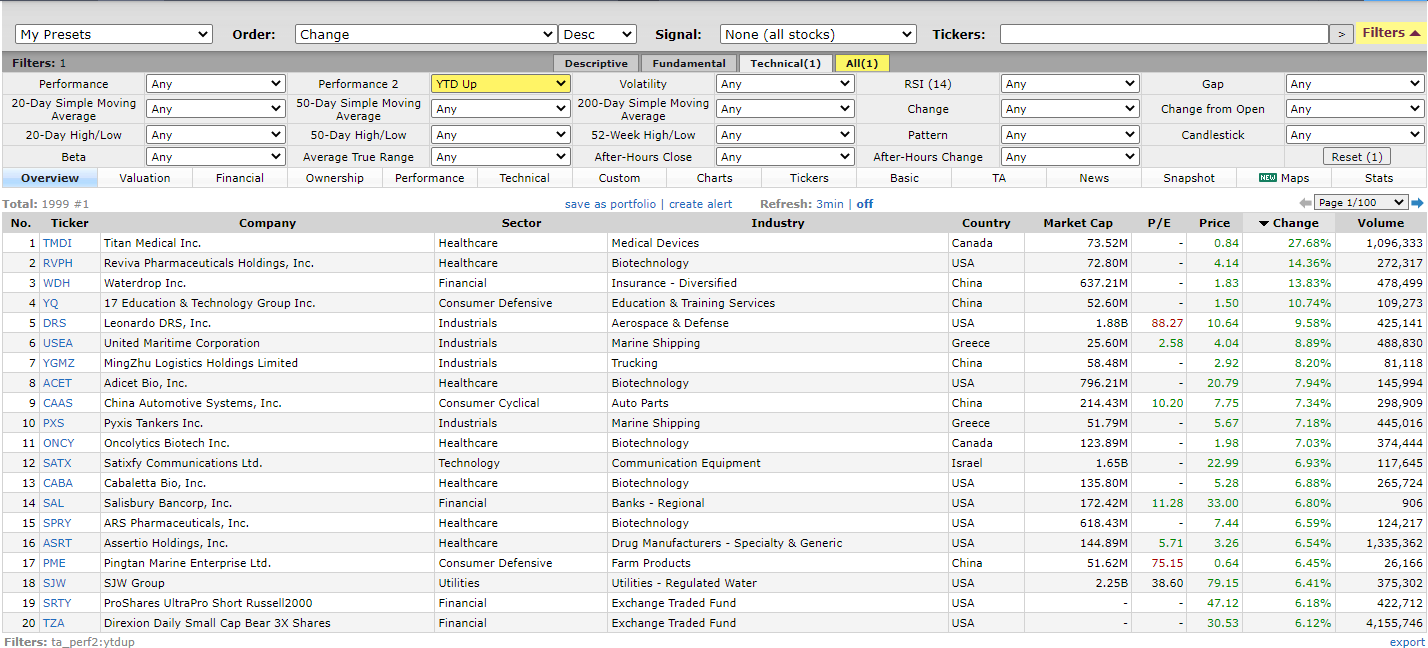

Easy, stock screeners.

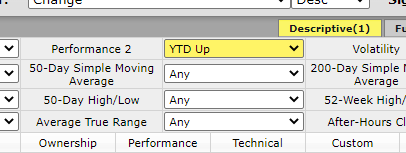

Identical to a judge, you insert what your standards are to your stock screener, and with only a push of a button…

The screener would filter out hundreds of stocks on the market based on the settings you’ve placed there.

One example could be the free stock screener called Finviz.

In case you wish to find out the best-performing stock to this point this yr:

Then the screener would immediately give results out of the hundreds of stocks on the market.

Are you able to see how essential a stock screener is?

So, remember!

Being a trader (judge) within the stock market is like selecting the perfect singer or stock on the market!

However, the stock market is selecting the perfect dance crew or group of currencies on the market!

With that said…

The following part is an important one.

So, make sure that you listen very, very closely.

Got it?

Forex market vs stock market: How risk management works

The aim of risk management is one thing:

Well…

To administer your risk, after all!

But what specifically is the aim of it?

That’s right.

Having risk management means that you simply never just buy any random shares and go all-in.

Every little thing is calculated.

You understand exactly what number of units or shares to purchase and also you exactly know what’s at stake before you even enter the trade!

But here’s the thing…

Managing your risk between Forex vs stock market may be different.

So, let’s break it down, we could?

1. Forex market

Well, I hate to inform to you.

But managing your risk in Forex may be complex.

Why?

Because in stocks, percentages are just about all you wish!

But in Forex, percentages in price movement are almost meaningless.

How so?

Two things…

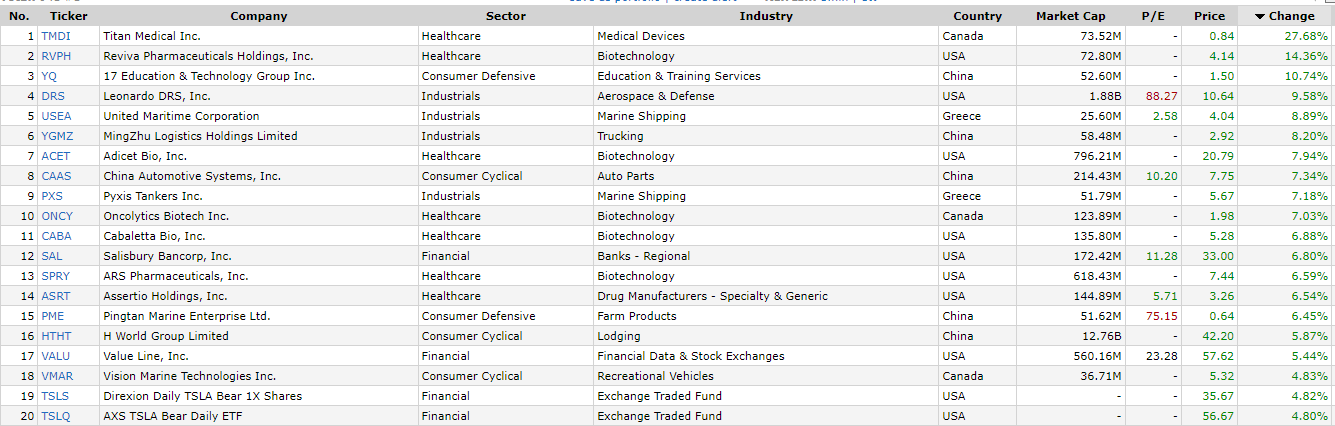

First, it is because we measure the Forex markets using pips, which is commonly the 4th decimal of the Forex pair price:

That’s why to administer your risk in Forex, you’ll want to determine the pip value.

It implies that if Forex moves 1 pip with or against you…

How much money will you gain or lose?

That’s what pip value means!

Second, we don’t buy shares when trading Forex.

We trade using Lot sizes.

Here’s what I mean:

- 100,000 Units = 1.00 Lot

- 10,000 Units = 0.10 Lot

- 1,000 Units = 0.01 Lot

- Below 1,000 Units = 0.001 Lot

So simply because you possibly can repeatedly buy 10 shares of a stock, don’t.

I repeat.

Don’t buy 10 lots regardless of how big your account is!

You’re attempting to buy 1,000,000 units and immediately blow up your account!

That’s insane!

As a substitute, discover these three things…

First, know the utmost amount you’re risking per trade.

Second, the gap of your stop loss to your entry price in pips (that’s right, in pips, not in percentage).

Third, determine the pip value.

Here’s an example

- The quantity you’re risking = 1% of your $5,000 = $30

- Distance of stop loss from entry = 60pips

- Pip value = $8USD/pip

So, if the formula is…

Units to enter = max risk in $ / (stop loss distance * pip value)

Then your values ought to be…

Units to enter = $30 / (60 * 8)

So what number of units it’s best to enter on a trade?

That’s right.

0.06 lots!

Which means that should you enter the trade right away on a certain Forex pair with 0.06 lots and with a stop lack of 60 pips away out of your entry…

You won’t lose greater than $30 on the trade.

Now, how concerning the Stock market?

2. Stock market

To begin with, there are lots of ways to administer your risk which you possibly can learn more about here.

Nonetheless!

One highly regarded risk management utilized by beginners and professionals (which can also be easy in comparison with Forex)…

Is what we call the portfolio allocation method.

How do you apply it?

First, determine the scale of your account.

Let’s say in this instance, you could have a $5,000 account.

Second, determine how much you’re willing to allocate per trade.

On this case, let’s say you need to allocate 10% per trade.

Which means that if you need to buy a stock, you won’t buy shares value greater than $500.

Are you following?

Finally, discover the stock price, and divide it by the quantity you’re willing to allocate per trade!

So, if SIRI’s current price is 6.16

Just divide it by $500, which is your max allocation per trade.

What number of shares do you have to buy?

Correct.

81 shares.

Easy peasy, right?

Take note:

If traders are in aggressive mode, they often allocate 20% of their portfolio per stock.

This provides them a maximum of 5 trades.

It’s riskier as there’s less diversification and more concentration on a stock!

In case you’re within the conservative mode, nonetheless…

You may allocate 10% of your portfolio per trade.

This provides you higher diversification while maintaining risk.

Is smart?

Again, this may be very essential.

Knowing the best way to manage your risk well is your major key to surviving on this trading business!

Now, I actually have only touched the tip of the iceberg in terms of risk management.

So, should you want more examples and methods surrounding risk management, I suggest you learn more about it here.

Now that you simply’re equipped with all of this information…

Let’s tackle the million-dollar query:

Forex market vs stock market: Which is the perfect market to trade?

In case you’ve been reading my guides for some time now I’m sure you’re conversant in the saying:

“There’s no such thing as the perfect, only the perfect one for you!”

Sure, there’s some truth to it as finding the perfect is rarely really a shortcut.

But in point of fact?

“The most effective is subjective”

What do I mean you might ask?

Easy.

The most effective market to trade is subjective in two ways:

- Experience in trading

- Market condition

Hmm.

Interesting, am I right?

Let me prove it to you…

1. Experience in trading

In case you’re starting in trading, and particularly should you don’t know the best way to apply risk management…

You will have to start out trading on the stock market before you trade on Forex.

Sure.

You may stay trading the stock market should you wish!

Or, who knows, trade each markets!

But again…

In case you’re recent to trading, I suggest starting trading the stock market first.

I’m sure you’re now wondering:

“Why?”

“Why shouldn’t I start trading Forex immediately?”

One word:

Leverage.

Leverage is optional when trading the stock market, or not even an option in any respect in some Stock markets.

But within the Forex markets…

Leverage is routinely within the equation because you won’t have the ability to trade the Forex markets without it!

Are you able to see how essential it’s?

No?

Let me explain…

Imagine that leverage within the Forex markets is sort of a bank card:

And let’s say that your leverage within the Forex markets is 1:10 (this can be a ratio you’ll encounter often).

It implies that in case your starting capital is $5,000 your credit limit (or buying power), is $50,000.

Holy moly!

Now let me ask you…

In case you’re starting your profession; get your paycheck for the very first time.

And also you’re still unsure the best way to manage your funds…

Would it not be smart to get a bank card with a limit that’s 10 times your salary?

In case you’re starting in trading and also you’re still unsure the best way to manage your risk…

Would it not be smart to get on trading with leverage?

Not quite!

So, on this case…

In case you’re a beginner, I suggest you follow the Stock market without leverage.

In case you’re already proficient at managing your risk with discipline, then I suggest you trade Forex!

2. Market condition

Have you ever ever heard of this saying?

“The Stock market is straightforward!”

“Go all-in, you’ll be wealthy blindly very quickly!”

“Forex is tough, don’t even dare try it!”

I hate to interrupt to you…

But that’s only a myth!

The Stock Market does have some similarities with Forex!

Let me prove it to you.

That is the S&P 500 index on a day by day timeframe:

As you possibly can see, it’s in an uptrend!

A bull market!

Every little thing you touch turns into gold!

It’s “easy!”

But what if the US Stock market index is in a downtrend?

What if the Indian Stock market is in a downtrend?

What if the Chinese Stock Market is in a downtrend?

Is the Stock market still easy?

Heck no!

A bear market is where the whole lot you touch turns into crap!

That’s every time the Stock market is in turmoil you hear sayings comparable to:

“Money can also be a position”

“Stay in money during these bloody times”

So, how concerning the Forex market?

Possibly it’s the one which’s actually “easy?”

Well…

Let’s take a chart that represents the “index” in Forex which is the dollar; the world reserve currency:

Much like the Stock market’s index, what do you see?

A bull market!

It creates “easy” trending market conditions on pairs just like the USDJPY on the day by day timeframe:

And creates bear trending market conditions on pairs like EURUSD on the day by day timeframe:

Now, if the dollar index is in a ranging market what can we get?

That’s right!

A “hard” Forex market!

And boy, trading on a ranging market condition is sort of suicide!

So…

Do you see what I mean?

All of it boils all the way down to certain market conditions!

At this point…

We’ve talked not only concerning the difference between Forex vs Stock market but in addition concerning the risk management aspect of it.

What if, eventually you’ll be the style of trader who already mastered what they’re and the way risk is managed in each markets?

Which might you trade?

What’s the answer?

Fortunately, there’s a compromise.

But only take this as a suggestion and never financial advice.

Promise?

Great.

So, one solution is to…

Add funds or concentrate your funds when the Stock market is in a bull market

Yes, should you’re trading in a market where the whole lot you touch turns into gold, then why wouldn’t you double down on the mining of it?

Nonetheless, if the Stock market is in a bear market comparable to closing below the 200-period Moving Average:

As a substitute of holding money and letting it stay there, why not add the money to Forex?

On this case…

Not only do you get to:

- Avoid potential losses

- Sidestep a whole bear market season

- Be open-minded as you explore other markets

But you furthermore may get to:

- Get the perfect of each worlds

- Keep an energetic trading account

Because in the long run…

That’s what it truly means to be a trader!

To remain-open minded to recent markets (whether it’s the agriculture or crypto markets).

And to all the time learn and improve out of your trades.

Is smart?

With the whole lot said and done…

Let’s have a fast recap of what you’ve learned today.

Conclusion

Wow…

What a reasonably long-ass guide, am I right?

But I do know that for many traders reading this…

Selecting between Forex vs Stock market can each be a significant dilemma and a choice.

So, here’s what you’ve learned in today’s training guide:

- Forex lets you buy and sell currencies while the Stock market lets you buy a share of a certain company

- There may be more flexibility in selecting timeframes on Forex on the upper and lower timeframes

- Liquidity within the Stock market is just not static and moves across hundreds of stocks, this makes stock screeners crucial

- Risk management within the Stock market may be simpler than managing risk in Forex

- Trading the Stock market as a beginner without leverage may be more favorable than trading Forex as a beginner

Congratulations!

You’ve made it to the tip of this training guide!

So, this time, I would like to know what you think that…

What else do you think that I’ve missed?

Did this training guide enable you to choose which market it’s best to trade first?

Let me know within the comments below!