When you’ve been following other traders’ technical evaluation for some time…

You’ve most definitely heard alien terms like bullish divergence, hidden divergence, reversal divergence, and bearish divergence.

You could be considering:

“Woah, what the *beep* is a divergence!”

“Look how cool the symptoms look on a chart with a divergence plot on it!”

“So, how does a divergence cheatsheet work?”

And yes, I have to admit…

It’s not a simple topic to learn and apply.

At the identical time, it’s a subject often not well-explained!

Sure, other traders will let you know:

“Ah if the chart does this and an indicator does that, then you must sell.”

But that’s not what this training guide is all about.

As an alternative…

I’ll go in-depth and teach you:

- What are all the various trading divergences and learn how to spot them with pinpoint accuracy

- How exactly a divergence cheatsheet works (apart from telling you when to purchase or sell)

- Different indicators you must use when trading divergences

- Learn how to trade with the divergence cheatsheet and learn how to incorporate it into your trading

Now…

It doesn’t matter whether you’ve been learning trading divergences for weeks or months.

This guide will likely be essential and straight to the purpose!

So, are you ready?

Then let’s start.

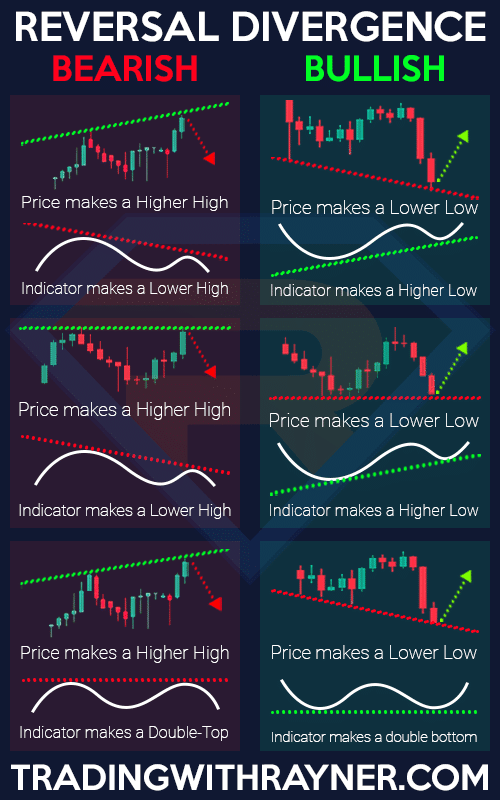

Divergence cheatsheet: What’s it and the REAL reason on how it really works

Now, to save lots of you the effort…

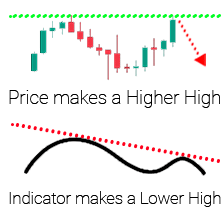

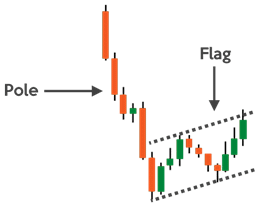

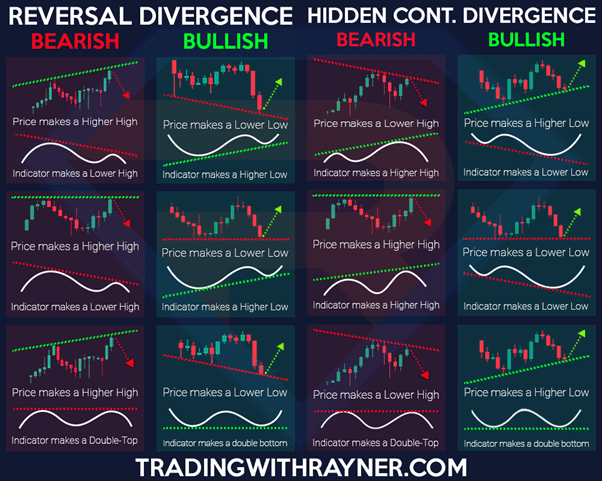

Here’s what the divergence cheatsheet looks like:

Sure…

Reserve it!

Make it your computer wallpaper!

Print it!

Nonetheless, how do you exactly know when one out of the six divergences occur in real-time markets?

Aha, that’s the tricky part!

And that’s why you’d need to stick around.

But now that you simply’ve seen the divergence cheatsheet, let’s get back to the fundamental query…

What’s a trading divergence?

To place it simply:

A trading divergence occurs when the direction of your indicator is different from the direction of the market price.

In other words…

The indicator is “diverging” from the market price!

It’s moving away like a cone!

Get it?!

So now…

I just shared with you WHAT a divergence is.

But let me ask you.

HOW does a divergence work?

What’s the logic behind it?

Let me let you know…

How does the divergence cheatsheet work

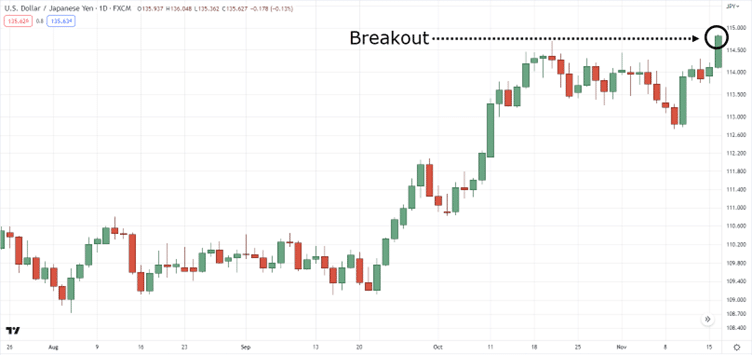

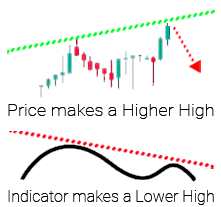

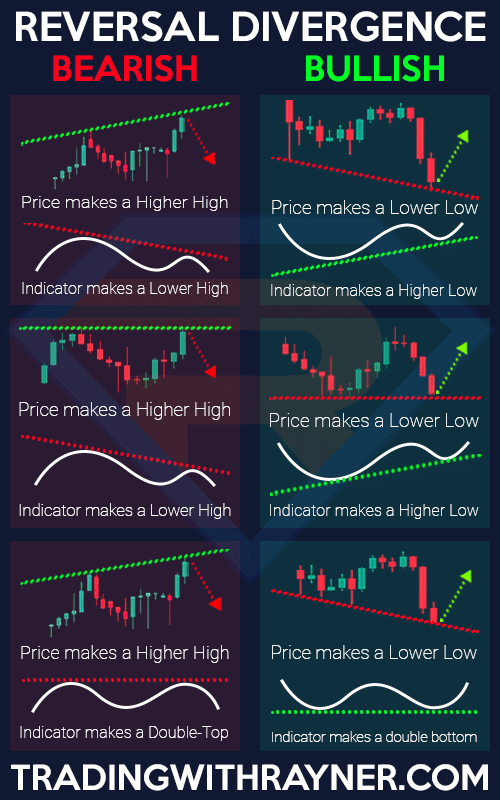

Take a take a look at this breakout…

Looks pretty strong, right?

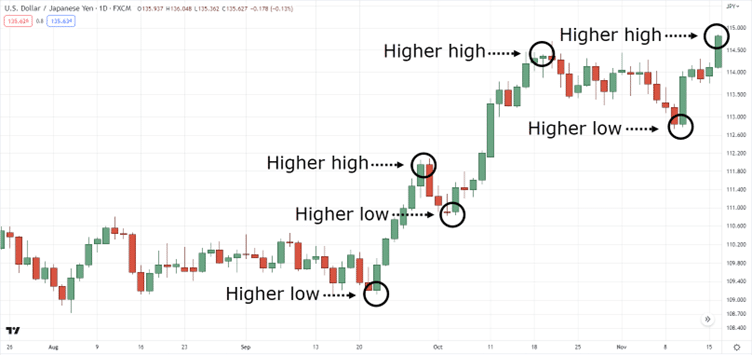

Not only that, but this market also shows a pleasant trend with higher highs and better lows!

You’ll be able to see it together with your own eyes!

Now…

What does our indicator see?

Hmm, it seems to imply that the momentum is decreasing!

Recall…

A divergence happens when the direction of the perceived price is different from the indicator!

So, based on the last example…

You see a powerful breakout and a great trend!

But your indicator is telling you:

“Hey boss, it’s a pleasant trend, but based on our calculations, the trend is weakening!”

Aha, a discrepancy!

So, who do you think?

Your eyes, or the indicator?

In fact, in your mind you’d probably say:

“Screw that indicator, I do know what I’m seeing!”

“I’m the trader here, the indicator is only a mathematical equation!”

But here’s the reality…

Your eyes can idiot you as all charts may be manipulated!

Let me prove it to you.

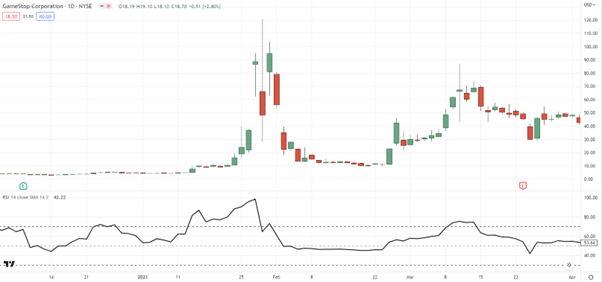

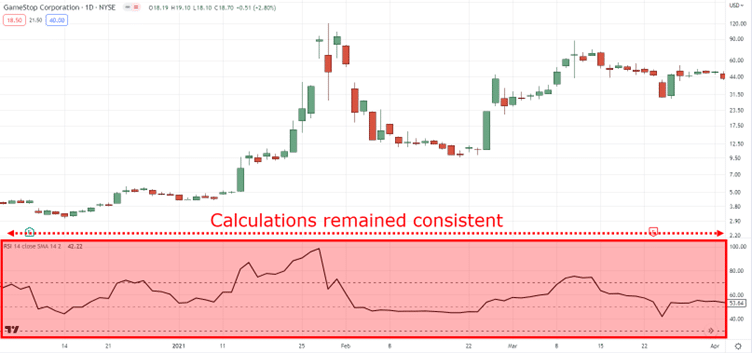

See this price of GME?

Now, what would occur if I switched it to a logarithmic chart?

Rattling, similar to regular price motion, right?

I didn’t even move anything!

I just turned on the logarithmic chart option!

So, when you saw that chart, your judgment would change!

However the RSI indicator, nevertheless, stays the identical regardless of how much you alter your chart…

Not only that!

Your chart may be manipulated in other ways resembling taking a look at your cell phone which has a smaller screen!

So that you see my friend…

The aim of getting a divergence cheatsheet is on your indicator to support your judgment; to see through chart discrepancies, and to find out whether the buyers or sellers are weakening.

Is smart?

Now, we’ll get to the varieties of indicators you must use when coping with the divergence cheat sheet.

But for now…

How do you specifically discover a divergence?

Like, in real-time markets and not only cherry-picked charts?

Well, the important thing to identifying considered one of those types within the divergence cheatsheet is to…

Watch the swing highs and lows of each the chart and the indicator.

Let me explain in the subsequent section…

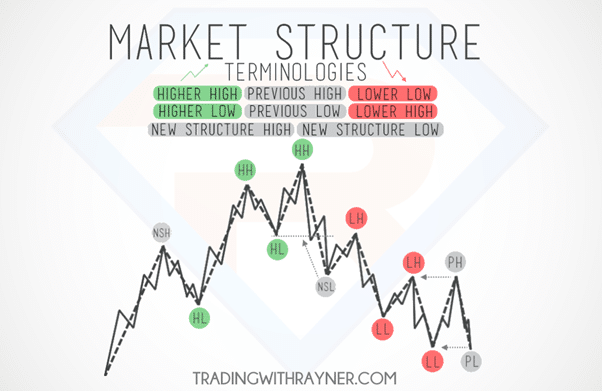

An easy method to read the divergence cheatsheet accurately

As you already know…

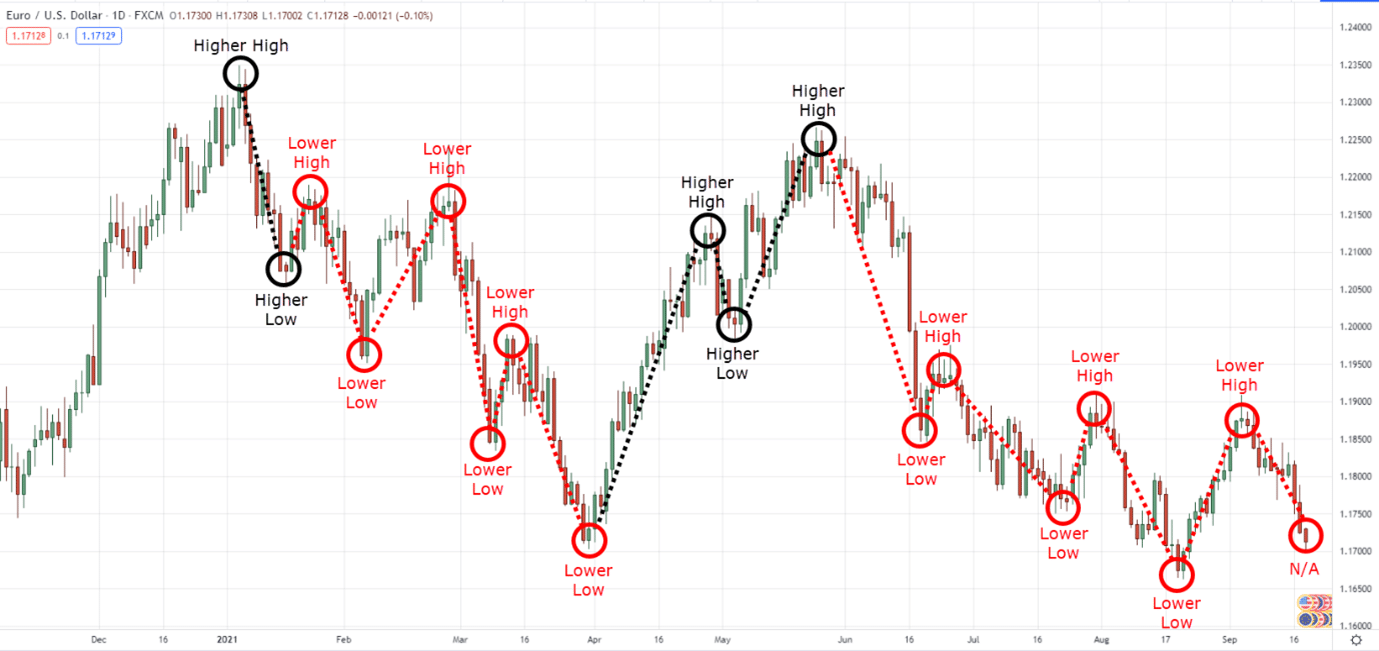

There are several types of market structures on the market resembling:

- Higher Highs

- Higher Lows

- Lower Highs

- Lower Lows

Familiar?

No?

Ah, then no worries.

I actually have just the fitting cheatsheet for you as a bonus.

P.S. If you wish to learn learn how to read price motion like a professional you may check this out.

And yes, the sequence of those happening can vary from one market to a different:

But since we’re here to discover not only market structures but in addition divergences…

What it is advisable to deal with are the first two market structures.

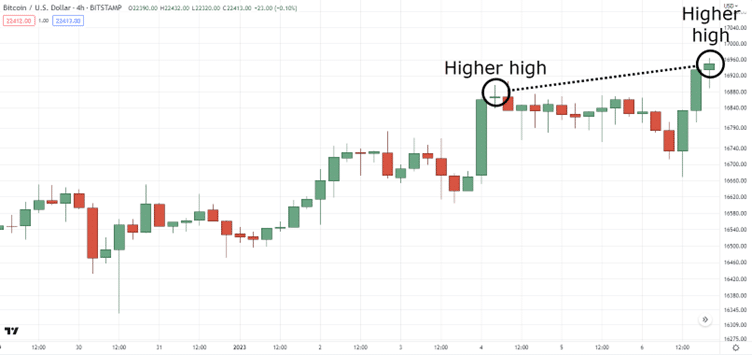

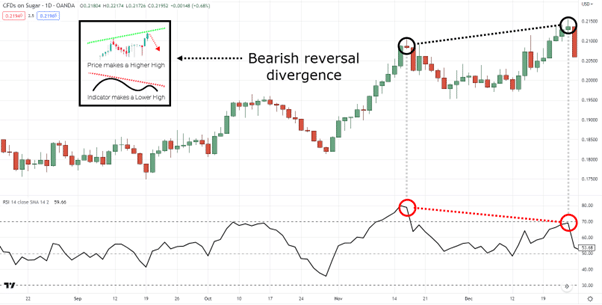

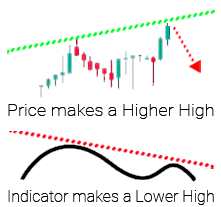

What do you see?

That’s right.

A high, after which one other higher high.

Following up to now?

So how in regards to the indicator?

What’s the market structure of the indicator relative to the value?

That’s right!

The next high, and a brand new lower high!

So, now that you might have these two pieces of data wherein the value makes a brand new higher high and the indicator makes a brand new lower high…

Where does it belong?

Found the reply yet?

…

…

…

That’s right!

A bearish reversal divergence!

Pretty easy, right?

How about this one?

That’s right!

One other bearish reversal divergence!

Now, in terms of coping with the divergence cheatsheet…

You could at all times deal with what the present market structure is doing.

The present price!

And never what has happened already!

As this might result in inaccurate plotting of those divergences.

So, when you don’t see anything, don’t do anything.

Trade what you see!

Is smart?

So, by now you have to be wondering:

“Alright, so what the heck is the indicator you used on the instance?”

“What’s the period?”

“Is the stochastic indicator okay?”

“Is the MACD okay to use this idea?”

“Is the RSI okay?”

I do know that you simply could be confused about having those questions in mind.

But take a deep breath… exhale… loosen up.

As I’ll be sure to enlighten you in the subsequent section…

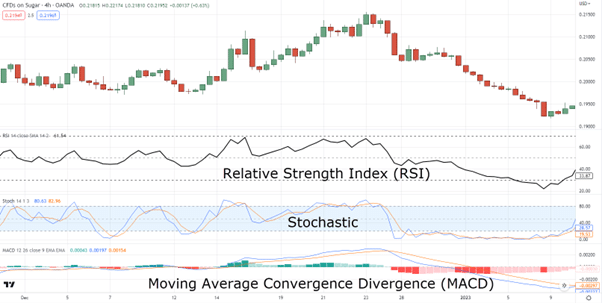

Which indicator do you have to use when trading the divergence cheatsheet?

Knowing which indicator to make use of must fall into two criteria:

- The indicator should be an oscillator

- You could have a full understanding of the indicator

The second is an important, but let me explain…

1. The indicator should be a momentum oscillator

What’s an oscillator indicator it’s possible you’ll ask?

An oscillator indicator is a tool that forms “waves” or bands that bounce off between extreme numbers resembling from 0 to 100 for instance.

In layman trader’s terms…

If it’s an indicator that doesn’t overlap or display in your chart, it’s an oscillator!

Examples of the oscillator indicator include:

- Relative Strength Index a.k.a. RSI (the indicator we’ll use on this guide)

- Stochastic Indicator

Is smart?

Now, here comes the necessary part…

2. You could have a full understanding of the indicator

That is where most traders fall short.

Remember, when you’re trading…

You’re not only hitting buy and sell buttons.

You might be putting your hard-earned money on the road in danger in order that you might grow it.

So, don’t you think that it’s necessary to understand how exactly your indicators work?

Whether or not you may trust those indicators together with your hard-earned money?

In fact, it’s!

That’s why when selecting an indicator, it’s crucial to understand how the numbers are calculated.

(By the way in which, this is applicable to any indicator on the market.)

So…

How is the RSI indicator calculated?

RSI = 100 – [100 / [1 + RS]]

Where RS = Average Gain / Average Loss

Now as much as I’d like to share how it really works in-depth and the logic behind the calculation…

This text would do more justice to show you how to truly understand the indicator:

The Essential Guide To RSI Indicator

But essentially…

The principle of the RSI indicator is that it systematically gauges the momentum of each buyers and sellers.

That’s right.

We’re not only talking about oversold or overbought here.

We’re talking in regards to the behaviors of buyers and sellers themselves!

Because that’s what the market is product of!

So, now that you simply understand the indicator we’ll use…

Let me show you ways you need to use the divergence cheatsheet to trade and cash in on

The markets.

We could?

The divergence cheatsheet strategy (the fitting method to trade it)

Every time I see traders making their evaluation using the divergence cheatsheet…

I at all times notice something:

They only use it to call the direction of the market but never actually use it to enter trades!

So yes, while it’s right to make use of it as a “confluence” to your market evaluation…

That’s not what I’m going to point out you today.

I’ll teach you learn how to “trade” the divergence cheatsheet!

Because what’s using learning something when you can’t make a cash in on it within the markets, right?

Now…

Trading the divergence cheatsheet comes only with three easy steps:

- Spot a reversal divergence

- Go into the lower timeframe

- Wait and trade the flag pattern

- Return into the upper timeframe and use the indicator to administer your trade

Spotting a divergence may be tricky enough at times.

For this reason I’ll keep the trading aspect of it so simple as possible!

So, let me show you ways it’s done…

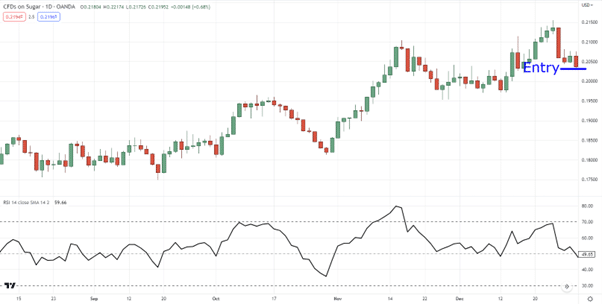

1. Spot a reversal divergence

With the assistance of the divergence cheatsheet, this step is only a walk within the park!

Yes, there are about six variations on this cheatsheet.

But remember, what makes a divergence is the difference between the direction of the value and the indicator.

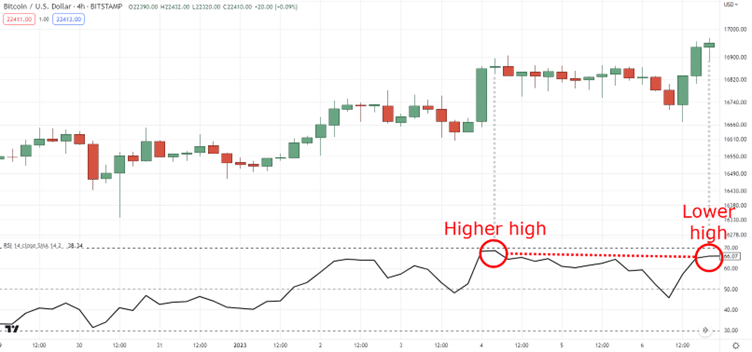

So if we take a look at this chart:

You’ll be able to see that there’s a bearish reversal divergence.

What can we do next?

2. Go into the lower timeframe

You’re probably wondering:

“Why do we’d like to go down into the lower timeframe?”

You see, simply because we spot a bearish divergence doesn’t mean it is going to go down immediately!

The worth can still proceed to go up!

For this reason we go down the lower timeframe, to attend for extra “confirmation.”

Got it?

Now, selecting which timeframe is one other topic of its own.

So I suggest you check this out:

The Essential Guide To Trading Multiple Timeframes

But for this instance…

We’ll go down into the 4-hour timeframe coming from the day by day:

Now that we’re within the lower timeframe what can we do?

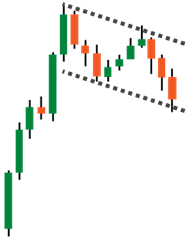

3. Wait and trade the flag pattern

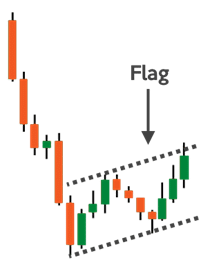

Just in case you don’t know yet, a flag pattern looks like this:

But for this instance, we’re in search of a bear flag pattern!

Now, what makes a flag pattern powerful are its two components!

The pole, and the flag:

Why, it’s possible you’ll ask?

The pole implies that the sellers have made an explosive move downwards!

A transparent direction to the downside!

Nonetheless, explosive moves should not sustainable, and it often “snaps” back in the other way.

But when it makes a flag?

Now that changes things!

It shows that the buyers are “sustaining” the upward move because the sellers can’t push it lower!

Now with all that said…

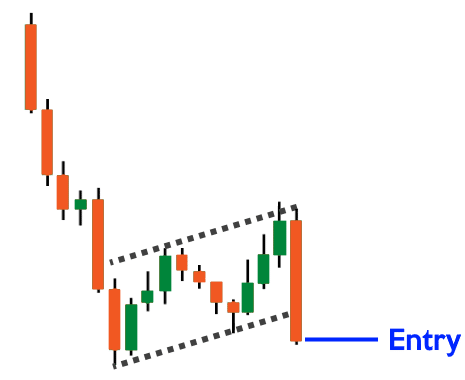

A flag pattern will only be valid once the sellers determine to interrupt out again, which also gives us an entry opportunity:

And it’s the identical thing for this chart example here!

(And yes, I’ve removed the RSI since we won’t need it within the 4-hour timeframe.)

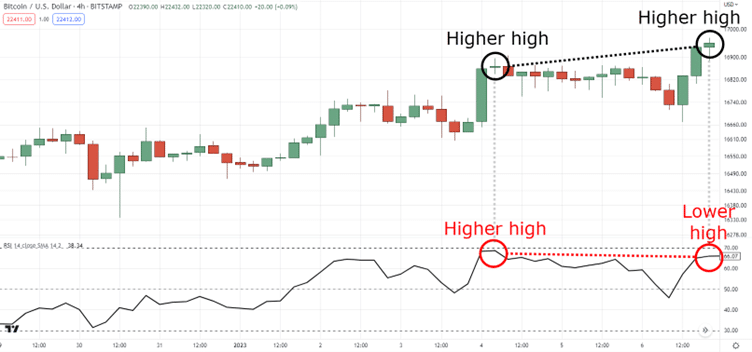

So, after spotting a bullish reversal divergence on the day by day timeframe…

We’ve drilled down into the 4-hour timeframe to search for a bull flag to time our entries (and likewise be confident of it after multiple confirmations).

So, what’s next?

Do I say bye bye and allow you to work out the remainder?

In fact not!

Because when you’re within the trade you’d need to…

4. Return into the upper timeframe and use the indicator to administer your trade

This one is more of a bonus as we’re using an idea called transition trading.

Where we enter on the lower timeframe and manage our trades on the upper timeframe!

So now that you simply’ve entered the 4-hour timeframe through the flag pattern…

We’ll be using the indicator again on the upper timeframe:

And the exits for selling short are easy!

Once the value approaches RSI 50, then you definately’d want to contemplate taking half of your profits after which take the remainder of your profits if it reaches RSI 30.

The alternative is similar for bullish trades!

Except that you simply’ll take the remainder of your profits when it reaches RSI 70.

But what when you entered the trade on this state?

As you may see, it’s already at RSI 50 where you must take partial profits.

What do you do then?

Well, we take one less step!

Once it “approaches” the RSI 30 then we take full profits!

Now…

There will likely be times when the value doesn’t reach extreme levels resembling on this case.

So, what do you do?

If the value makes a powerful candlestick against you (resembling a bullish engulfing on this case), then you definately exit your trades.

I do know…

It isn’t so simple as it seems in this instance.

But I would like to be sure I prepare you for various scenarios when trading the divergence cheatsheet.

So that you simply’re prepared to administer your trade in any scenario!

There you go!

So, only a recap of this strategy…

- Use the divergence cheatsheet to identify a reversal divergence

- Go into the lower timeframe to search for entries

- Wait and trade the flag pattern’s breakout

- Scale out once the value reaches RSI 50 and trail the remaining half to RSI 30 or exit the trade prematurely if a powerful candlestick pattern is formed against you

With that said…

Here’s something to take into accout…

Despite the strategy that I’ve shared with you, there are other ways learn how to use divergences to your advantage.

In addition to different forms, which is the “hidden” divergence that I actually have not discussed.

Why?

Well, the reversal divergence is when the indicator goals to search for the discrepancy in the value’s momentum on the chart.

However the hidden divergence is the alternative, which doesn’t fit with the principles I shared today!

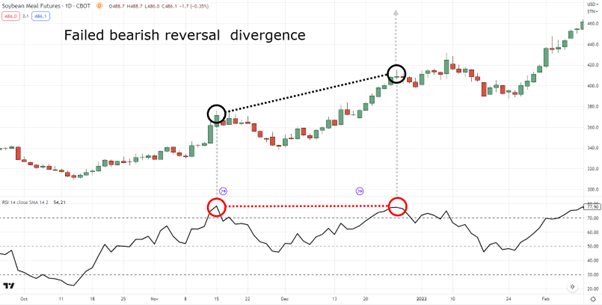

Finally, do know that trading divergence is just not the holy grail and they’ll fail at times.

For this reason I suggest you construct up your skill in managing your risk through these guides as well:

Forex Risk Management and Position Sizing (The Complete Guide)

The Complete Guide to Stop Loss Order

The Monster Guide to Candlestick Patterns

Great?

Then let’s do a fast recap on what you’ve learned today!

Conclusion

In today’s guide…

I’ve not only shown you ways the divergence cheatsheet works but in addition the principles behind it by way of the dynamics between buyers and sellers.

In order a fast recap, here’s what you’ve learned in today’s guide:

- A divergence happens when the direction of the indicator (which goals to find out buying or selling momentum) is different from the direction of market price

- Referencing the highs and lows of each the chart and indicator is the simplest method to spot divergences

- Indicators resembling the RSI and Stochastic may be used with trading divergence, but understanding how they work is crucial

- Trading divergences may be traded by timing entries into the lower timeframe and managing that trade into the upper timeframe

And there you go!

An in-depth guide on how a divergence cheatsheet works!

Now over to you…

What are a number of the indicators have you ever tried successfully trading divergences?

What are a few of your experiences trading divergences?

Perhaps you’ve stopped for a time and also you’re considering using it once more?

Let me know within the comments below!