PM Images

The iShares Residential and Multisector Real Estate ETF (NYSEARCA:REZ) is a REIT ETF that tracks quite a lot of key exposures mostly within the US market. There’s quite a lot of residential exposure, but additionally some healthcare and specialised exposures. Critically, there’s little office exposure. Overall, the composition of the ETF is sweet from an actual estate perspective, but we just don’t think the time is yet right for real estate. China coming back could put an excessive amount of pressure on global inflation for rates to ease quickly.

Quick Take a look at REZ

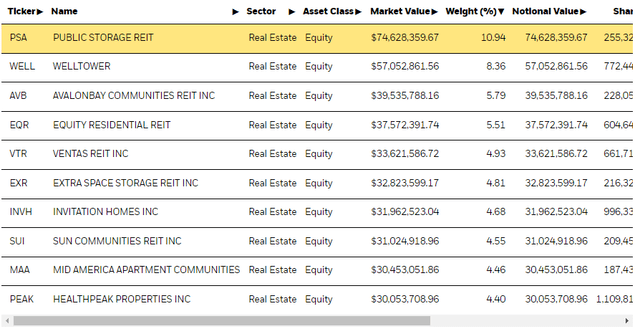

REZ is somewhat skewed to some large holdings in Public Storage REIT (PSA) and Welltower (WELL) which together make almost 20% of the general exposures.

Top Holdings (iShares.com)

Specialty exposures like PSA aren’t so limited, with 22% of the portfolio allocated to specialty REITs like that. Welltower gets categorised as a healthcare REIT, which make 29% of the general portfolio. The residential exposures do make the brunt of the exposures at 50%, starting with AvalonBay (AVB) at 6%.

Expense ratios are fairly low at 0.48% and yield shouldn’t be too bad at 3.37%.

Bottom Line

The shortage of office exposures is kind of attractive. There is kind of quite a lot of leverage within the office real estate world, and we aren’t convinced that it is going to make a complete comeback, very like the disrupted retail a decade ago. While that will have been an idiosyncratically unattractive element of the portfolio, REZ cannot hide from the broader issue of rates.

In our previous coverage on the speed situation, we pushed back against commentators who continued to insist inflation was some out-of-control force. Inflation is easing, not least for base effects, but additionally due to economic pressure in Europe that can’t be fixed with any form of immediacy. The problem is the easing inflation can also be coming from the proven fact that China has been dormant. This may increasingly not be the case.

In retiring the COVID-zero policies, and in moving rapidly to guard wealth within the Chinese housing and developer markets, China is starting to rev up into a better gear. Years of virtually zero traveling means China shall be on the move again, even just to go to families on regional flights, but additionally as tourists abroad. Commodity demand goes to rise, with China being an enormous commodity importer because the local economy restarts fully.

At the identical time, activity in China will even mean sickness of significant employees, and provide chain issues from Chinese capability could reinitiate while demand continues to construct. Inventory buildup that has been completed across industries due to the cooling off of most economies may reverse again, and inflation could come back.

The problem is that the Chinese impact on global commodity markets is sharp. This may increasingly cause the Fed to take care of higher rates as supply side pressures begin to remount. Indeed, they’ve already tried to prep markets that they’d keep rates high, but with out a clear economic imperative, markets didn’t necessarily consider them. We predict that changes now. Property markets will proceed to be under pressure as the speed cycle proves longer than many expect, and we may even see one other drawdown in equity markets too which is able to probably hit REITs.

Overall, people will not be considering how the fortunes of China are the misfortunes of the US real estate markets. We’d avoid this ETF for now.

While we do not often do macroeconomic opinions, we do occasionally on our marketplace service here on Looking for Alpha, The Value Lab. We concentrate on long-only value ideas, where we try to search out international mispriced equities and goal a portfolio yield of about 4%. We have done very well for ourselves over the past 5 years, however it took getting our hands dirty in international markets. For those who are a value-investor, serious about protecting your wealth, us on the Value Lab is likely to be of inspiration. Give our no-strings-attached free trial a attempt to see if it’s for you.